BKash

Learn how to configure API Settings for BKash Payment Gateway from Admin.

Most people in Bangladesh prefer internet banking over traditional banking these days with the introduction of digital Payment Gateways. For this reason, Automatic Payment Gateways are an asset to businesses because they ensure smooth and safe transactions, and reduce losses associated with late payments. So, both the Customers and Shop Owners need to work together when using payment gateways to make a transaction.

Image 1: Automatic Payment Gateways are an asset because they ensure smooth and safe online transactions.

API stands for Application Programming Interface, which is a set of programmatic instructions that allow a program to interface with another program. Here, an API authorizes and integrates two applications to communicate with one another to provide a seamless digital purchase experience for Customers when making payment for Orders.

Automatic Payment Gateways with API Settings are payment processing portals which facilitate payment fulfillment processes for online stores. They operate to integrate a payment solution with an application, like connecting a business’ checkout function to the payment system. By authorizing the payment between Shop Owner and Customer through a payment gateway, it processes the transaction.

Automatic Payment Gateways with API settings takes request from the Shop Owner’s end which include Customer details and passes it to the payment gateway for transaction processing. It is usually a third-party service that process, verify, and accept or decline credit card, debit card and internet banking transactions that allow Shop Owners to accept payment from Customers on Website, avoiding the risk of Shopping Cart abandonment.

The advantage of using a payment gateway with API settings is that it can simplify the payment process (request, authorization, receipt and confirmation). The way a payment API typically works is that an application transmits a request to the API, which relays it to the payment processing network, which in turn processes the request and responds to the API that relays the response to the application.

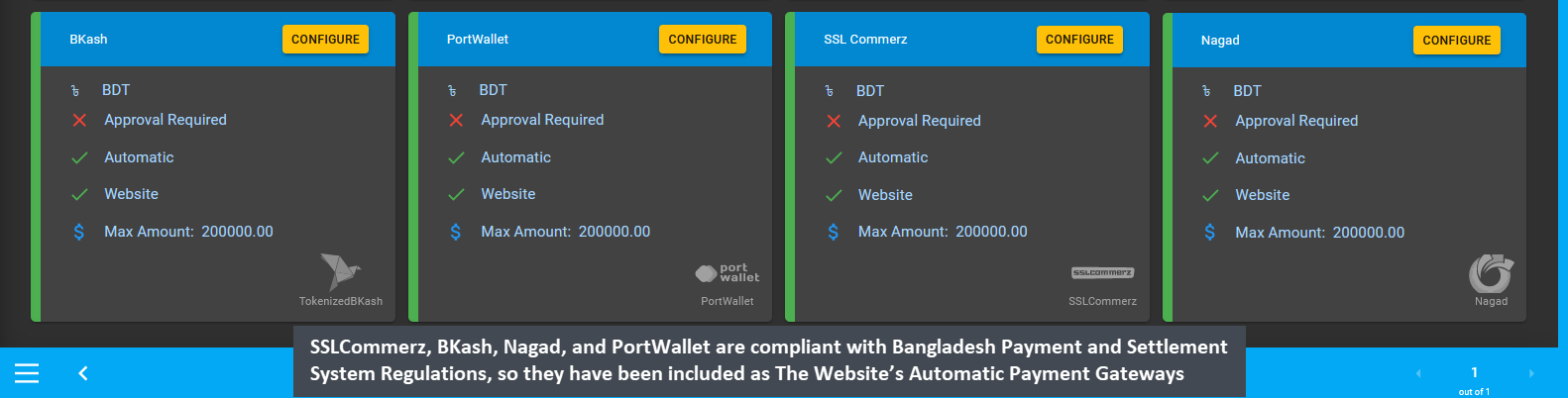

The Website supports Automatic Payment Gateways like BKash, Nagad, PortWallet, and SSLCommerz that has some distinct characteristics and features, which makes them stand out. They will ensure that the Customer’s payment experience is secure, smooth, fast, and increase their trust to purchase more Products from the Shop in future. As SSLCommerz, BKash, Nagad, and PortWallet are compliant with Bangladesh Payment and Settlement System Regulations, they have been included as The Website’s Automatic Payment Gateways.

Image 2: SSLCommerz, BKash, Nagad, and PortWallet are compliant with Bangladesh Payment System Regulation.

Learn how to configure API Settings for BKash Payment Gateway from Admin.

Learn how to configure API Settings for Nagad Payment Gateway from Admin.

Learn how to configure PortWallet Payment Gateway in The Website

Learn how to configure SSLCommerz Payment Gateway in The Website