Reports

Detailed overview of various reports are given with screenshots here.

This section is a useful feature in the content management system designed to provide an overview of reports. It contains in-depth quantitative analysis of orders, customers, products, and product batches modules.

The first few section of the report includes explanation of cost basis of orders, customers, products, and product batches. Understanding the cost basis is important for tax purposes as it calculates the amount of total profit, cost/ purchase price, and revenue to understand capital gain or loss. Determining the difference between selling price and purchase price, the cost basis value will help the shop owner to understand if their investment is profitable or not. By keeping track of the business’ performance, cost basis reports will help calculate possible tax consequences.

The Cost Basis sections in our system can be accessed from four modules - Customers, Orders, Products, and Product Batch. Keep track of cost basis calculations to bring more revenues and profits.

1 - Customer Cost Basis

Detailed overview of cost basis for Customer Section.

This section discusses the importance of cost basis for tax purposes as it calculates the amount of total profit, cost/ purchase price, and revenue to understand capital gain or loss.

Customer Cost Basis

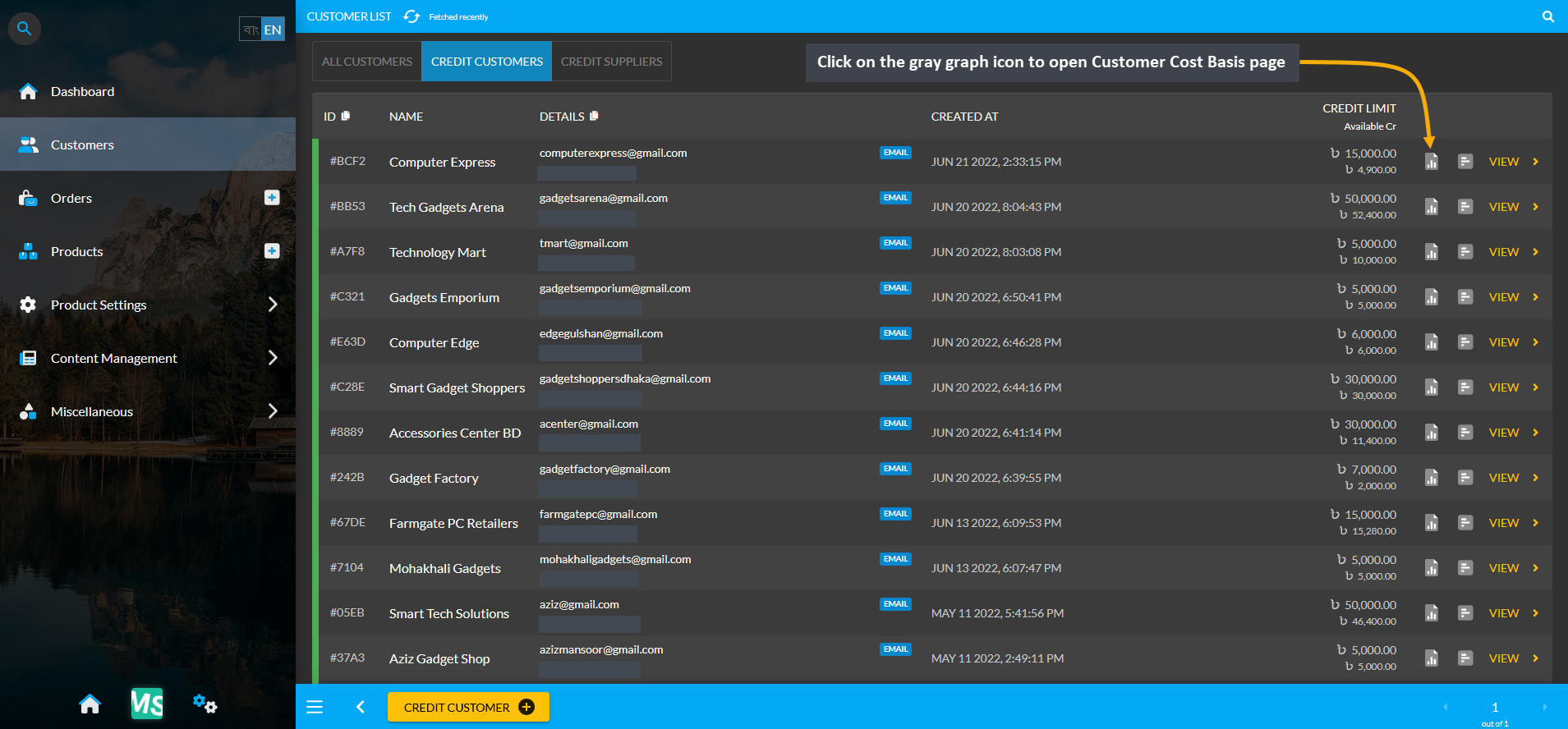

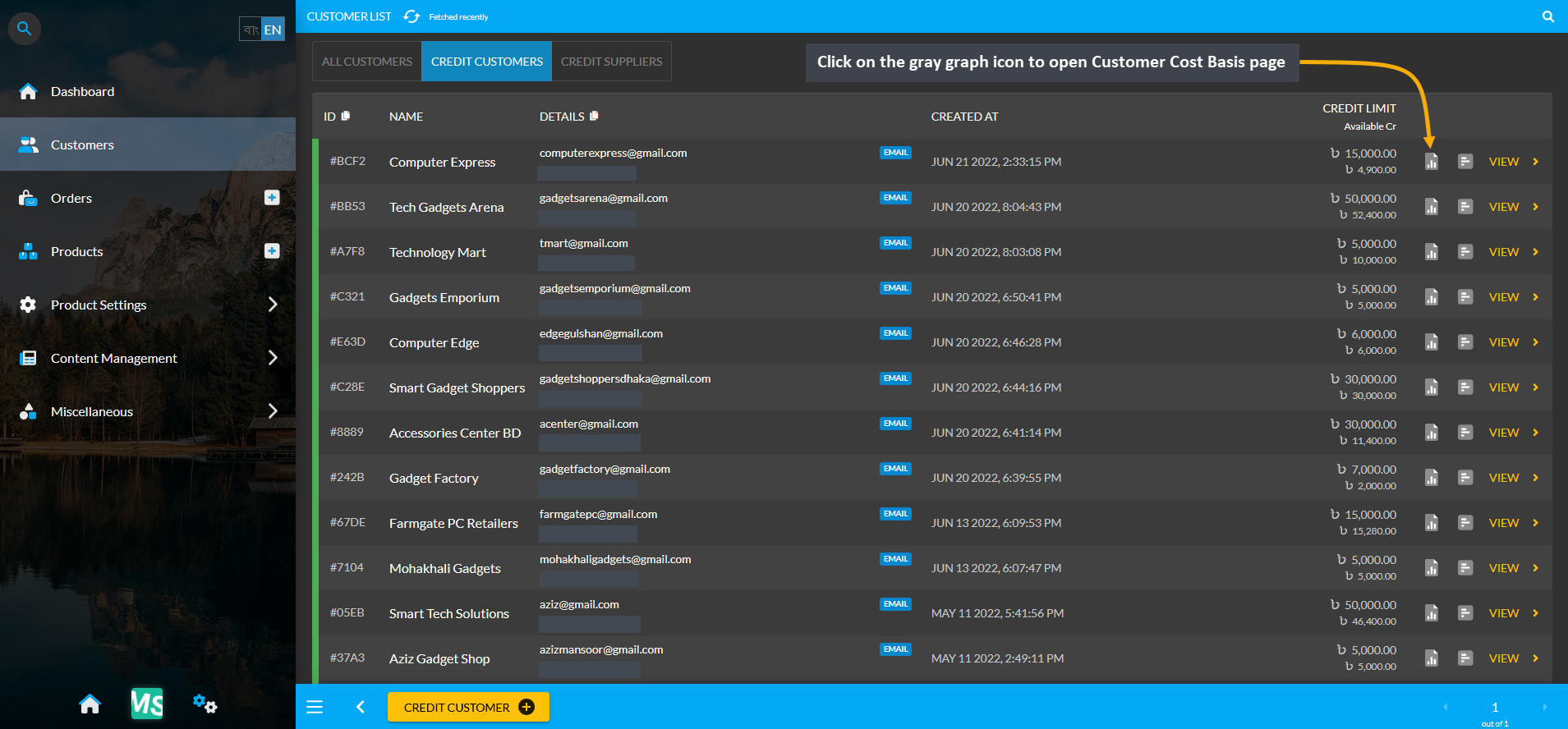

Click the Customers module which will open the Customer List. From here, go to any Customer and click on the small gray graph icon that will redirect to the Customer Cost Basis page showing total profit, total revenue, total cost, total vat, and total discount of that Customer within different time frame ranges.

Image 1: Click the small gray graph icon on Customer List that will redirect to Customer Cost Basis page.

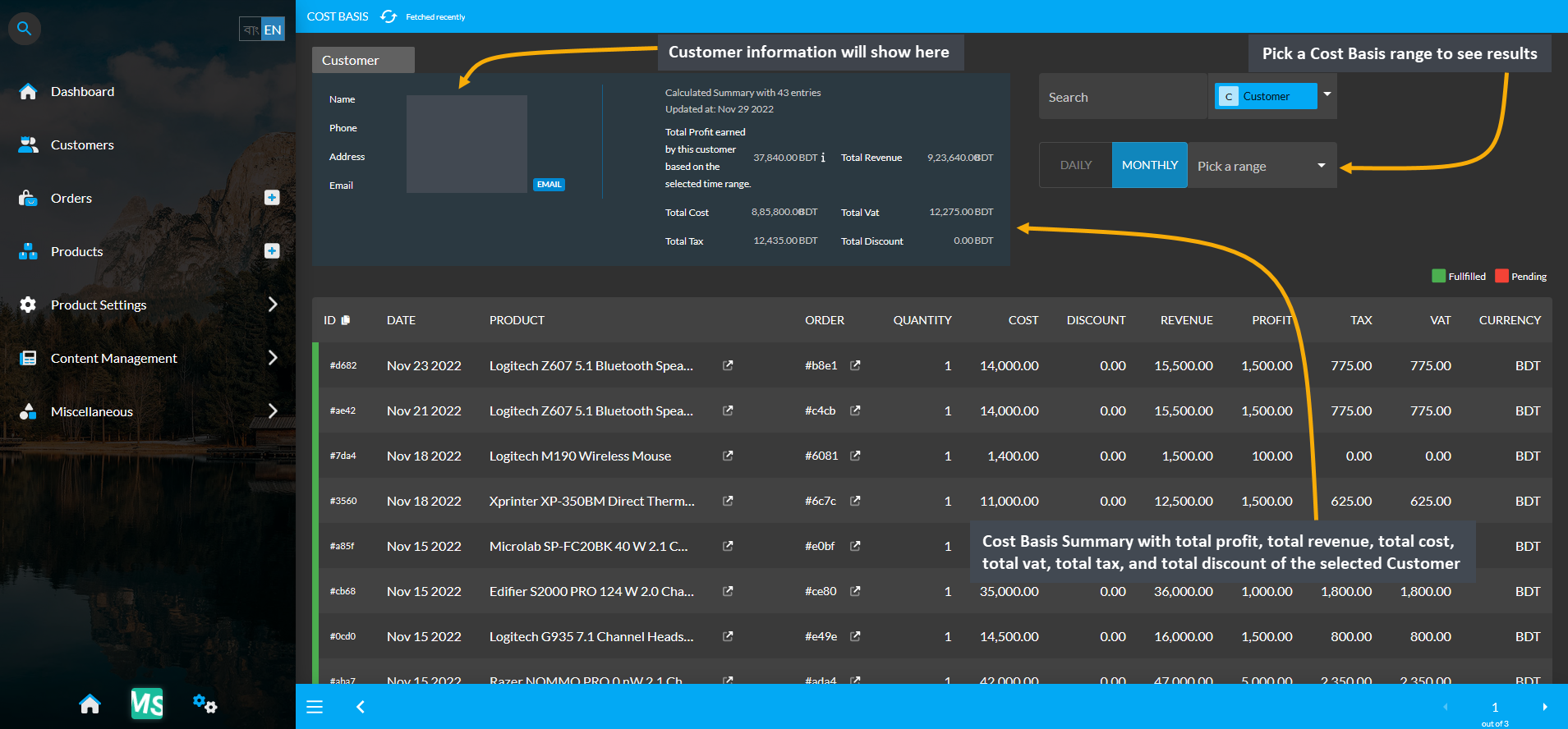

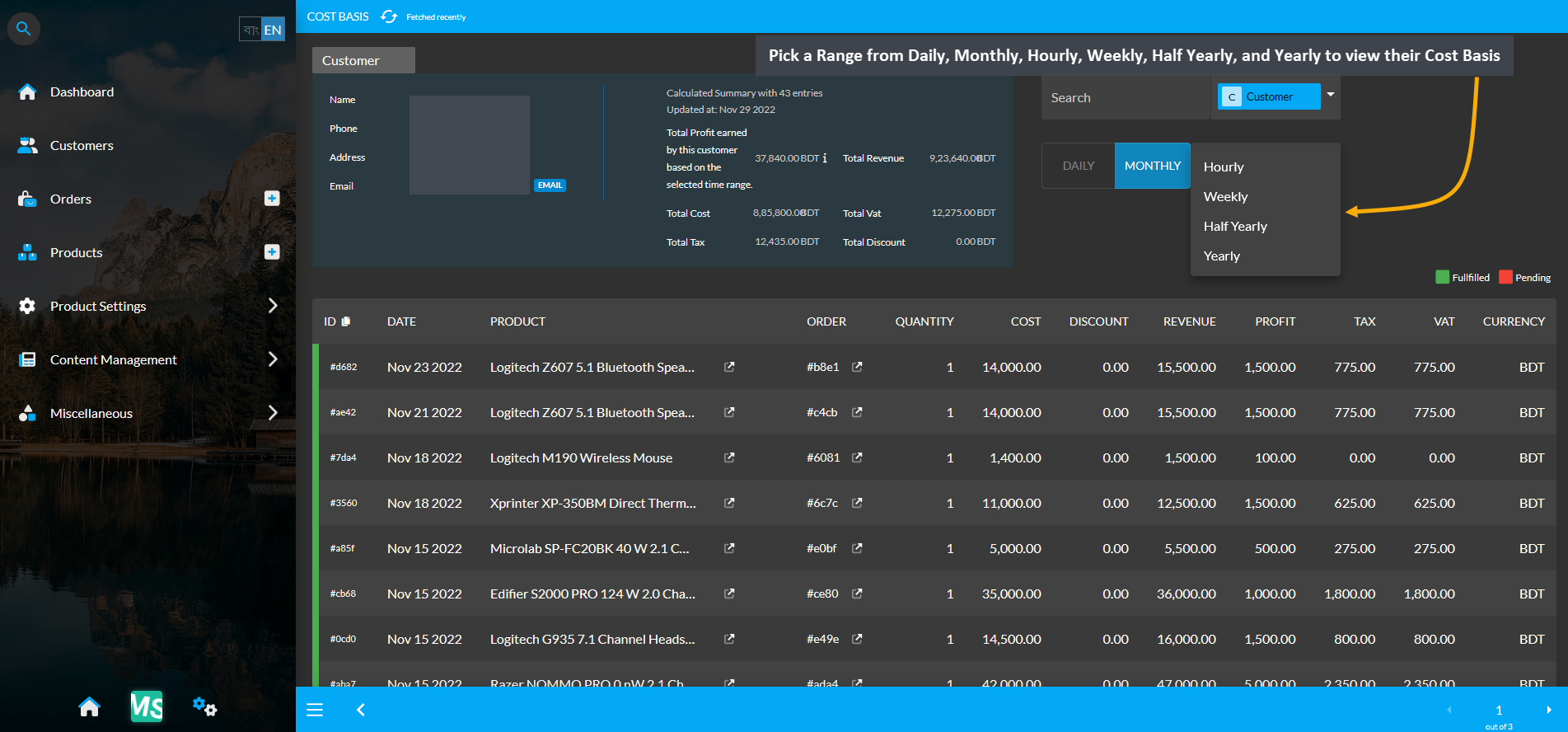

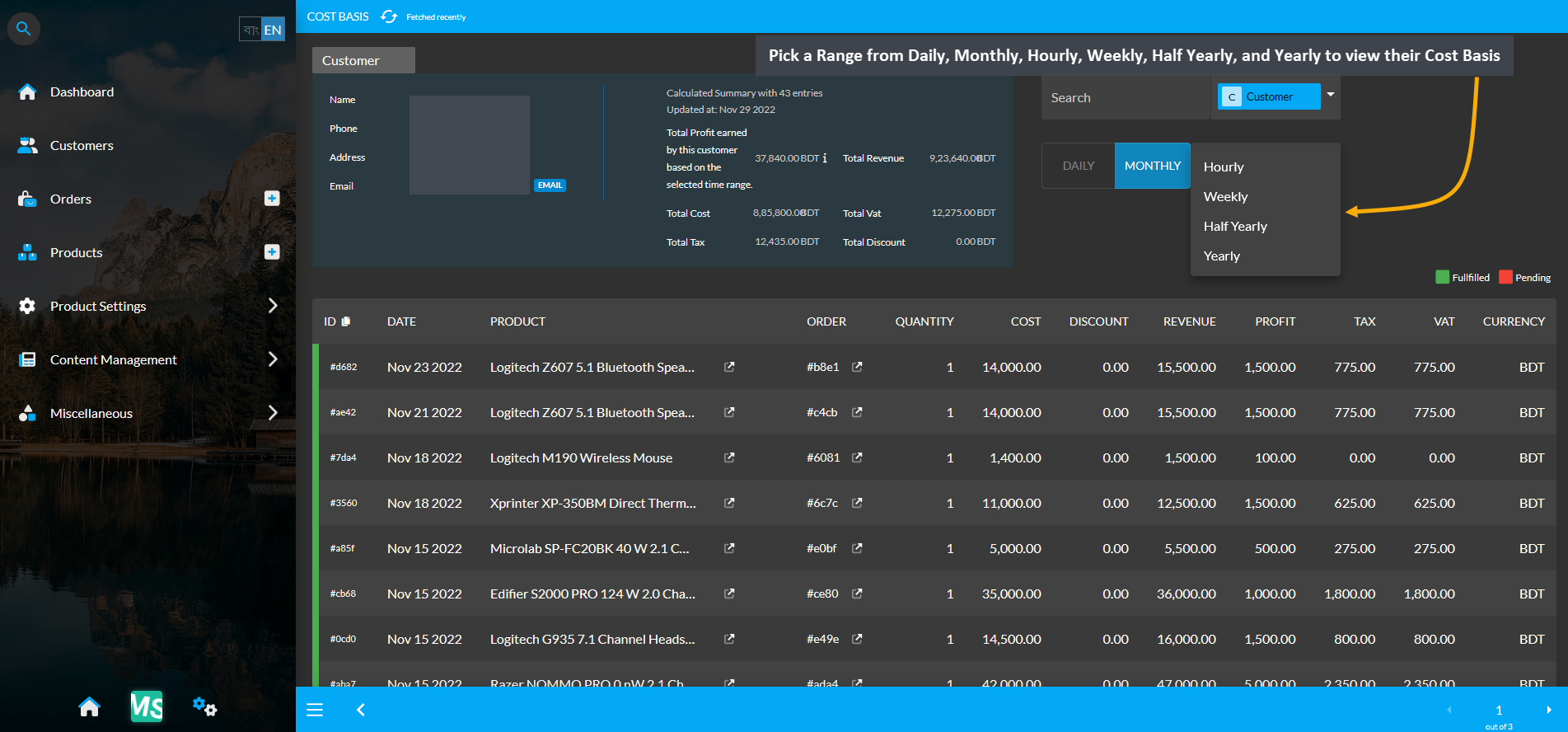

Cost Basis Summary Section

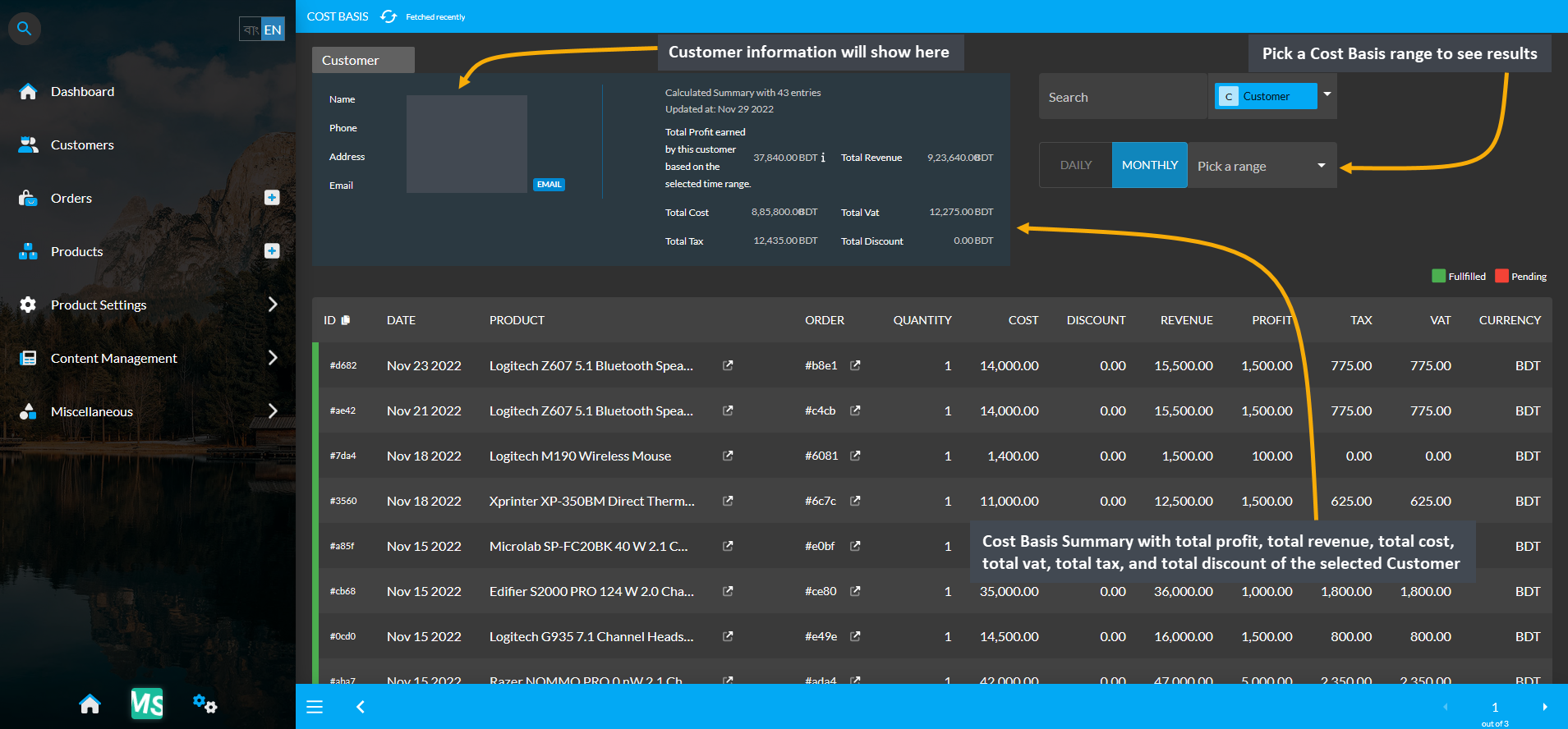

Clicking the small gray graph icon from Customer List will redirect to Customer Cost Basis page. On the top is the Customer cost basis summary showing total profit, total revenue, total cost, total vat, total tax, and total discount and below it is a Customer profile box with basic customer information. For Customer Cost Basis, the Pick a Range or range filtering option will show Customer’s Cost Basis on Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly basis. Below is a long list of entries showing calculations of profit, cost, revenue, vat, tax, and discount separately.

Image 2: Customer Cost Basis shows Customer profile, Cost Basis summary and detailed Order breakdown.

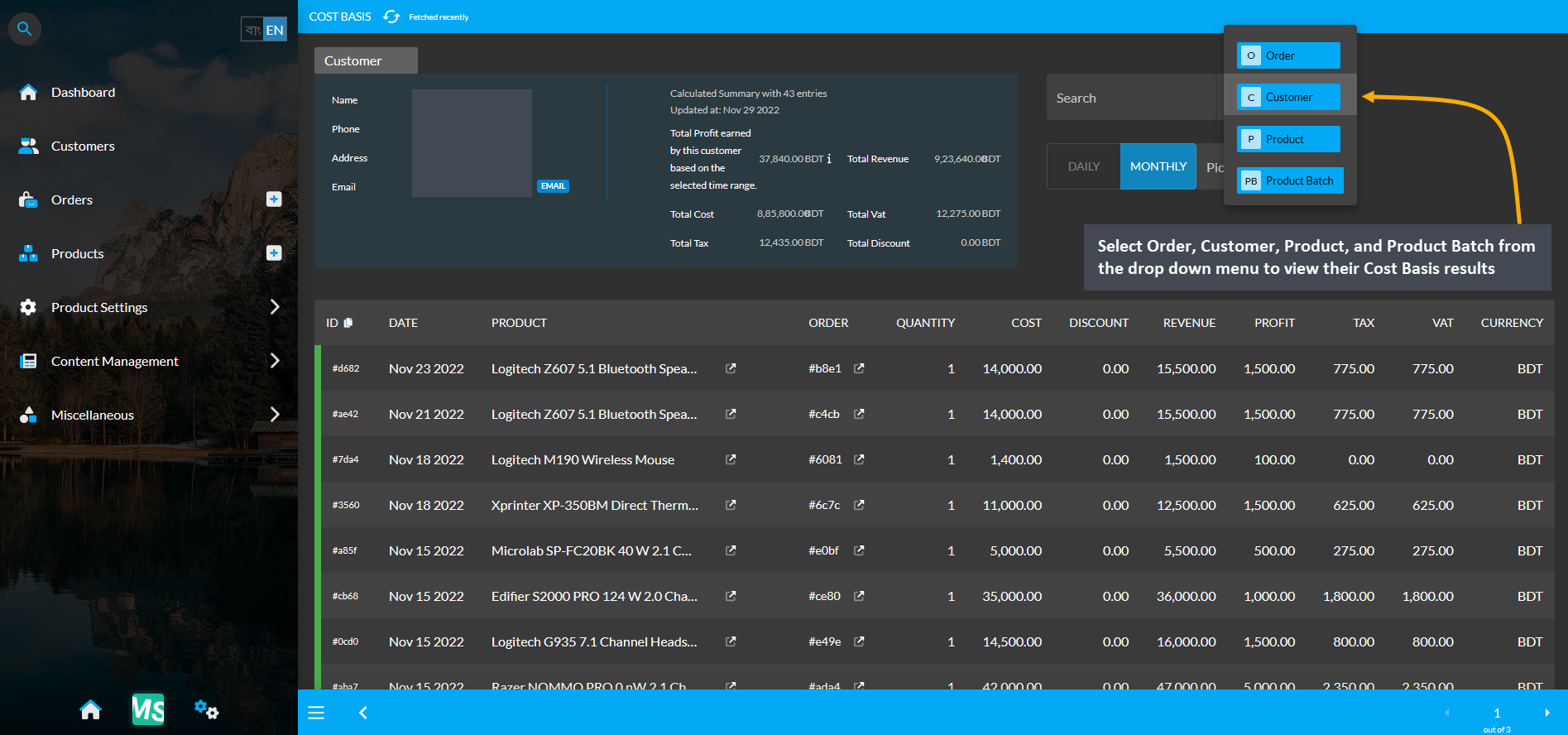

Cost Basis Search and Range Selection

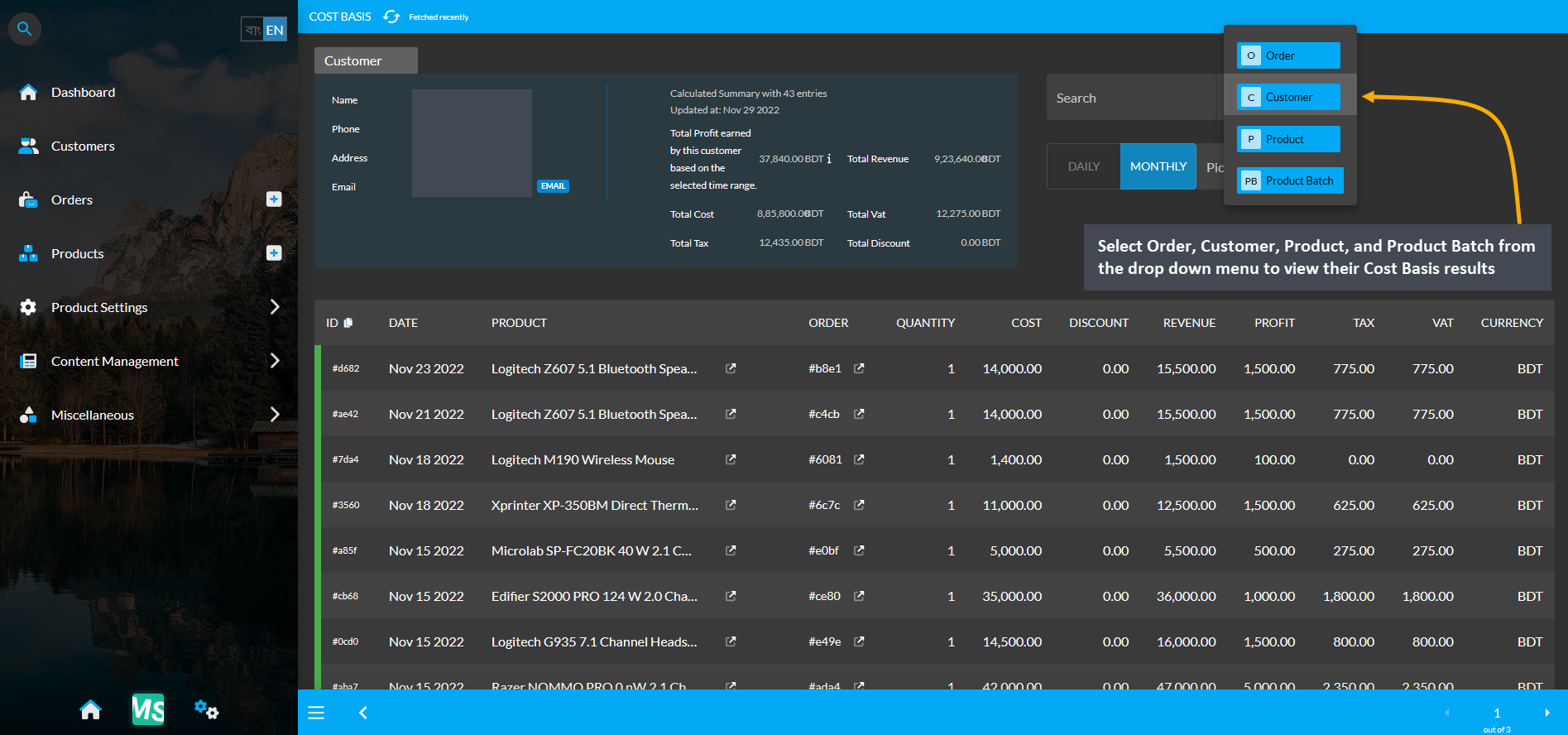

The Customer Cost Basis page have a Search button with a dropdown menu with four options for Order, Customer, Product, and Product Batch on the top right. Clicking each of these options will bring cost basis summary results of Order, Customer, Product, and Product Batch whichever is selected by redirecting to those pages.

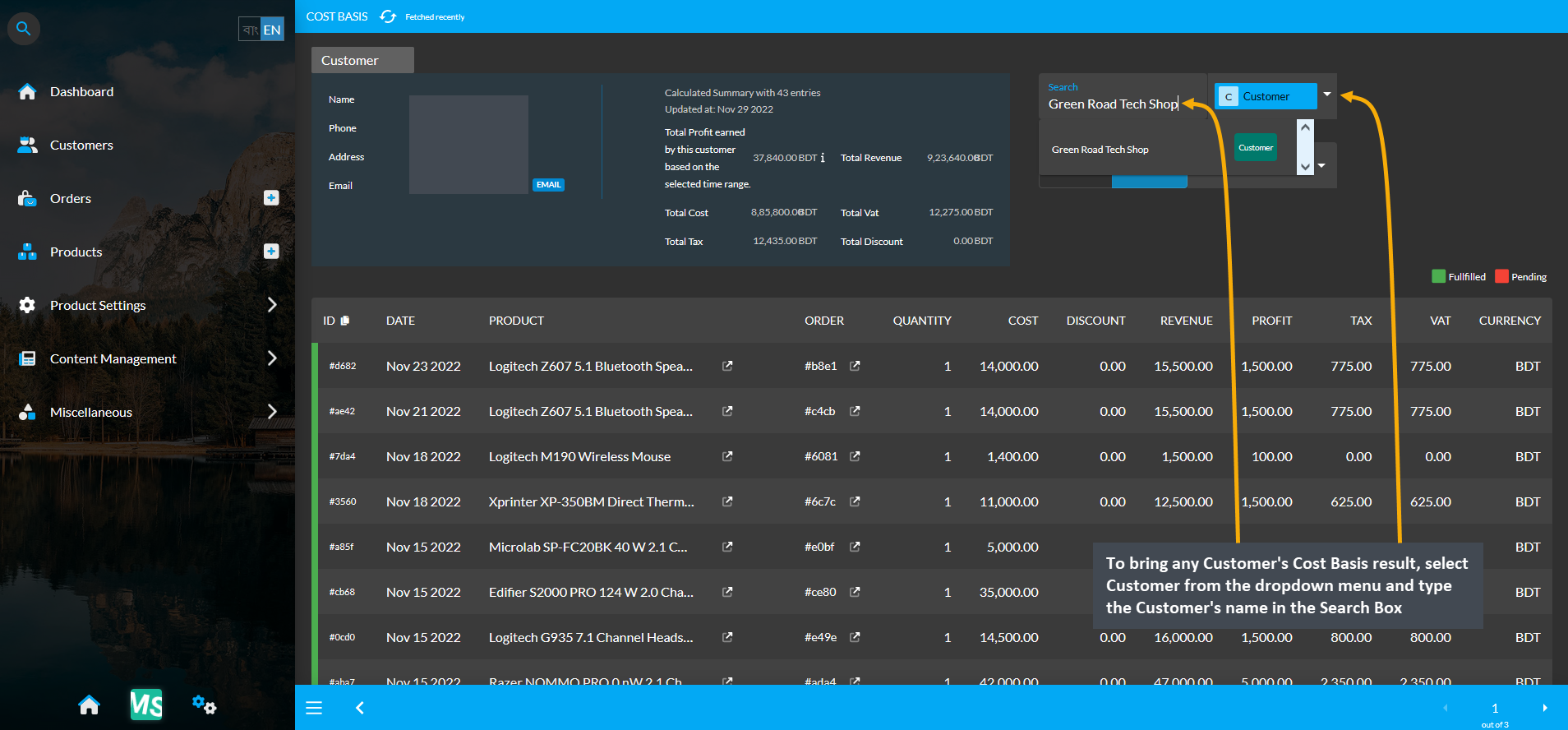

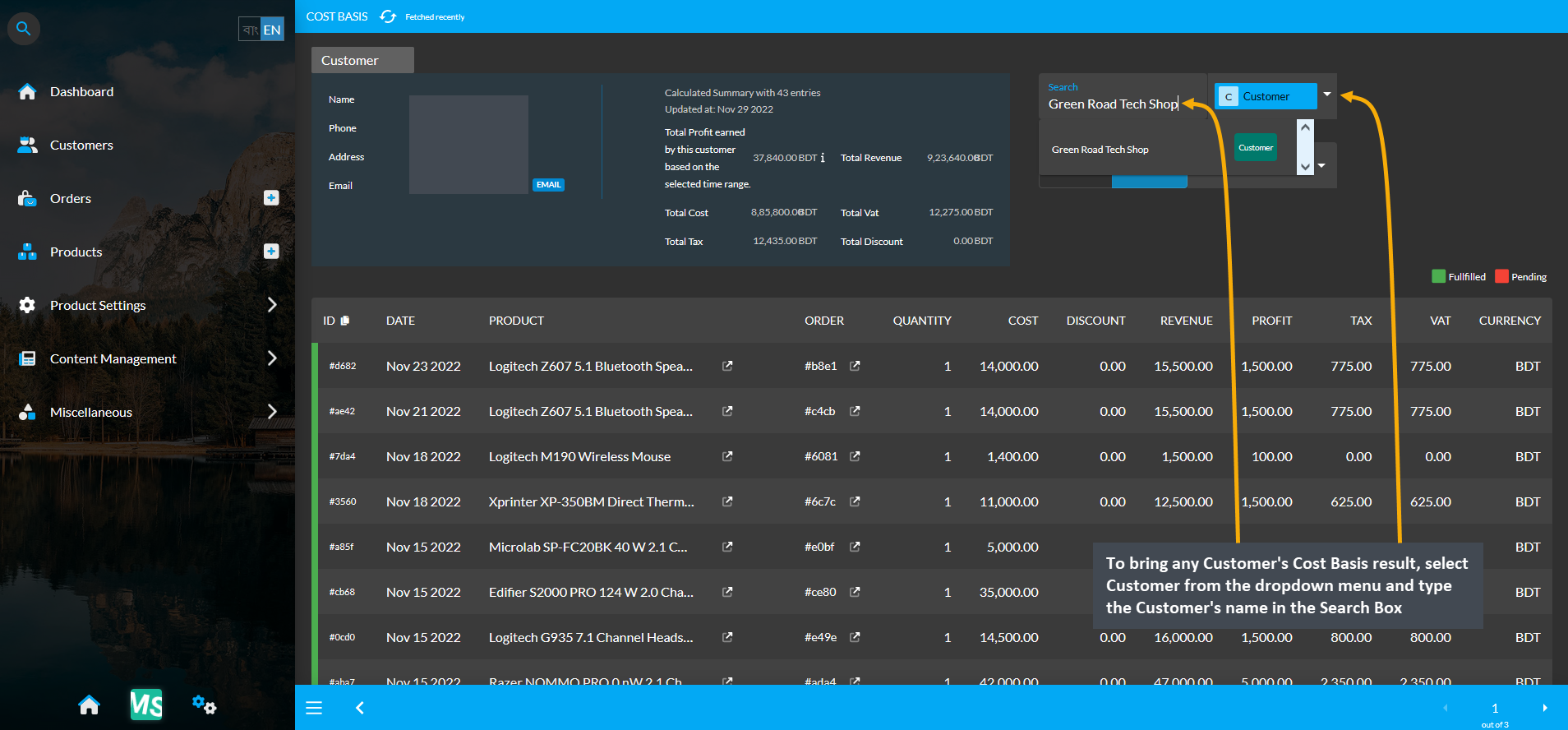

For example, to search and find a Customer’s Cost Basis result, select Customer from the dropdown and type the Customer’s name in the Search box which will bring in the selected Customer’s Cost Basis result. From the Pick a Range box, select - Daily, Monthly, Hourly, Weekly, Half Yearly, and Yearly to view the results of chosen cost basis summary. In this way, the Shop Owner can search for any Customer’s Cost Basis result.

Image 3: Range Filtering option is enabled for Customer, select an option to view their Cost Basis result.

Image 4: Select Customer from dropdown and type Customer's name in Search Box to view their Cost Basis.

Image 5: Pick a Range from Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly to view their Cost Basis.

2 - Order Cost Basis

Detailed overview of cost basis for Order Section.

This section discusses the importance of cost basis for tax purposes as it calculates the amount of total profit, cost/ purchase price, and revenue to understand capital gain or loss.

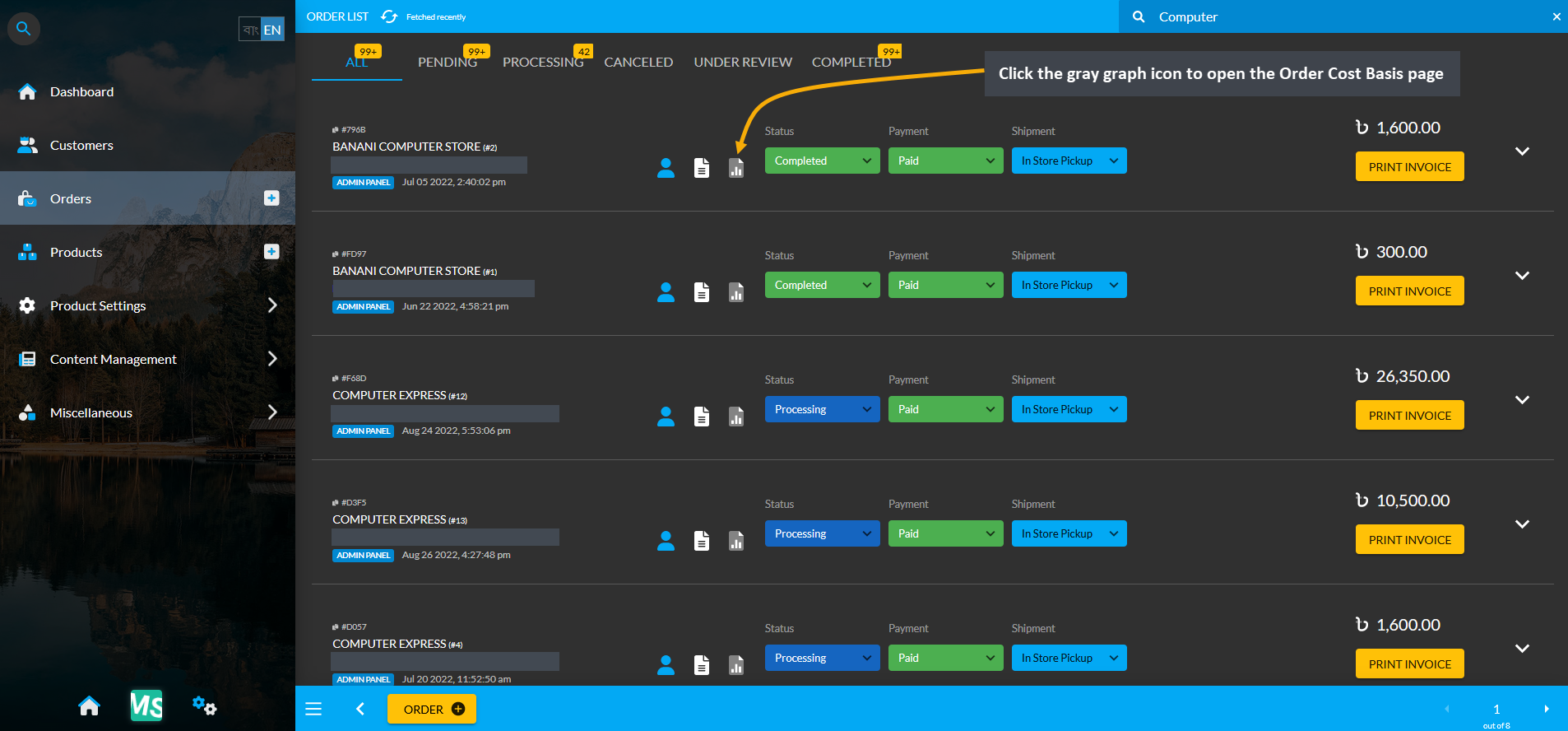

Order Cost Basis Summary

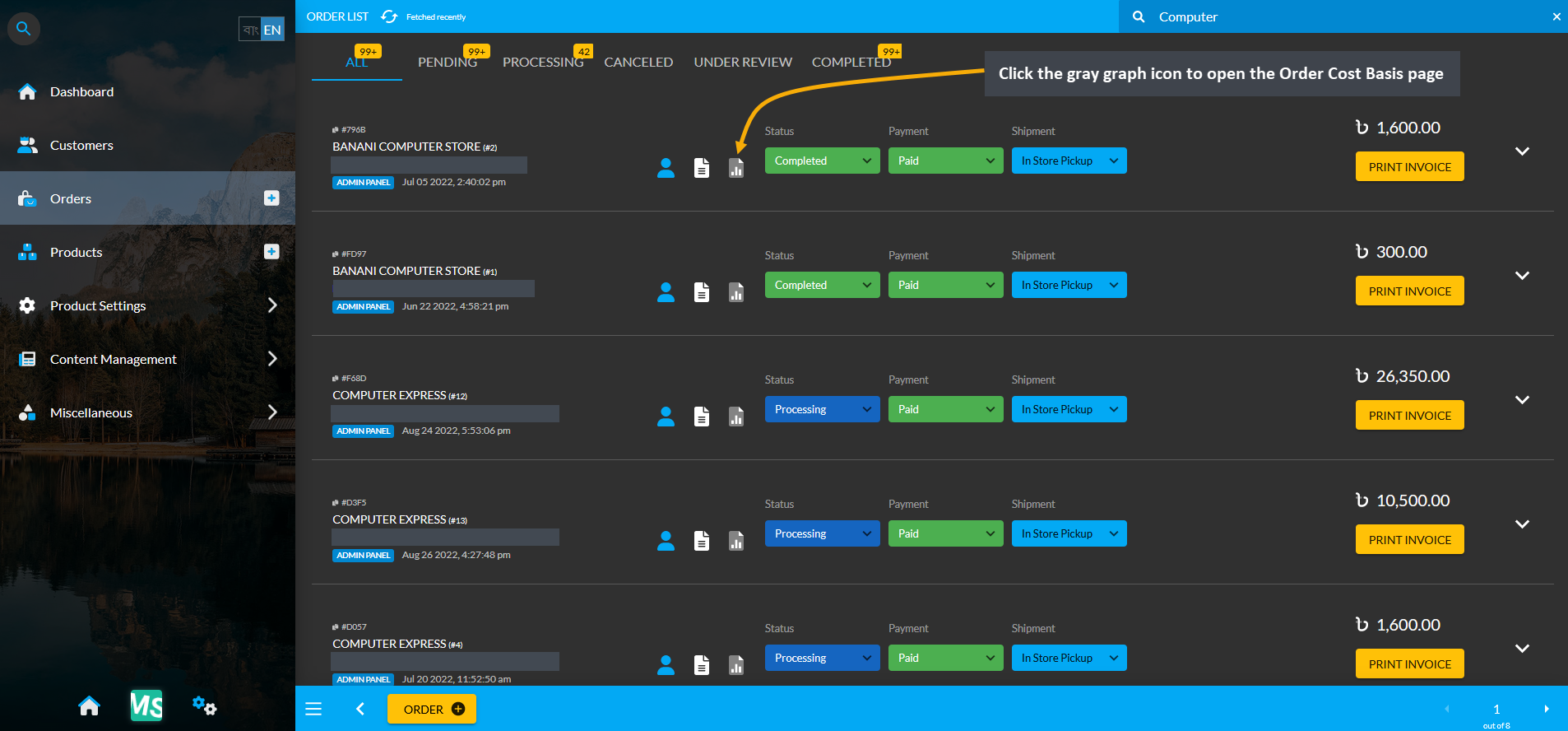

Click the Orders module which will open the Order List. From there, click on the small gray graph icon that will redirect to the Order Cost Basis page showing total profit, total revenue, total cost, total vat, and total discount.

Image 1: Click the small gray graph icon on Order List that will redirect to the Order Cost Basis page.

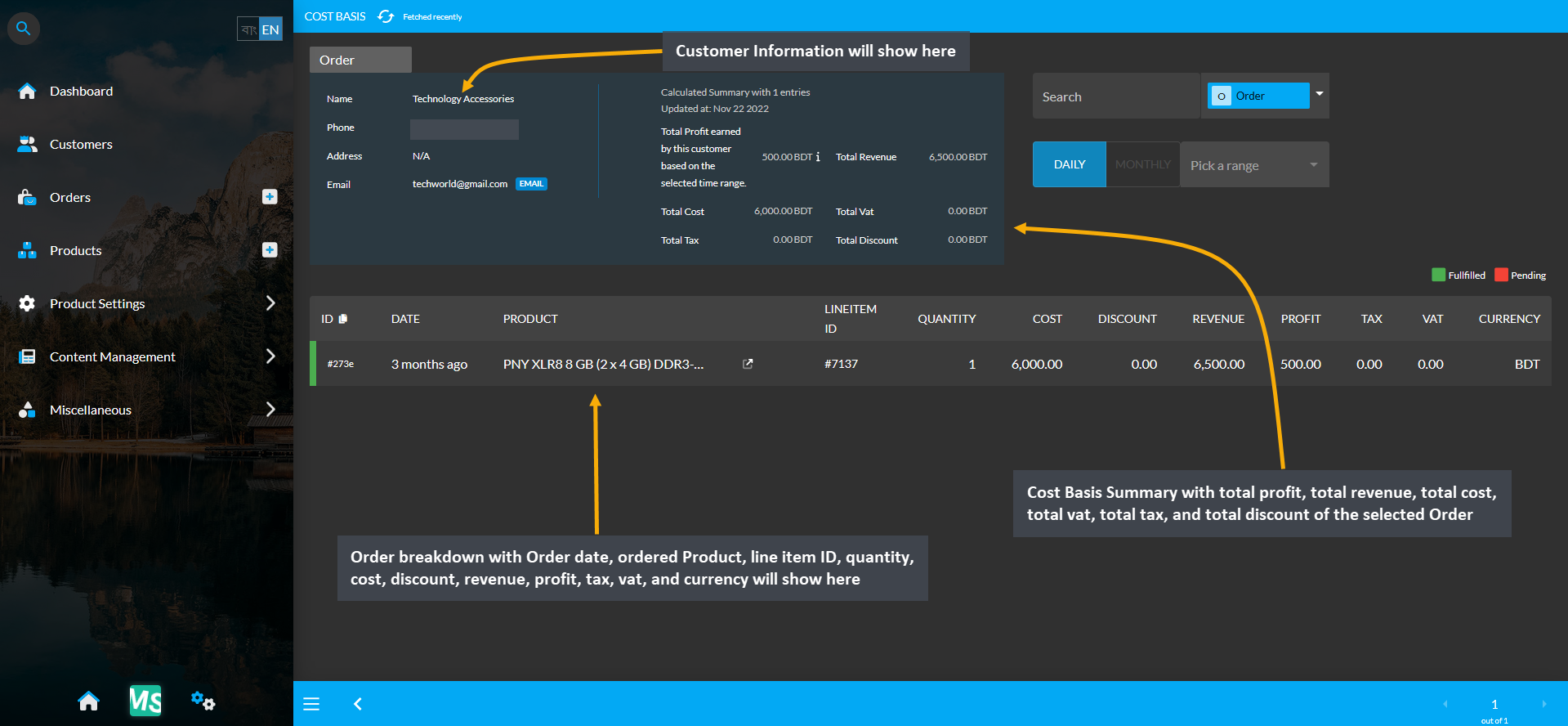

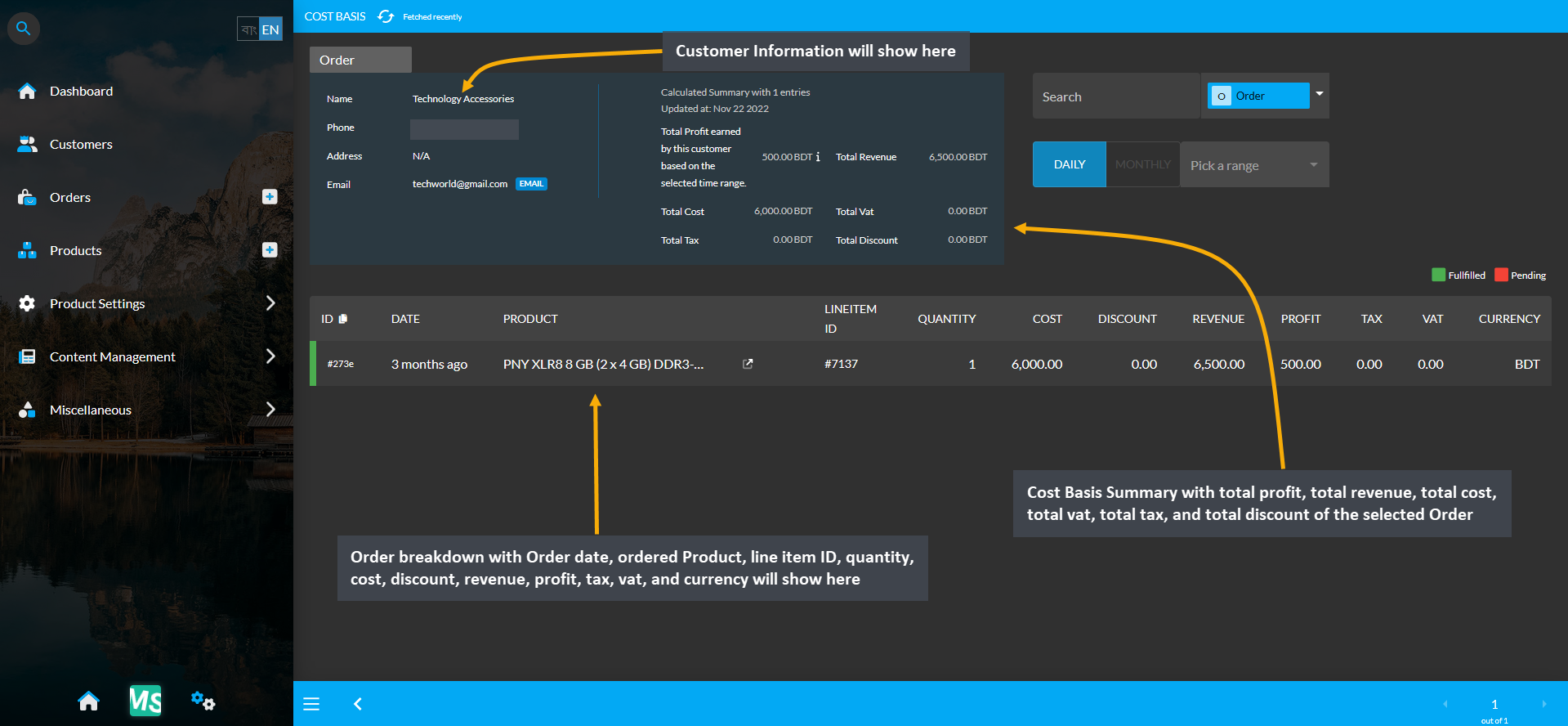

Cost Basis Summary Section

For Order Cost Basis, the Pick a Range or range filtering option is disabled, because Orders do not have multiple cost basis. Clicking the small gray graph icon from Order List will redirect you to Order Cost Basis page. On the top left of the page is an Order profile box with basic customer information and Order cost basis summary showing total profit, total revenue, total cost, total vat, total tax, and total discount of the selected Order. Below shows the Order date, ordered Product, line item ID, quantity, cost, discount, revenue, profit, tax, vat, and currency.

Image 2: Order Cost Basis shows Customer profile, Order Cost Basis summary and detailed Order breakdown.

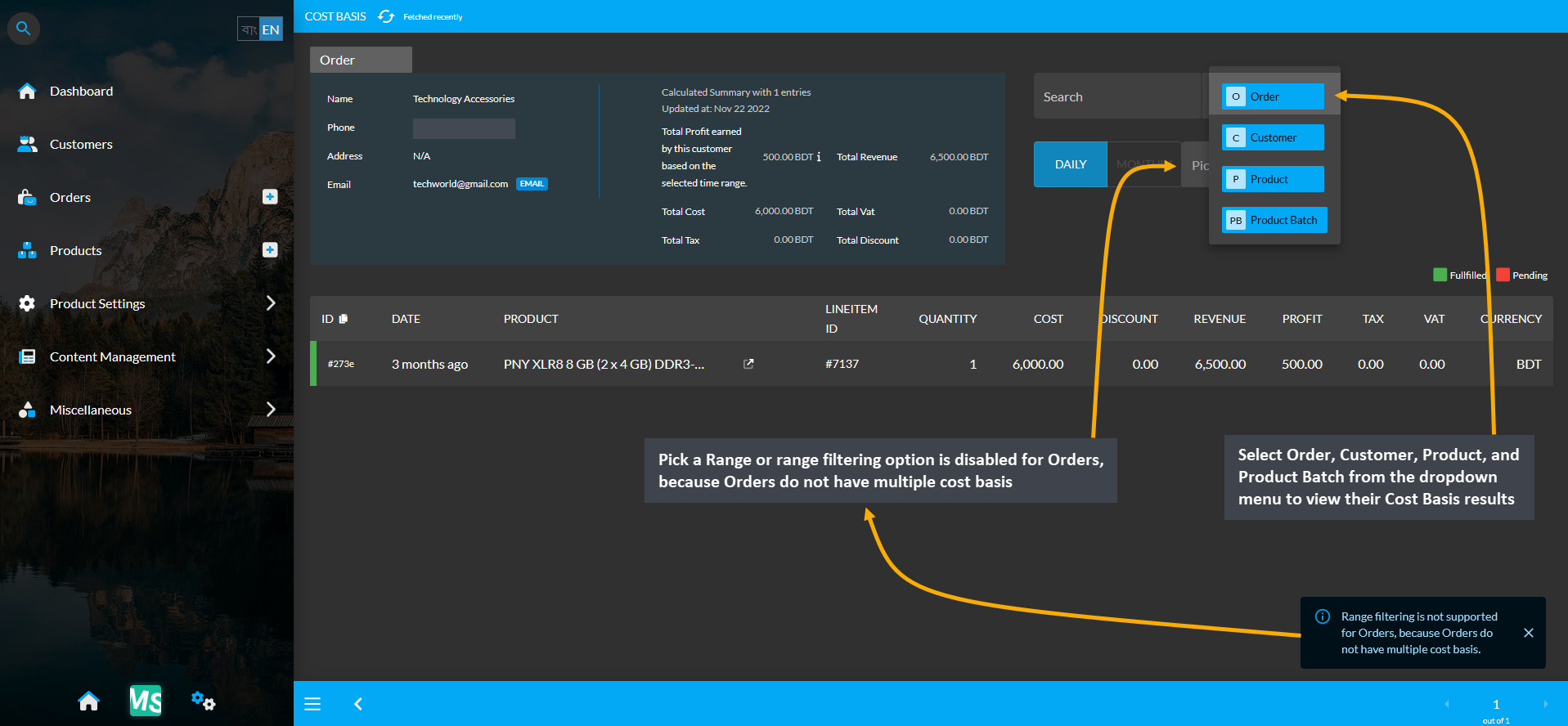

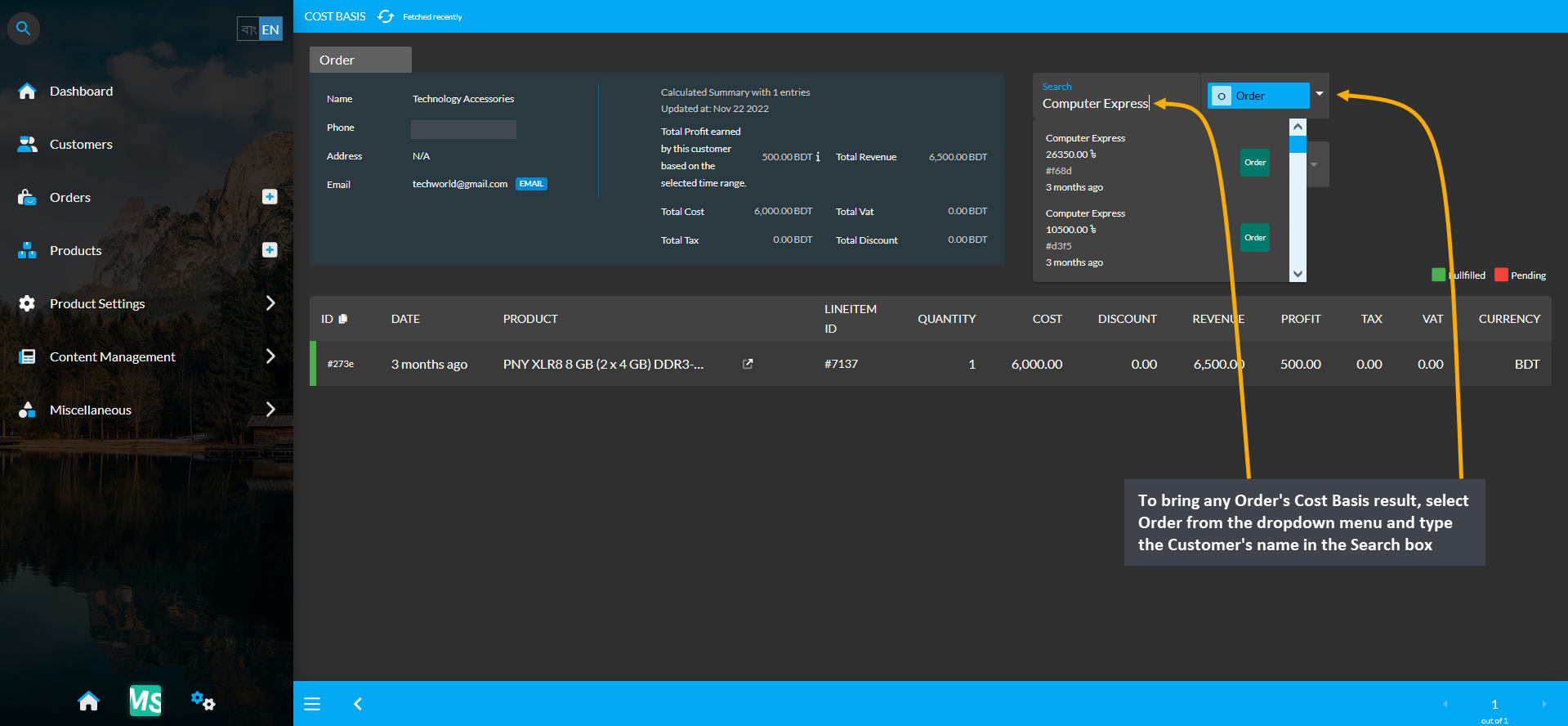

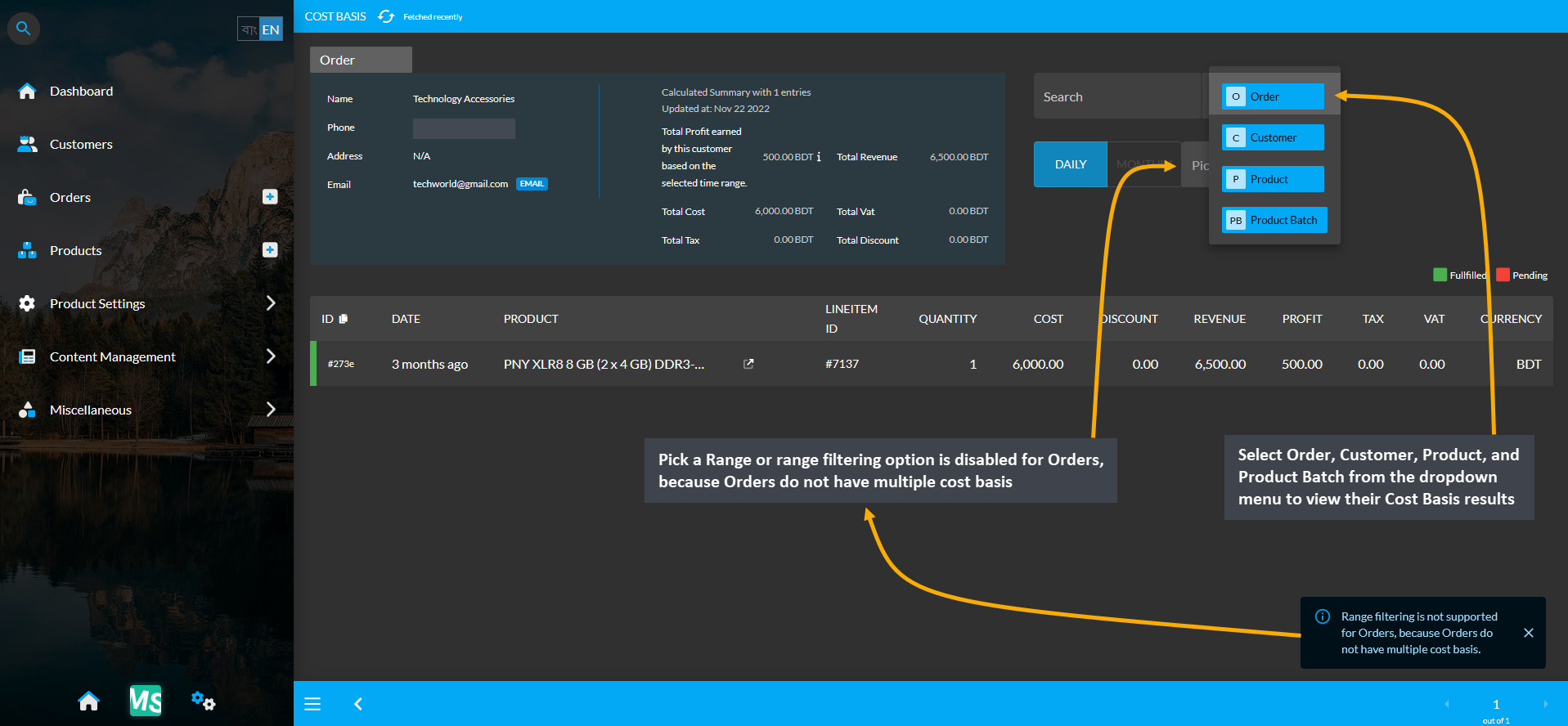

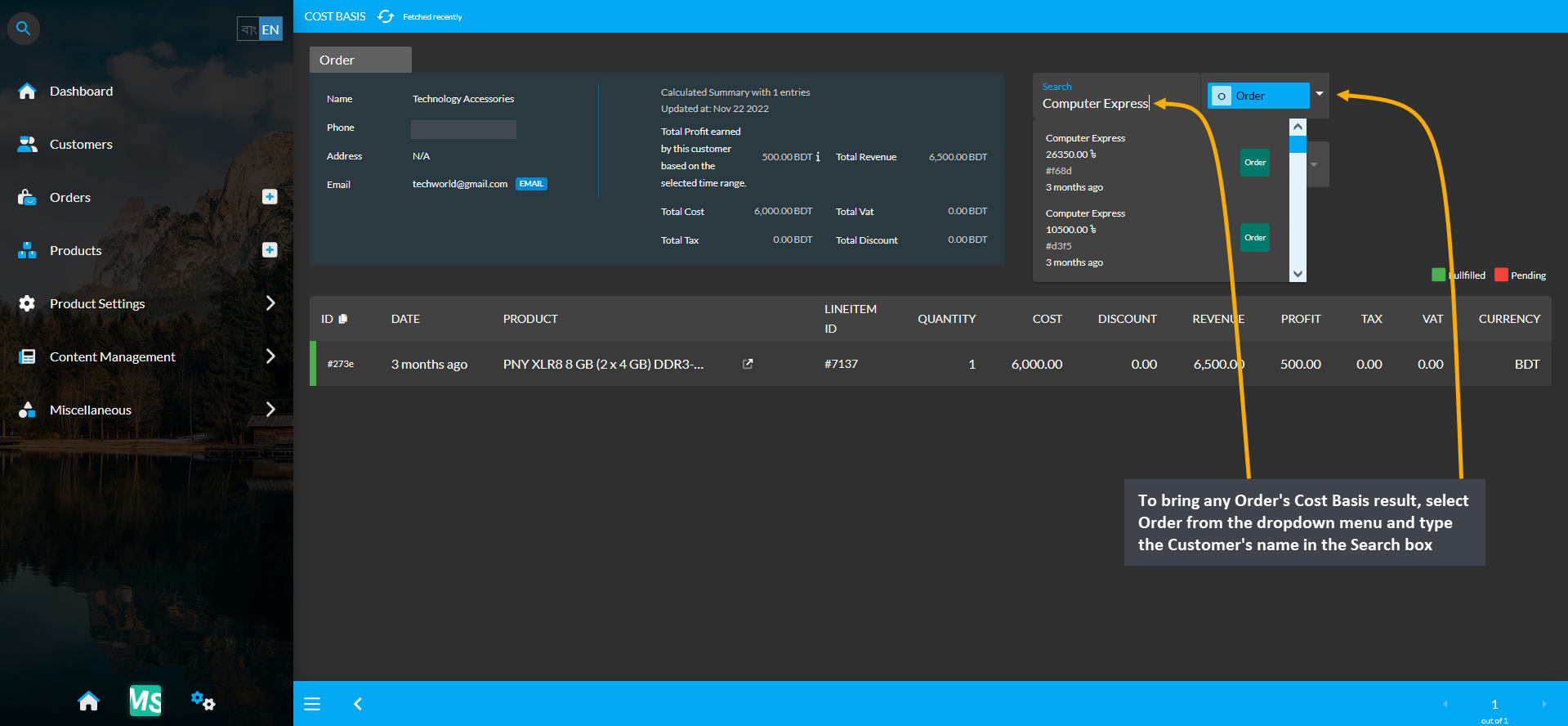

Cost Basis Search and Range Selection

The Order Cost Basis page also have a Search button with a dropdown menu with four options of Order, Customer, Product, and Product Batch on the top right. Clicking each of these options will bring cost basis summary results of Order, Customer, Product, and Product Batch whichever is selected. For example, to search and find an Order’s Cost Basis result, select Order from the dropdown and type the Customer’s name in the Search box which will bring in the selected Order’s Cost Basis result. In this way, the Shop Owner can search for any Order’s Cost Basis result.

Image 3: Range Filtering option is disabled for Orders, select an option to view their Cost Basis result.

Image 4: Select Order from dropdown and type Customer’s name in Search box to view their Cost Basis result.

3 - Product Cost Basis

Detailed overview of cost basis for Product Section.

This section discusses the importance of cost basis for tax purposes as it calculates the amount of total profit, cost/ purchase price, and revenue to understand capital gain or loss.

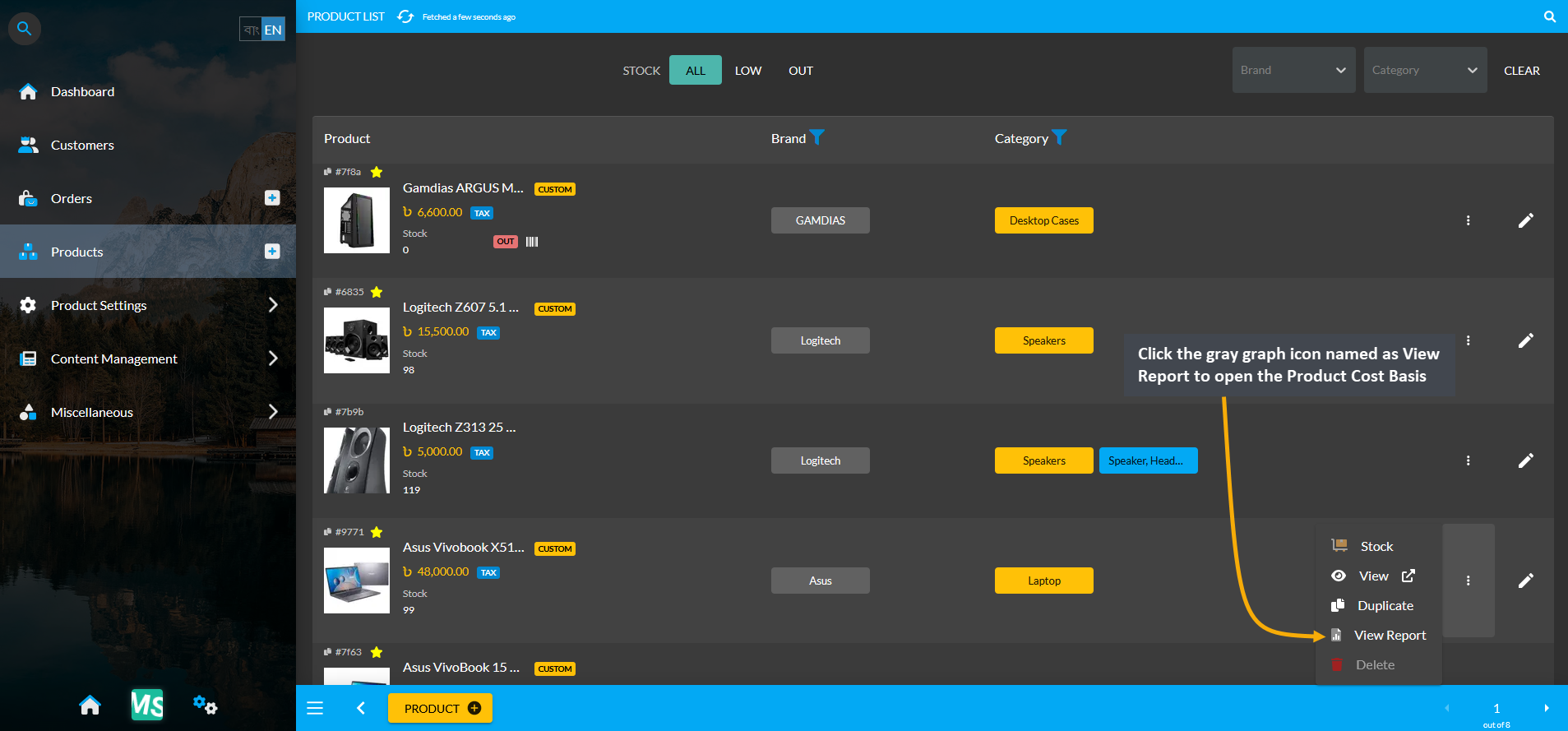

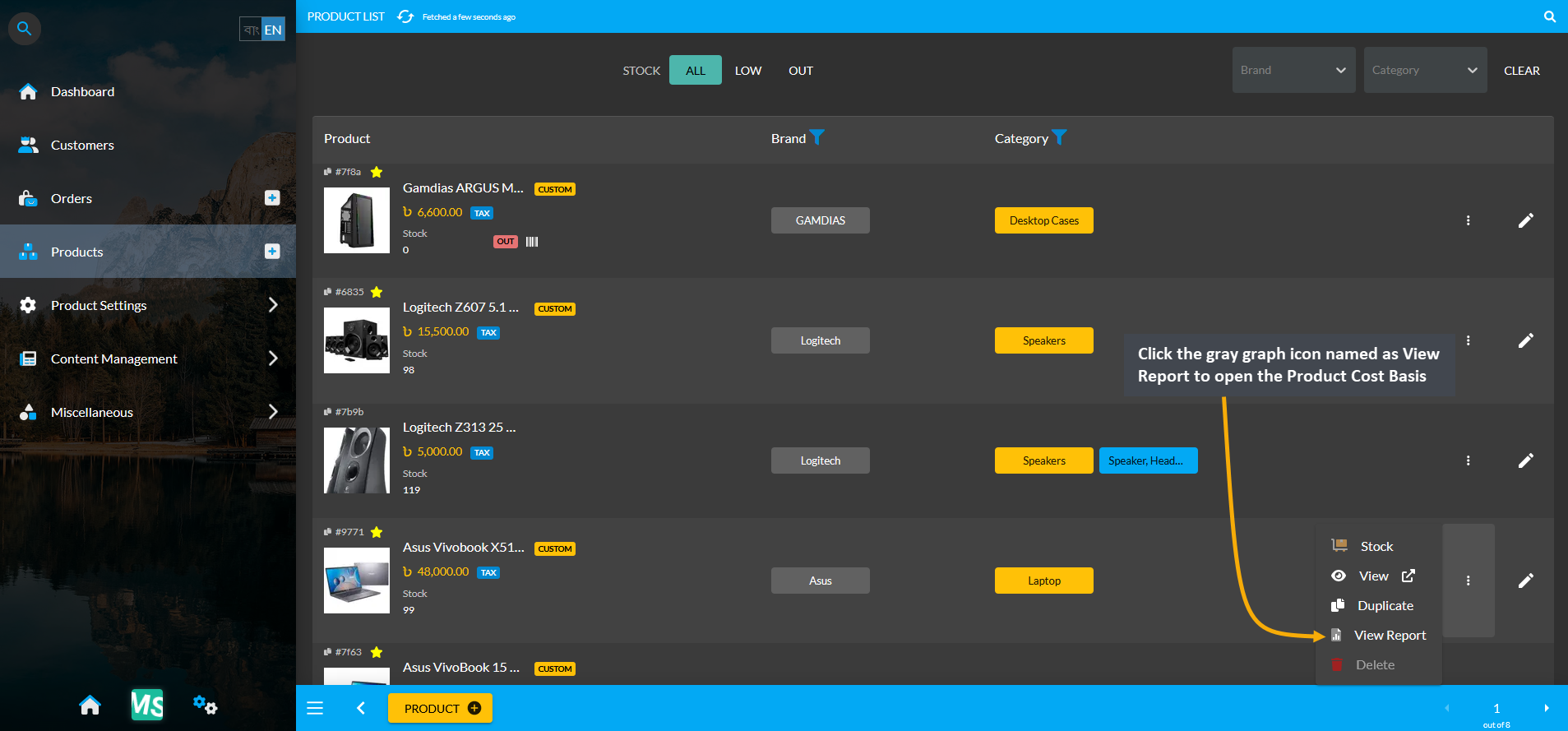

Product Cost Basis

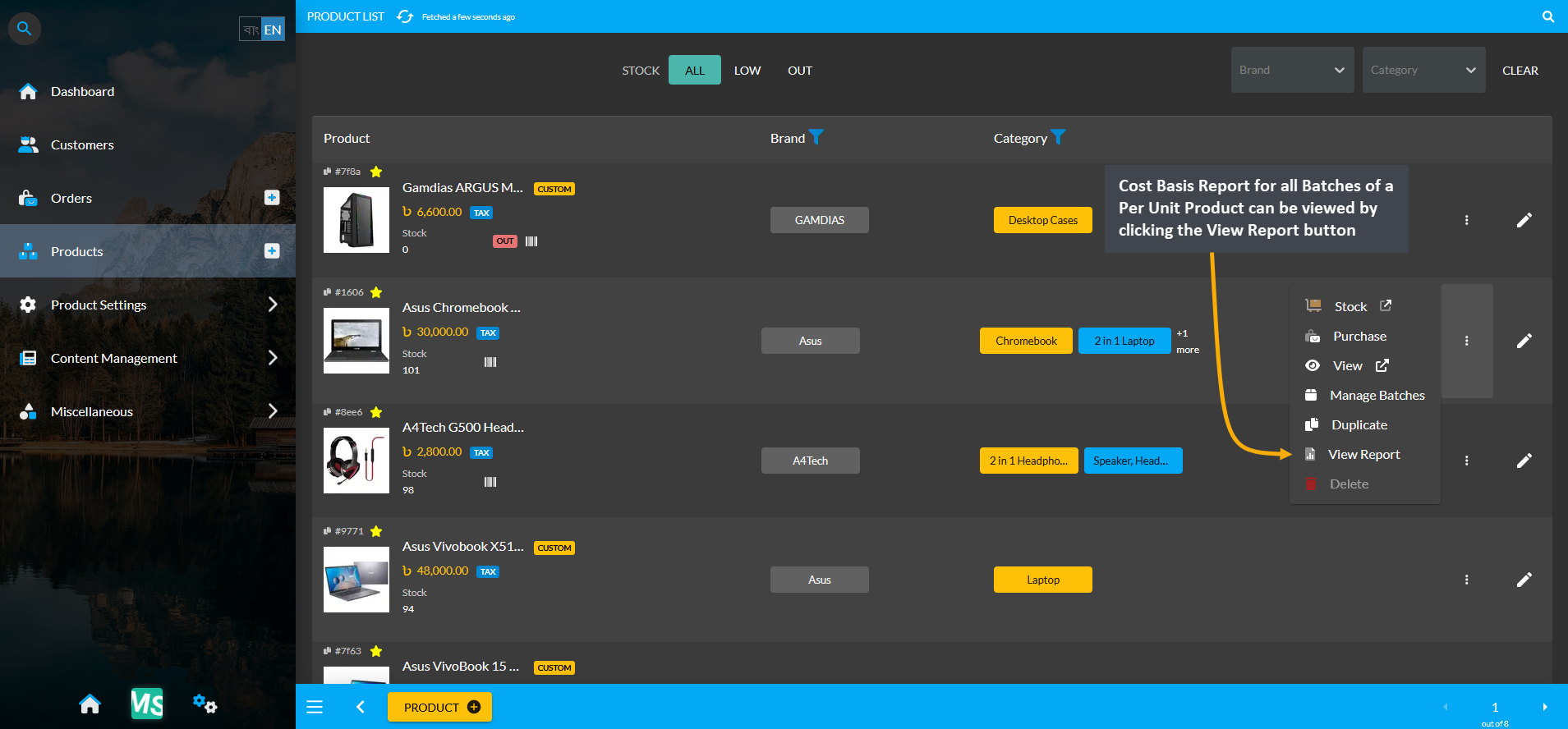

Click the Products module which will open the Product List. From here, go to any Product and click on the small gray graph icon marked as View Report that will redirect to the Product Cost Basis page showing total profit, total revenue, total cost, total vat, and total discount of that Product within different time frame ranges.

Image 1: Click the small gray graph icon on Product List that will redirect to the Product Cost Basis page.

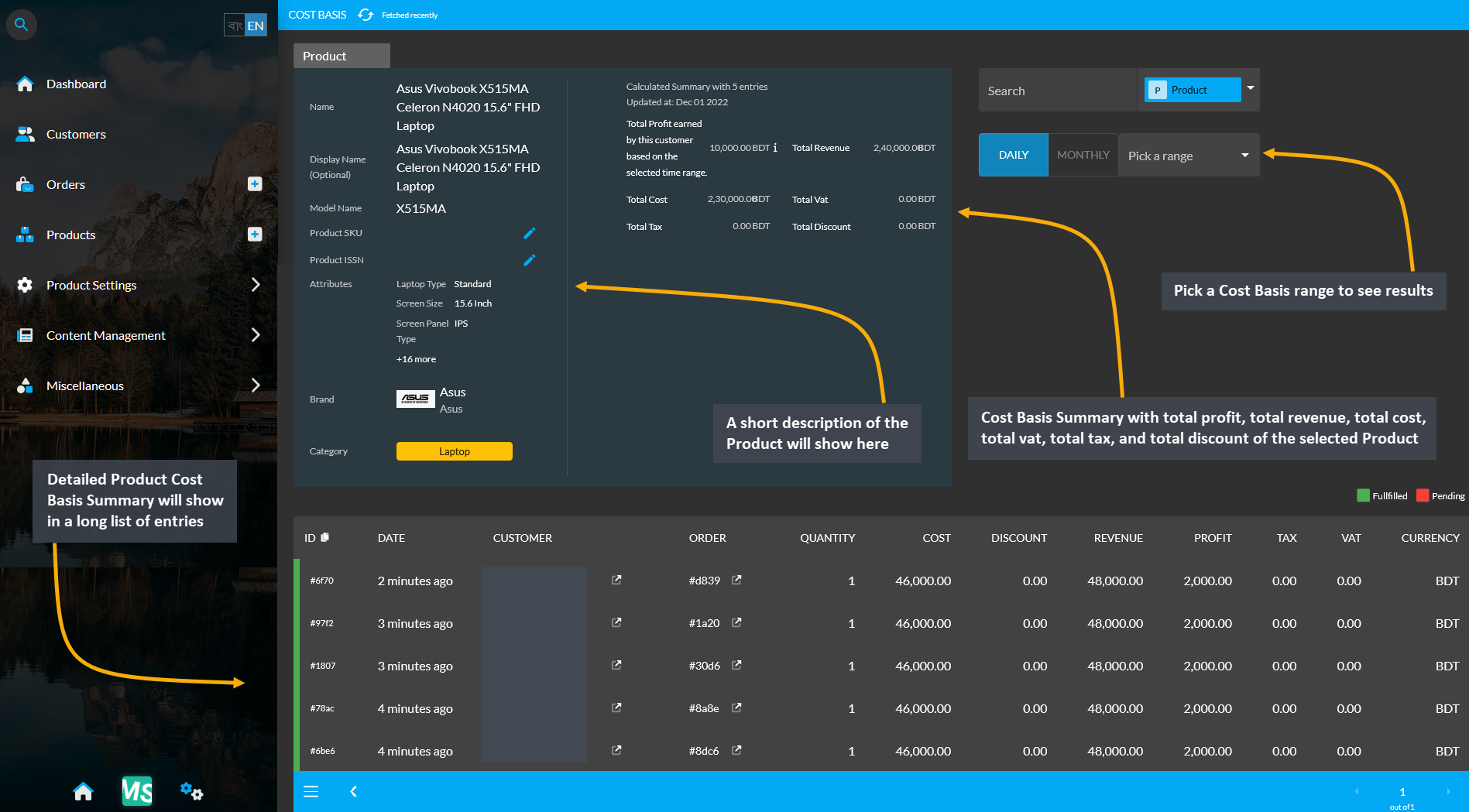

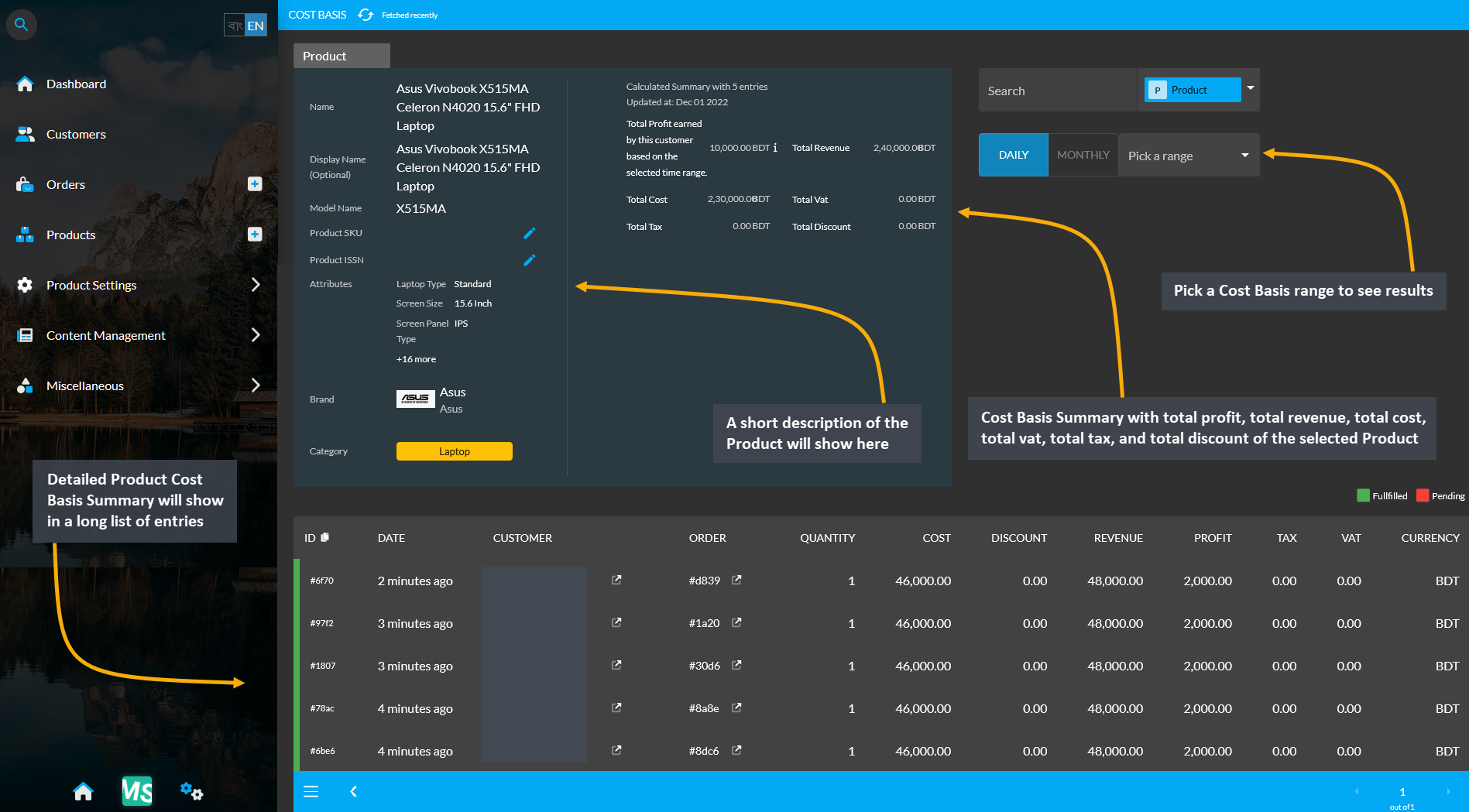

Cost Basis Summary Section

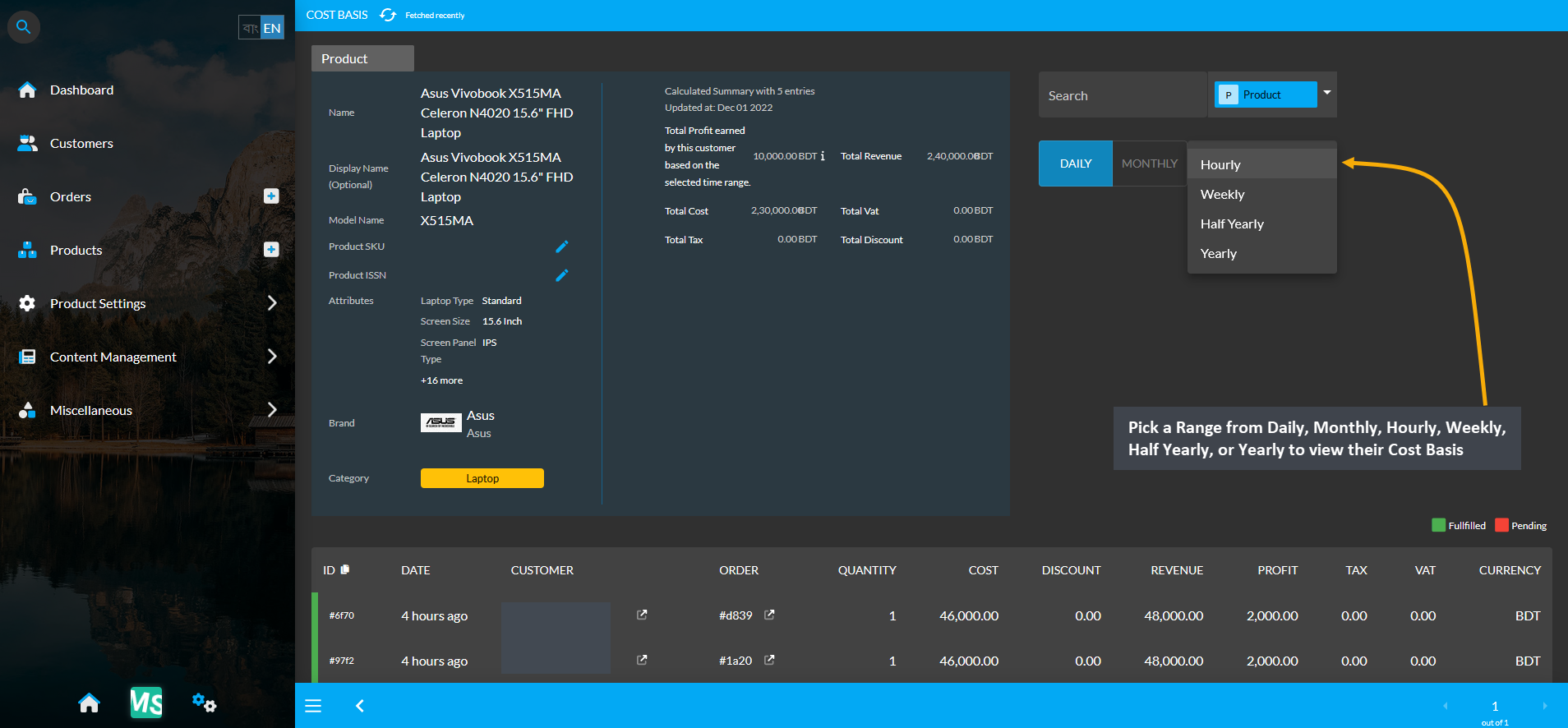

Clicking the small gray graph icon from Product List will redirect to Product Cost Basis page. On the top is Product cost basis summary showing total profit, total revenue, total cost, total vat, total tax, and total discount and below it is the detailed description of the Product. For Product Cost Basis, the Pick a Range or range filtering option will show the Product’s Cost Basis on Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly basis. Below is a long list of entries showing calculations of profit, cost, revenue, vat, tax, and discount separately.

Image 2: Product Cost Basis shows Product info, Product Cost Basis summary and detailed Order breakdown.

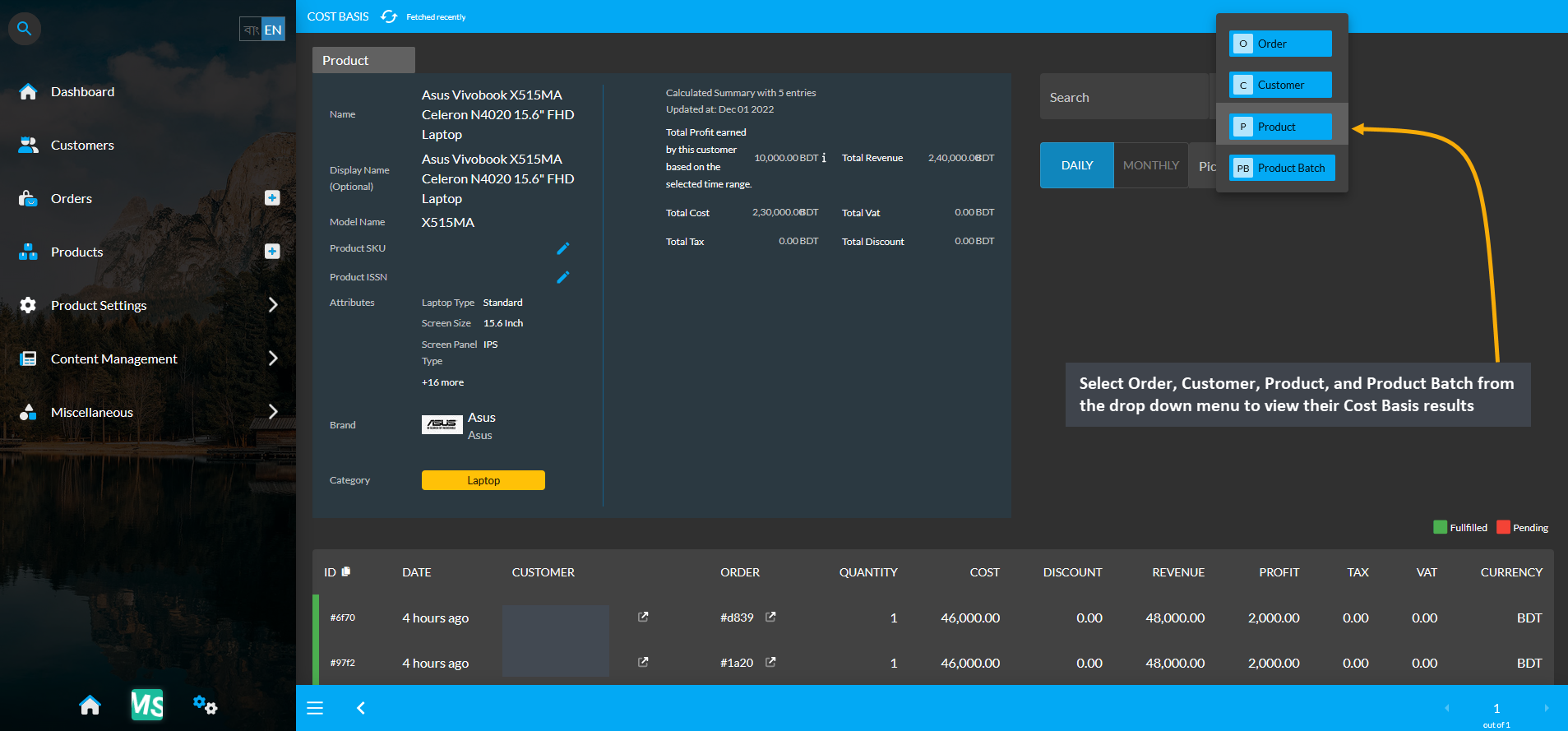

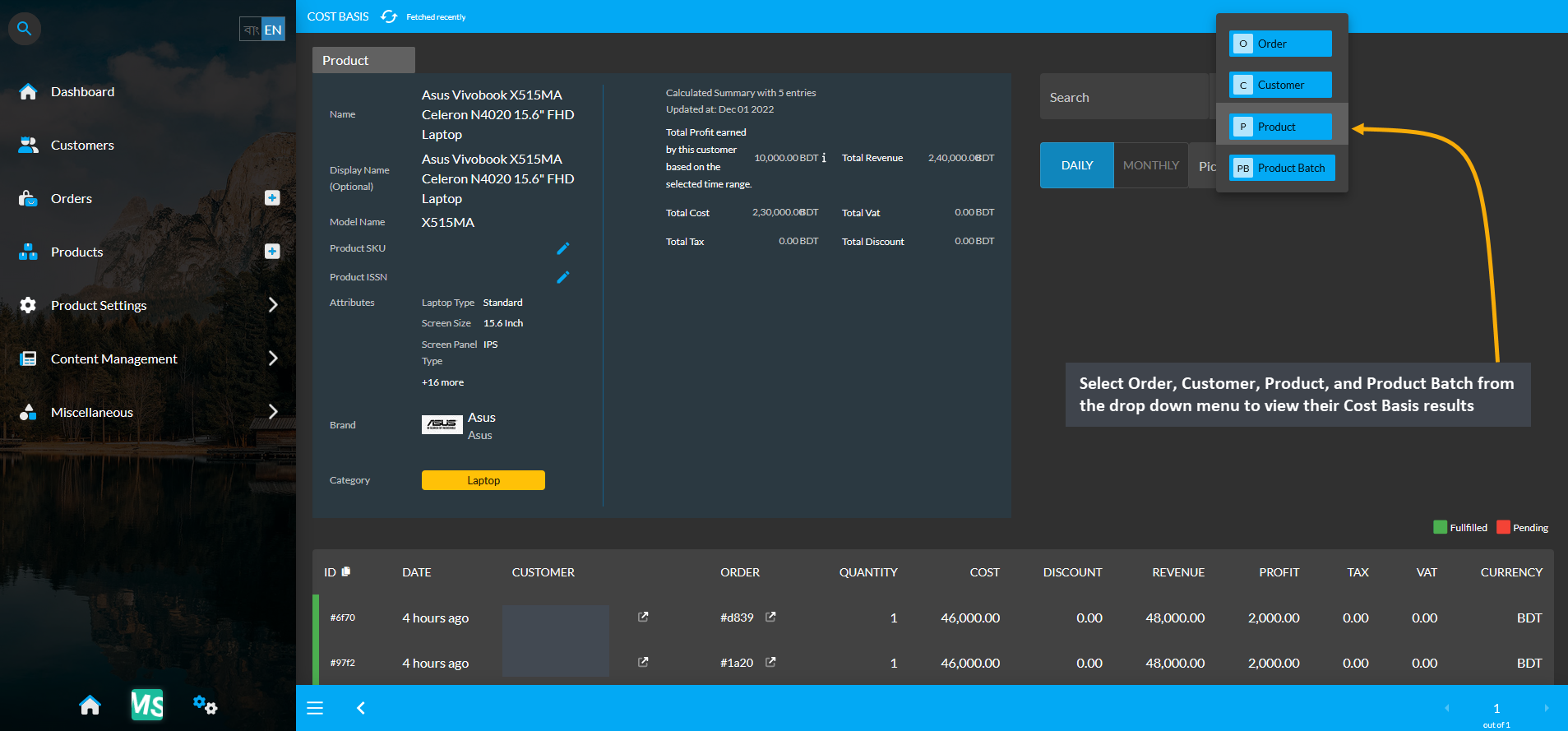

Cost Basis Search and Range Selection

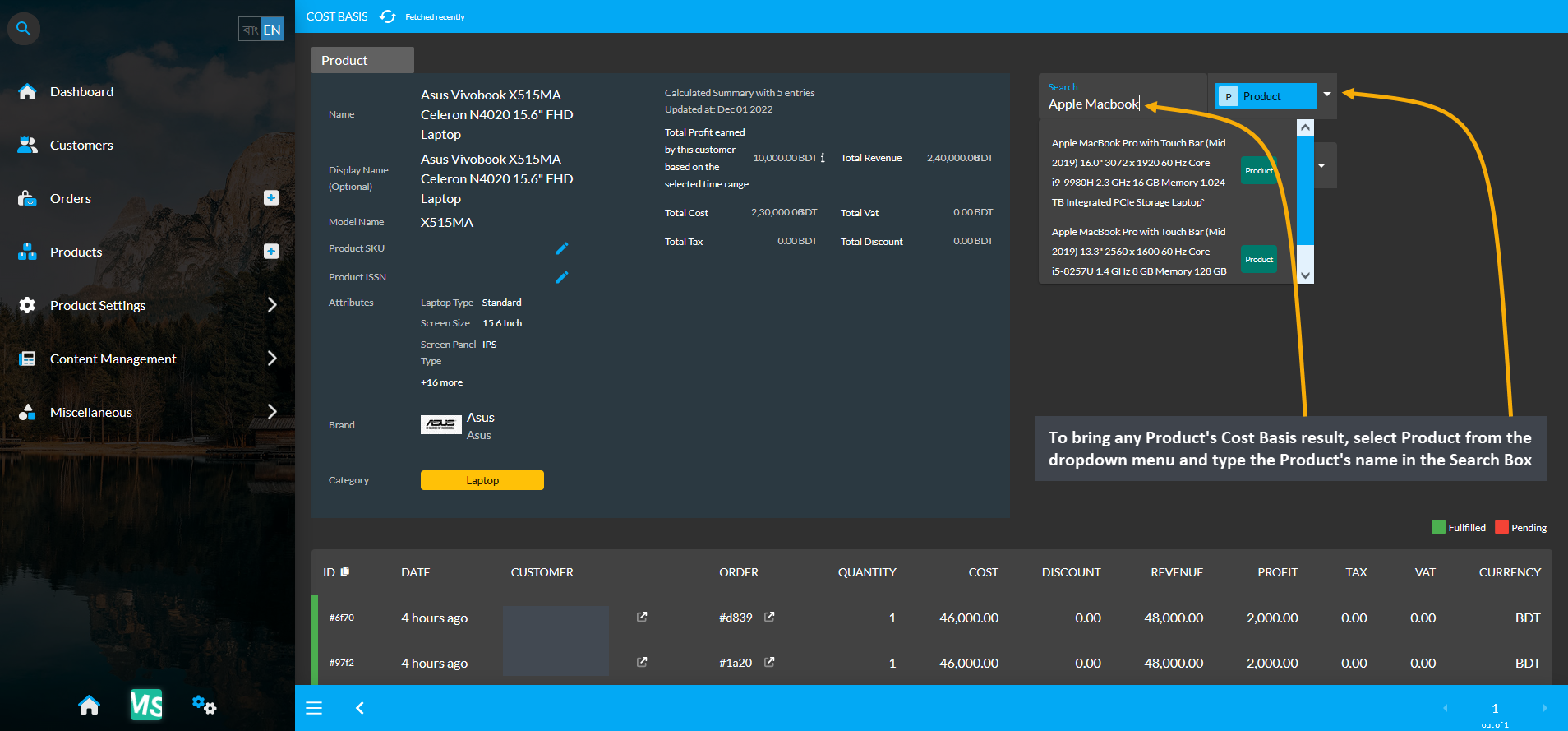

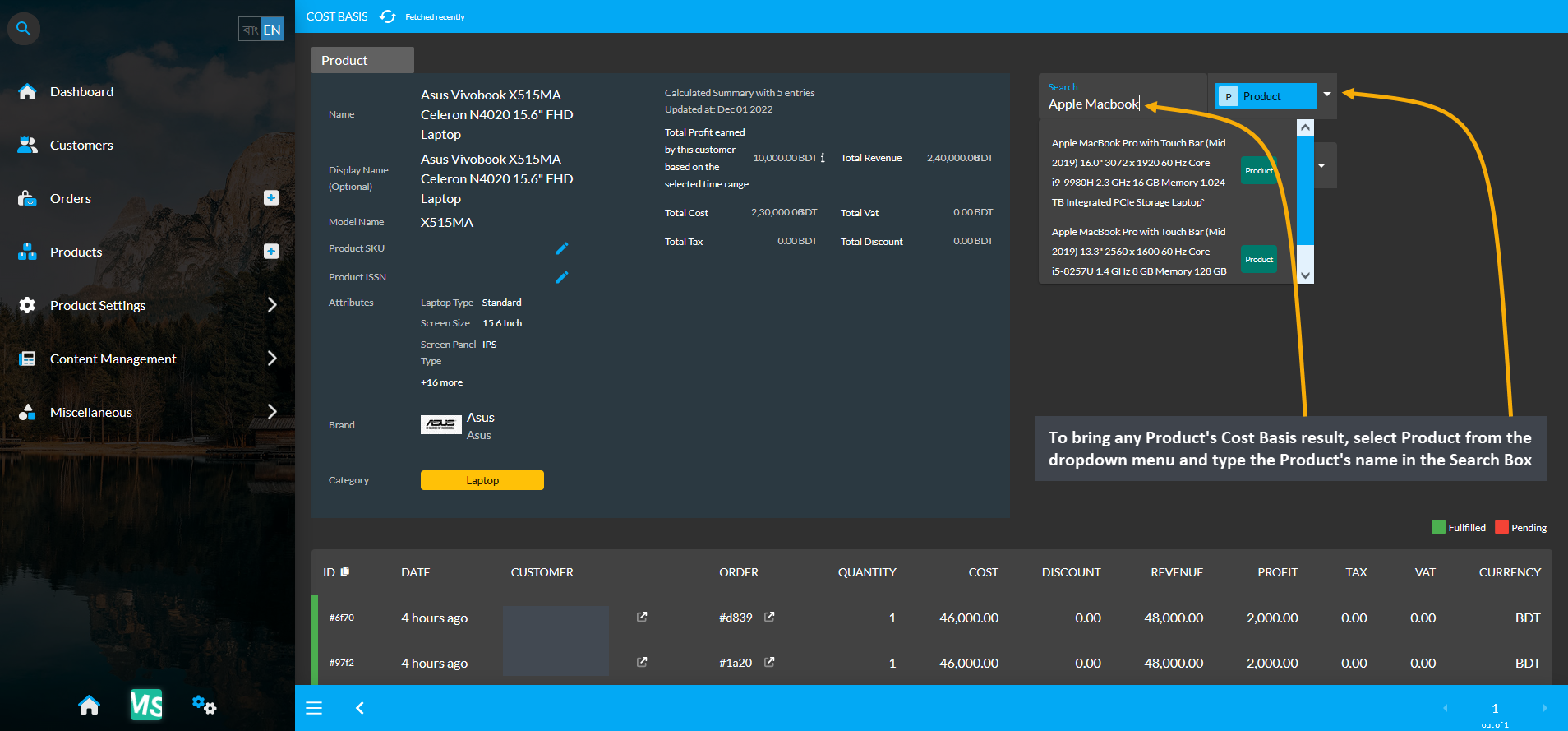

The Product Cost Basis page have a Search button with a dropdown menu having four options for Order, Customer, Product, and Product Batch on the top right. Clicking each of these options will bring cost basis summary results of Order, Customer, Product, and Product Batch whichever is selected by redirecting to those pages.

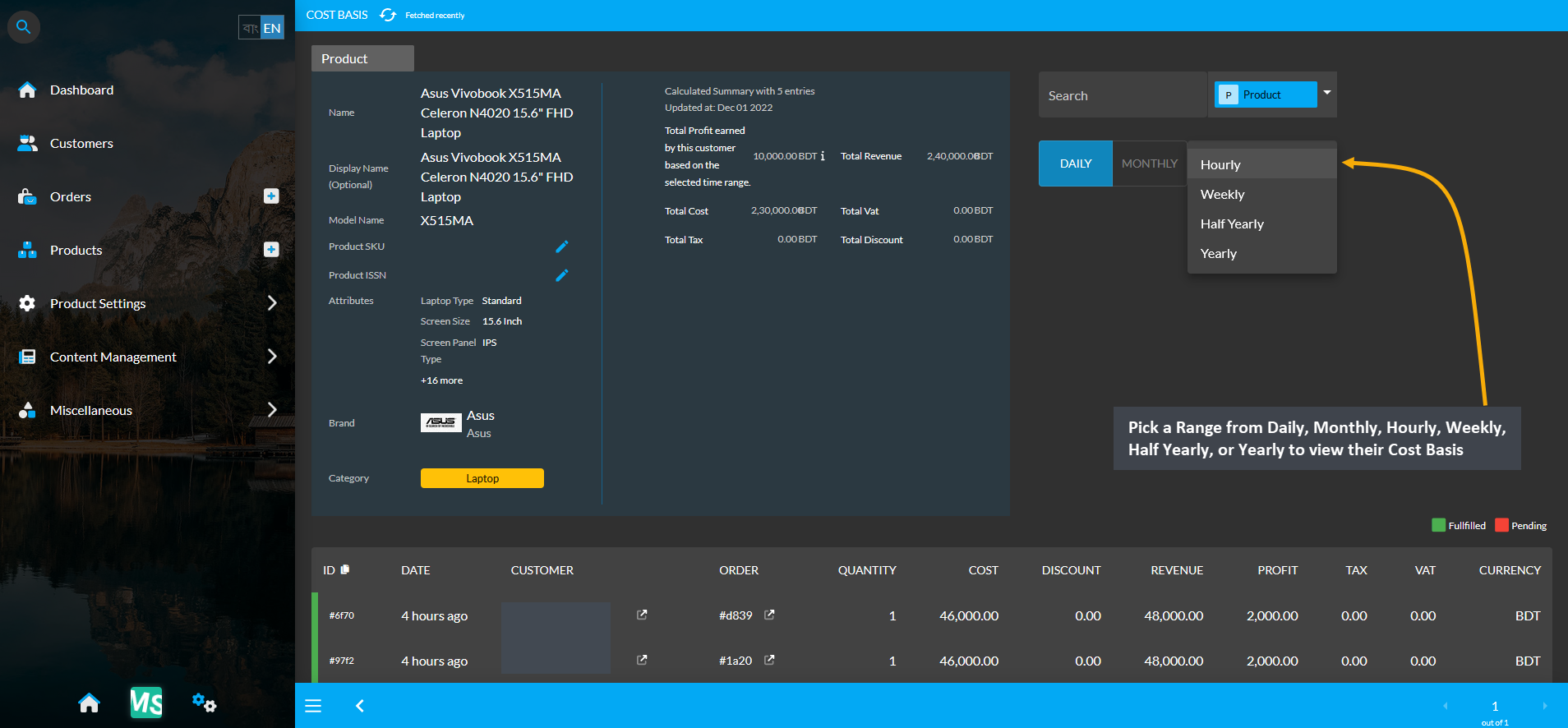

For example, to search and find a Product’s Cost Basis result, select Product from the dropdown and type a target Product’s name in the Search box which will bring in the selected Product’s Cost Basis result. From the Pick a Range box, select - Daily, Monthly, Hourly, Weekly, Half Yearly, and Yearly to view results of chosen cost basis summary. In this way, the Shop Owner can search for any Product’s Cost Basis result.

Image 3: Range Filtering option is enabled for Product, select an option to view their Cost Basis result.

Image 4: Select Product from dropdown and type Product's name in Search Box to view their Cost Basis.

Image 5: Pick a Range from Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly to view their Cost Basis.

4 - Product Batch Cost Basis

Detailed overview of cost basis for Product Batch Section.

This section discusses the importance of cost basis for tax purposes as it calculates the amount of total profit, cost/ purchase price, and revenue to understand capital gain or loss.

Product Batch Cost Basis

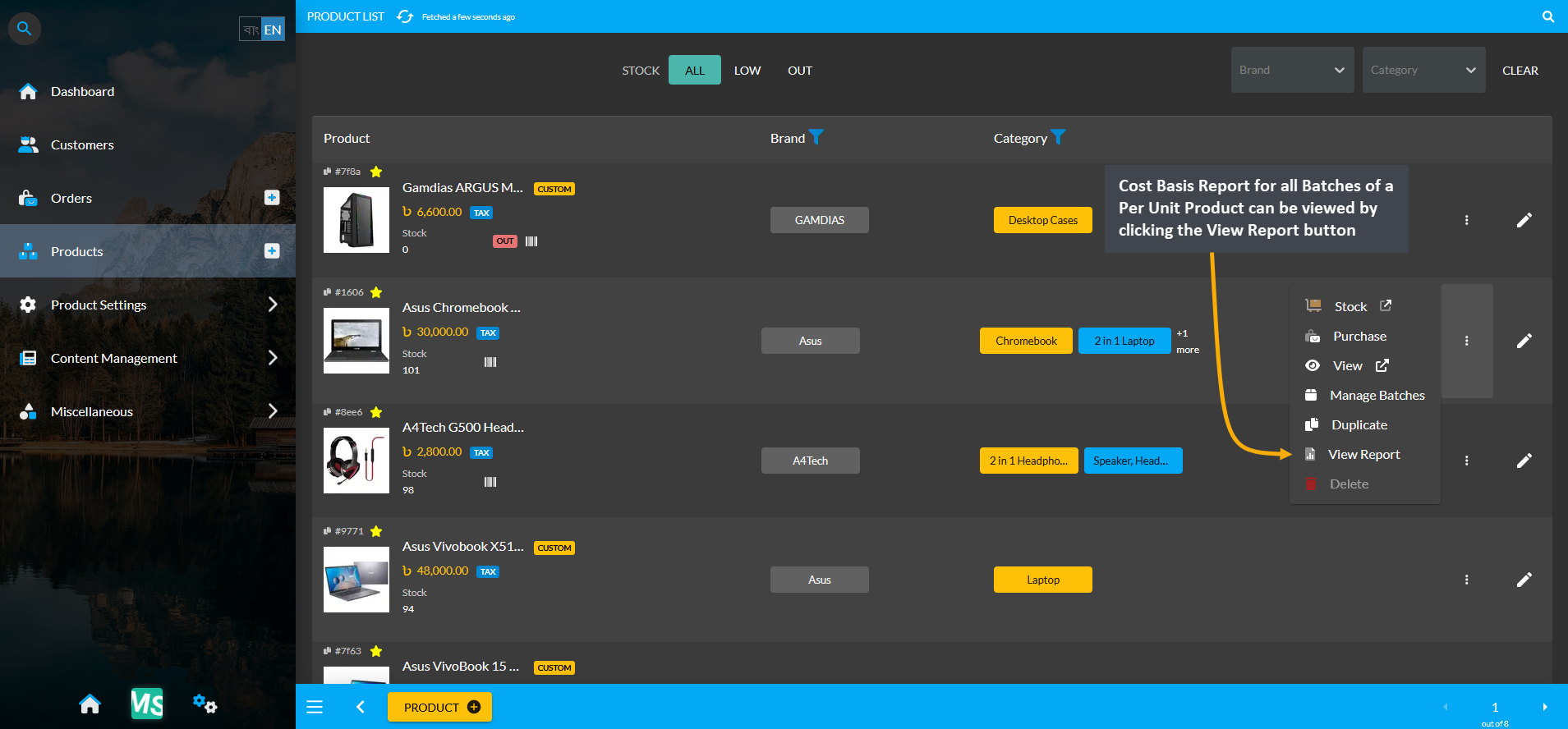

View Cost Basis for all Product Batches

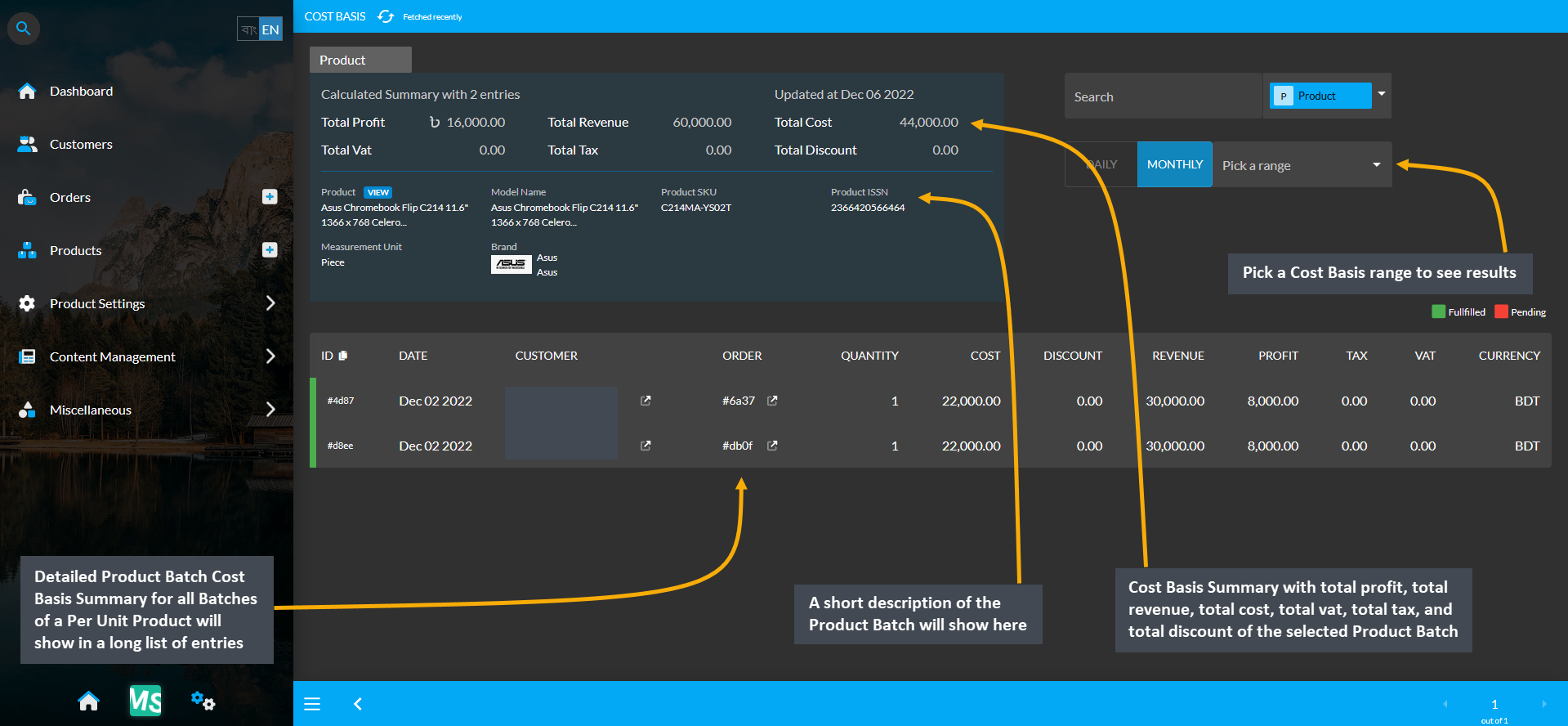

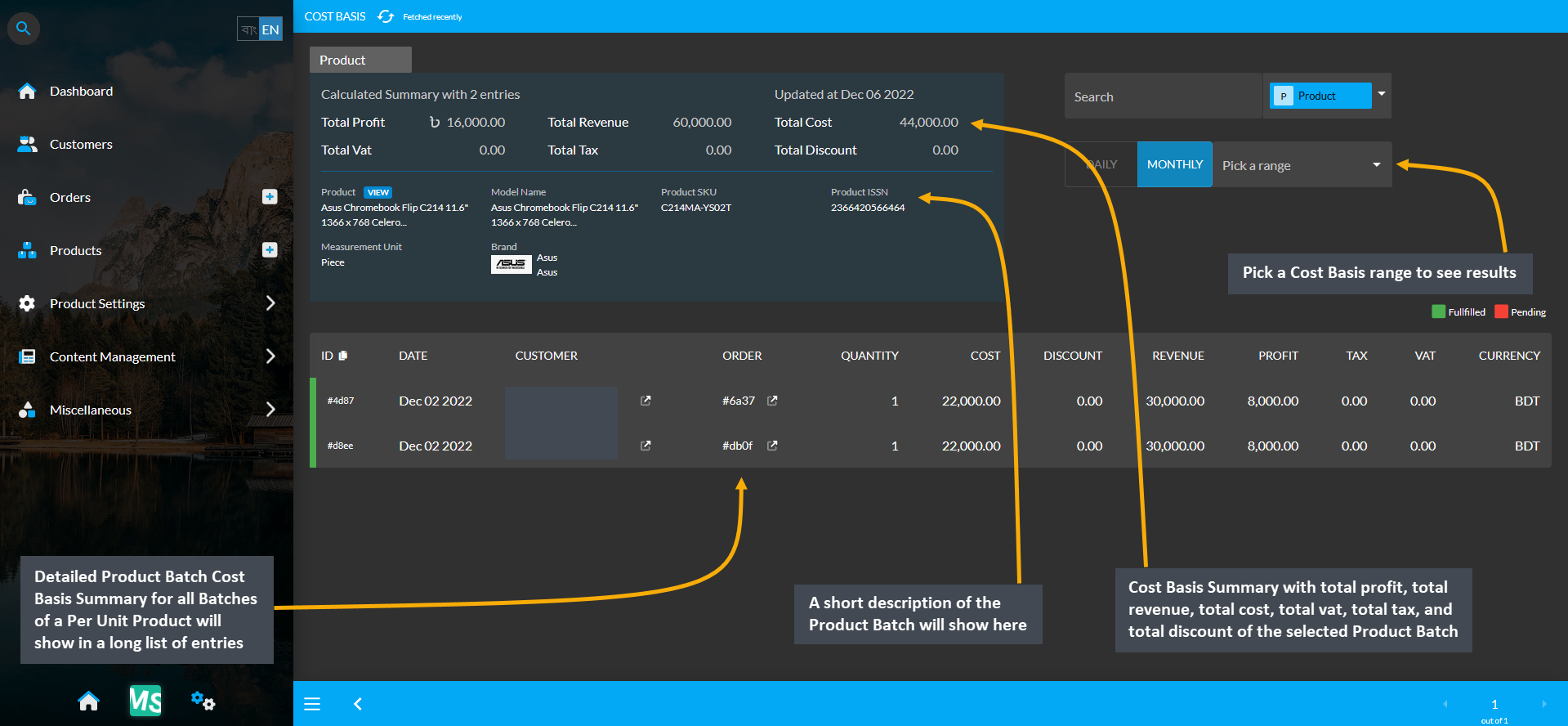

Click the Products module which will open the Product List. From here, go to any Product and click the small gray graph icon marked as View Report that will redirect to the Product Batch Cost Basis page for all Batches created of the selected Per Unit Product. The cost basis report will show total profit, total revenue, total cost, total vat, and total discount of that Per Unit Product within different time frame ranges.

A short description of the Product Batch will show below the cost basis summary. Pick a Cost Basis range from the dropdown menu to see results on Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly basis. Also, detailed Product Batch Cost Basis Summary for all Batches of a Per Unit Product will show in a long list of entries.

Image 1: Cost Basis Report for all Batches of a Per Unit Product can be viewed by from View Report button.

Image 2: Product Batch Cost Basis shows Per Unit Product info and detailed summary of all Product Batches.

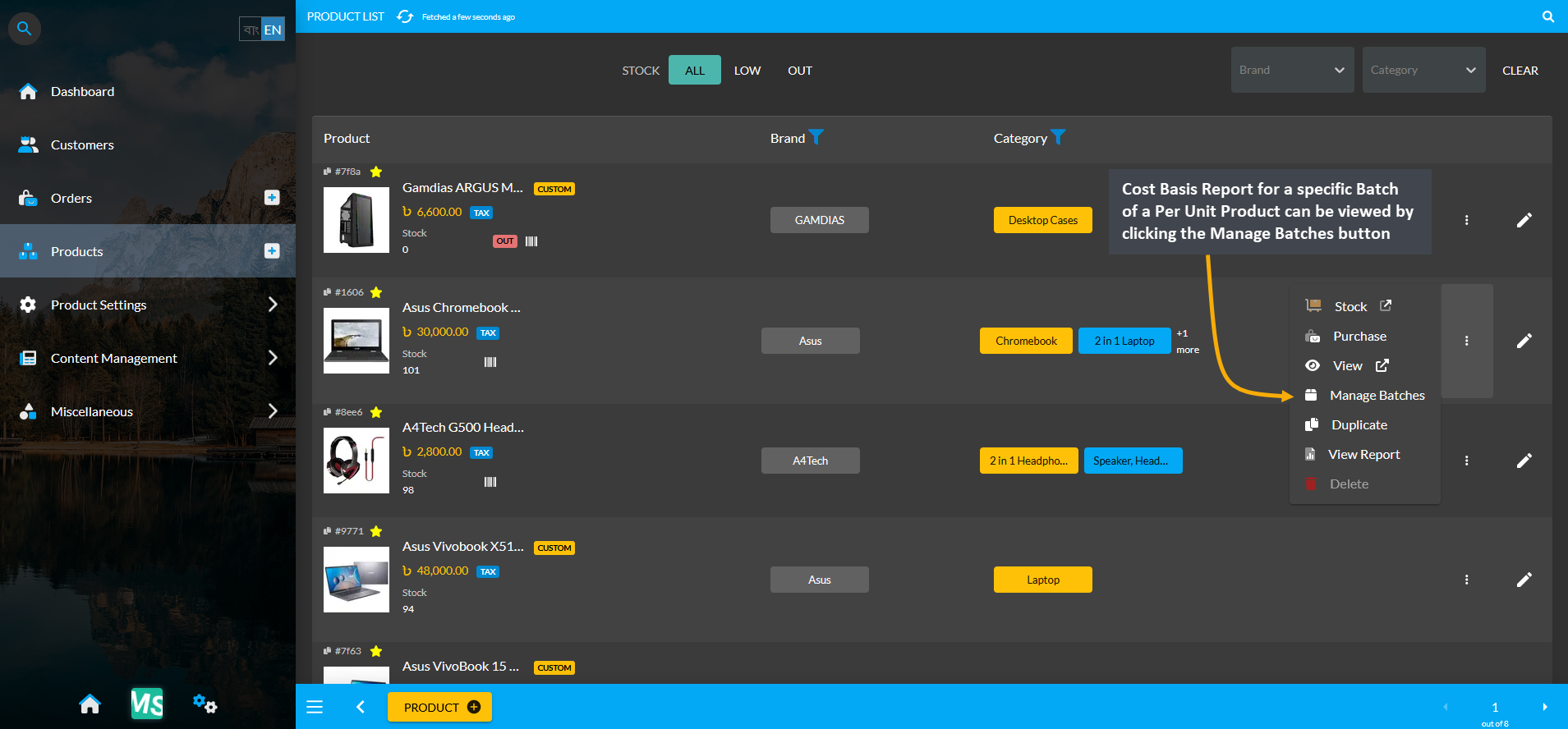

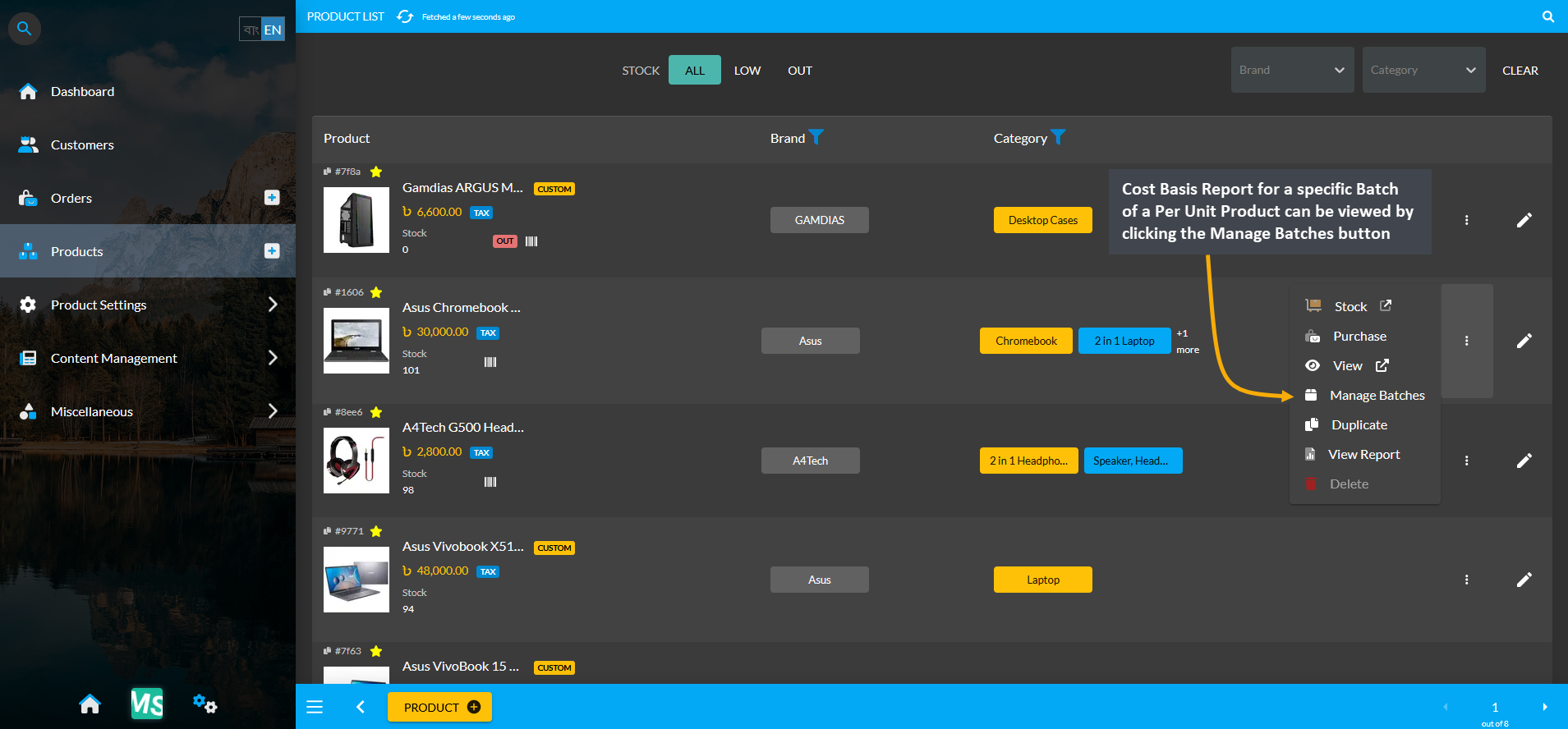

View Cost Basis for a Specific Product Batch

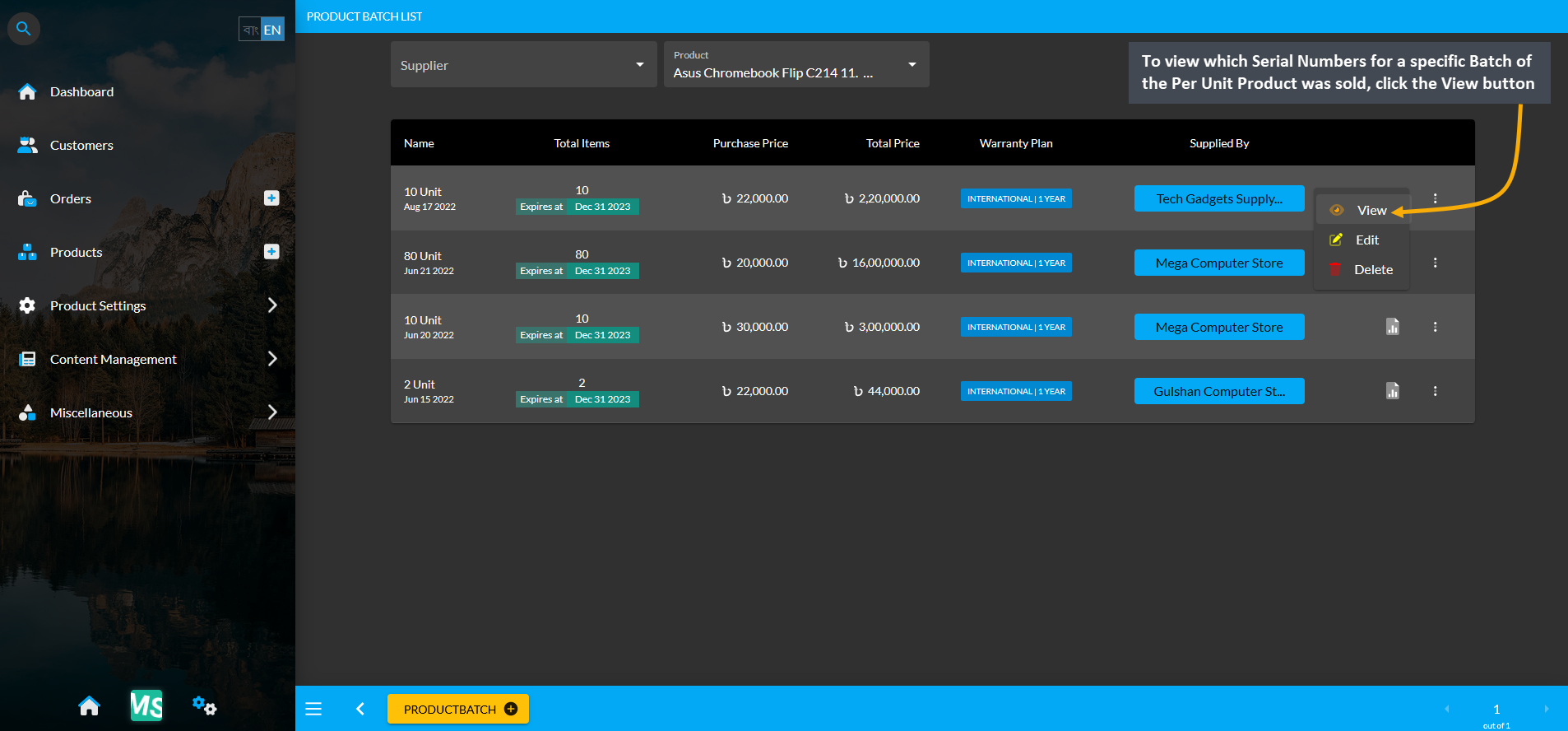

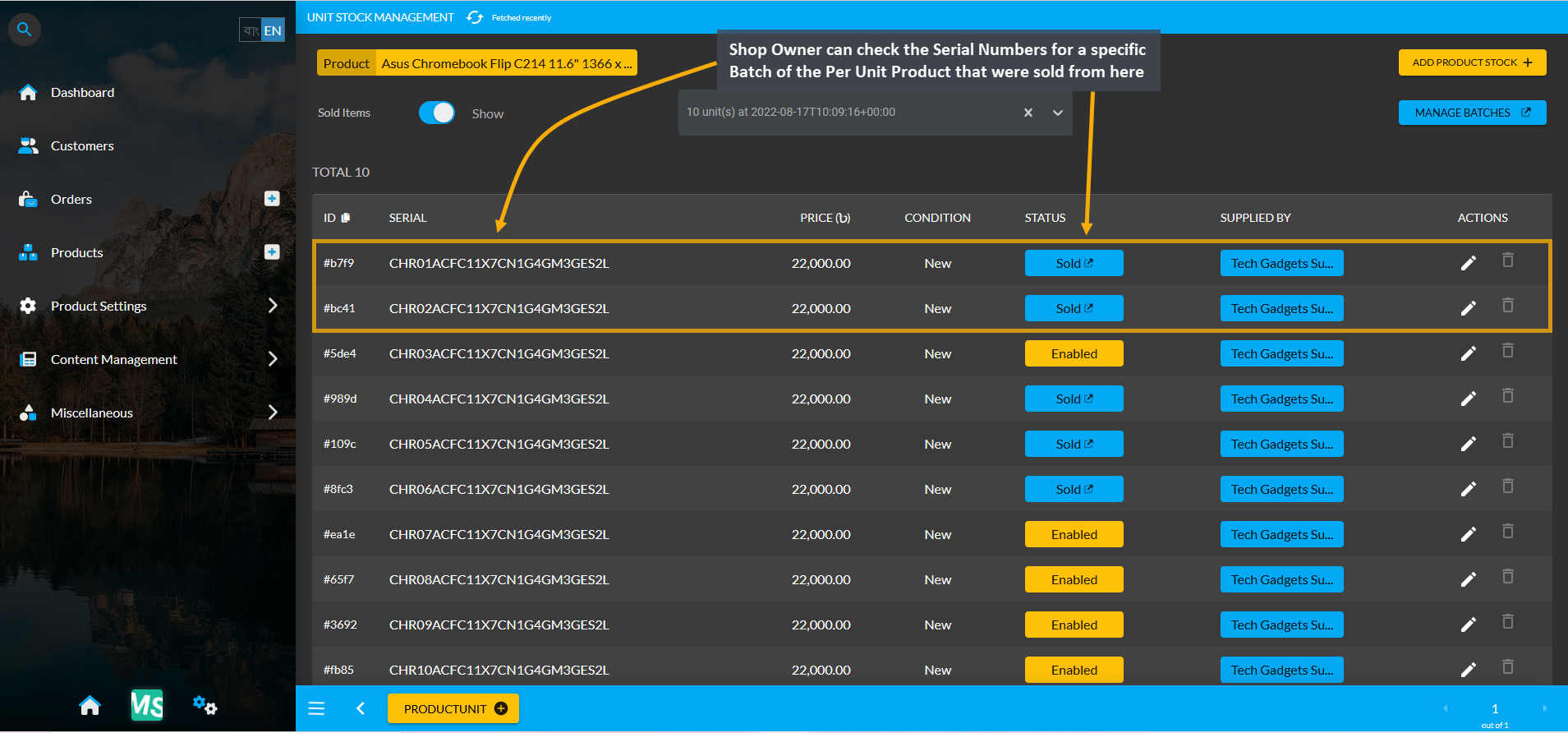

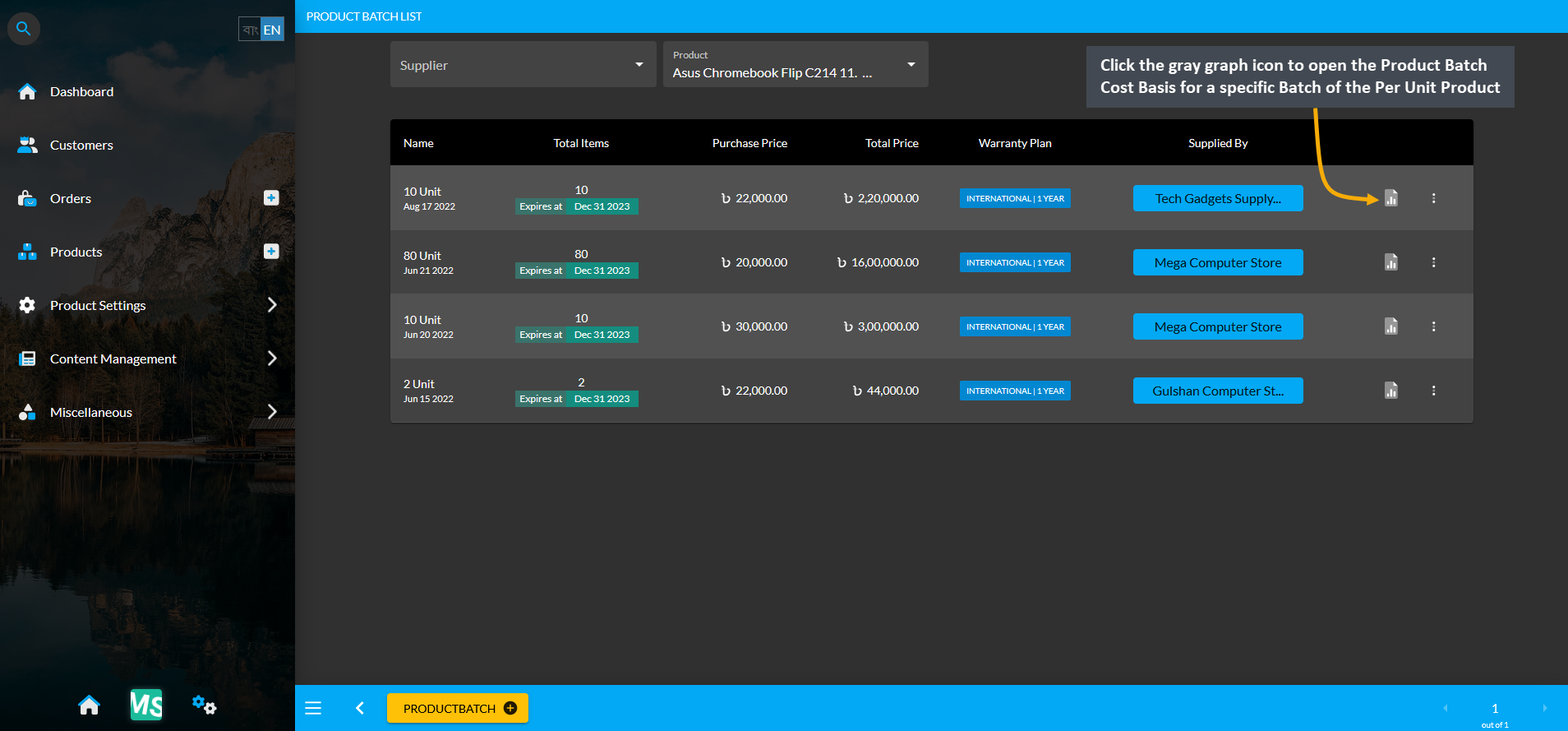

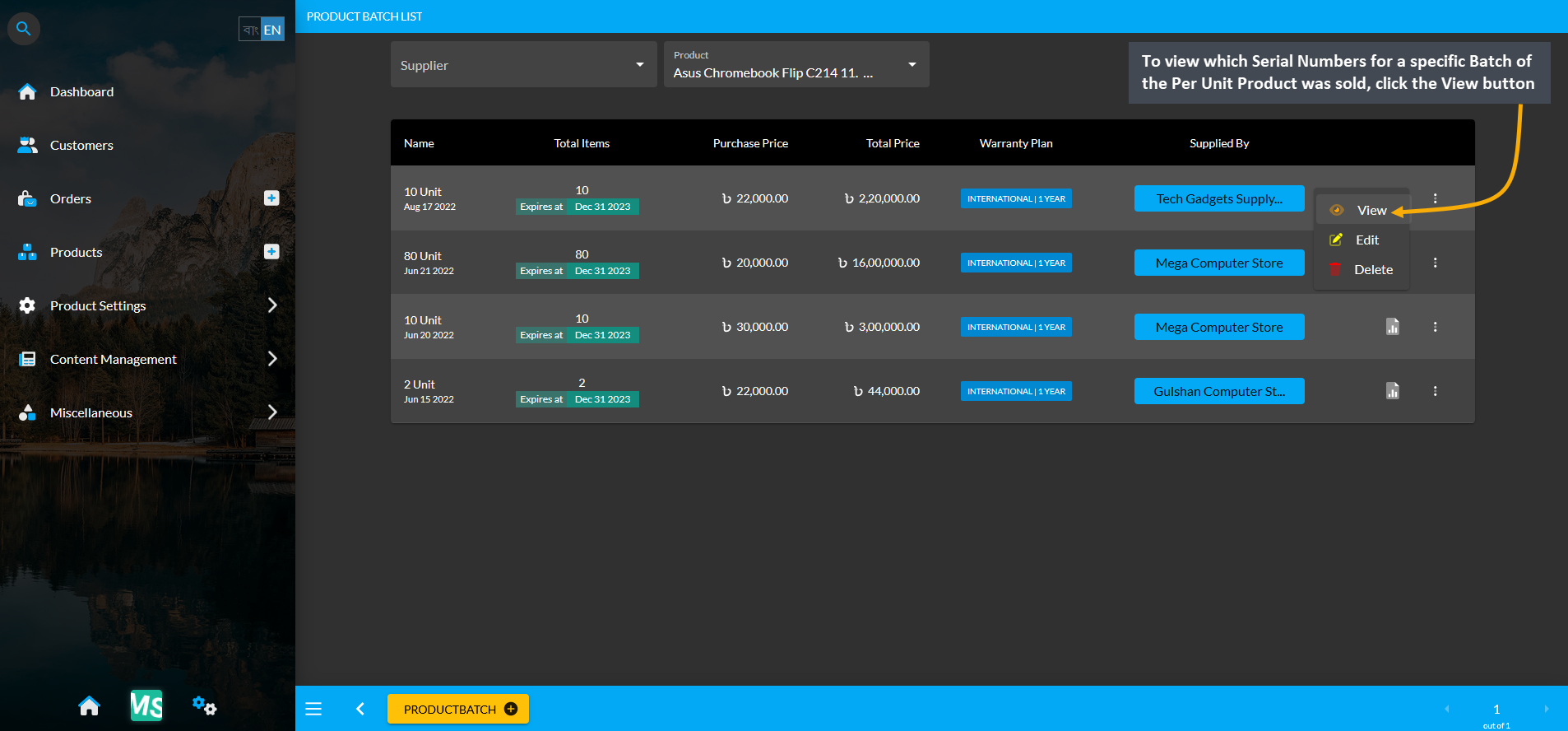

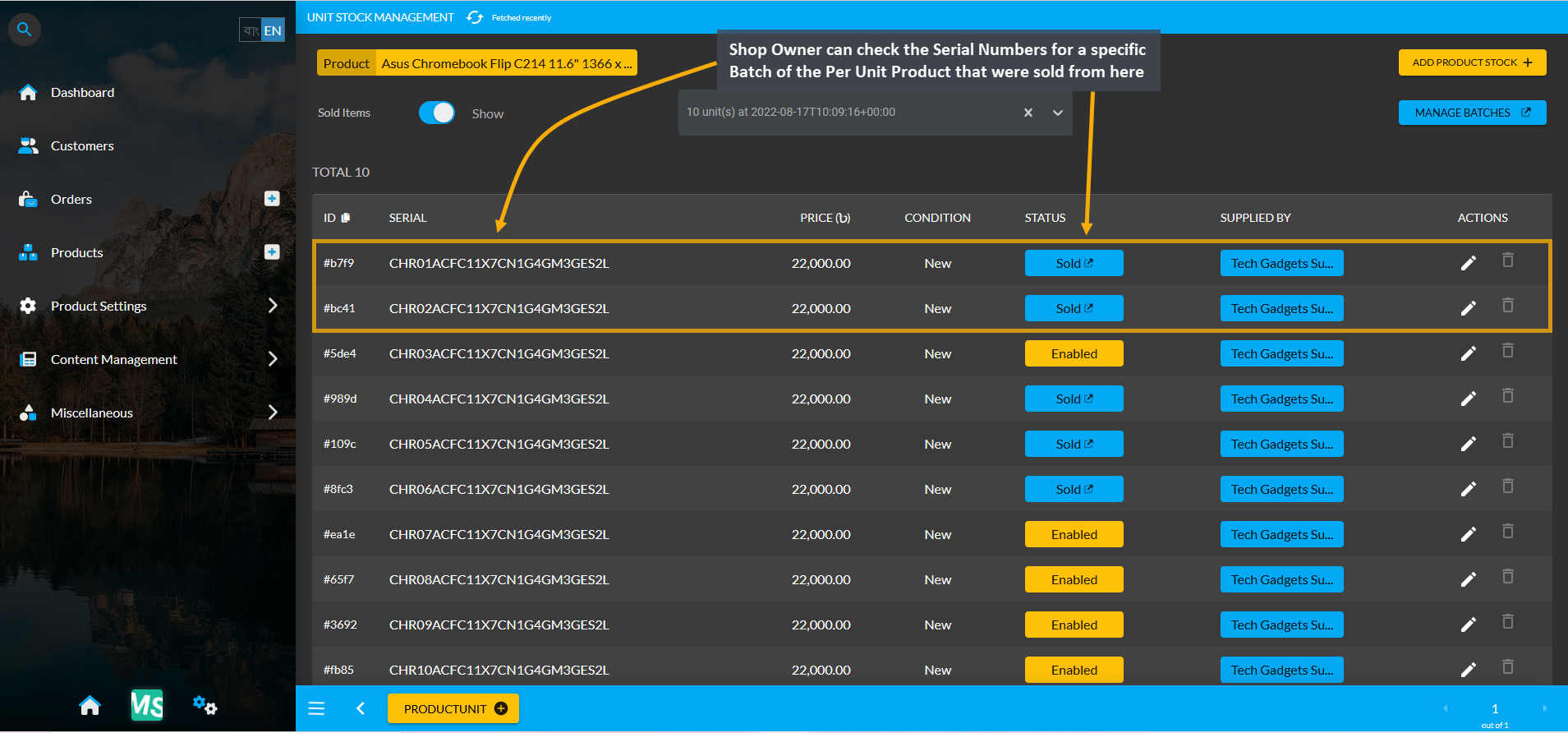

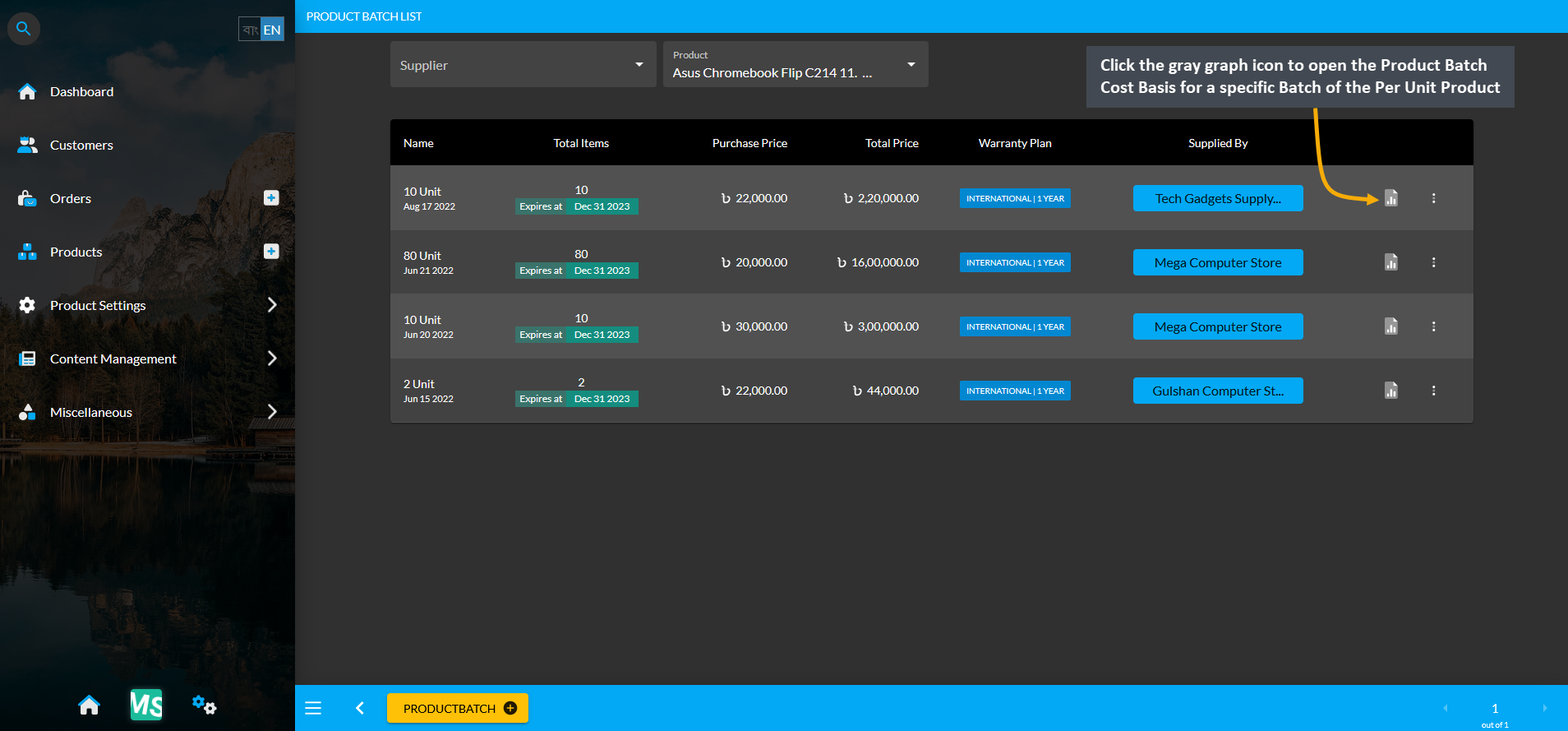

Product Batch Cost Basis Report for a specific Batch of the selected Per Unit Product can be viewed by clicking the Manage Batches button on the Product List page. This will redirect to the Product Batch List page where clicking on the View button will show which Serial Numbers for a specific Batch of the Per Unit Product were sold. In Product Batch List page, click the gray graph icon to open Cost Basis for a specific Batch of the Per Unit Product.

Image 3: View Cost Basis Report for a specific Batch of a Per Unit Product from the Manage Batches button.

Image 4: Click the View button to see which Serial Numbers of a specific Per Unit Product Batch was sold.

Image 5: Check all the sold Serial Numbers or Units for a specific Per Unit Product Batch marked in blue.

Image 6: Click the gray graph icon to open Cost Basis for a specific Product Batch of the Per Unit Product.

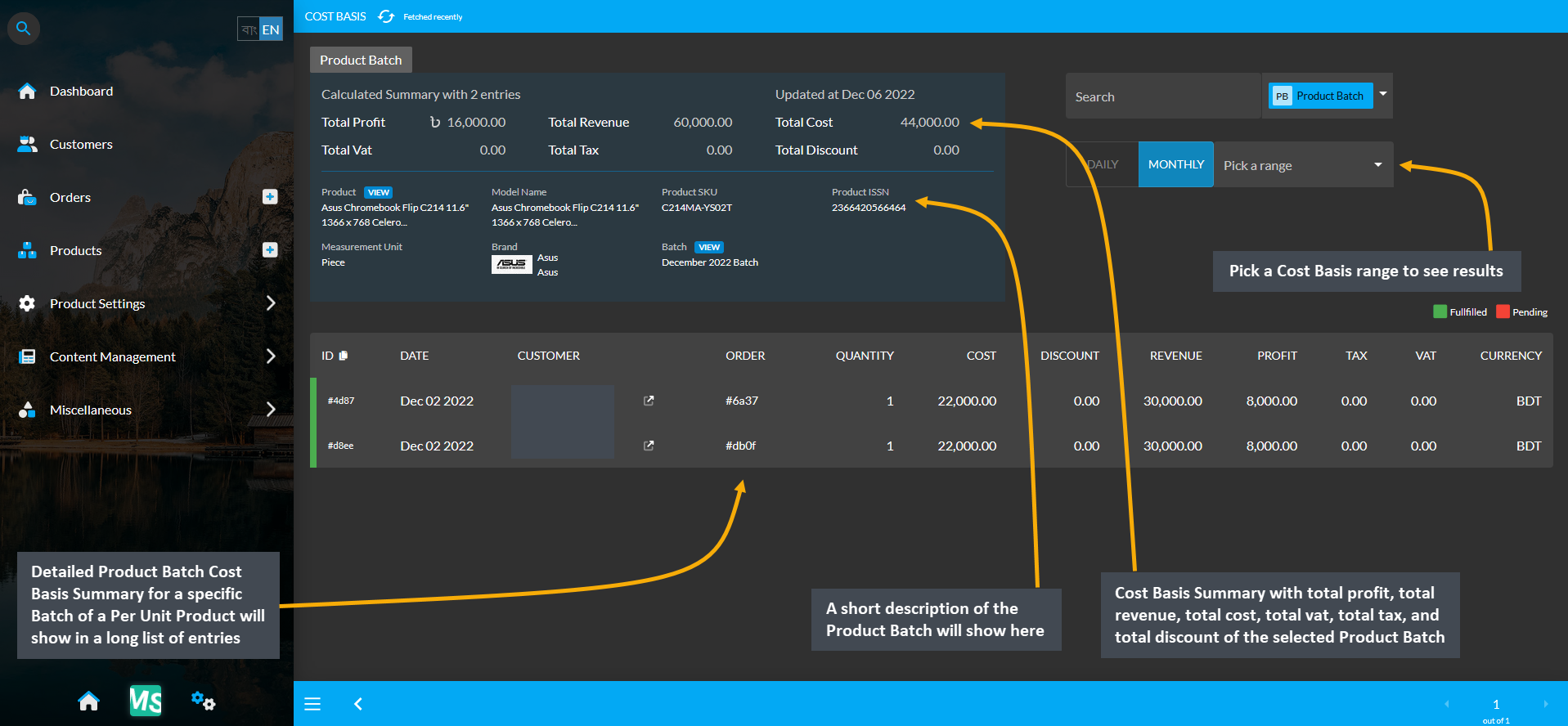

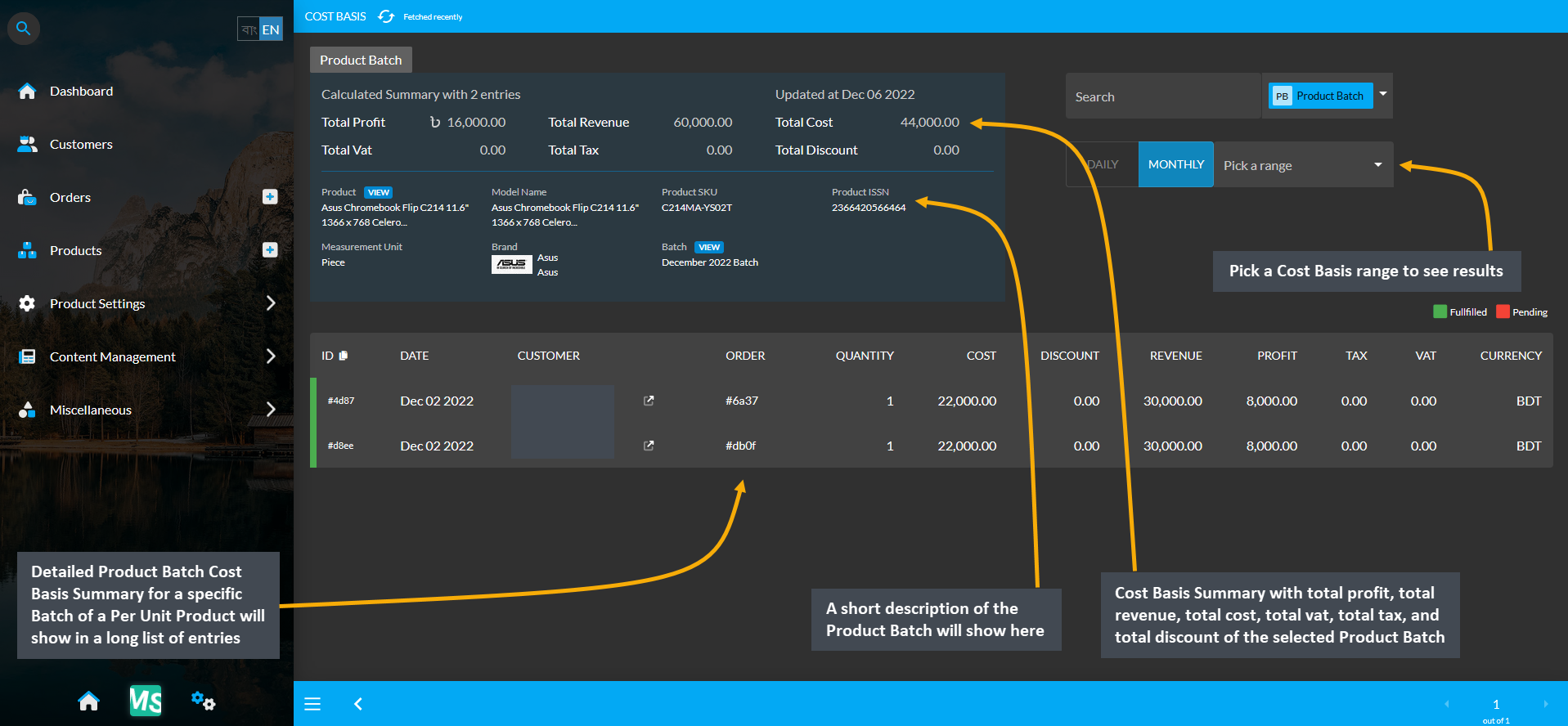

Cost Basis Summary Section

Clicking the small gray graph icon from Product List will redirect to Product Cost Basis page. On the top is Product cost basis summary showing total profit, total revenue, total cost, total vat, total tax, and total discount and below it is the detailed description of the Product Batch. For Product Batch Cost Basis, the Pick a Range or range filtering option will show the Product’s Cost Basis on Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly basis. Below is a long list of Product Batch entries showing calculations of profit, cost, revenue, vat, tax, and discount separately.

Image 7: Product Batch Cost Basis shows Cost Basis summary, Product Batch info and detailed breakdown.

Cost Basis Search and Range Selection

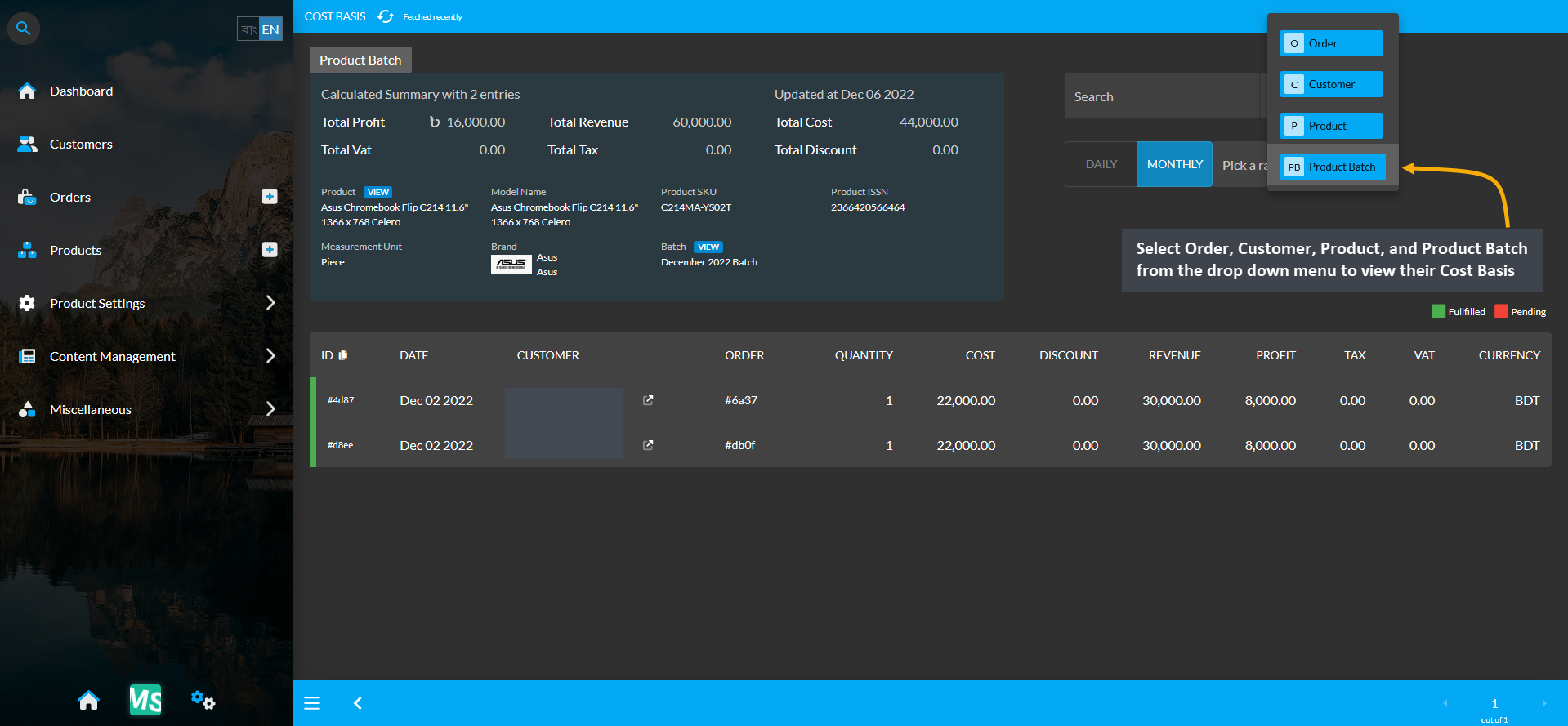

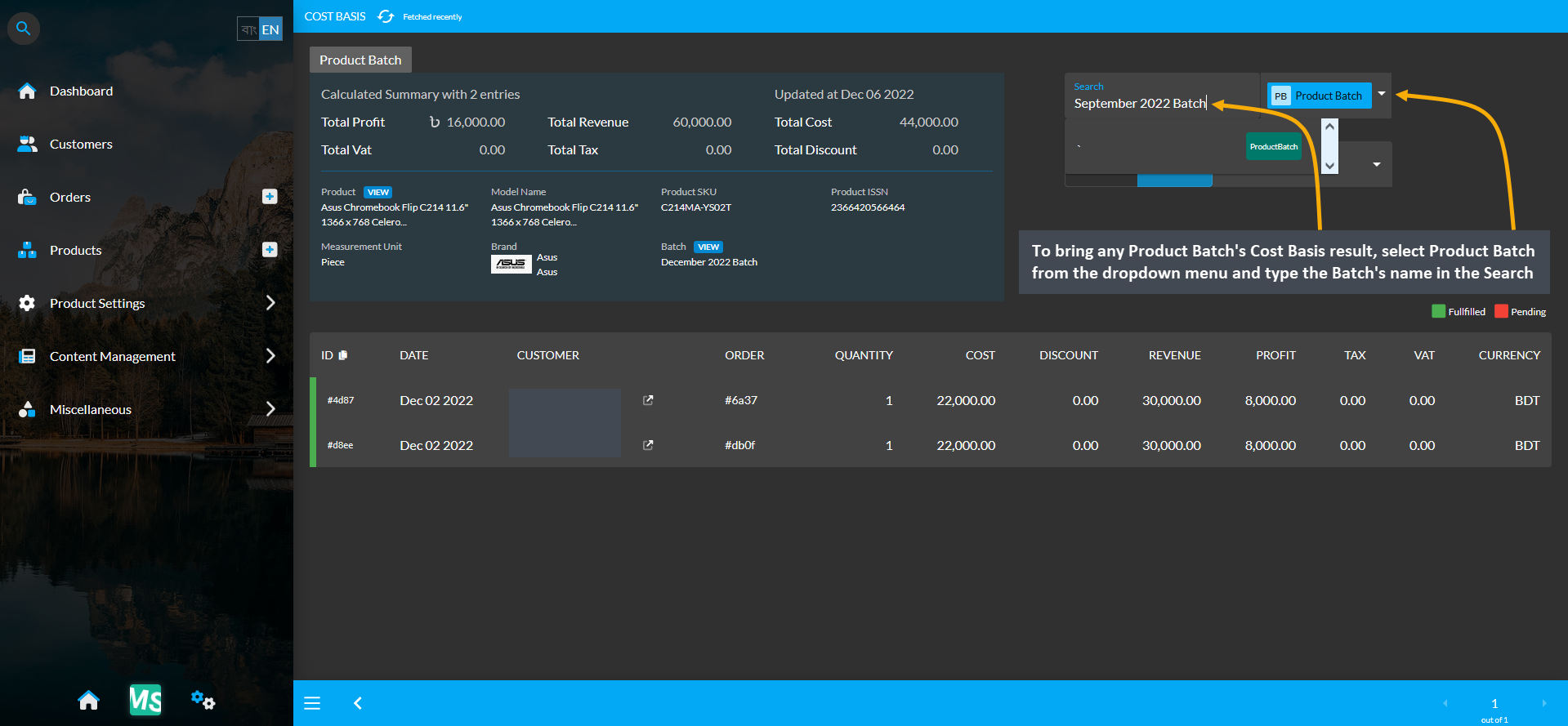

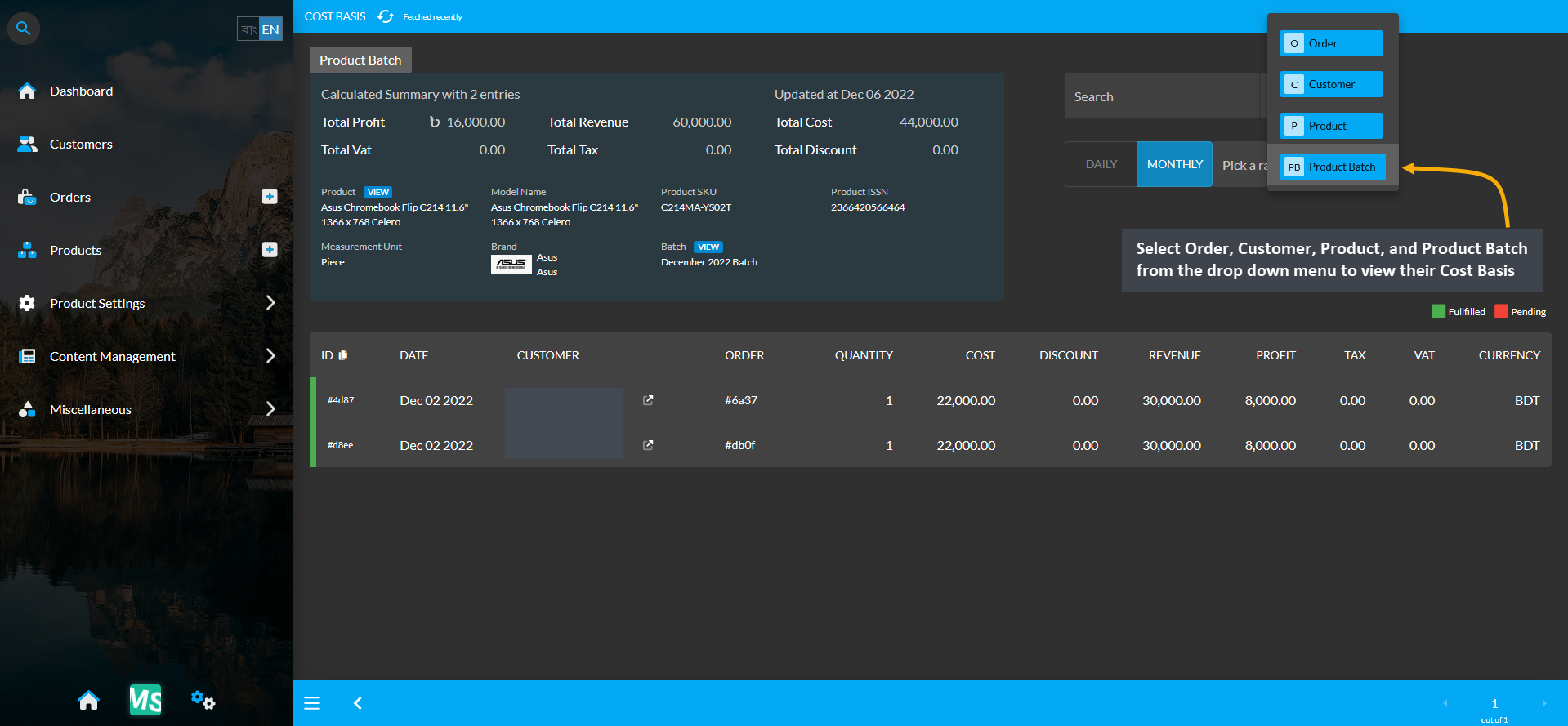

The Product Batch Cost Basis page have a Search button with a dropdown menu for four options - Order, Customer, Product, and Product Batch on the top right. Clicking each of these options will bring cost basis results of Order, Customer, Product, and Product Batch whichever is selected by redirecting to those pages.

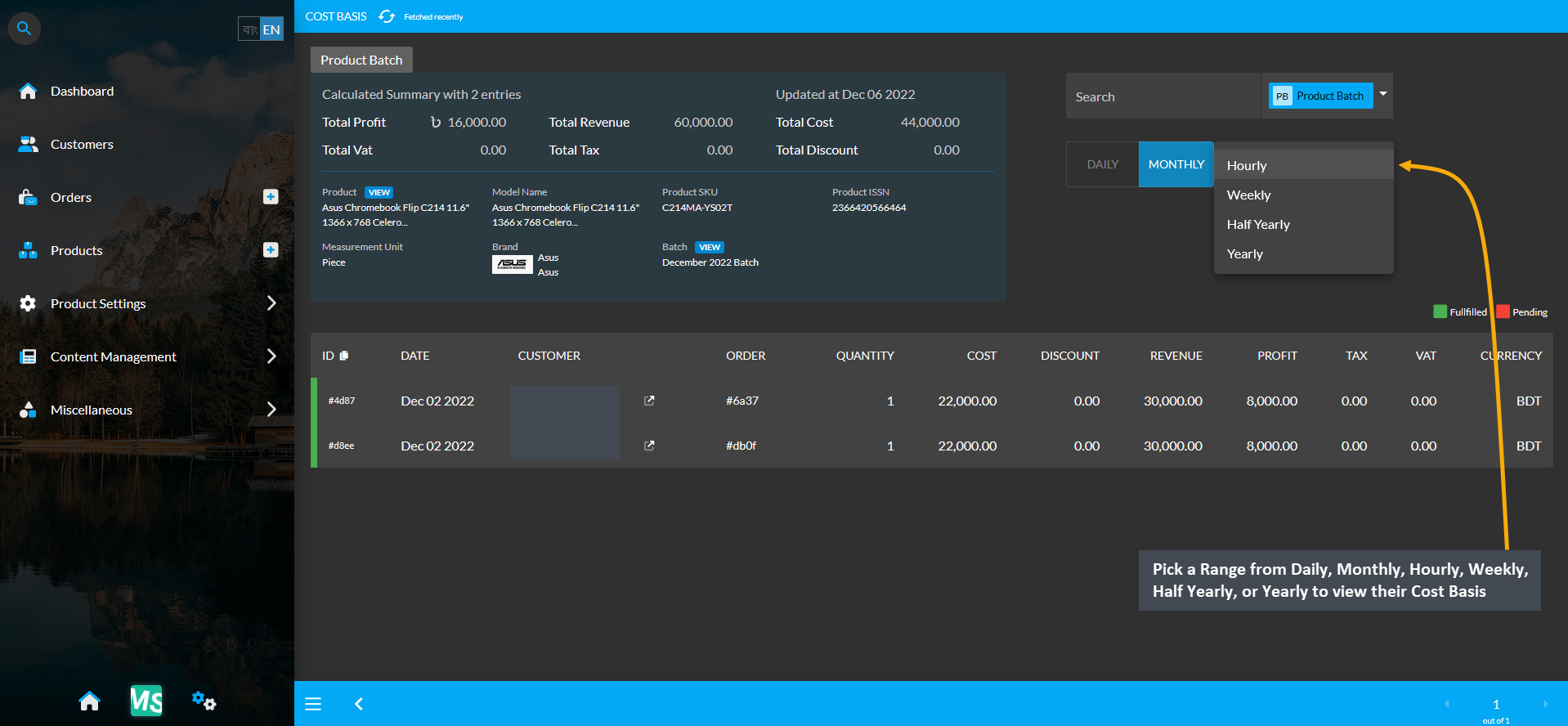

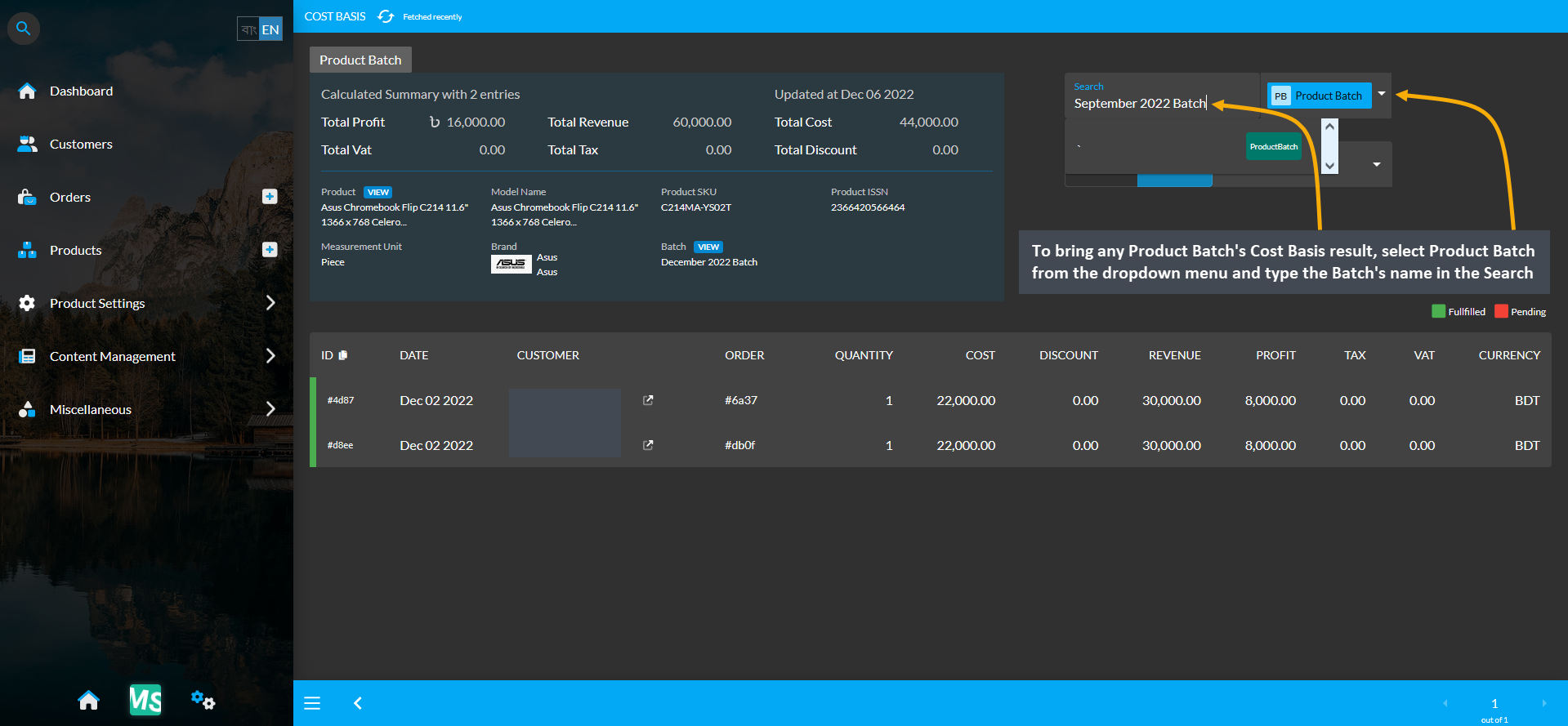

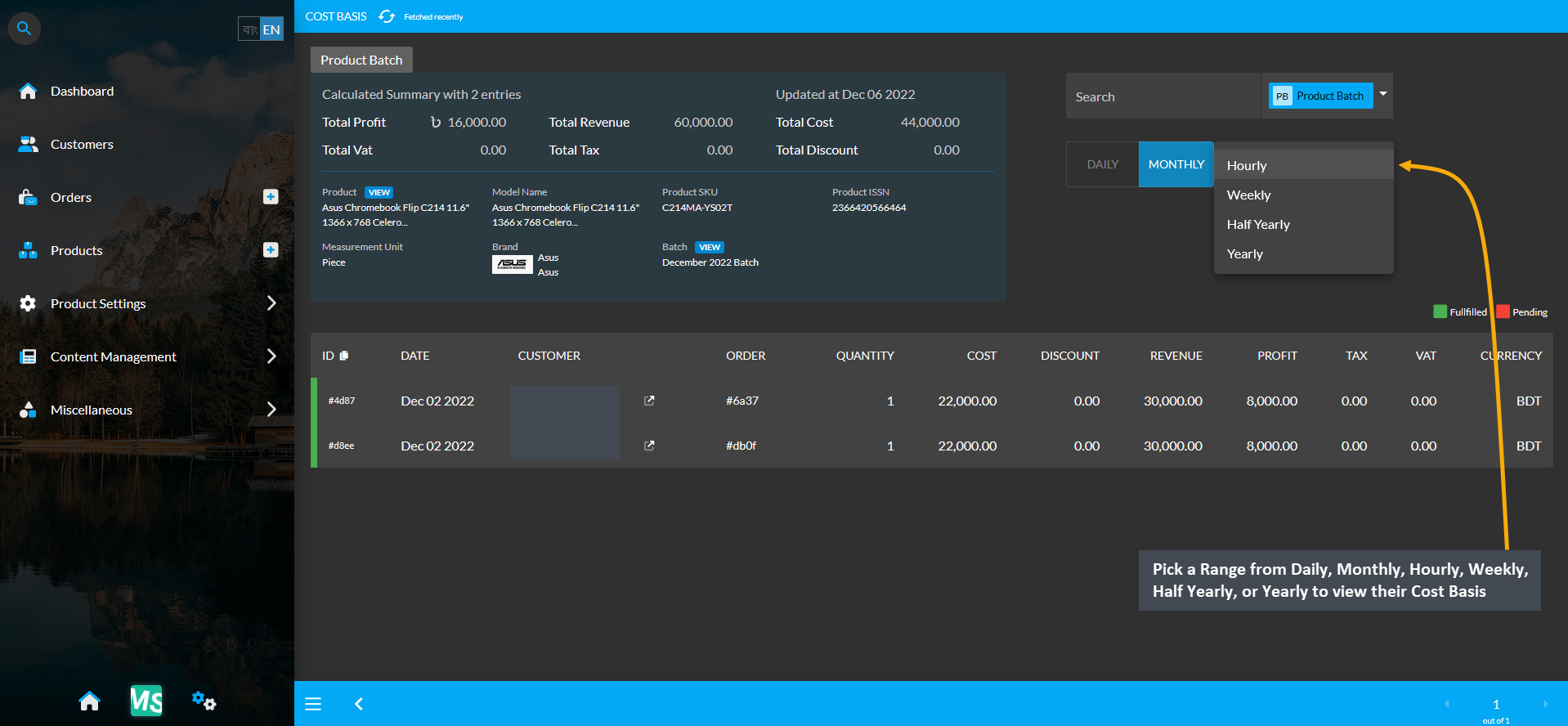

For example, to search and find a Product Batch’s Cost Basis result, select Product Batch from the dropdown and type a target Product Batch’s name in the Search box which will bring in the selected Product Batch’s Cost Basis result. From the Pick a Range box, select - Daily, Monthly, Hourly, Weekly, Half Yearly, and Yearly to view results of chosen cost basis summary. In this way, the Shop Owner can search for any Product’s Cost Basis result.

Image 8: Range Filtering option is enabled for Product Batch, select an option to view their Cost Basis.

Image 9: Select Product Batch from dropdown and type Batch's name in Search Box to view their Cost Basis.

Image 10: Pick Range from Daily, Monthly, Hourly, Weekly, Half Yearly, or Yearly to view their Cost Basis.