1 - Cash Customer Transaction Flow

Functionality of Cash Customer’s Transaction Modals on Cart and Order Page.

Cash Customer Transaction Flow

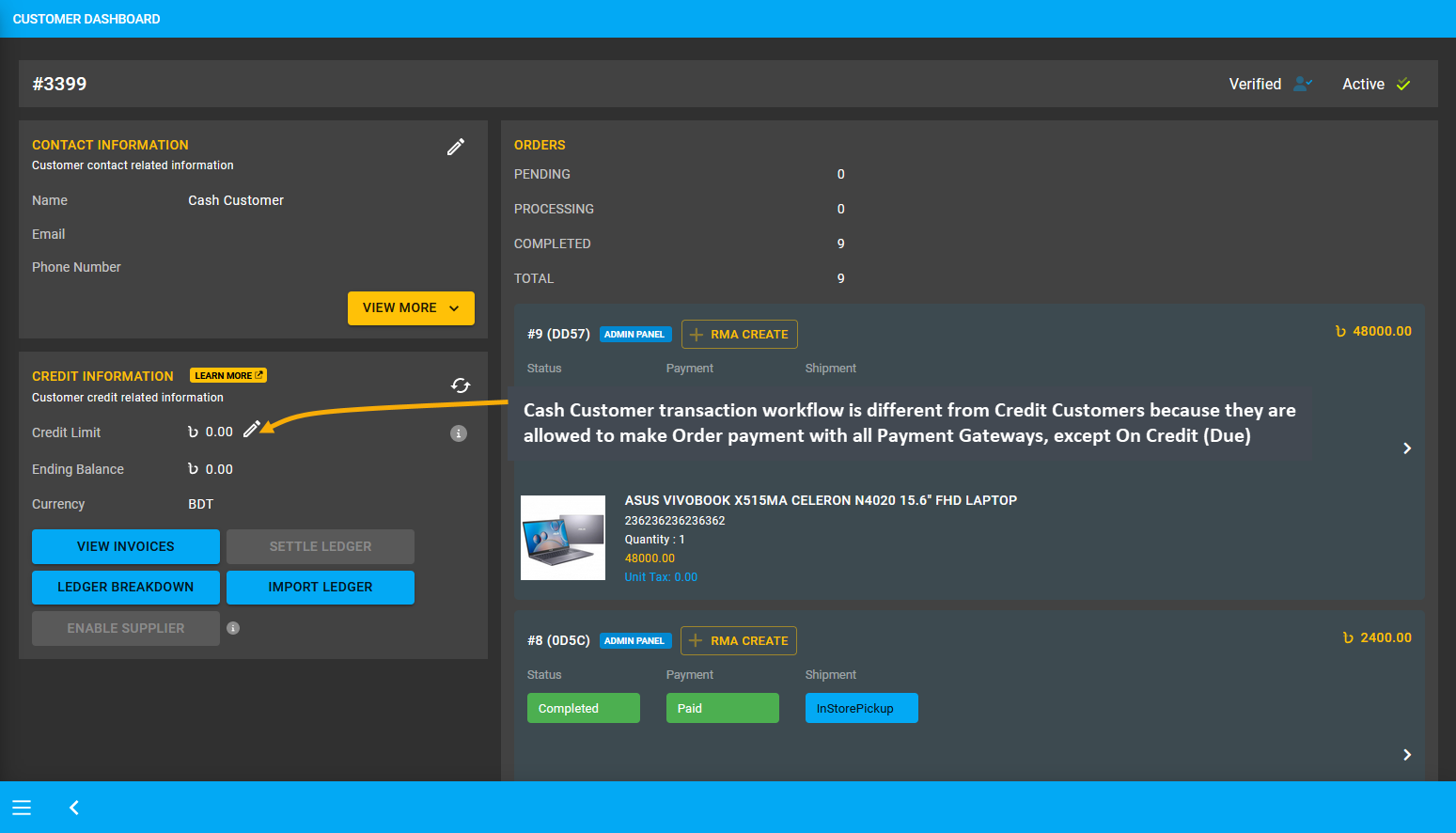

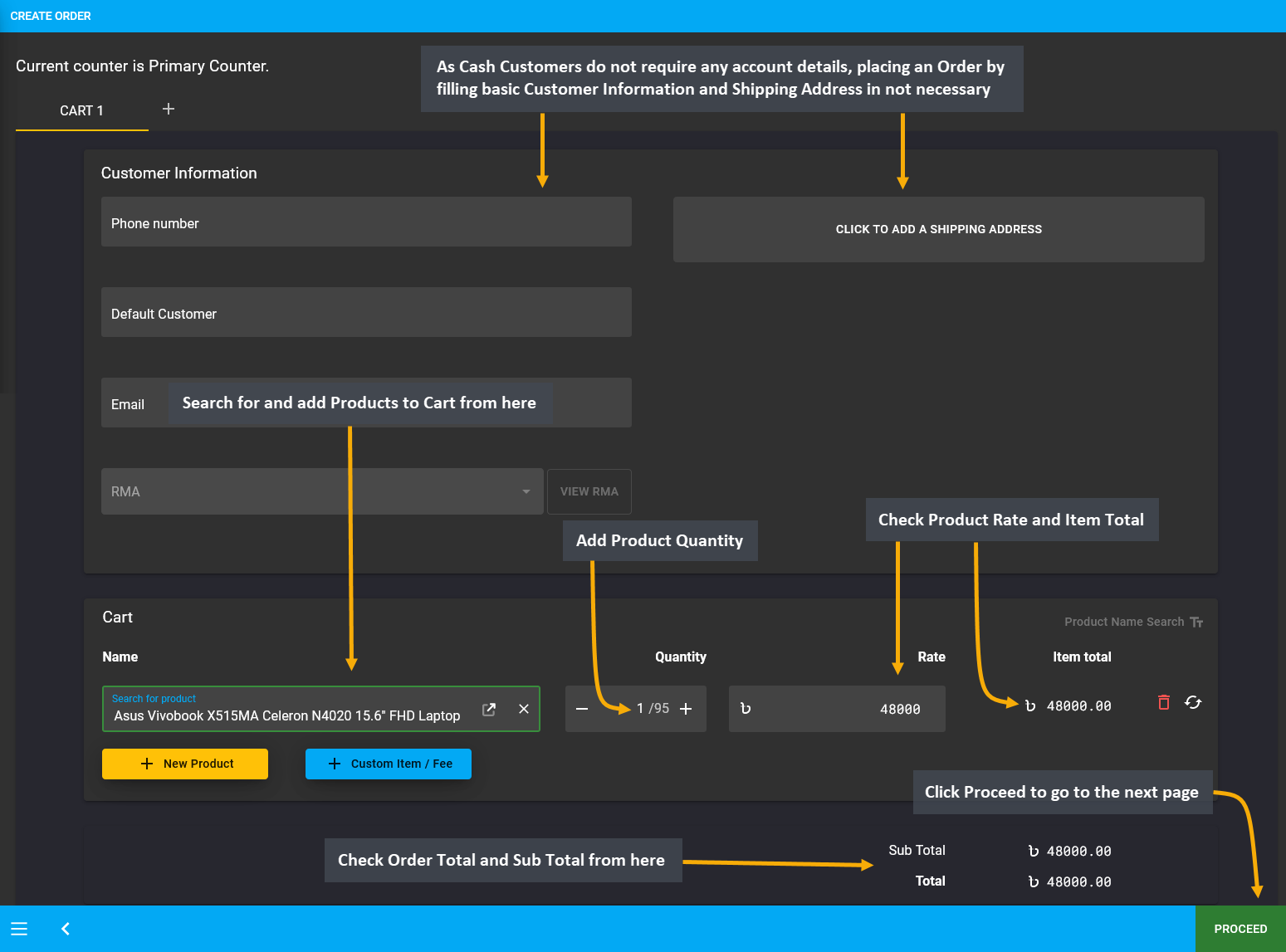

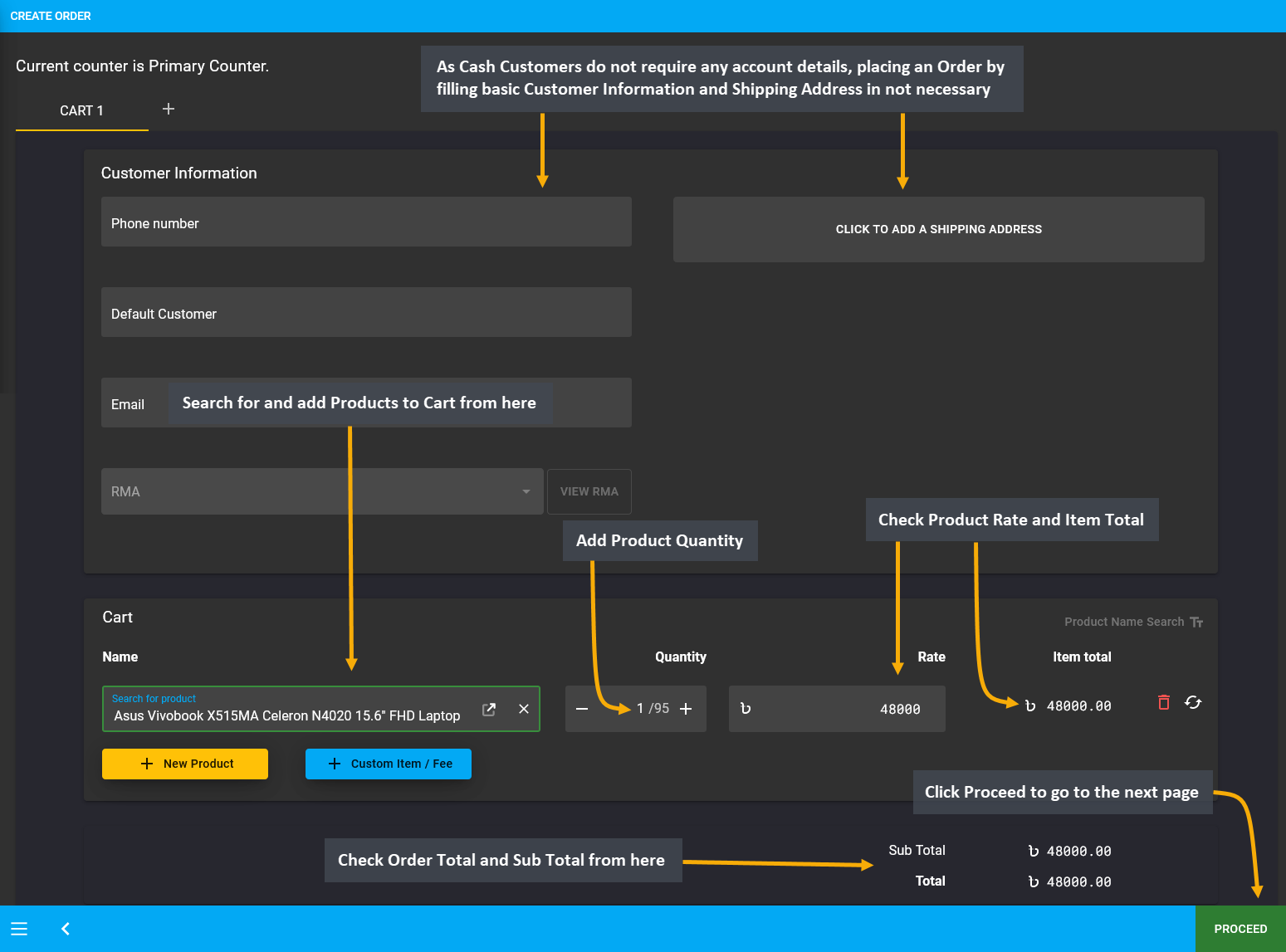

Cash Customer transaction workflow is different from Credit Customers because they are allowed to make Order payment with all types of gateways, except On Credit (Due). As Cash Customers do not require any account details, placing an Order by filling basic Customer Information and Shipping Address in not necessary. Thus, search for and add Products. Check Product rate, Order total, subtotal, and click Proceed to select payment and shipping option.

Image 1: Cash Customer can make Order payment with all types of Payment Gateways, except On Credit (Due).

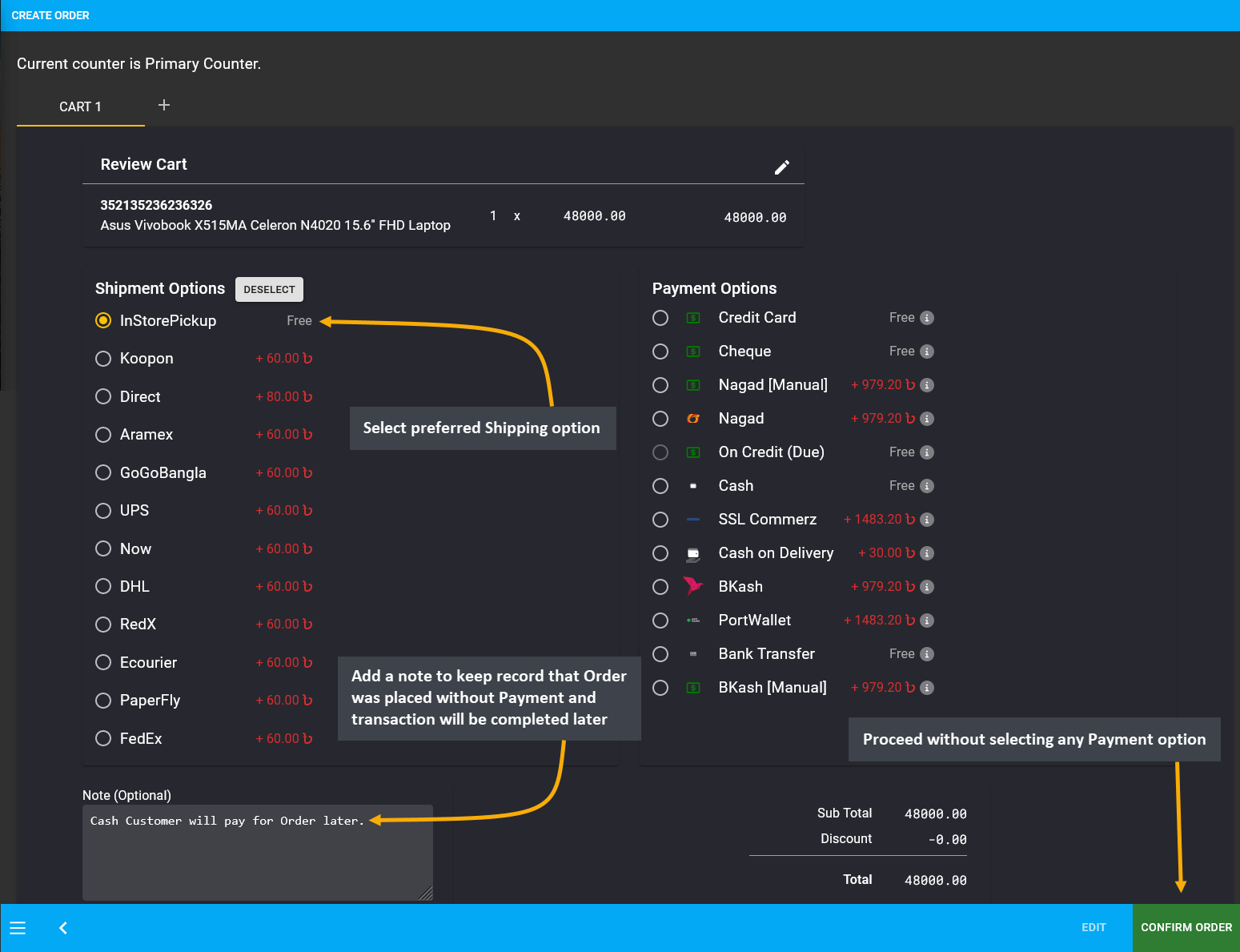

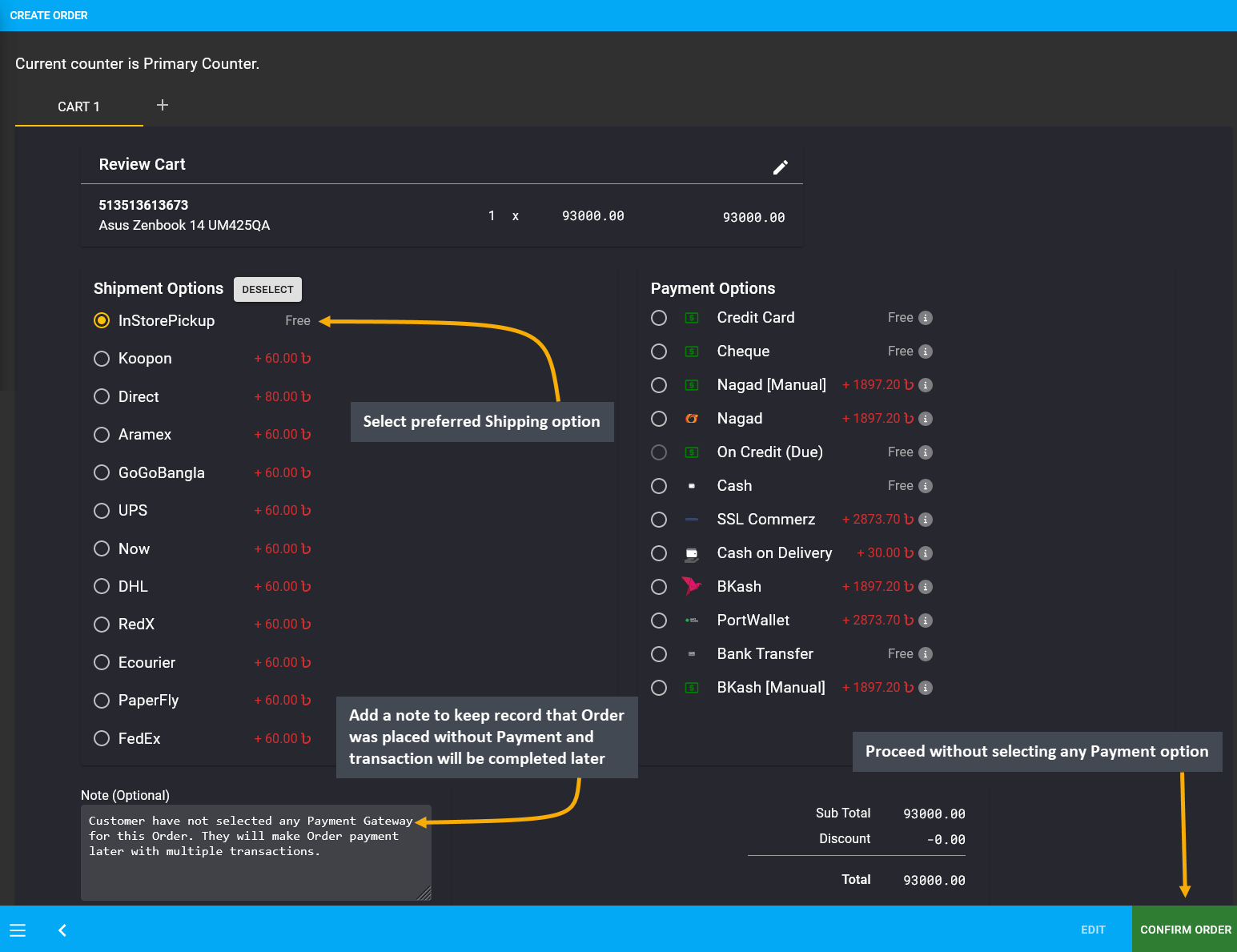

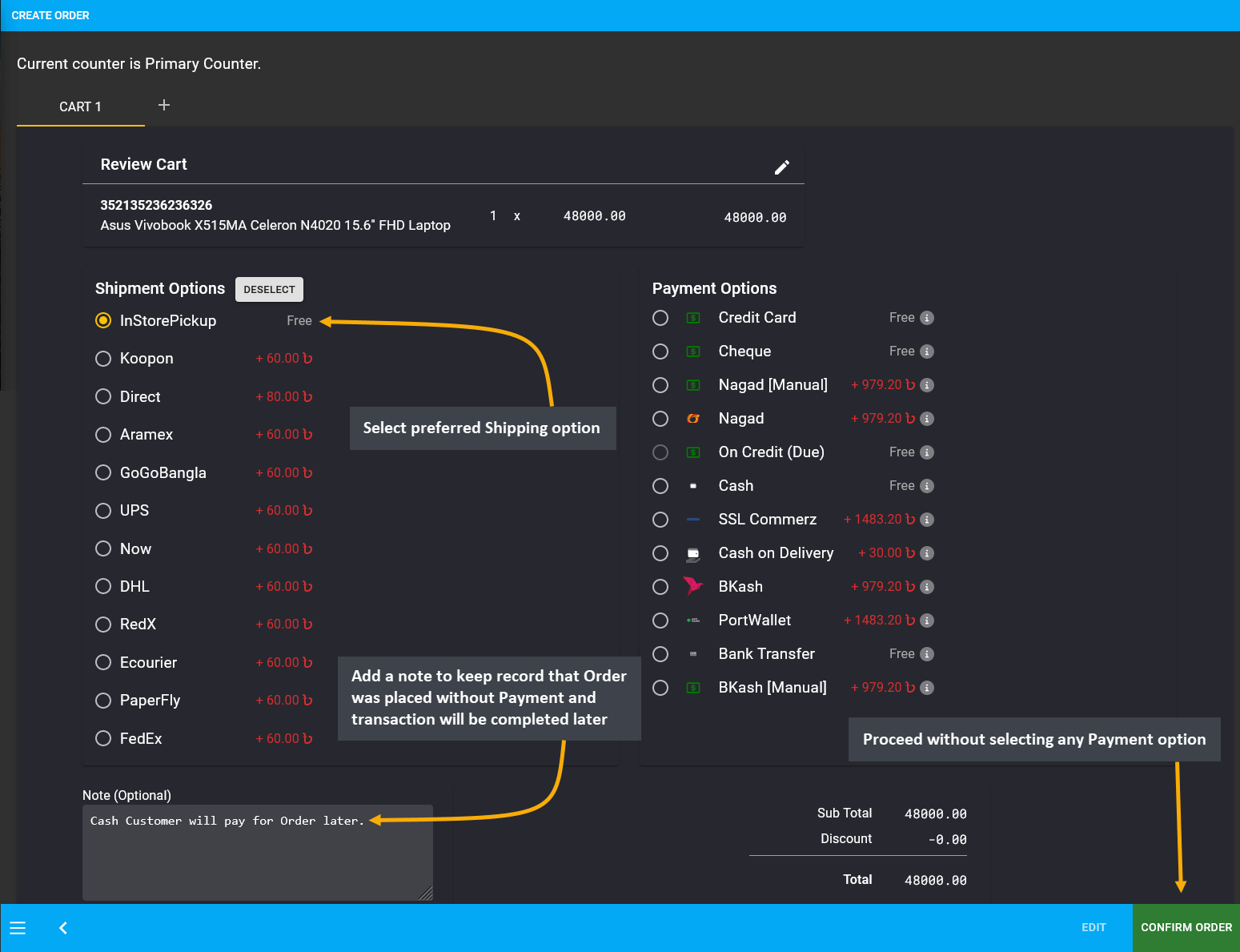

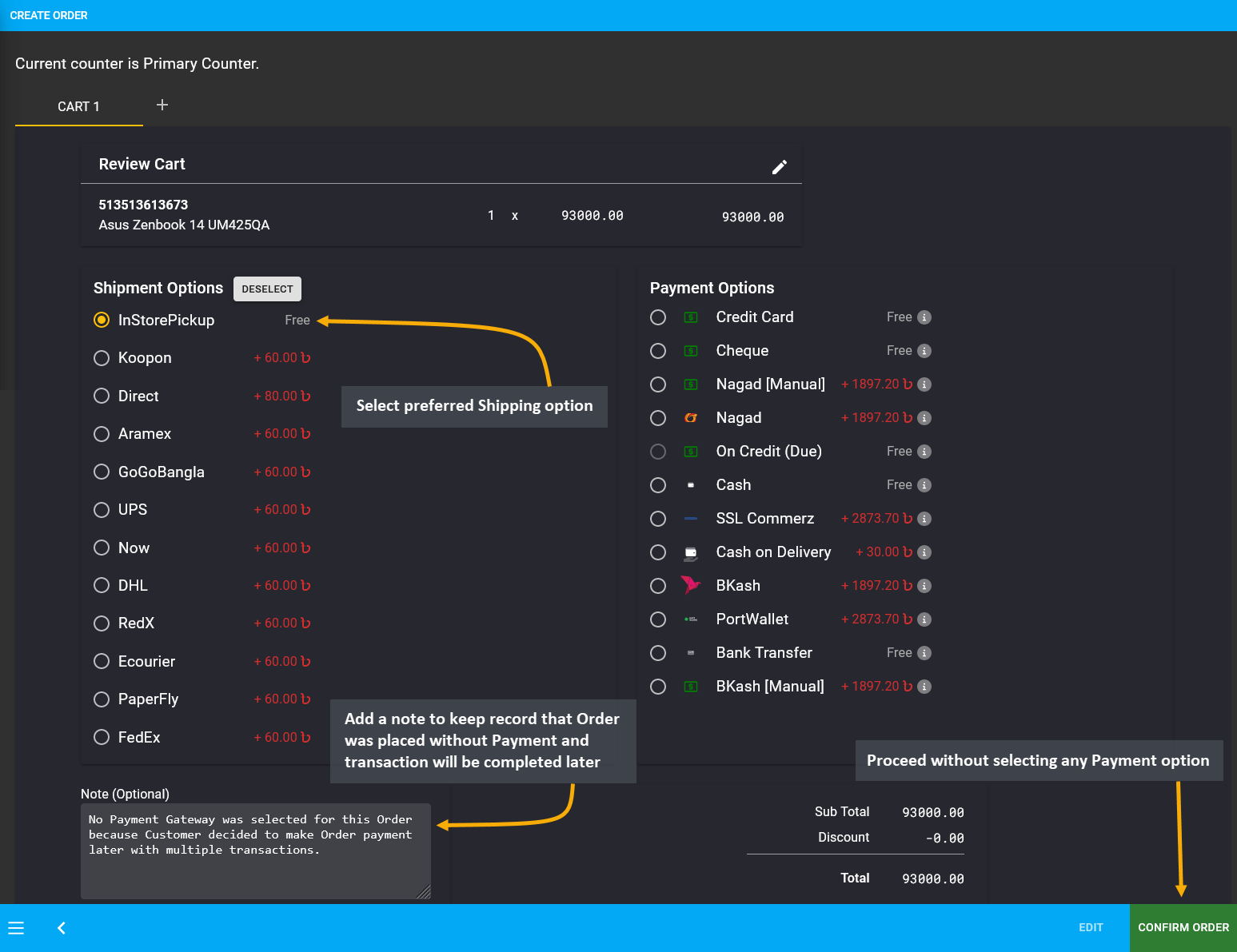

If the Cash Customer wants to place Order without payment, then they can complete Order without selecting any payment options. In the example, In Store Pickup was selected as the Shipment without selection of any payment option. Add a Note to keep record that Order was placed without Payment and the transaction will be completed later. Thus, proceed without selecting any payment option and click on Confirm Order to proceed to the next step.

Image 2: Cash Customer can complete Order without selecting any payment options and make payment later.

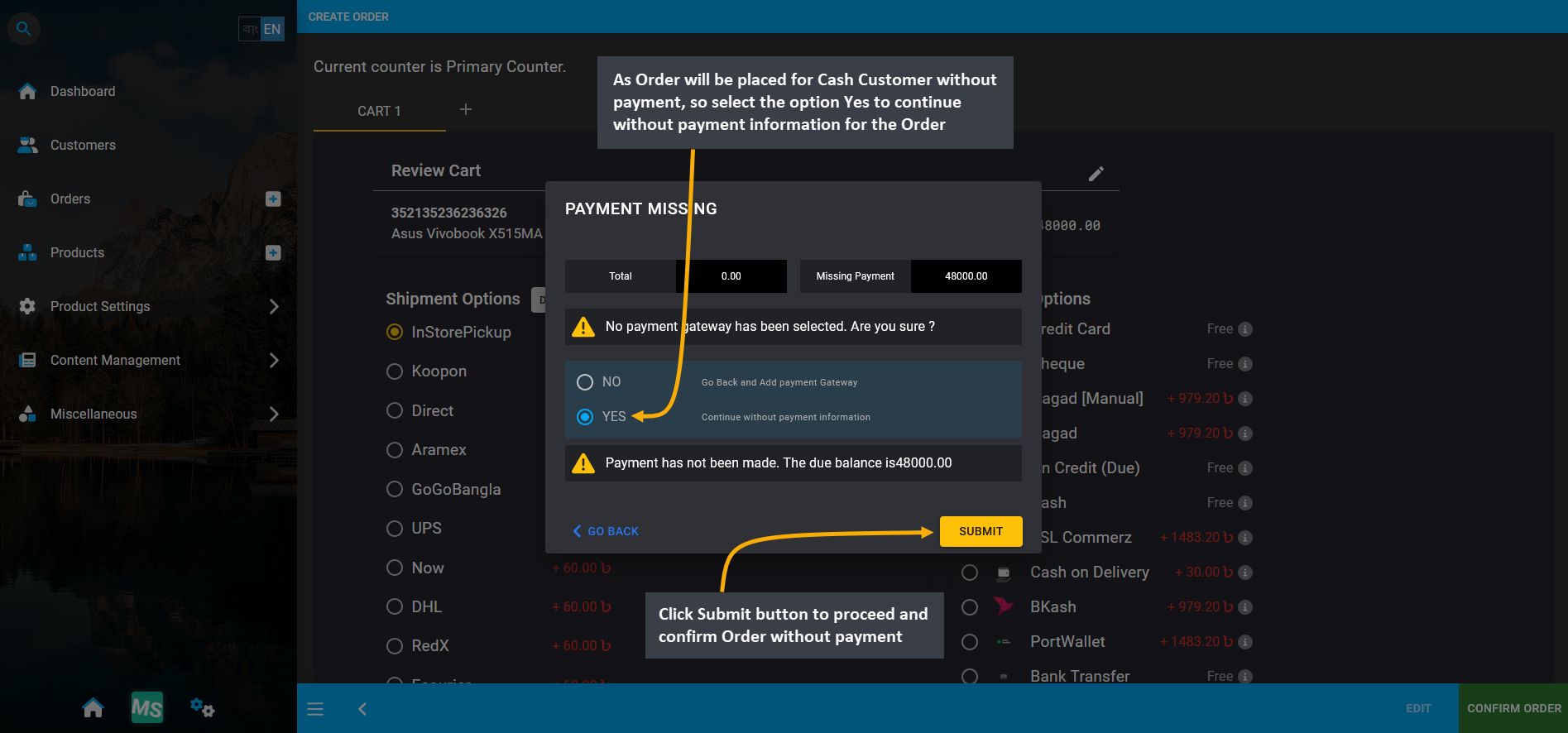

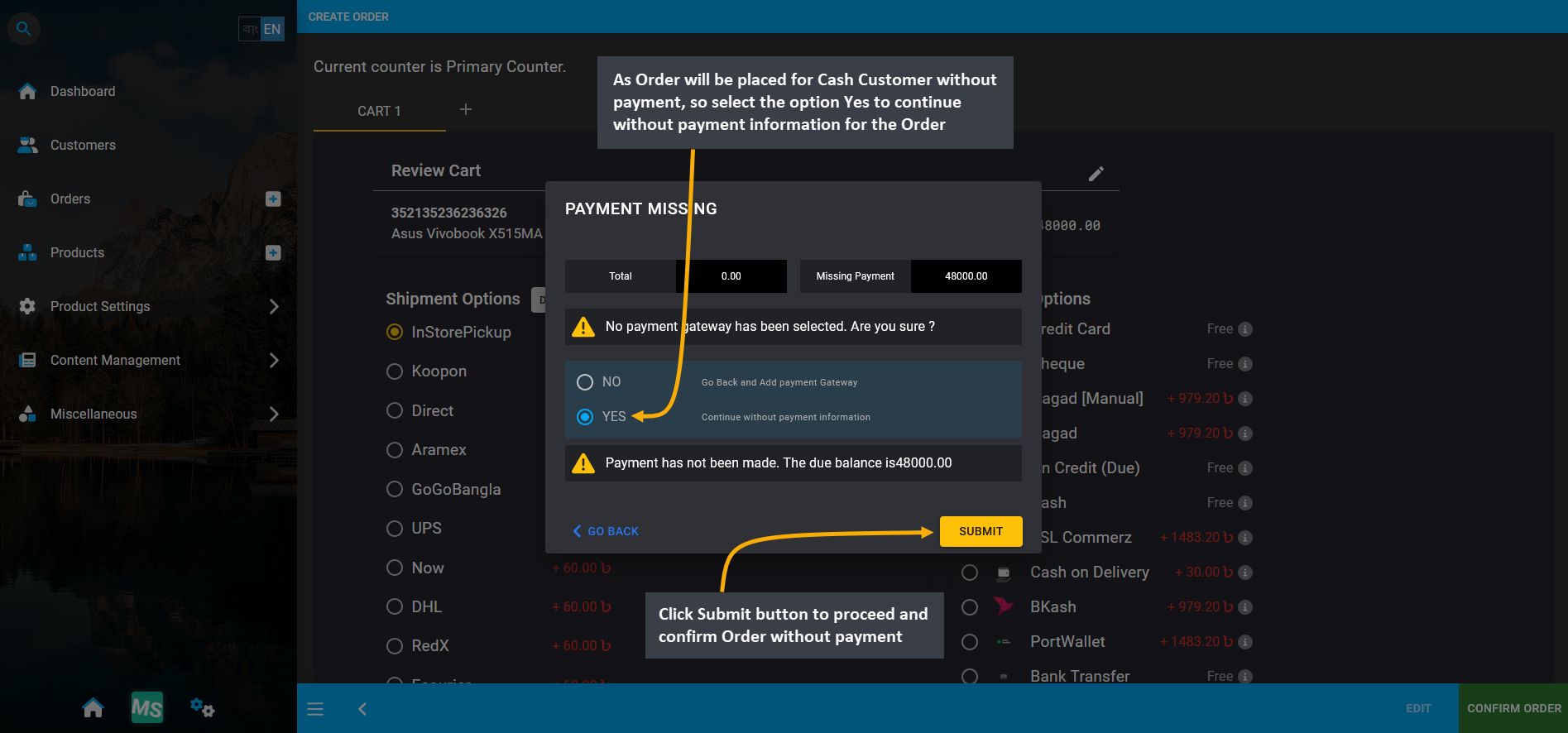

As Order will be placed for Cash Customer without payment, so select the option Yes to continue without payment information for the Order. Click the Submit button to proceed and confirm the Order without any payment.

Image 3: Select the option Yes to continue without payment information for the Order for Cash Customer.

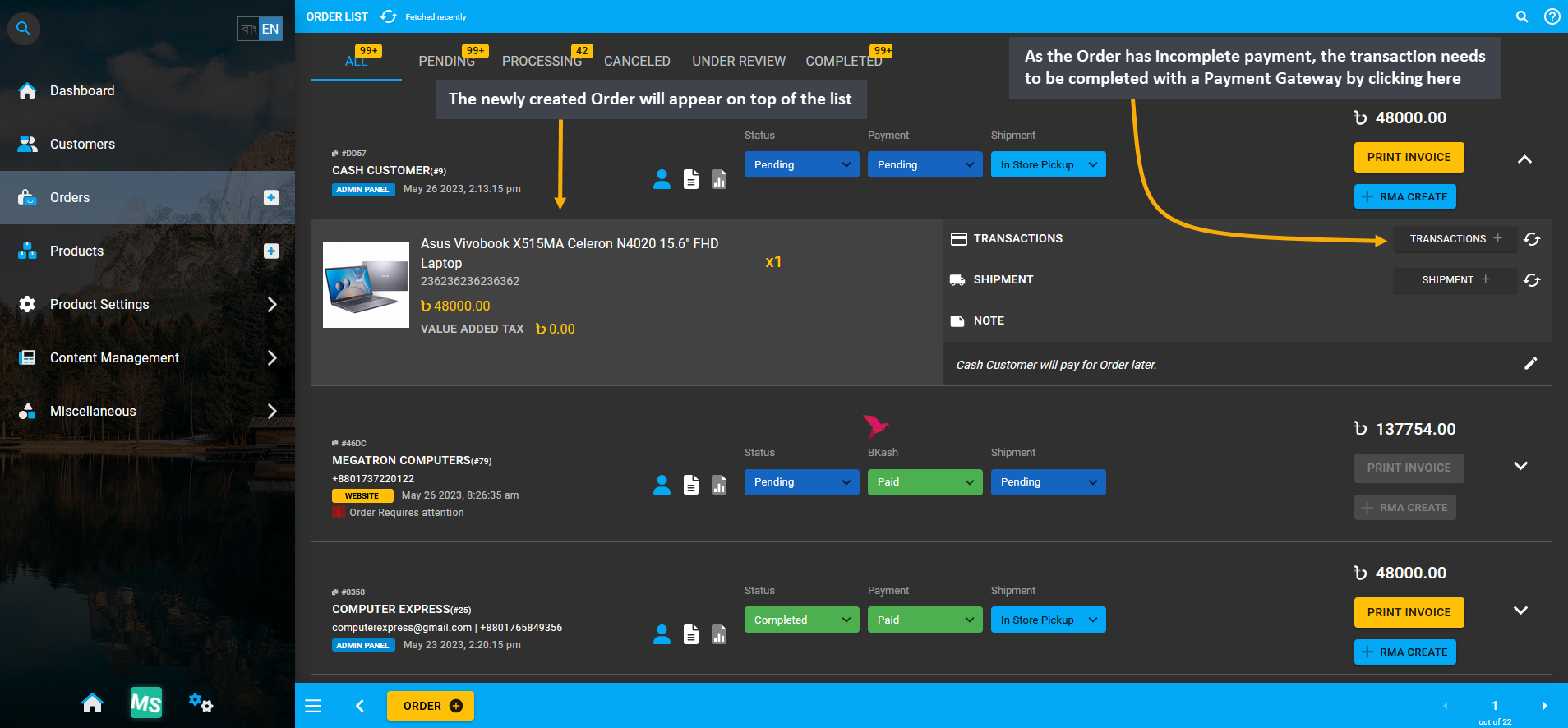

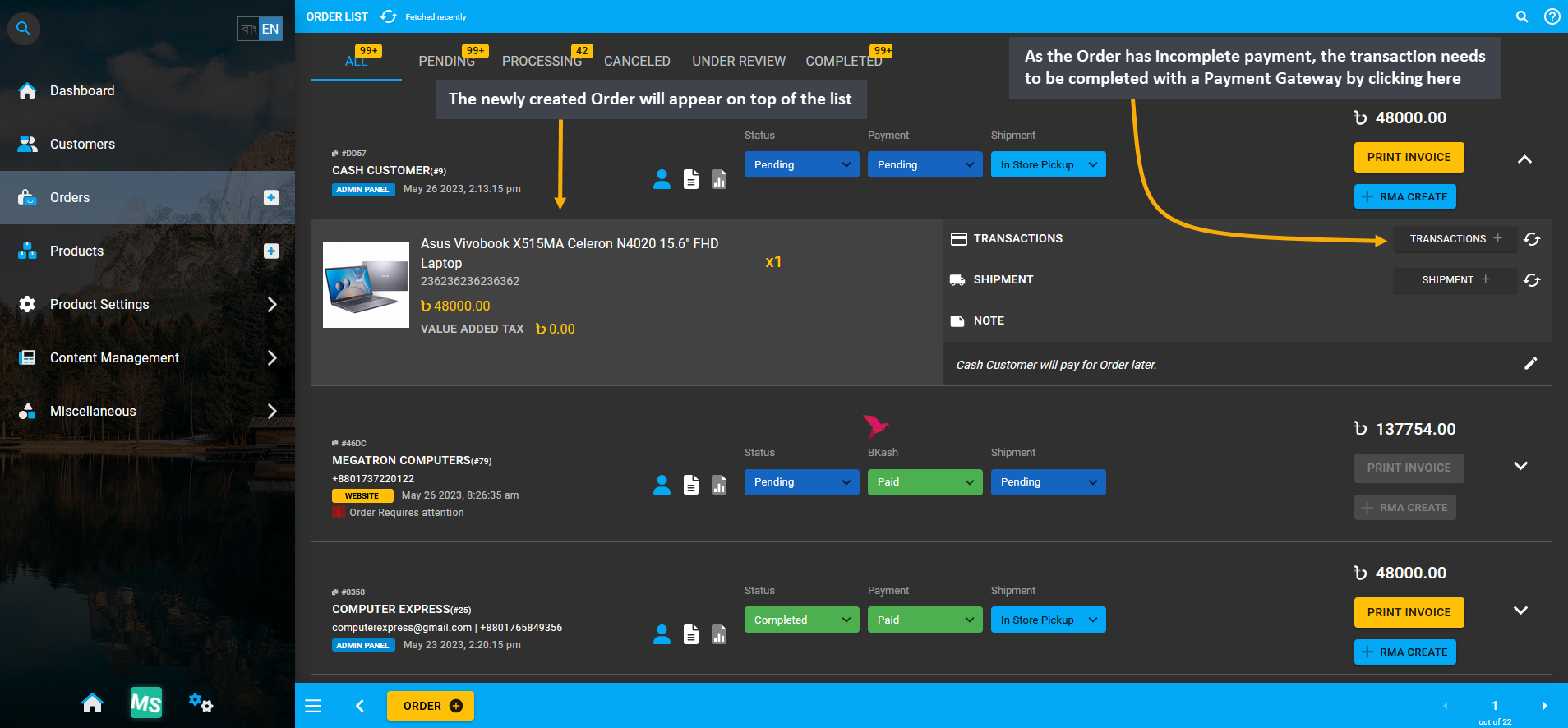

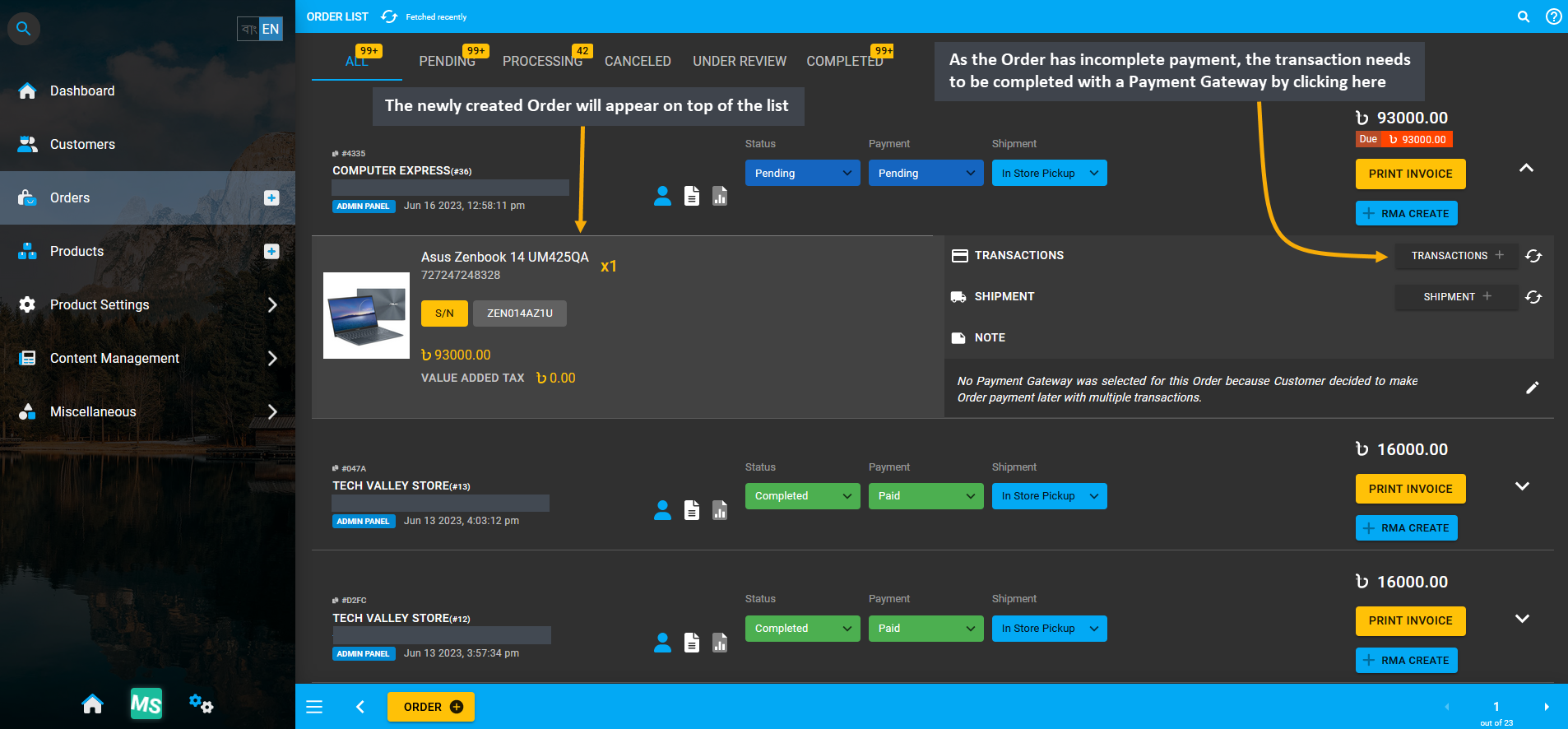

To add payment details to this Order, go the Orders Tab. The newly created Order will appear on top of the list. It has incomplete payment which needs to be completed. For this, click the Transaction + button which will redirect to the Payment Gateway from where transaction can be completed for this Order with Multiple Transactions.

Image 4: Click the Transaction + button to complete Transaction for this Order with Multiple Transactions.

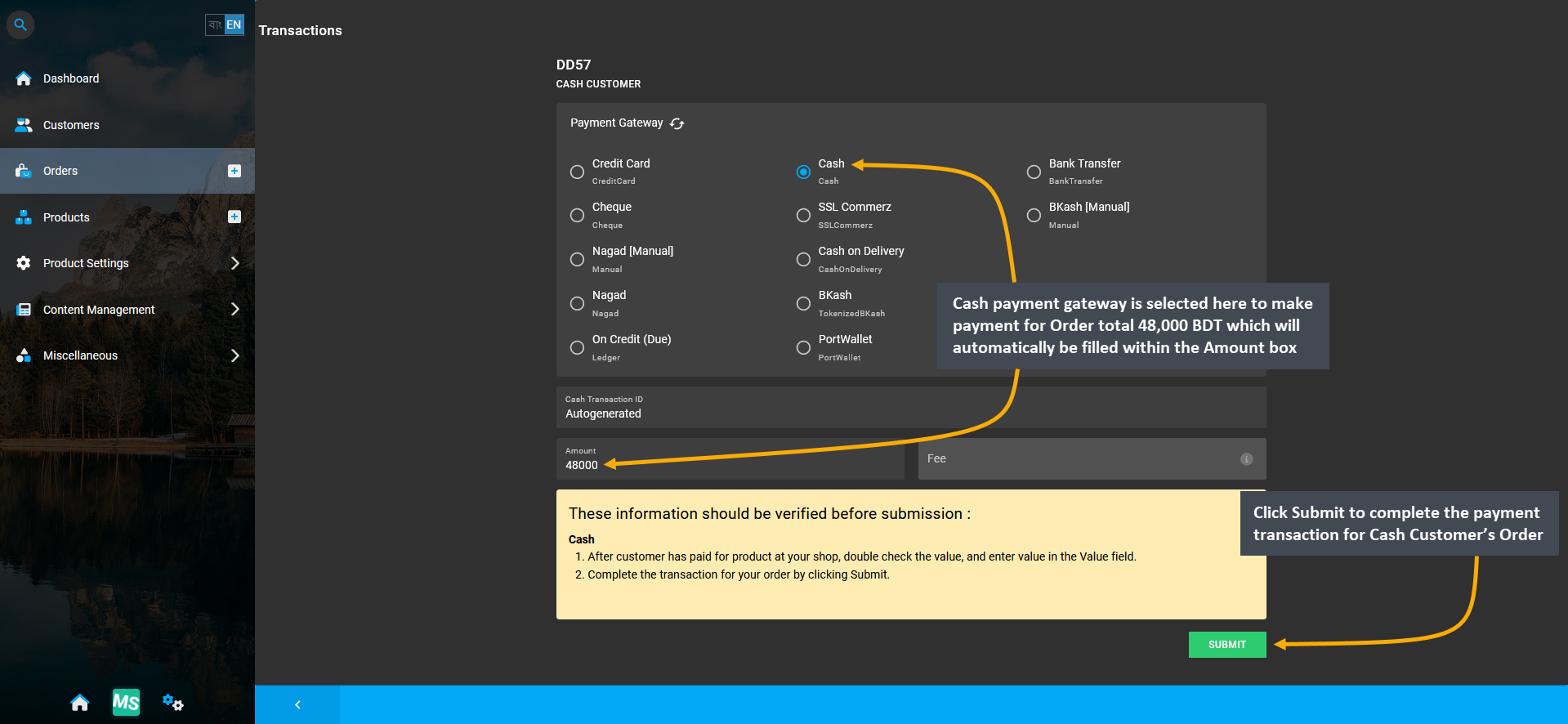

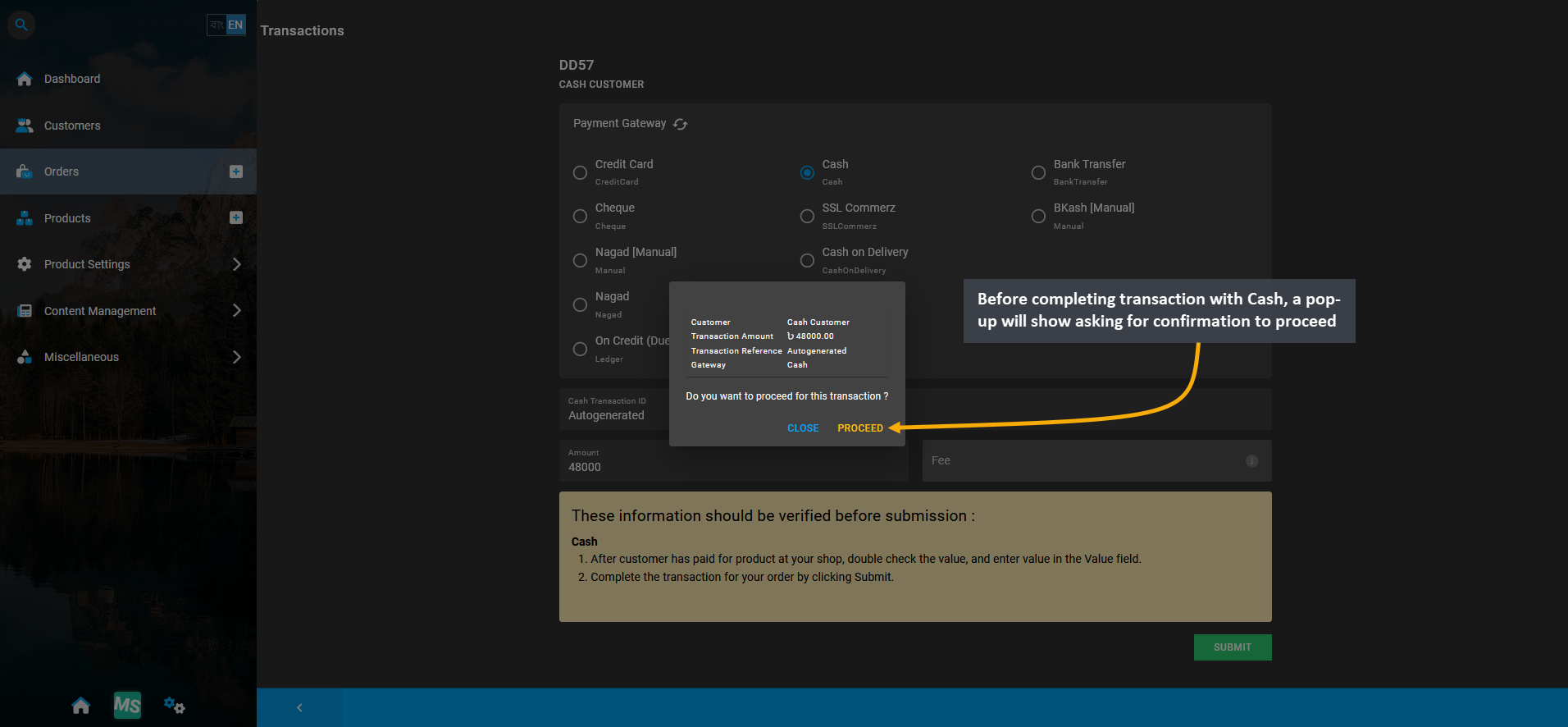

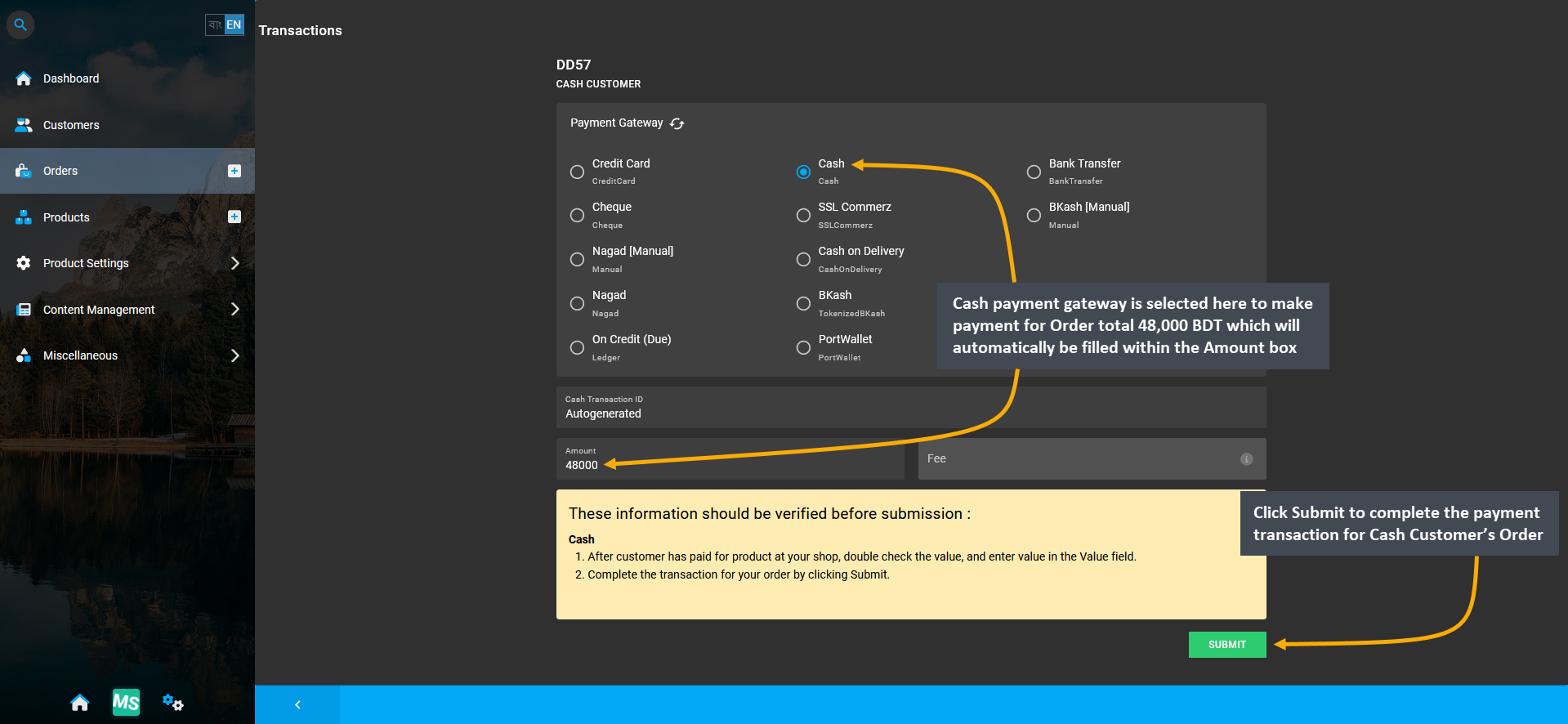

To resolve this Pending Order for Cash Customer, complete the Order payment by selecting any Payment Gateway. Cash payment gateway is selected here to make payment for Order total 48,000 BDT which will automatically be stated within the Amount box. Click Submit to complete the payment transaction for Cash Customer’s Order.

Image 5: To resolve Pending Order for Cash Customer, complete payment by selecting any Payment Gateway.

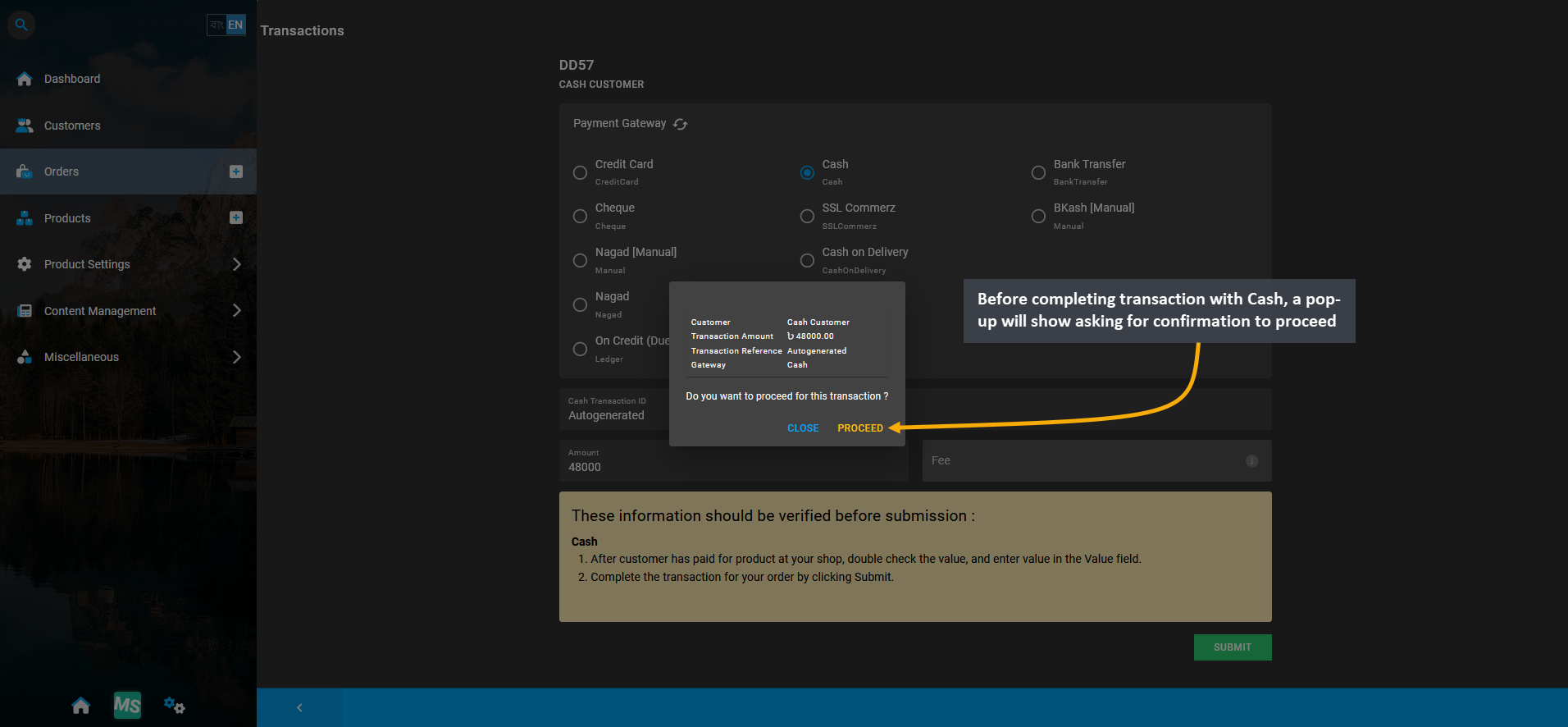

Before completing the pending payment of 48,000 BDT with Cash, a pop-up will ask for confirmation to proceed with the transaction. Click Proceed to confirm payment with Cash that will be saved under Transactions.

Image 6: Before completing transaction with Cash, a pop-up will show asking for confirmation to proceed.

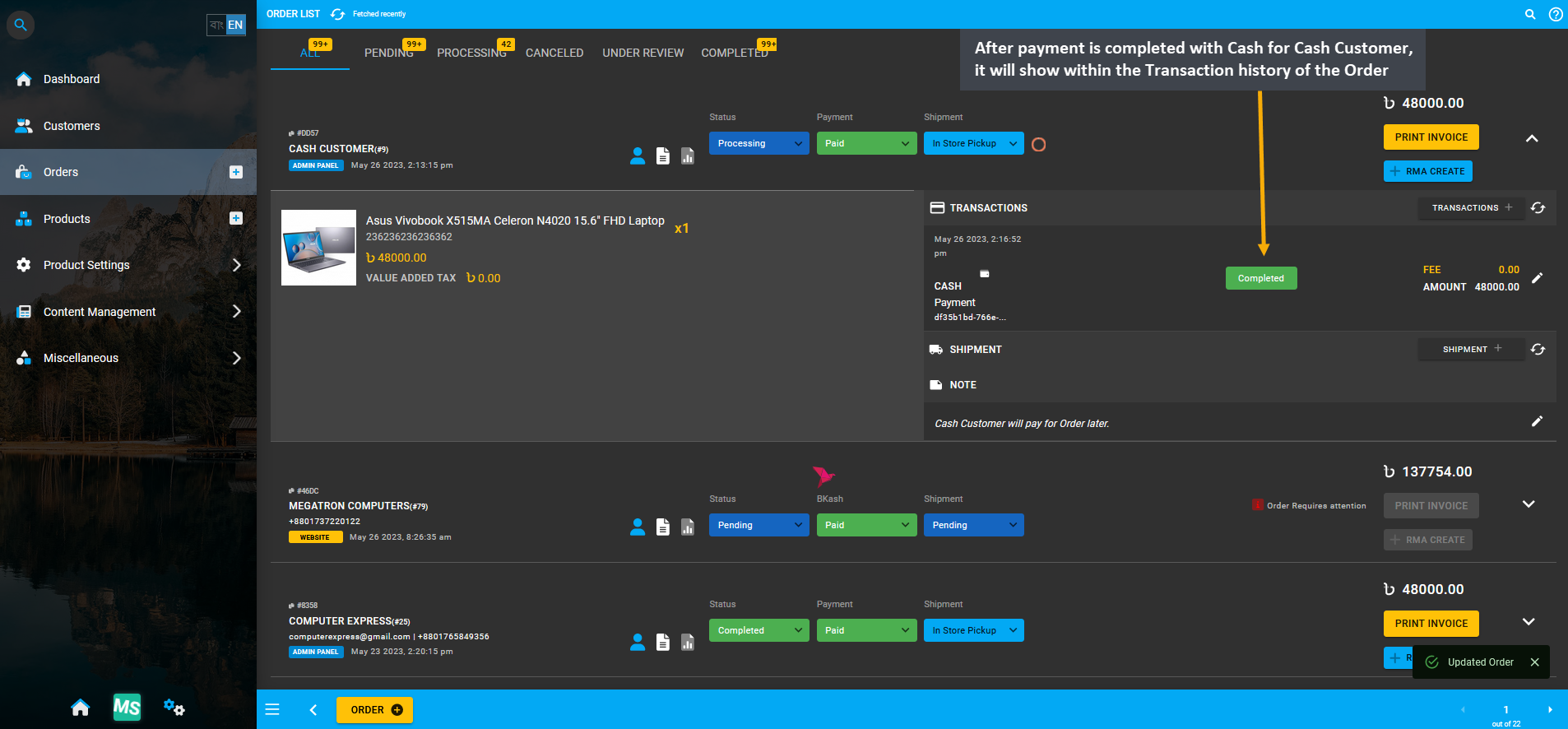

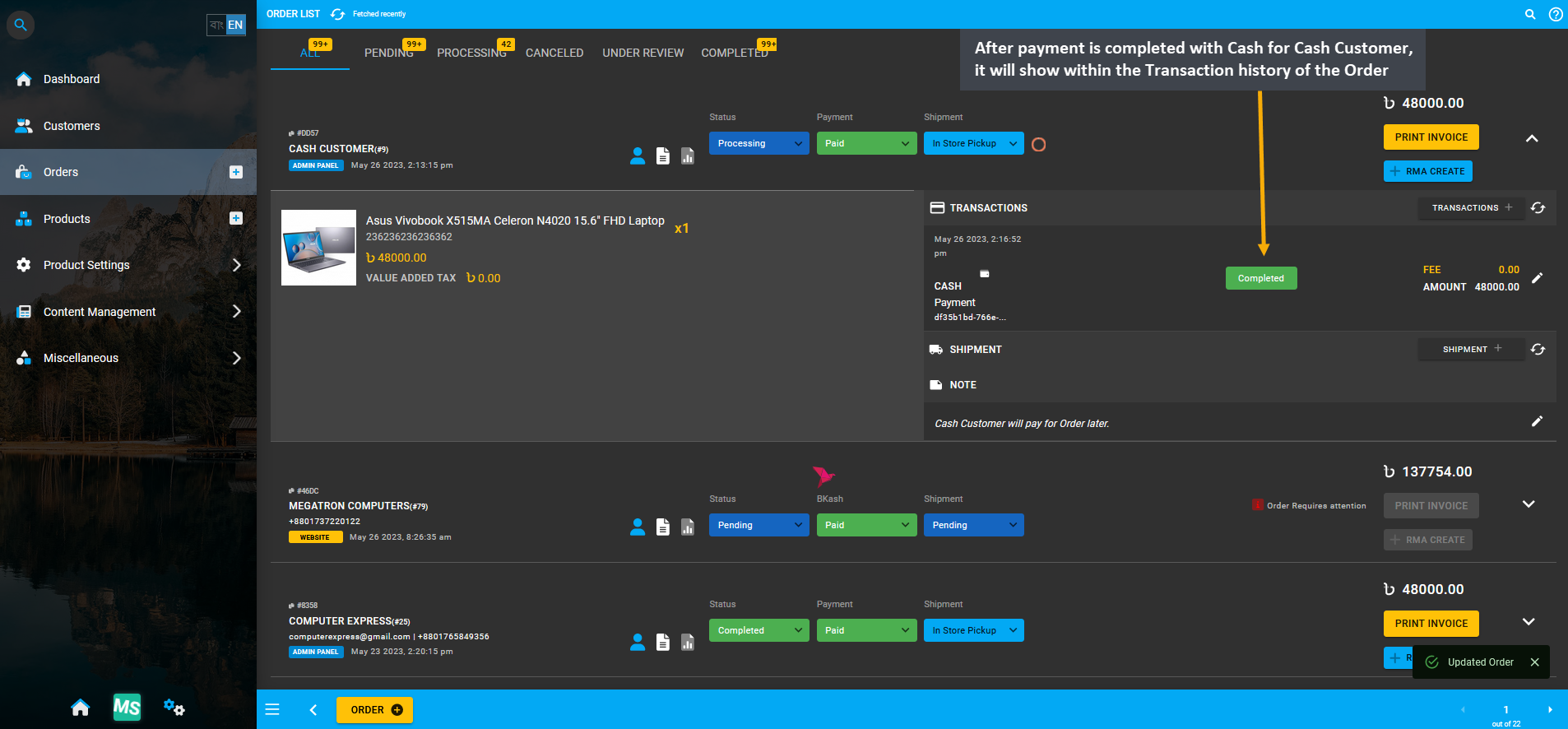

After payment is completed with Cash for Cash Customer, it will show within the Transaction history of the Order. 48,000 BDT was paid with Cash here that will show status as Completed with no Fee Amount for Cash payment.

Image 7: Transaction status will be marked as Completed with no Fee for Cash payment on Order history.

2 - Regular Customer Transaction Flow

Functionality of Regular Customer’s Transaction Modals on Cart and Order Page.

Regular Customer Transaction Flow

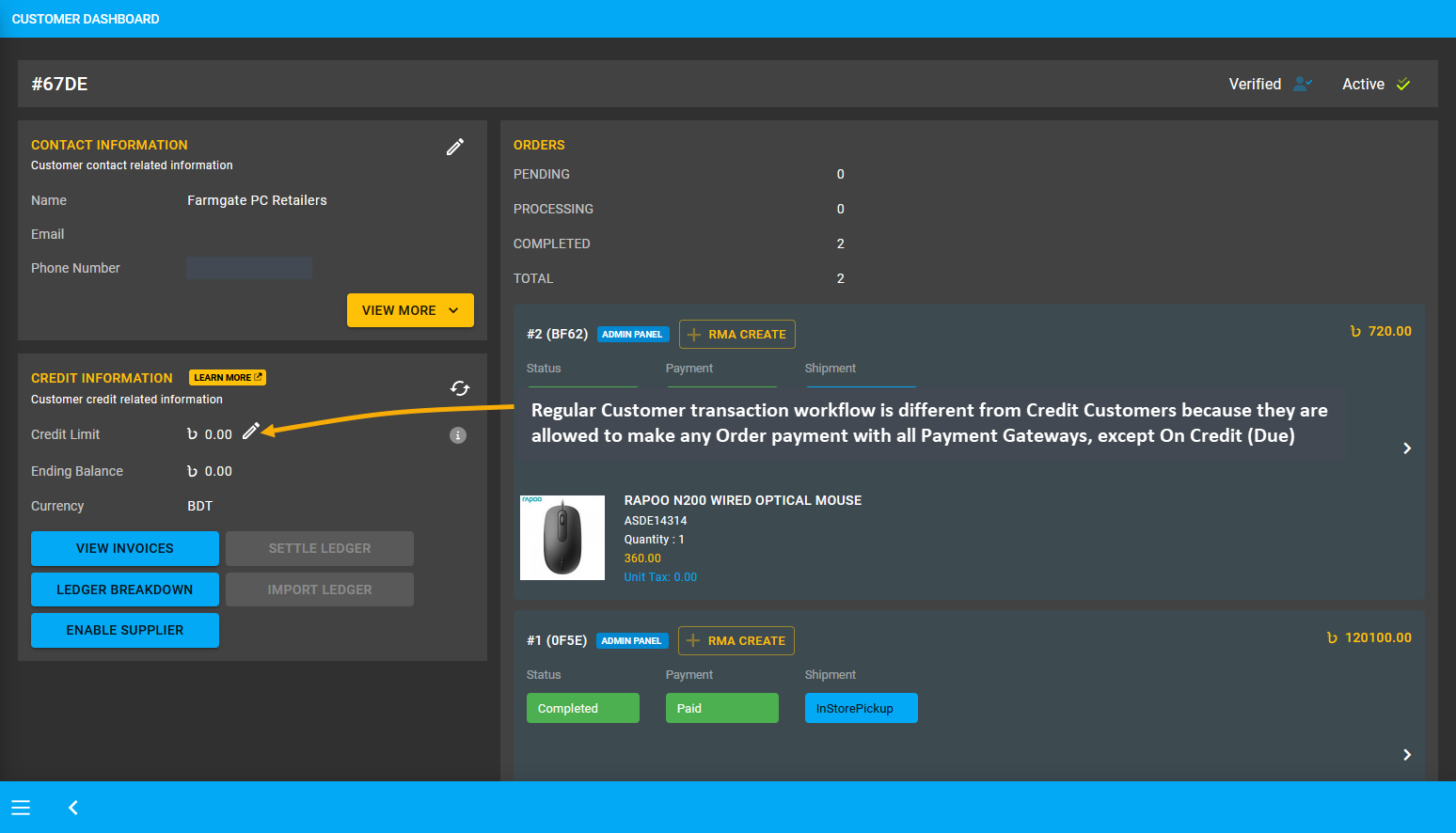

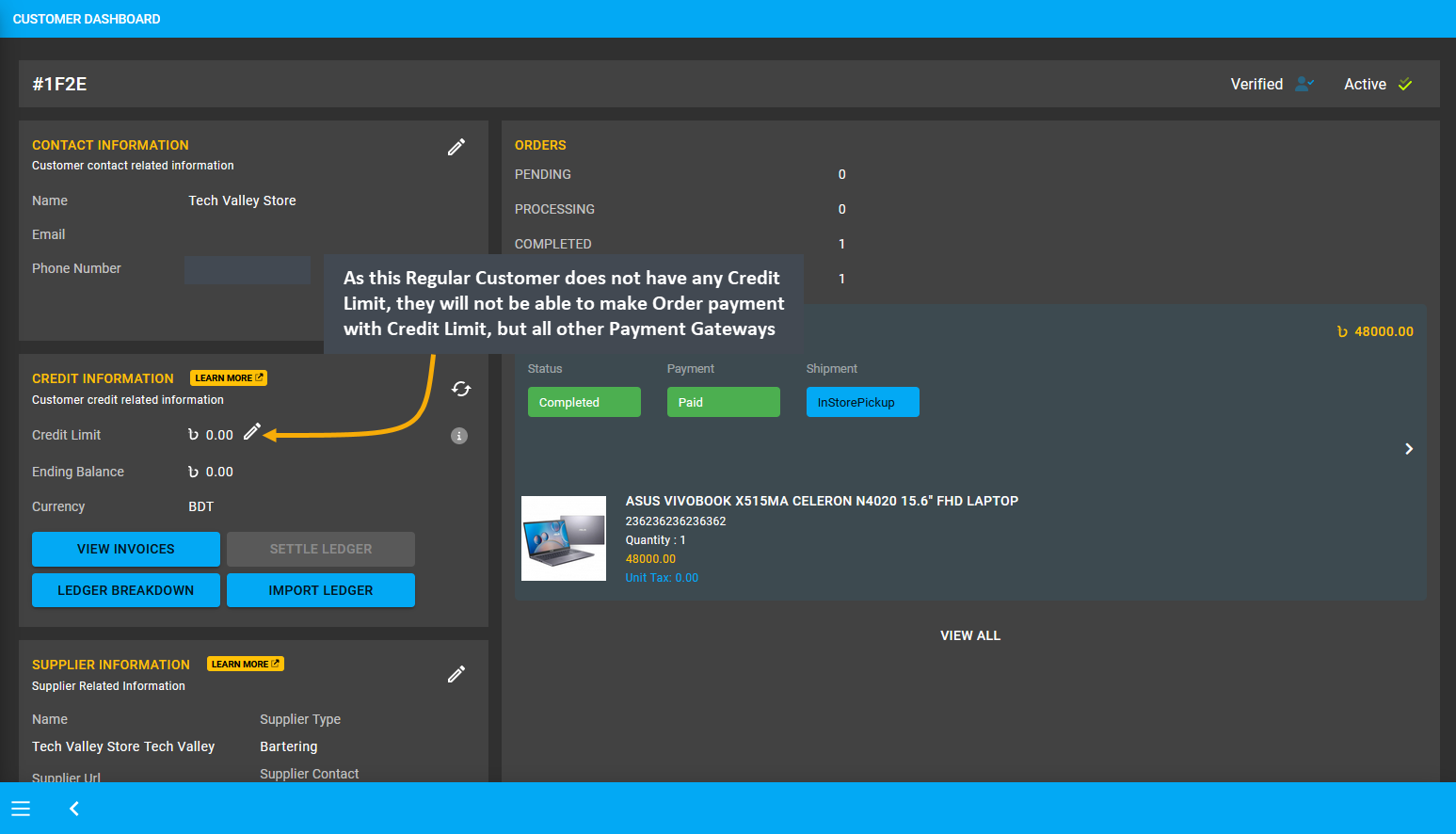

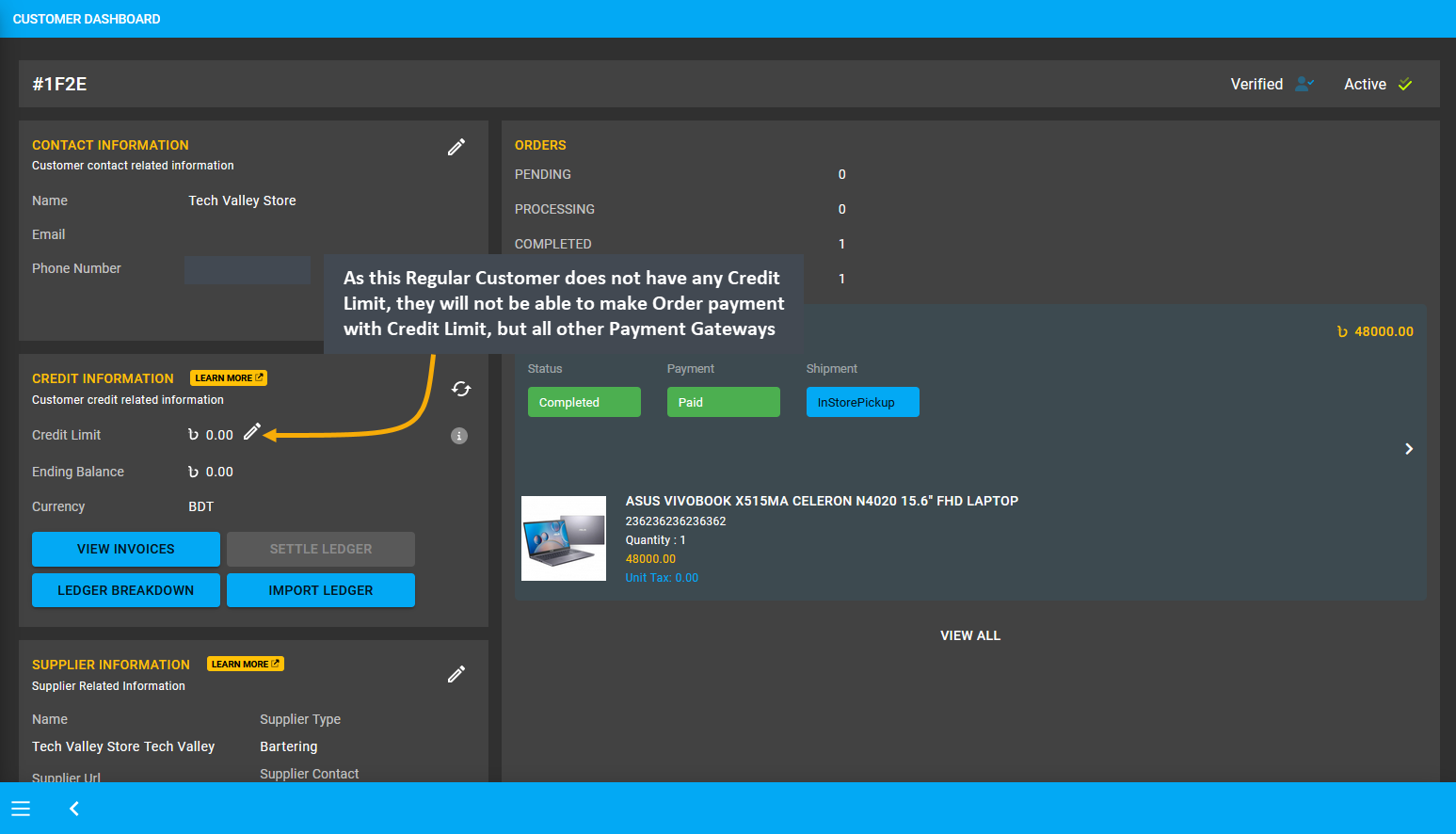

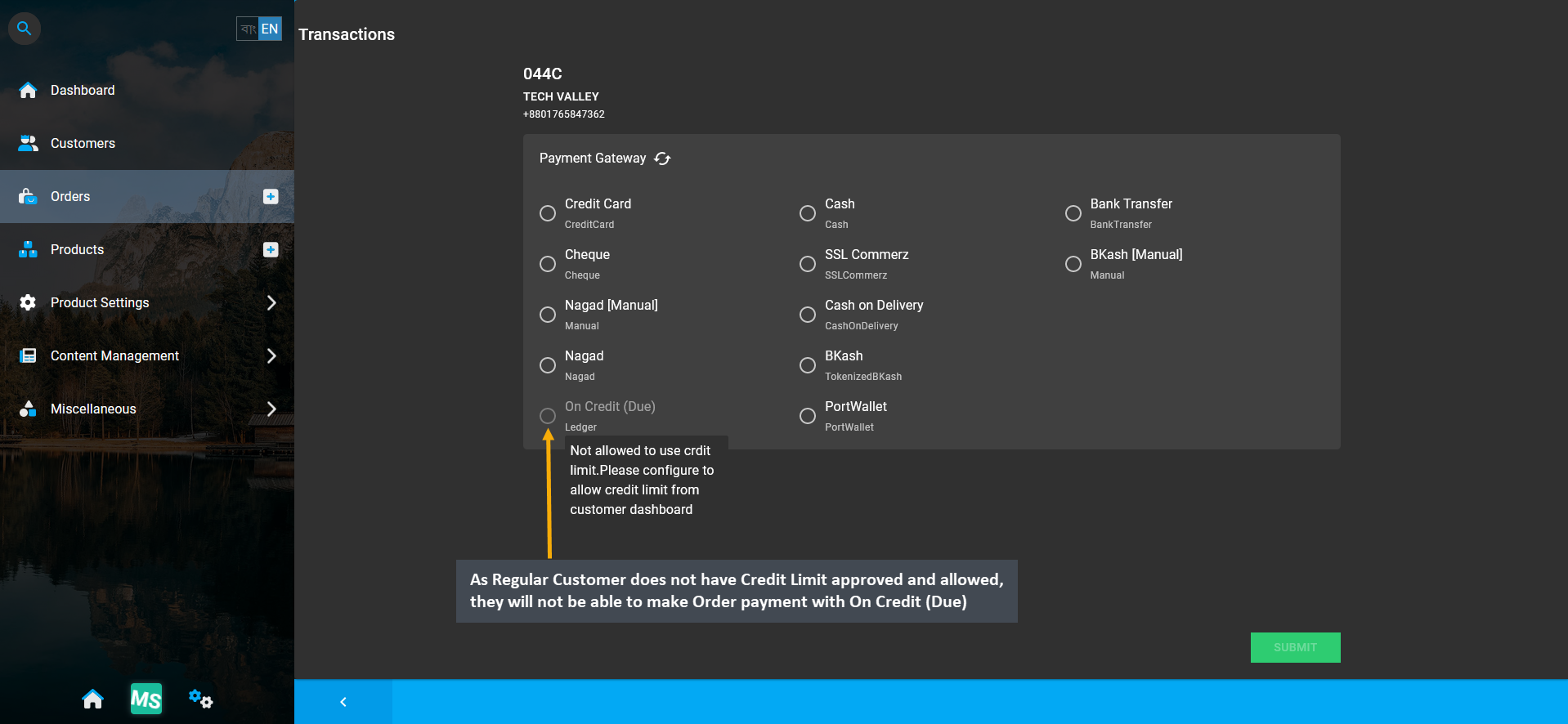

Regular Customer transaction workflow is different from Credit Customers because they are allowed to make any Order payment with all types of gateways, except On Credit (Due). As Regular Customer are not provided with any Credit Limit, they will not be able to make Order payment with Credit Limit, but all other Payment Gateways.

Image 1: Regular Customers can make any Order payment with all types of gateways, except On Credit (Due).

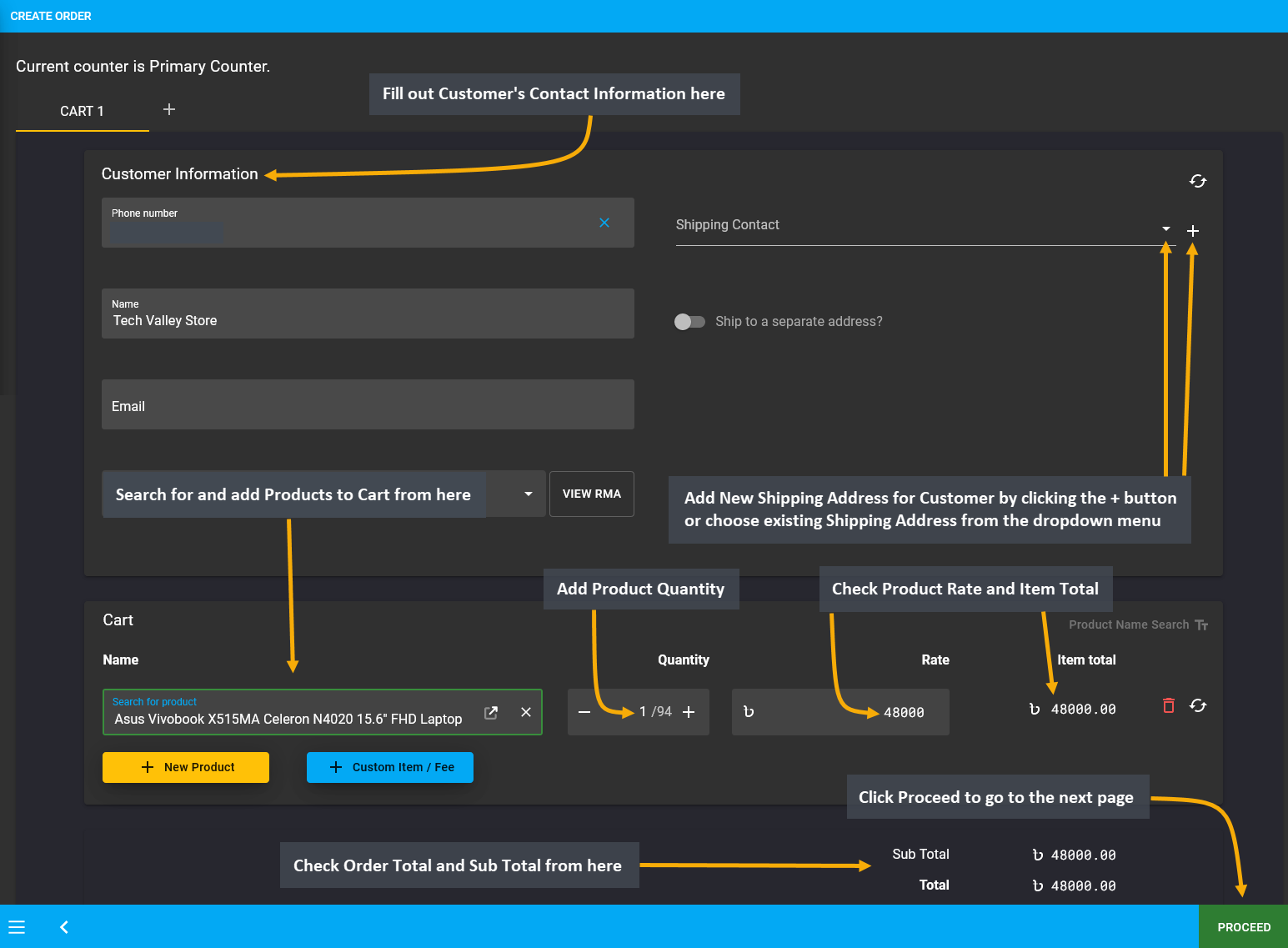

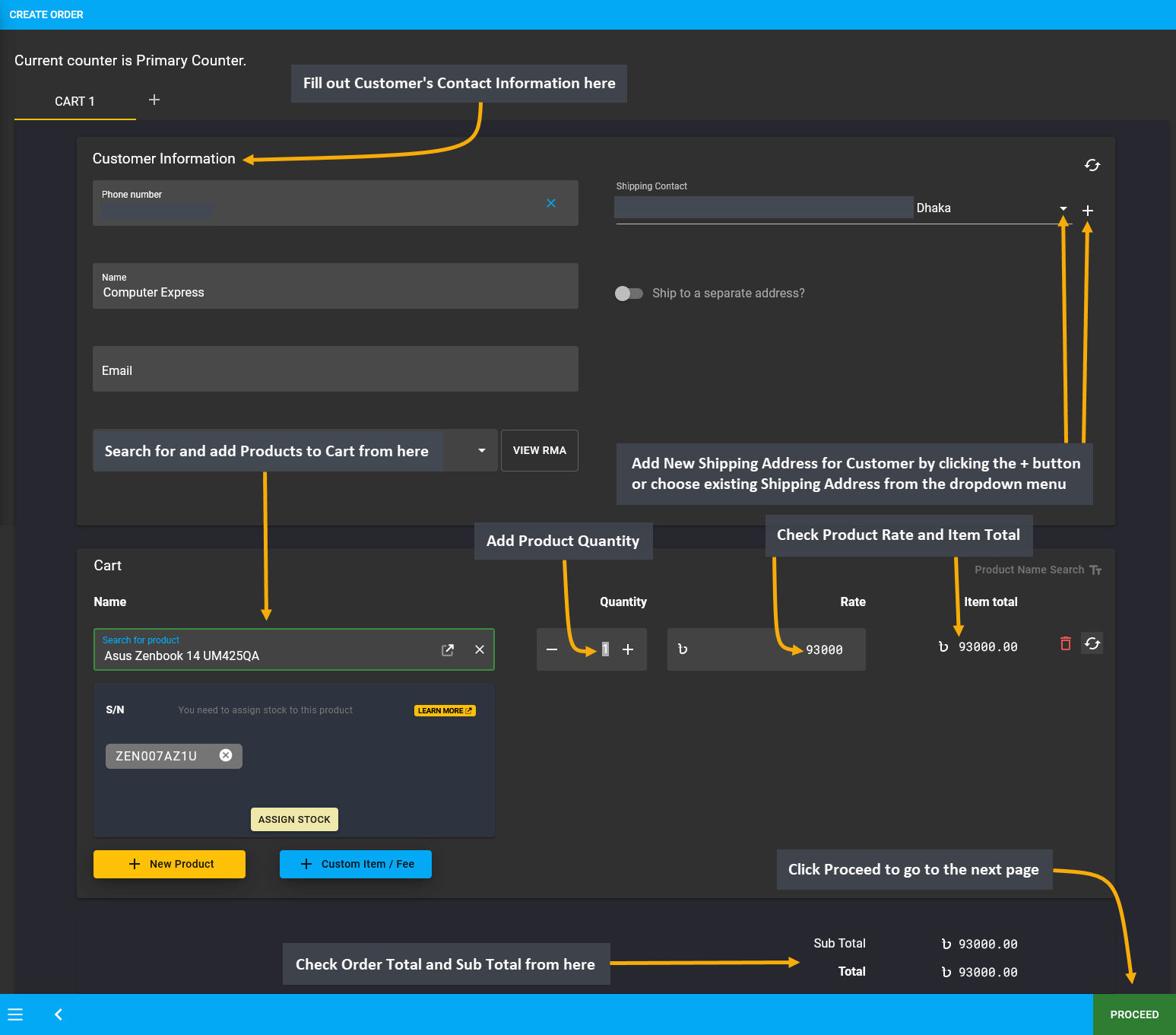

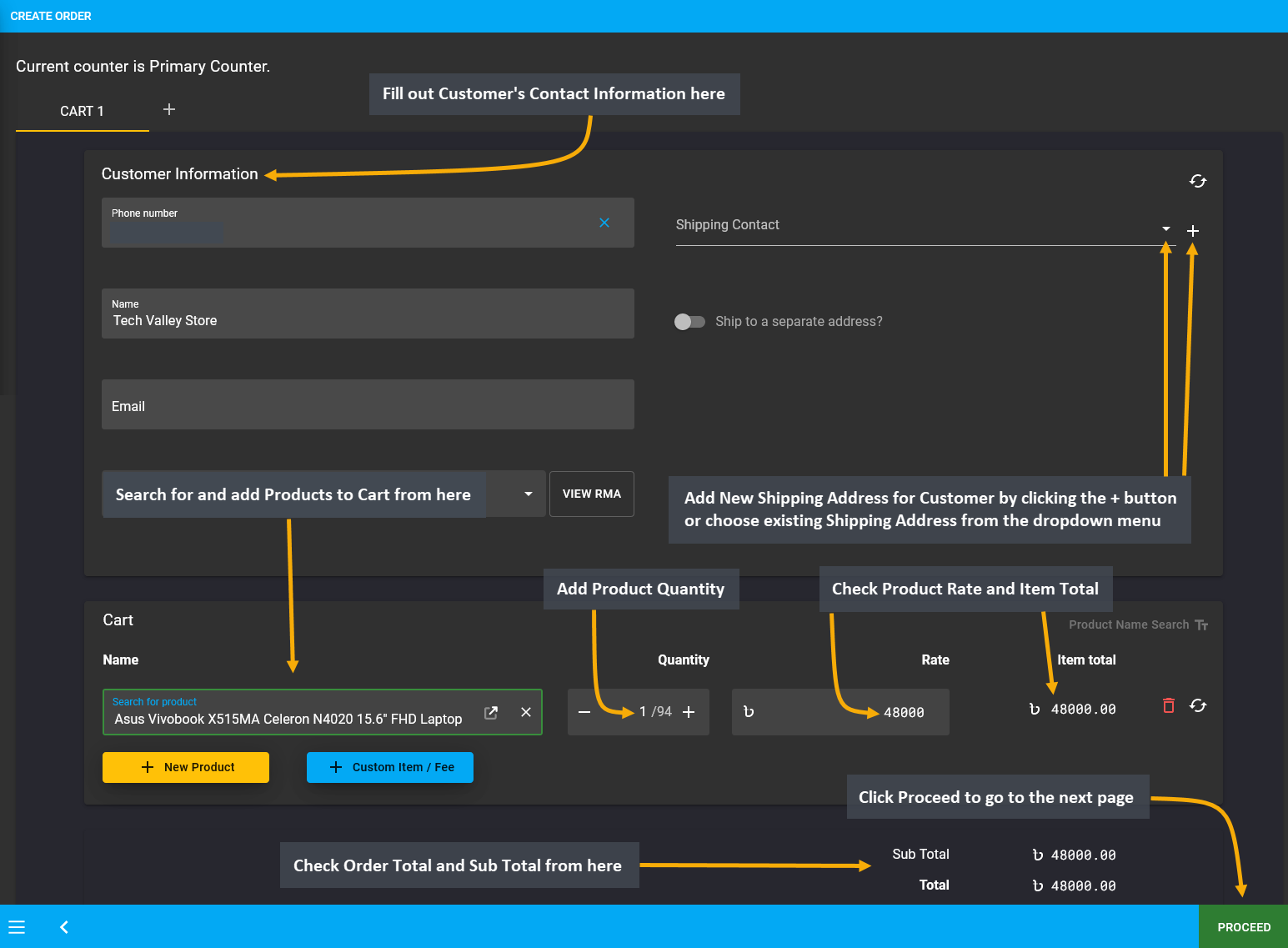

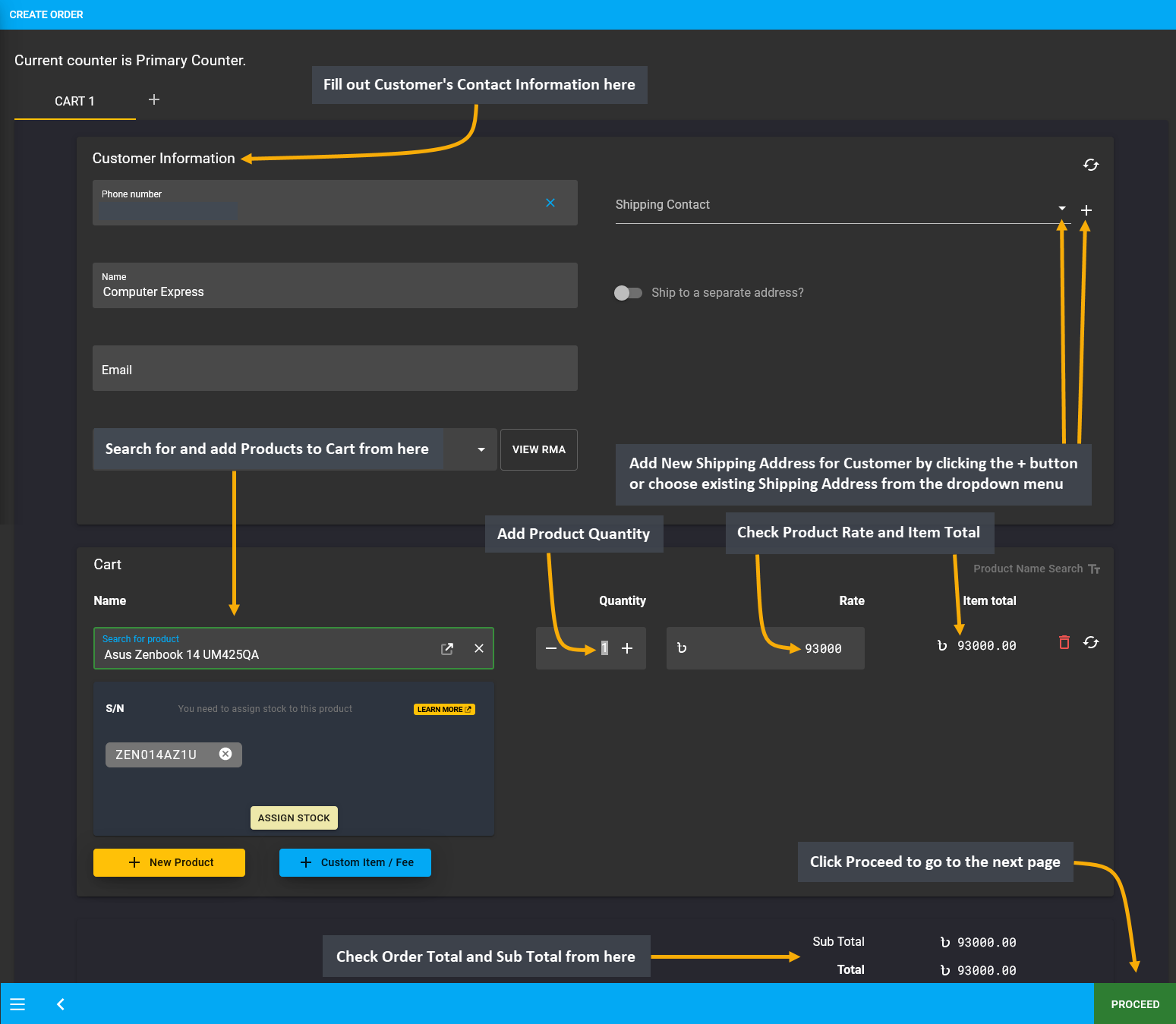

Create an Order for Regular Customer by filling basic Customer Information and Shipping Address. In the Order Cart, search for and add Products from the drop down menu. Check the Product quantity, rate, item total, Order total, subtotal, and click the Proceed button to select payment option and shipping option on the next page.

Image 2: Create an Order for Regular Customer by filling basic Customer Information and Shipping Address.

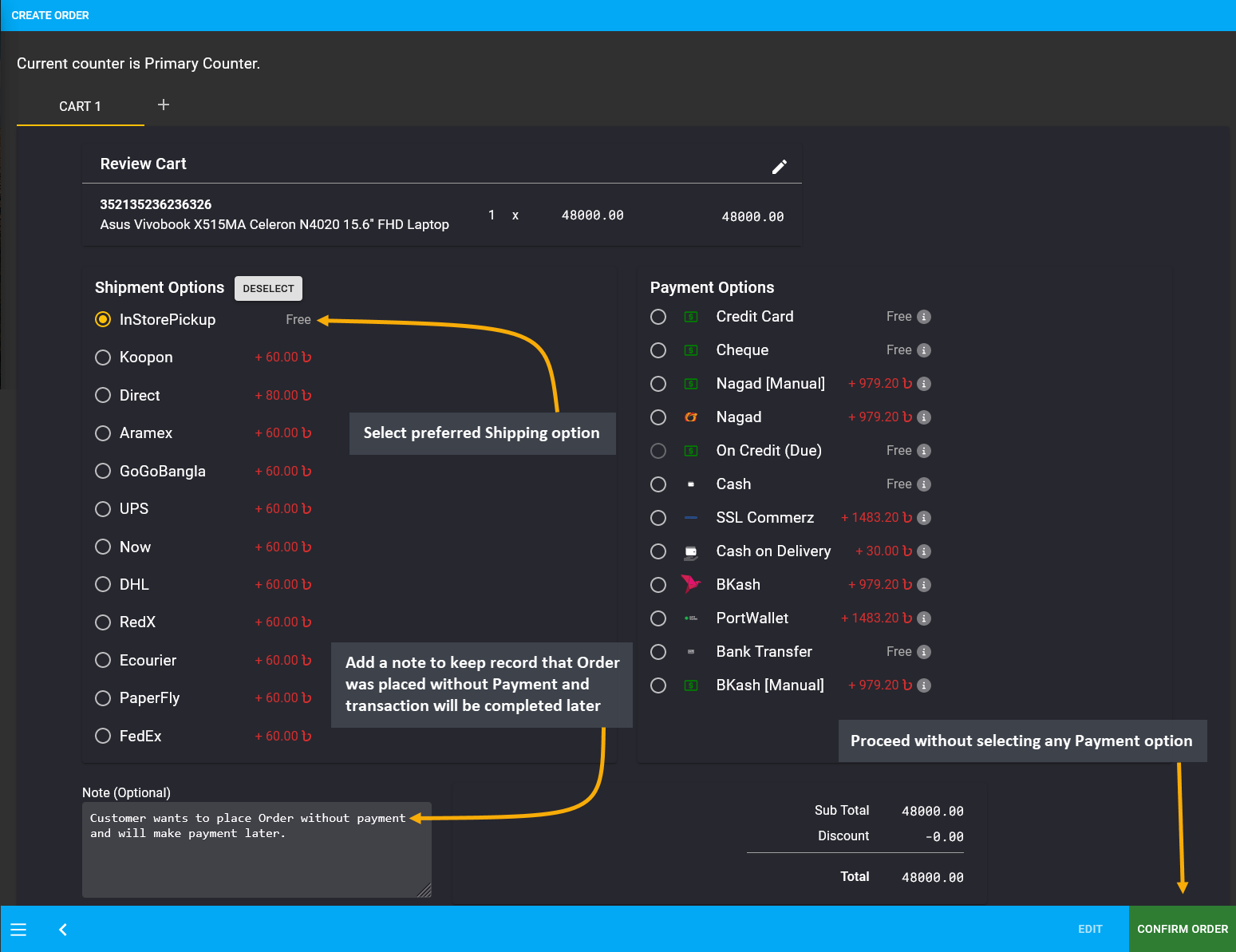

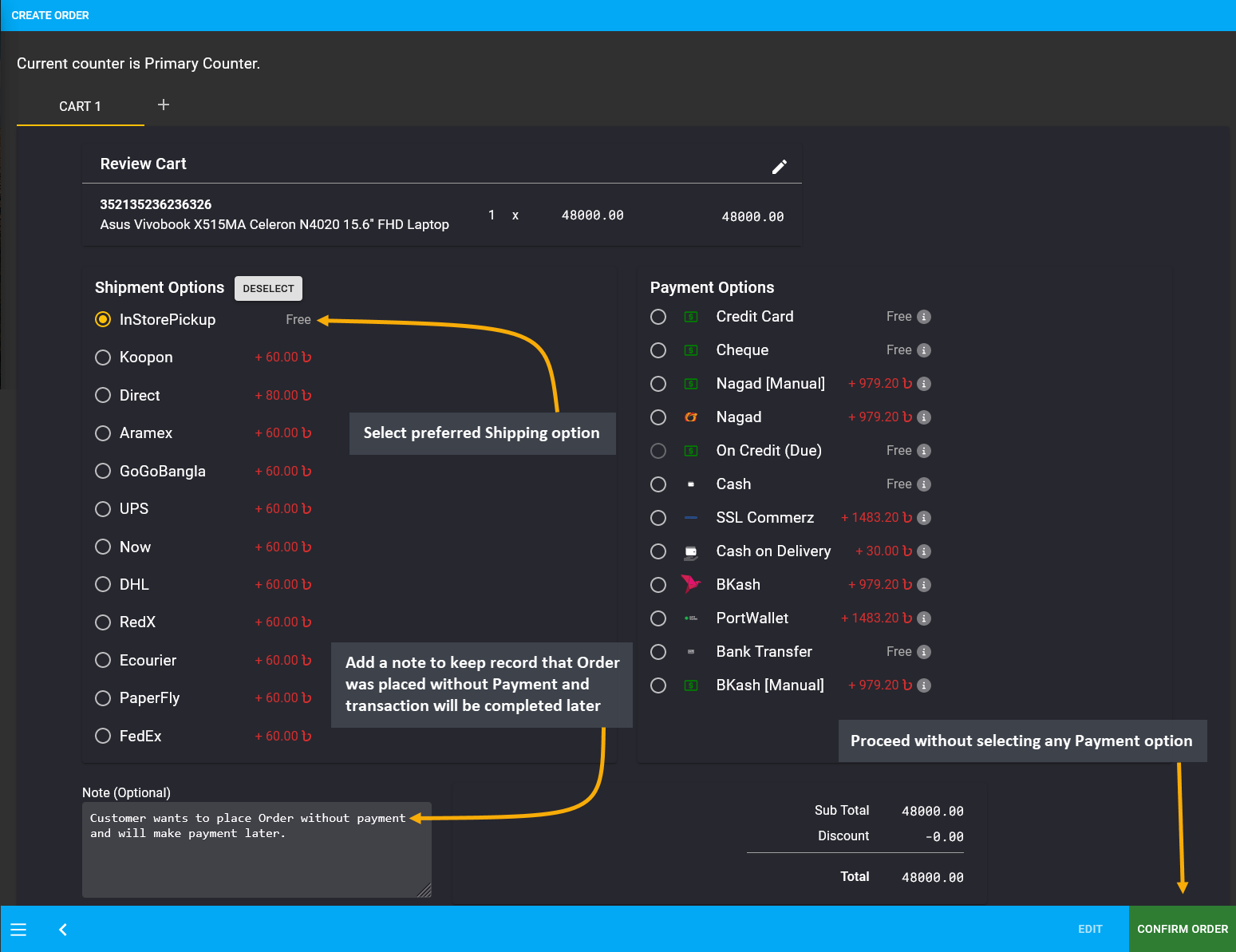

If the Regular Customer wants to place Order without completing payment, then they can complete Order without selecting any payment options. Here, In Store Pickup was selected as the Shipment option, but no Payment option was selected to allow making Payment later. Add Note to keep record that Order is being placed without Payment and transaction will be completed later. Click the Confirm Order button to proceed to the next step.

Image 3: Regular Customer can complete Order without selecting any Payment and complete transaction later.

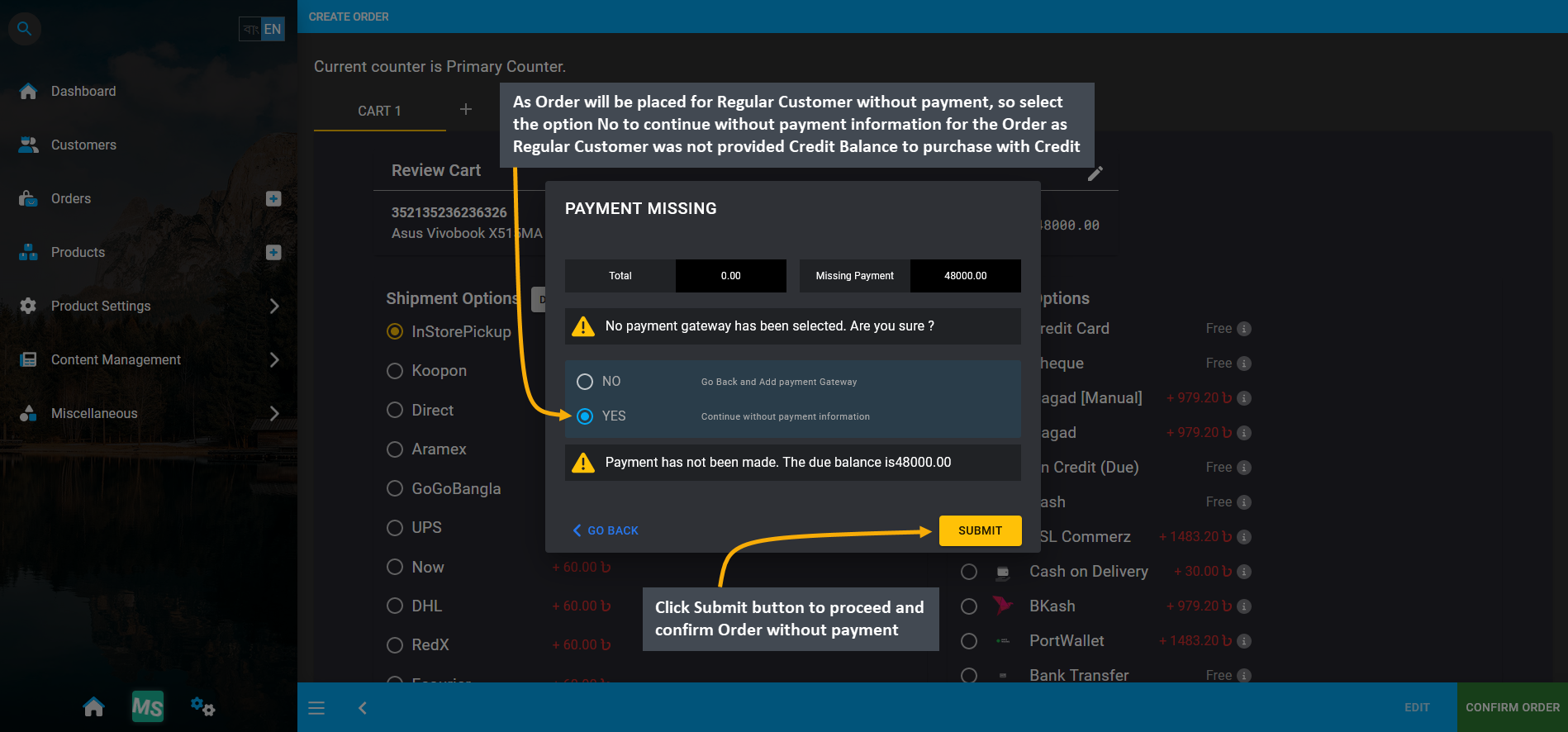

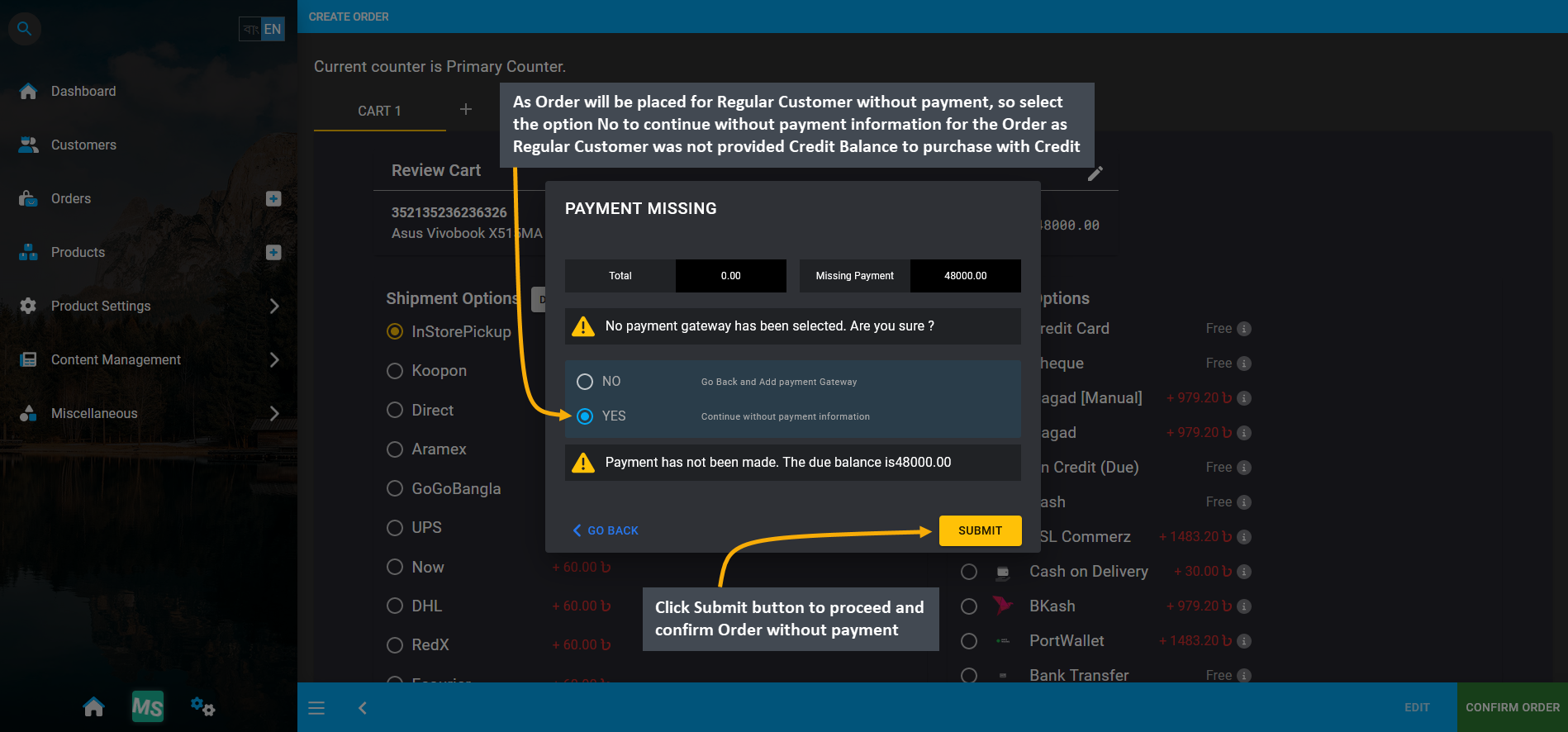

As Order will be placed for Regular Customer without payment, so select option No to continue without payment information for the Order as Regular Customer was not provided Credit Balance to purchase with Credit.

Image 4: As Regular Customer will place Order without payment, so select No to continue without payment.

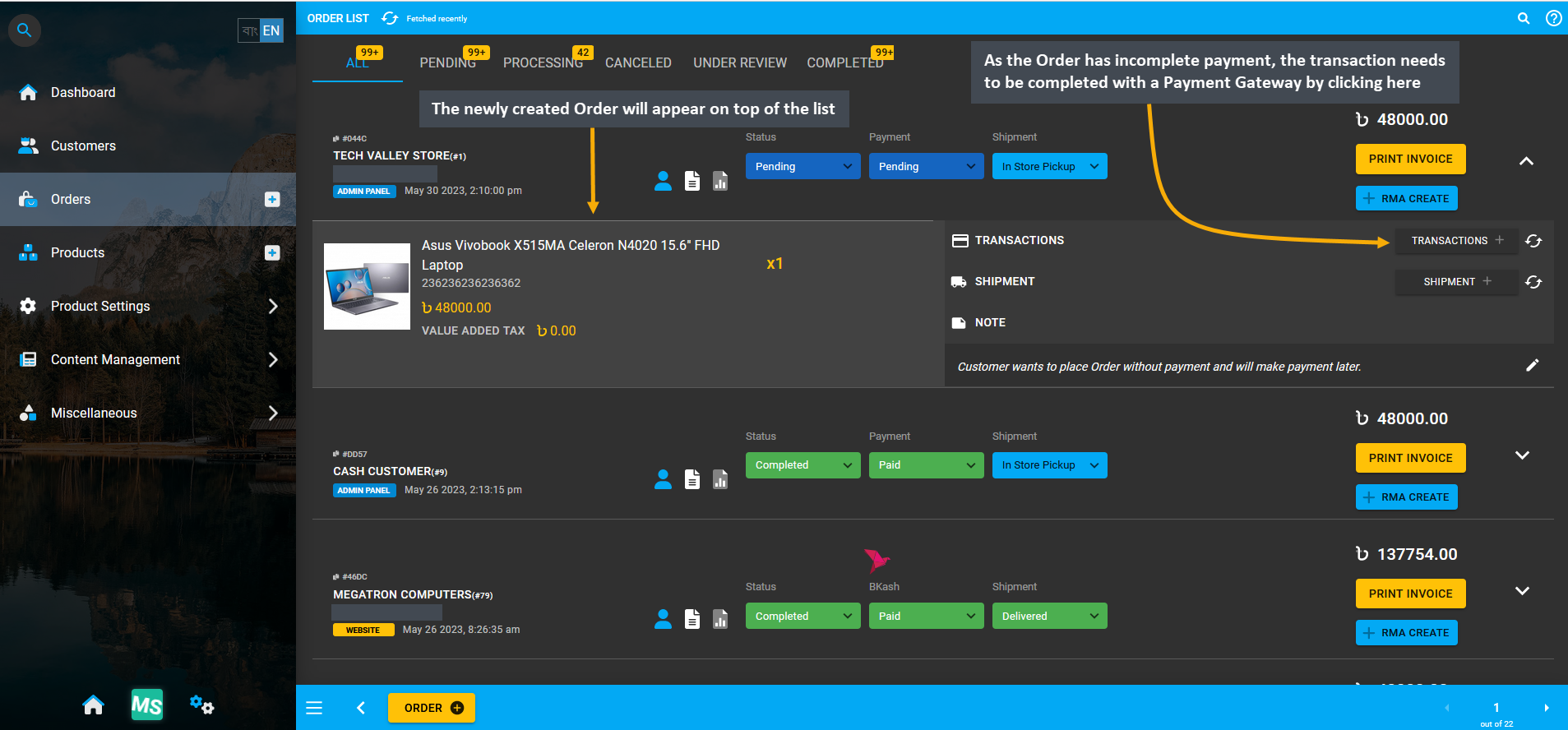

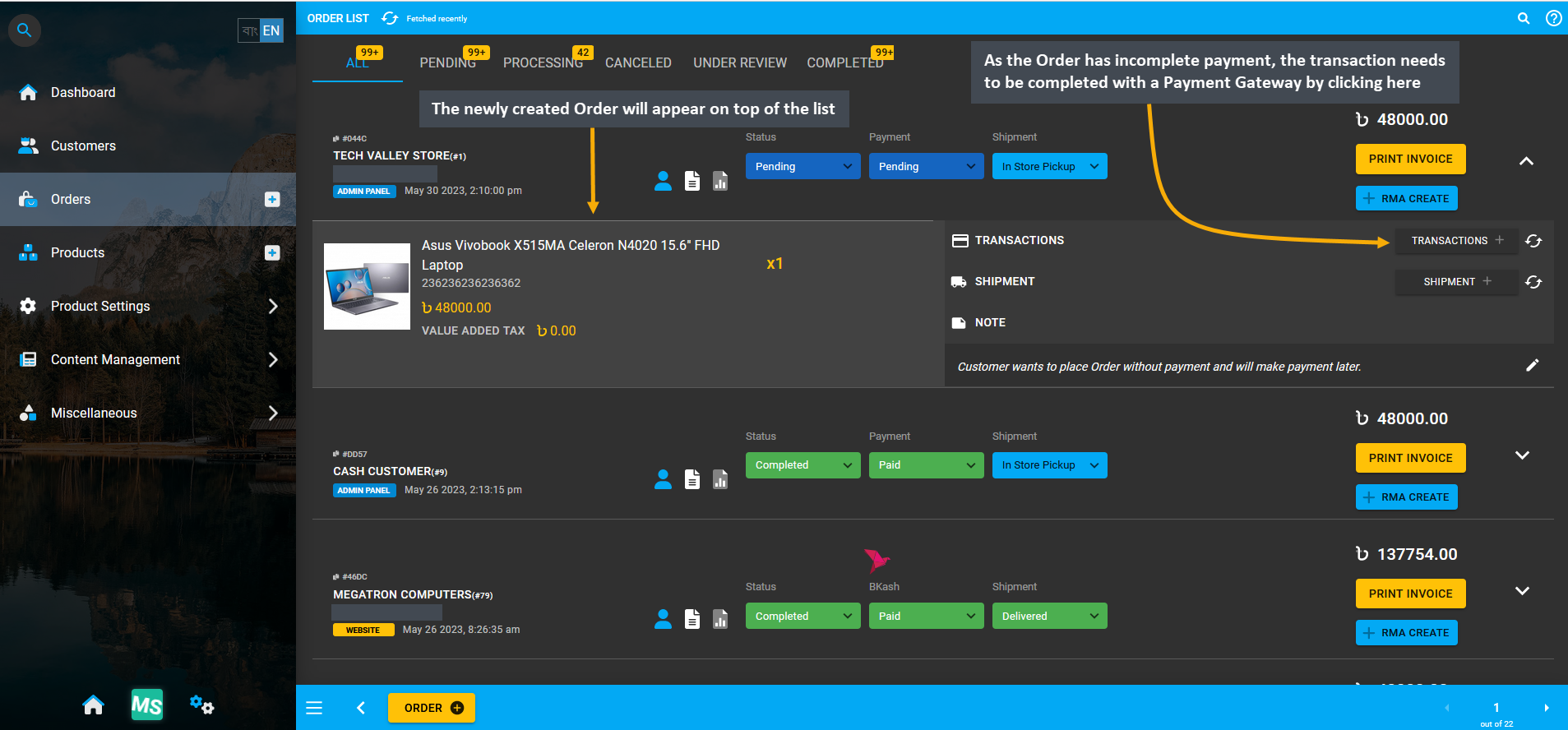

In order to add payment details to this Order, go the the Orders Tab. The newly created Order will appear on top of the list. It has incomplete payment which needs to be completed. For this, click the Transaction + button which will redirect to the Payment Gateway from where transaction can be completed for this Pending Order.

Image 5: Click Transaction + to select Payment Gateway and complete transaction for this Pending Order.

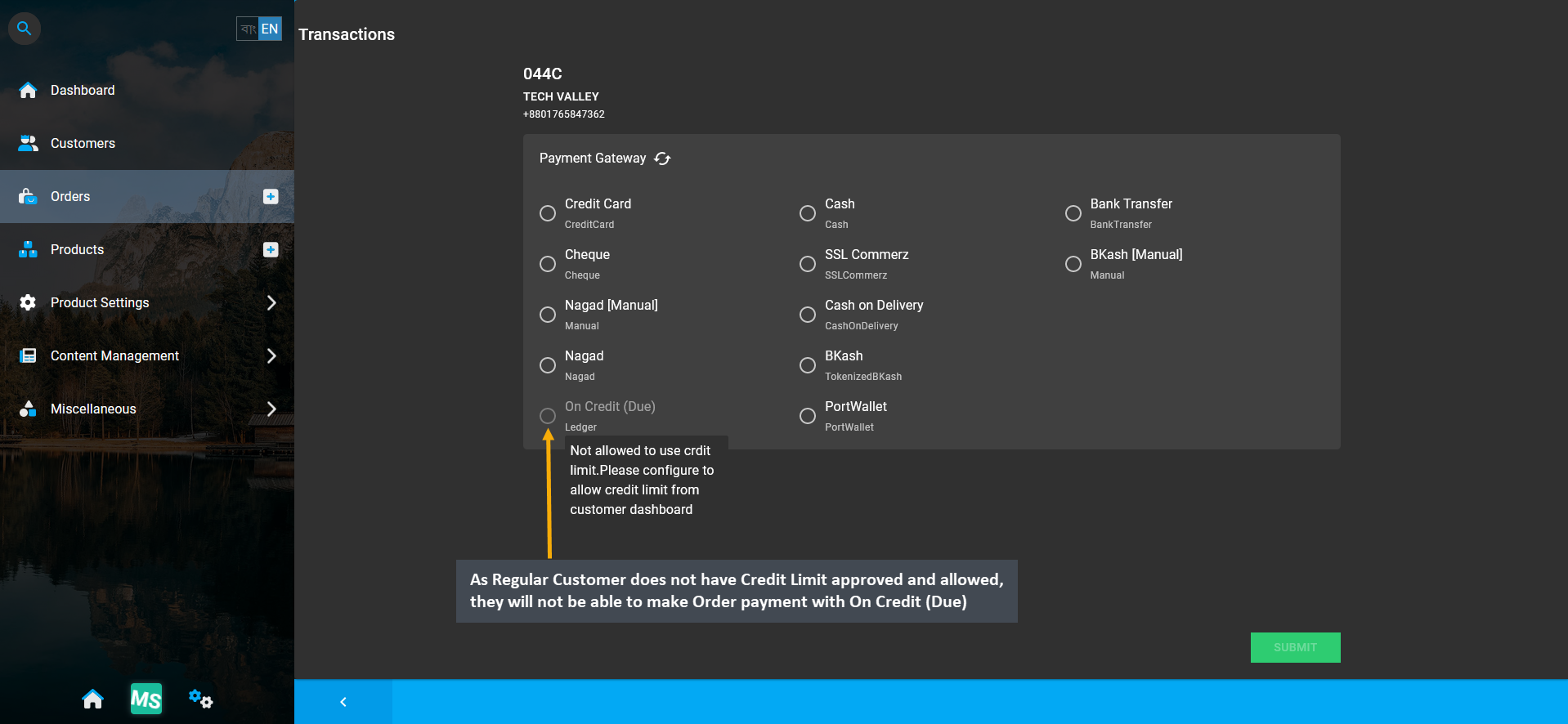

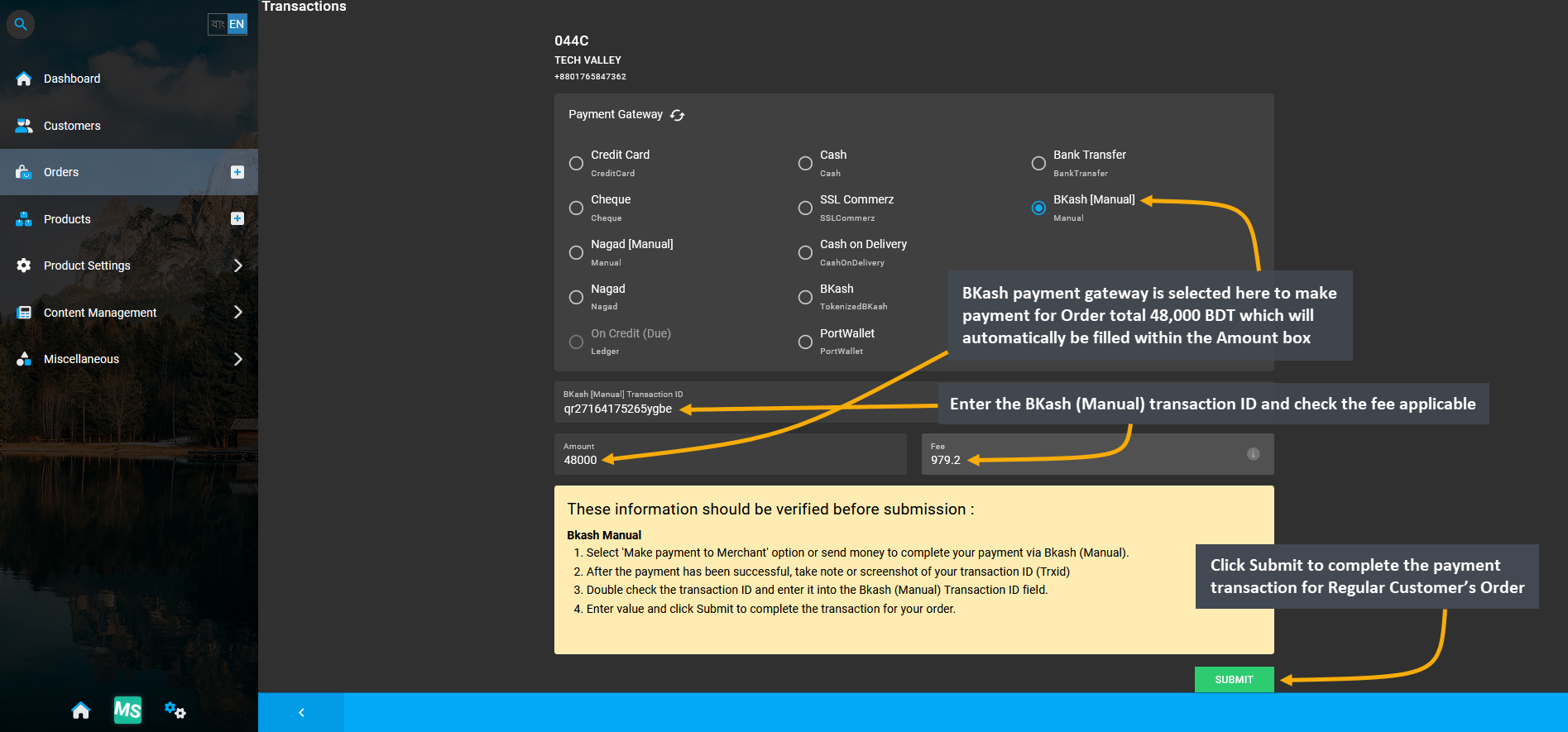

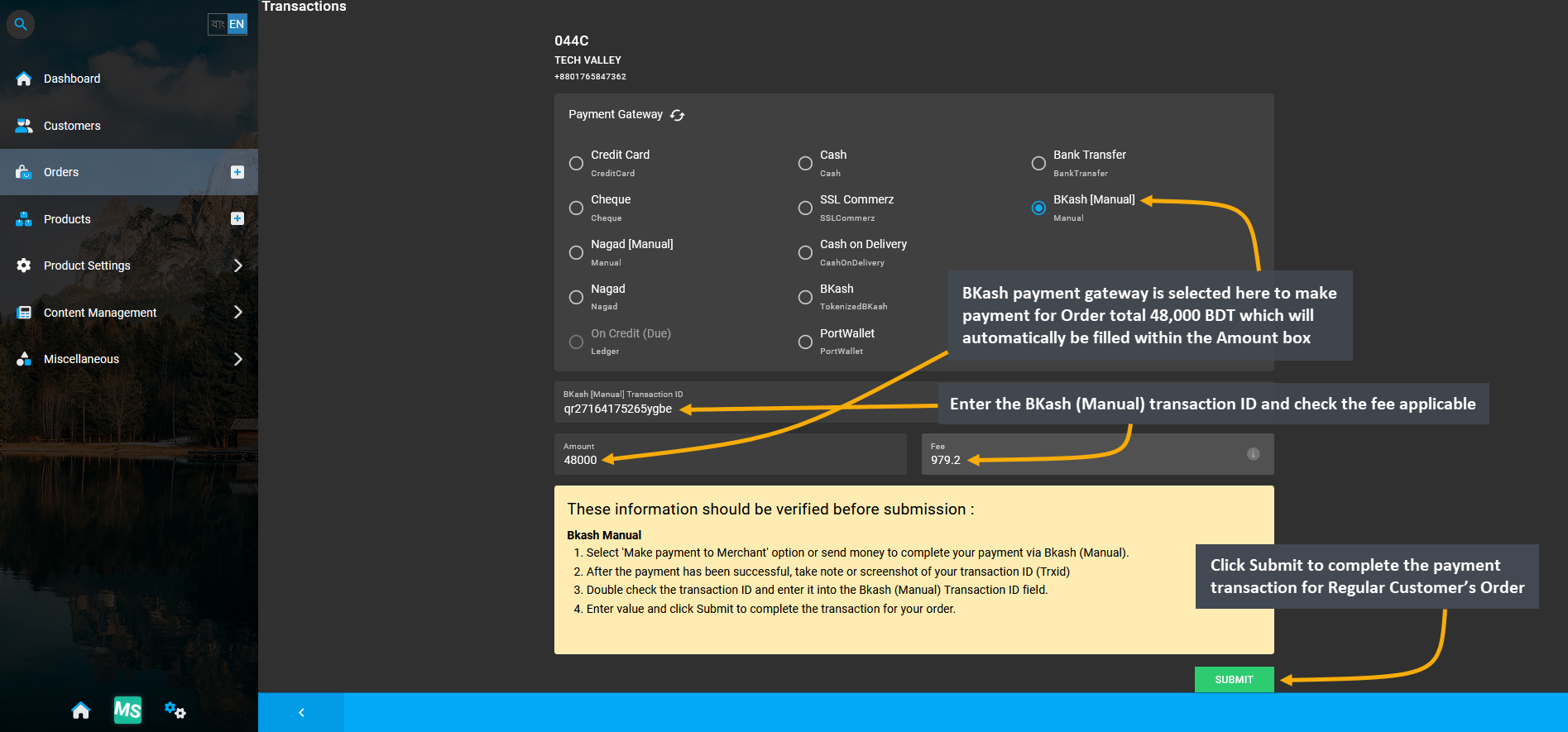

To resolve this Pending Order for Regular Customer, complete Order payment by selecting any Payment Gateway. As Regular Customer does not have any Credit Limit approved and allowed, they will not be able to make Order payment with On Credit (Due). For this reason, this option will be disabled on Payment Gateway selection.

Image 6: To resolve Pending Order for Regular Customer, complete payment by selecting a Payment Gateway.

BKash (Manual) is selected here to make payment for Order total 48,000 BDT which will automatically be stated in the Amount box. Enter the BKash (Manual) Transaction ID and check the fee applied. Click Submit to complete the payment transaction for Regular Customer’s Order. Instructions for the selected Gateway will be shown below.

Image 7: BKash (Manual) payment gateway is selected here to make payment for Order total 48,000 BDT here.

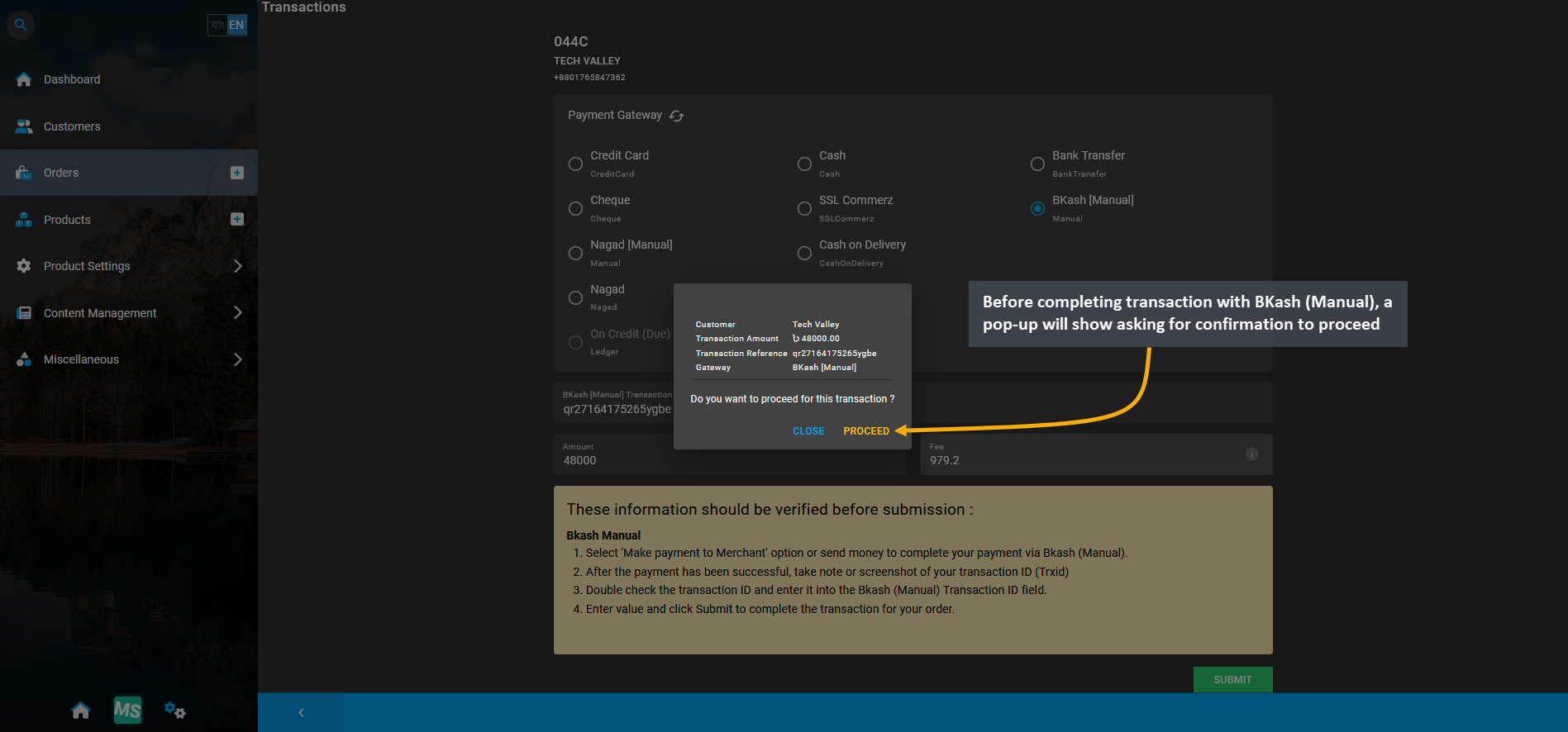

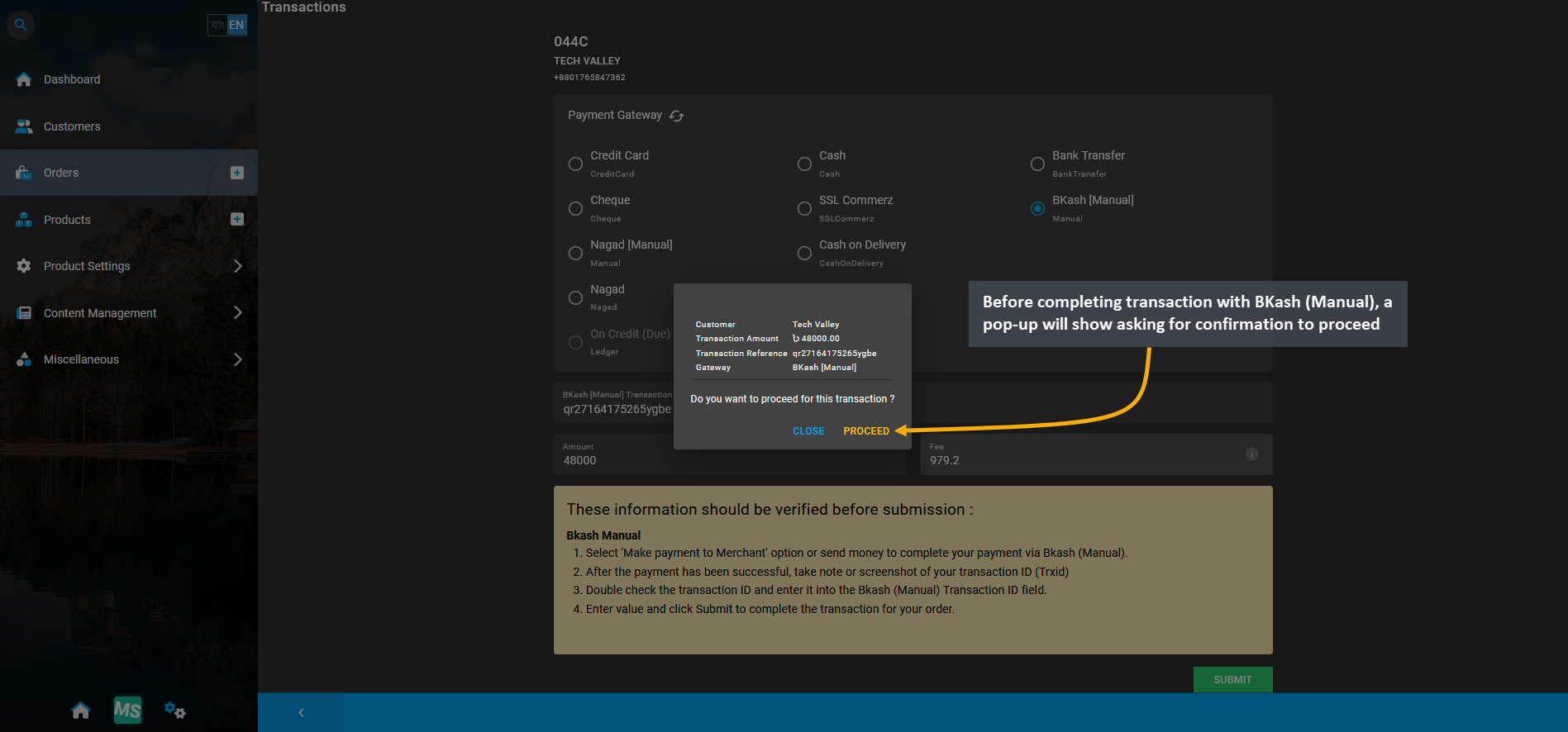

Before completing the remaining payment of 48,000 BDT with BKash (Manual), a pop-up will ask for confirmation to proceed with the transaction. Click the Proceed button to confirm payment with BKash (Manual).

Image 8: Before completing transaction with BKash (Manual), a pop-up will ask for confirmation to proceed.

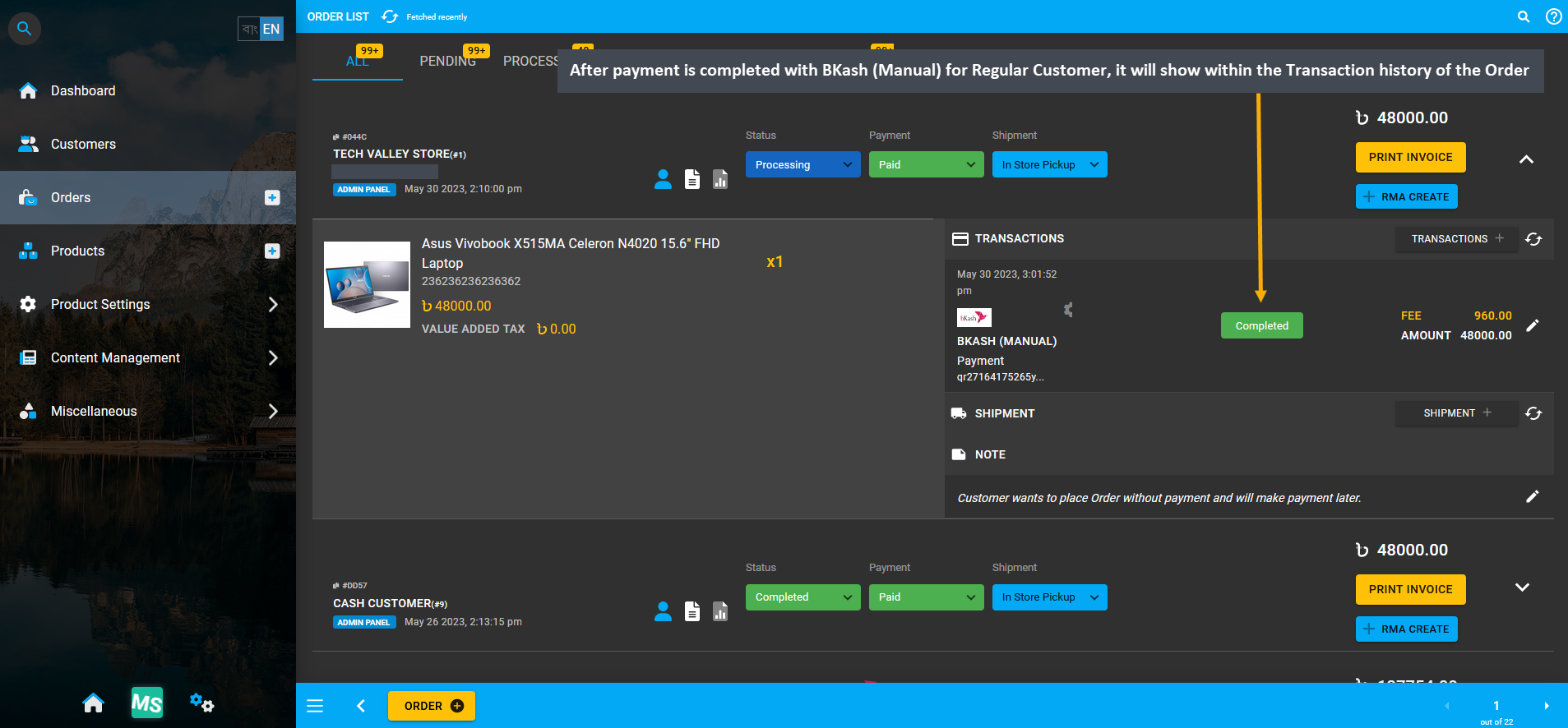

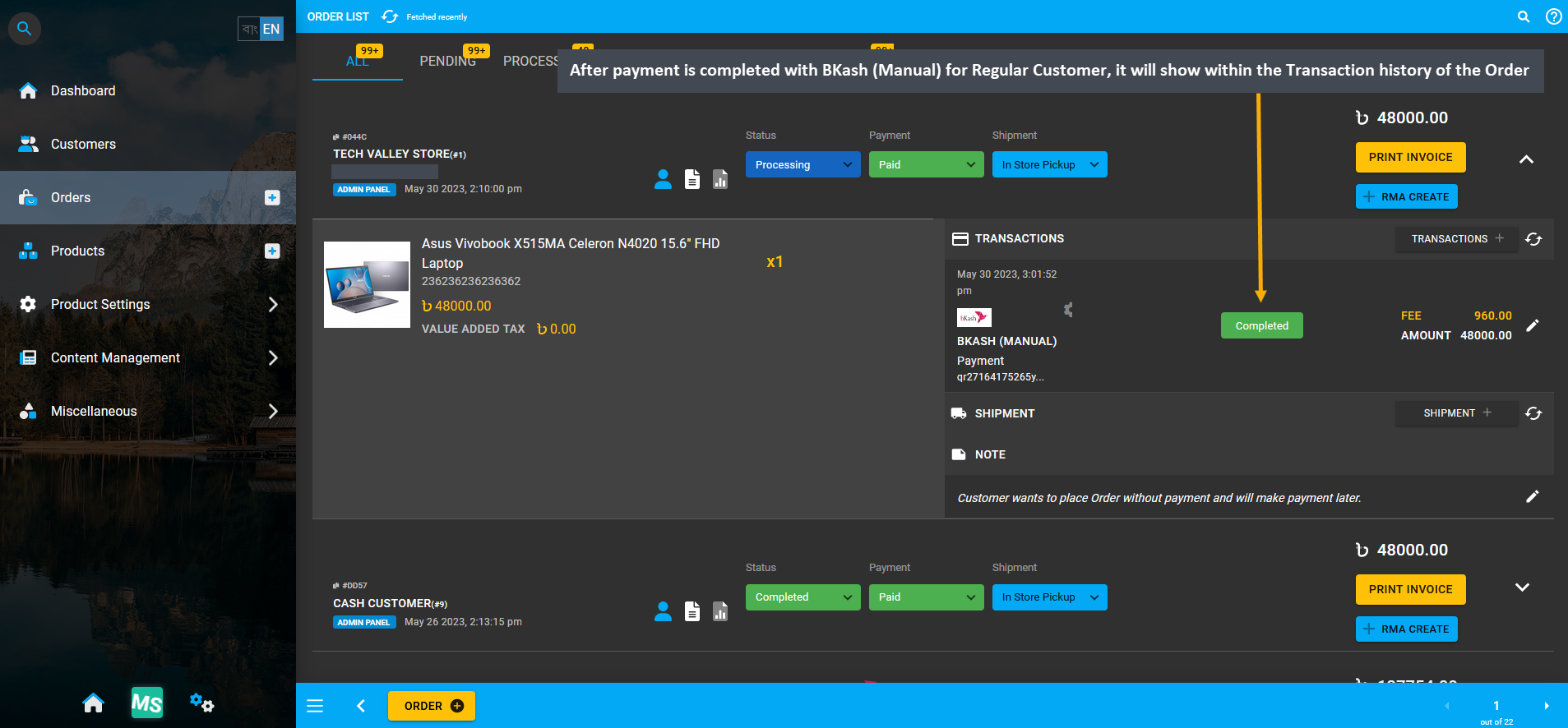

After payment is completed with BKash (Manual) for Regular Customer, it will show within the Transactions history of the Order. As 48,000 BDT was paid with BKash (Manual), the transaction status will show as Completed with no Fee Amount for Cash payment. This is how Order payment can be completed with gateways for Regular Customer.

Image 9: As 48,000 BDT was paid with BKash (Manual), its status will show as Completed under Transactions.

3 - Credit Customer Transaction Flow

Functionality of Credit Customer’s Transaction Modals on Cart and Order Page.

Credit Customer Transaction Flow

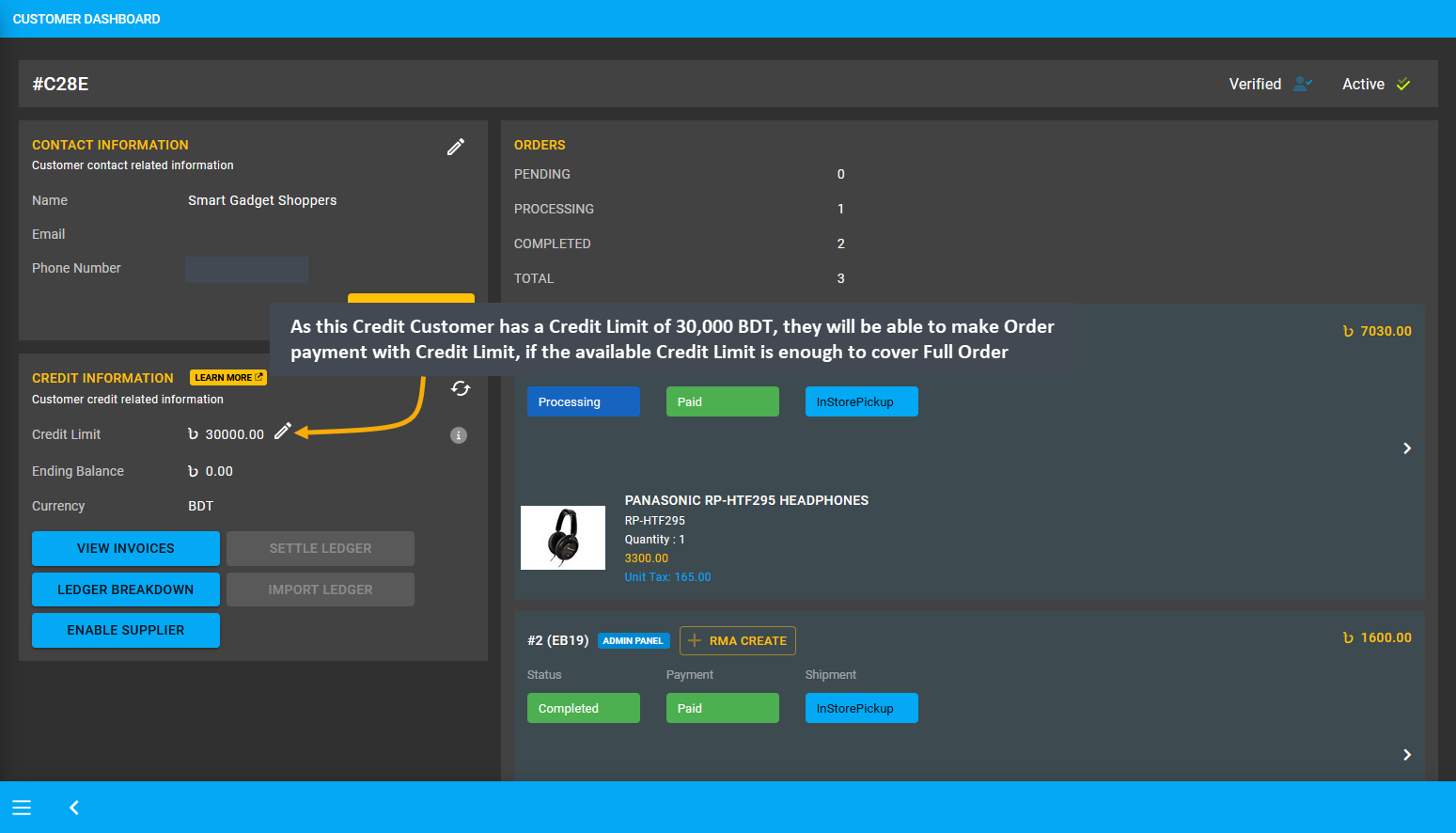

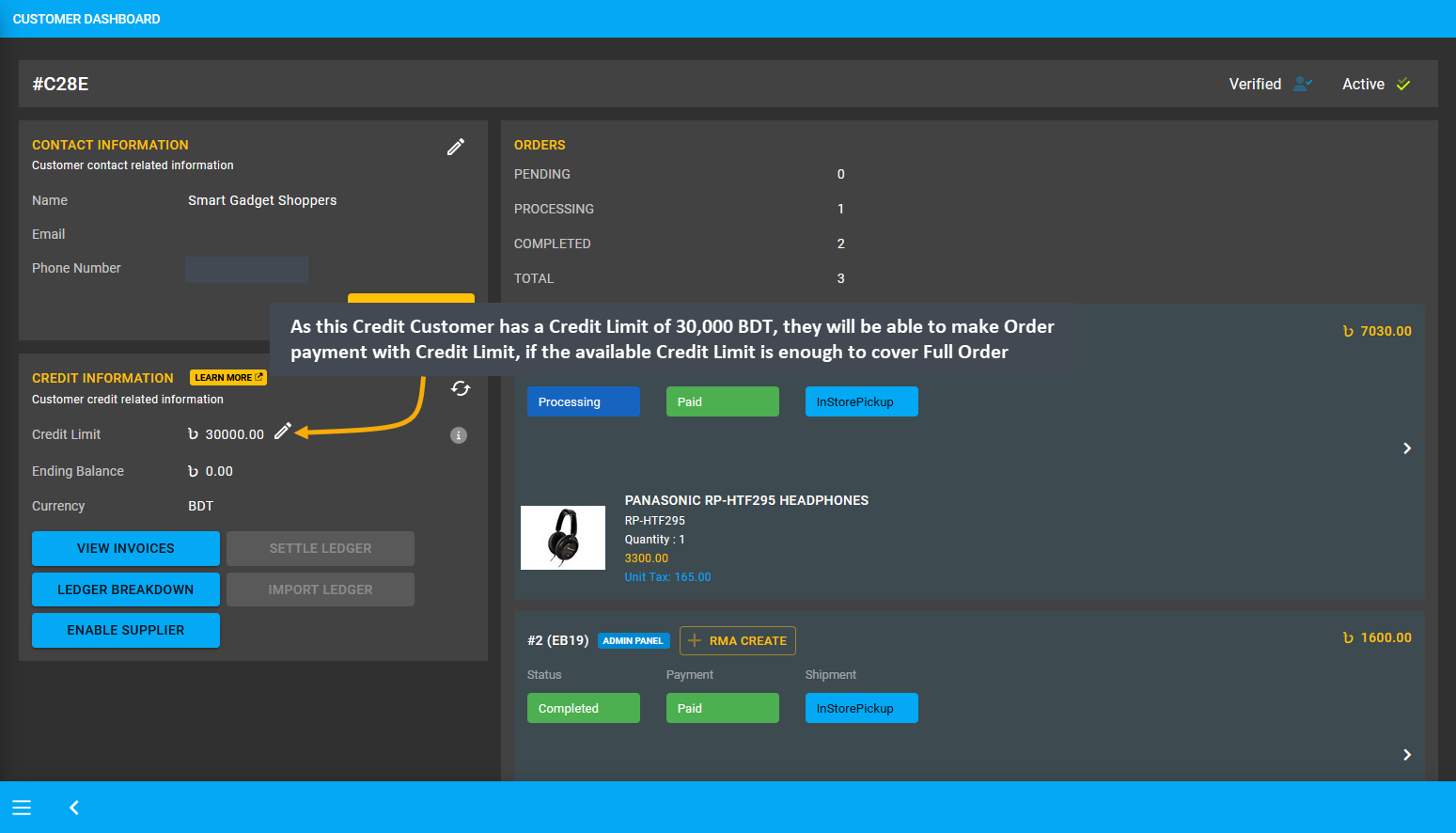

Credit Limit available to cover Full Order Payment

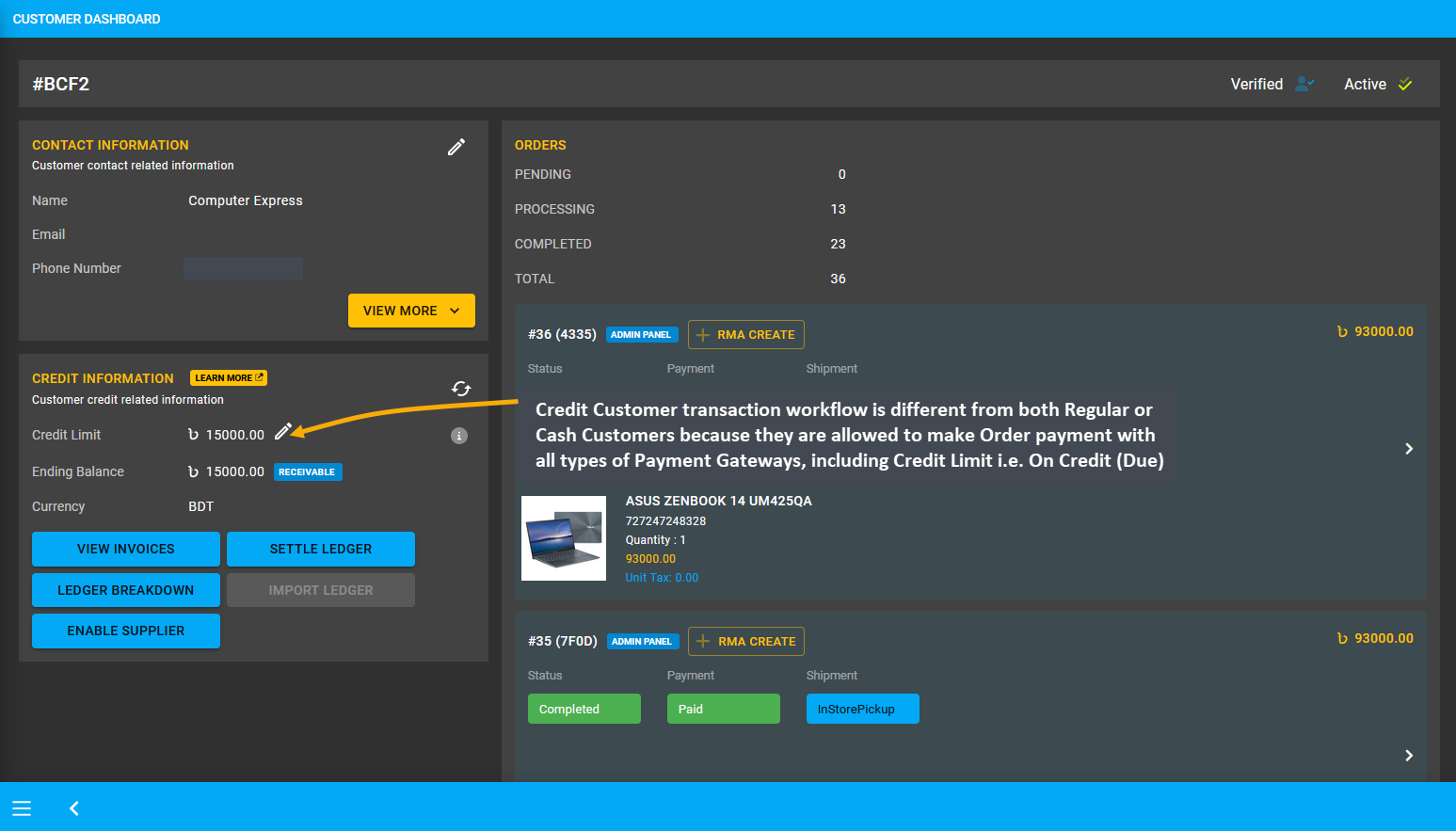

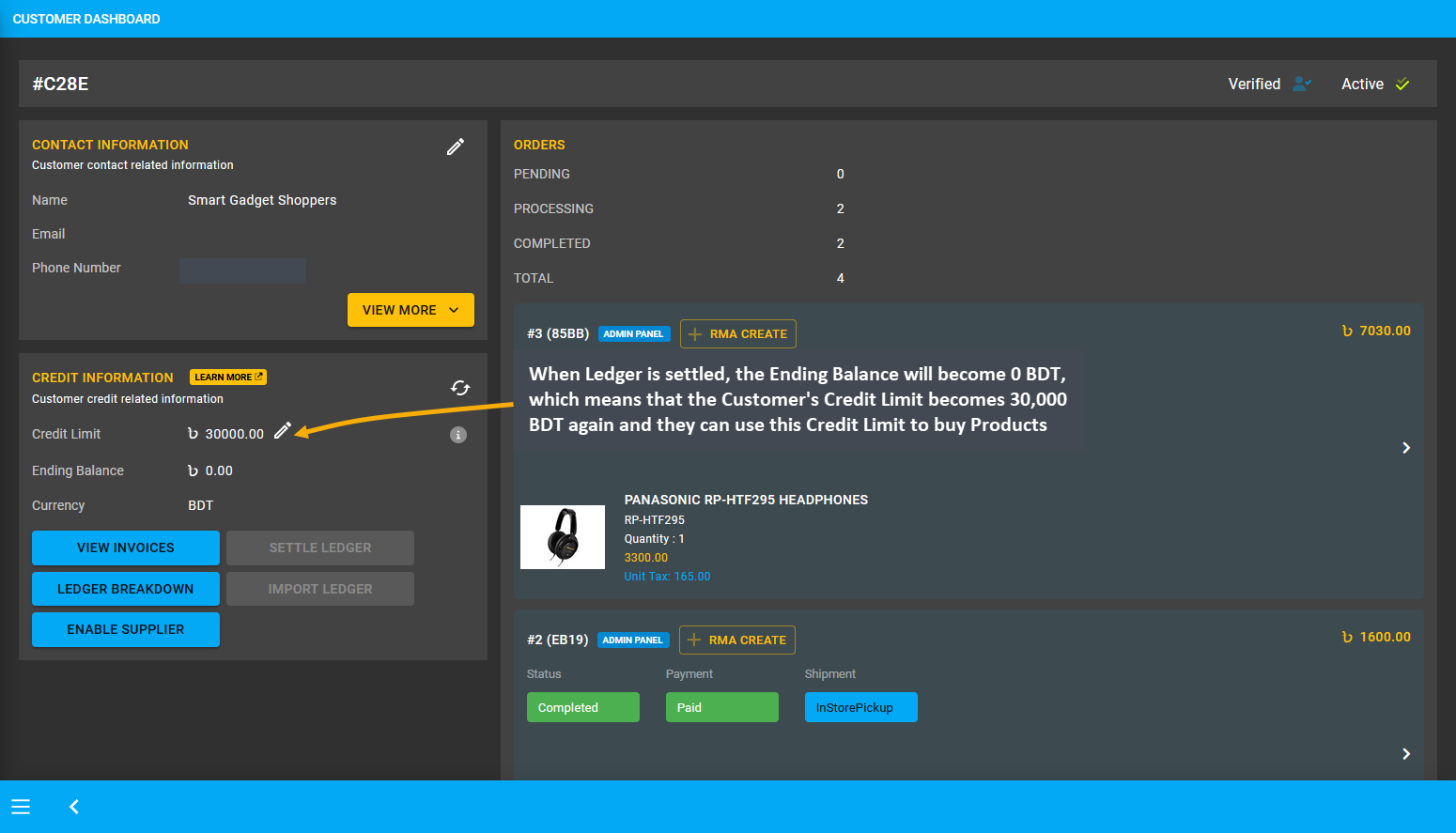

Credit Customer transaction workflow is different from both Regular or Cash Customers because they are allowed to make Order payment with all types of gateways, including Credit Limit i.e. On Credit (Due) payment gateway. So, as this Credit Customer has a Credit Limit of 30,000 BDT, they will be able to make Order payment with Credit Limit, if the available Credit Limit is enough to cover Full Order Payment. Their Credit Limit can cover this Order payment.

Image 1: Credit Customer can pay for Order with Credit Limit, if it is enough to cover full Order Payment.

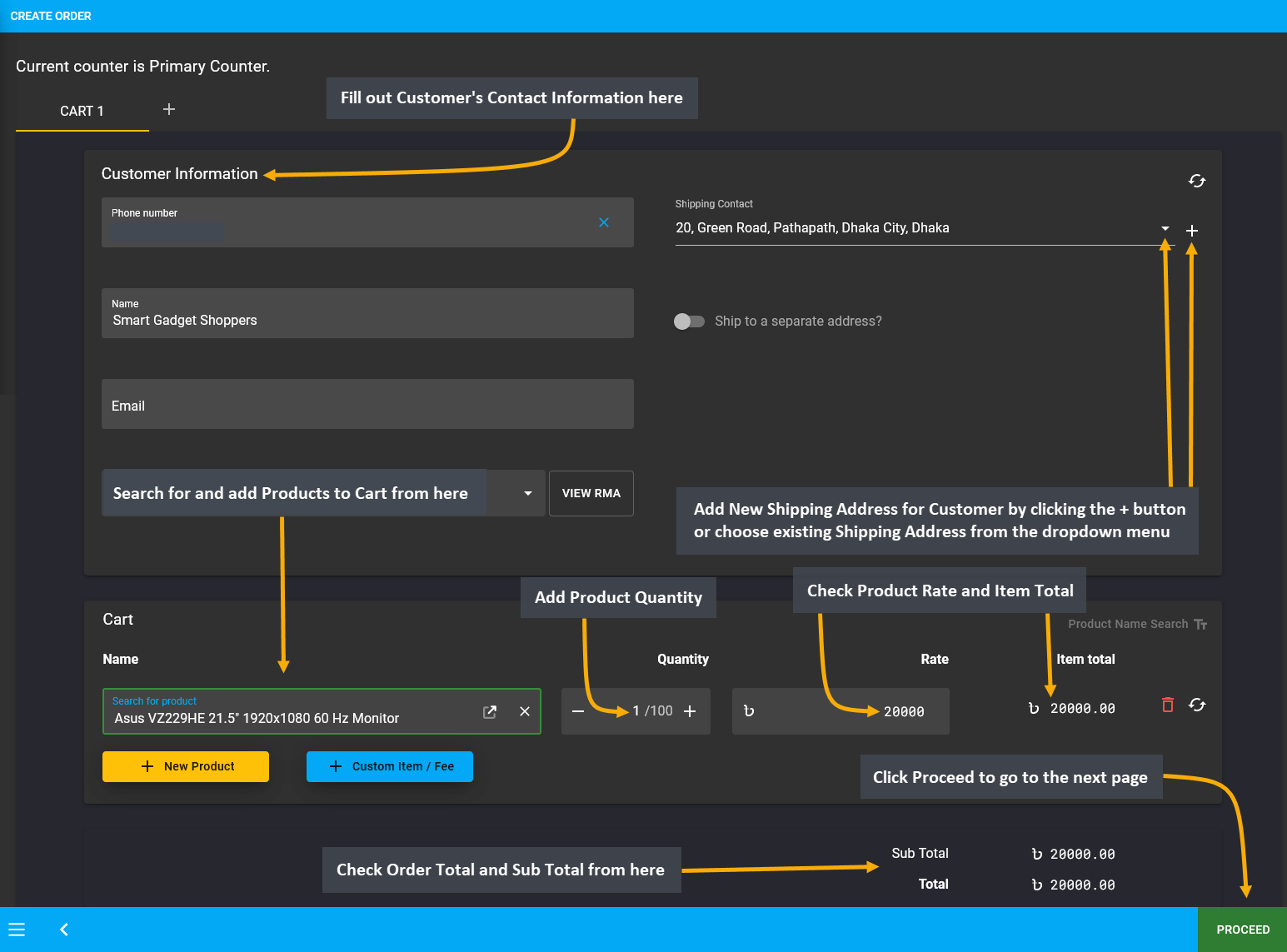

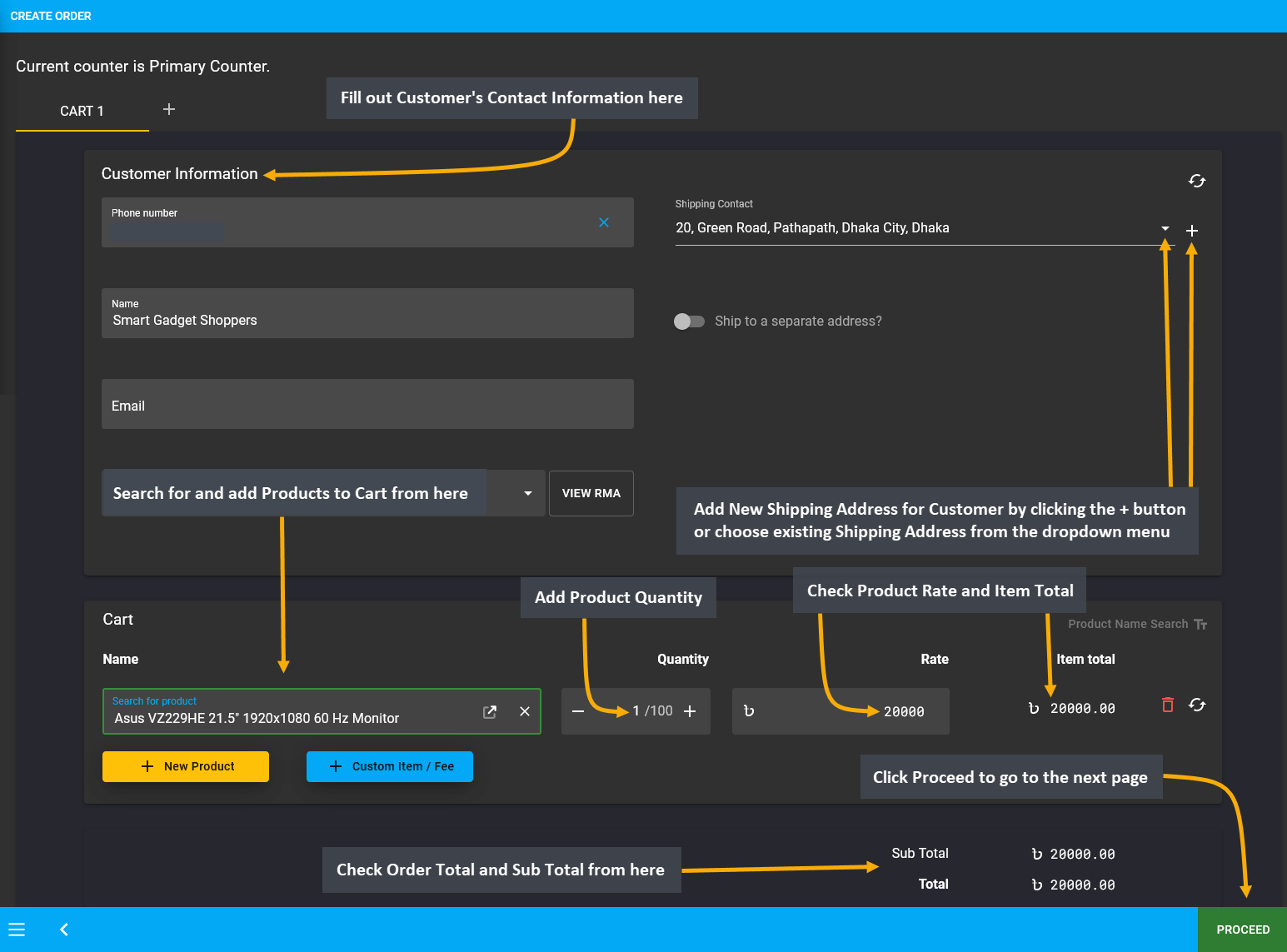

To place an Order and make payment with Credit Limit, start by filling the basic Customer Information and Shipping Address. Search for and add Products to Cart from the dropdown. Check Product quantity, rate, item total, Order total, and subtotal. Click the Proceed button to select payment and shipping options on the next page.

Image 2: Create Order Cart by adding Product and checking Product quantity, Order total, and subtotal.

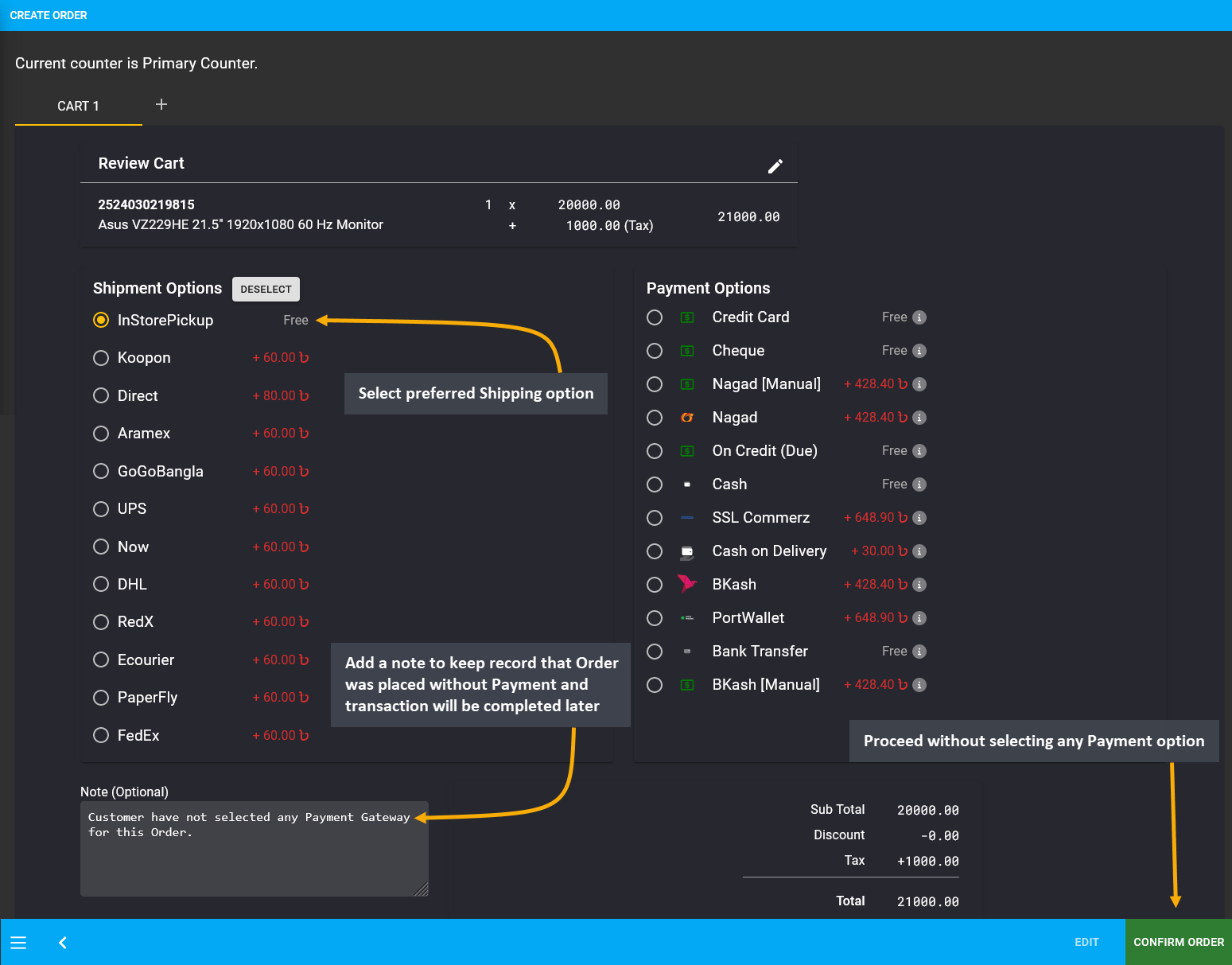

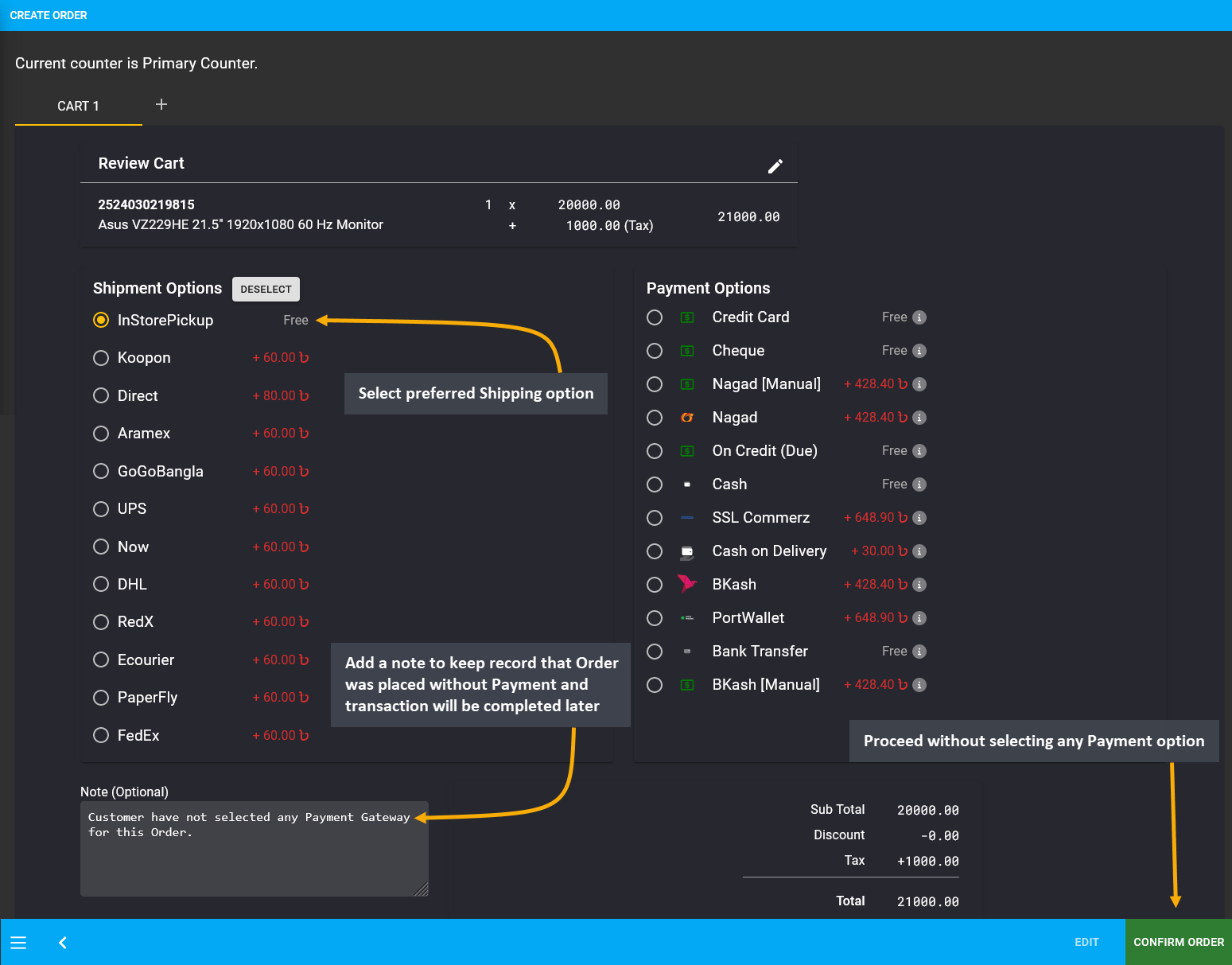

If the Credit Customer wants to place Order without payment, then they have to complete Order without selecting any payment option. Here, In Store Pickup was selected as shipment option without selecting any payment option. Add a Note to keep record that Order was placed without Payment and transaction will be completed later. Thus, proceed without selecting any payment option and click the Confirm Order button to proceed to the next step.

Image 3: Credit Customer can proceed without selecting payment option to complete Order without payment.

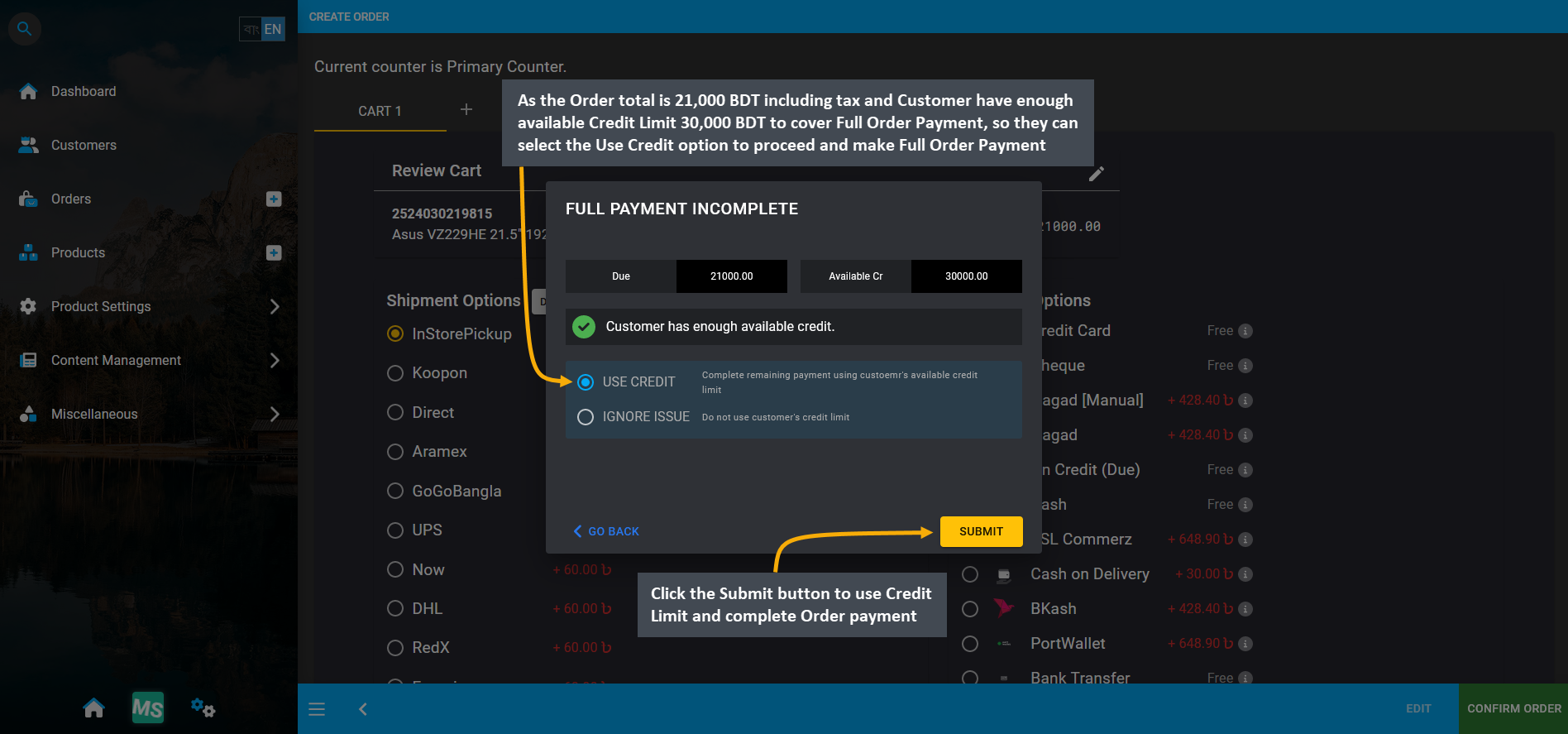

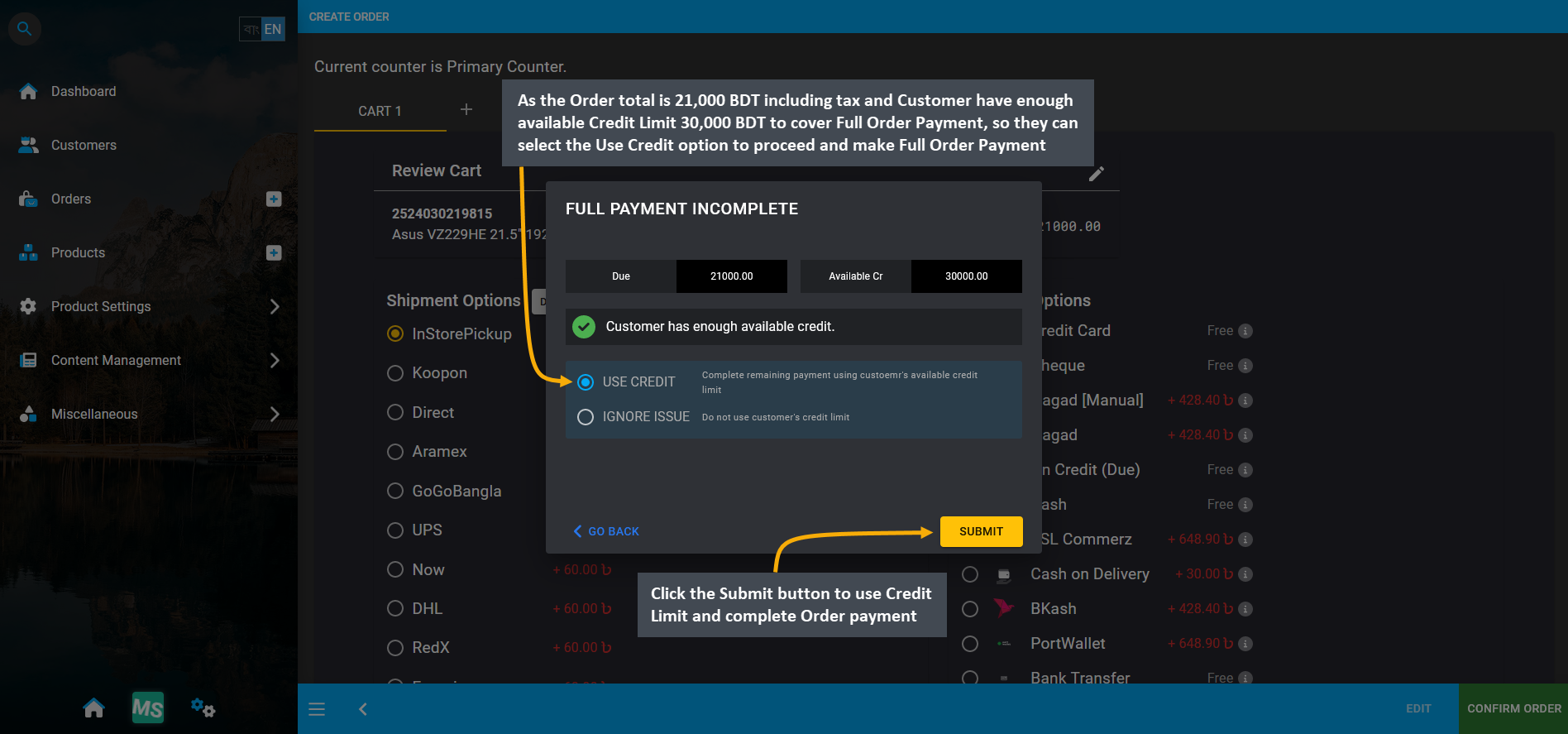

As Credit Customer proceeded to place Order without payment, a pop-up of Full Payment Incomplete will show and inform that Customer has available Credit Limit which they can use to complete Order payment or they can ignore to use Credit Limit and complete Order payment later. The Order total is 21,000 BDT and Customer have available Credit Limit 30,000 BDT to cover Full Order Payment, so they can select Use Credit to proceed and make full Order Payment. Therefore, click the Submit button to use the Credit Limit and complete Order payment.

Image 4: Customer have available Credit Limit to cover Full Order Payment, so select Use Credit option.

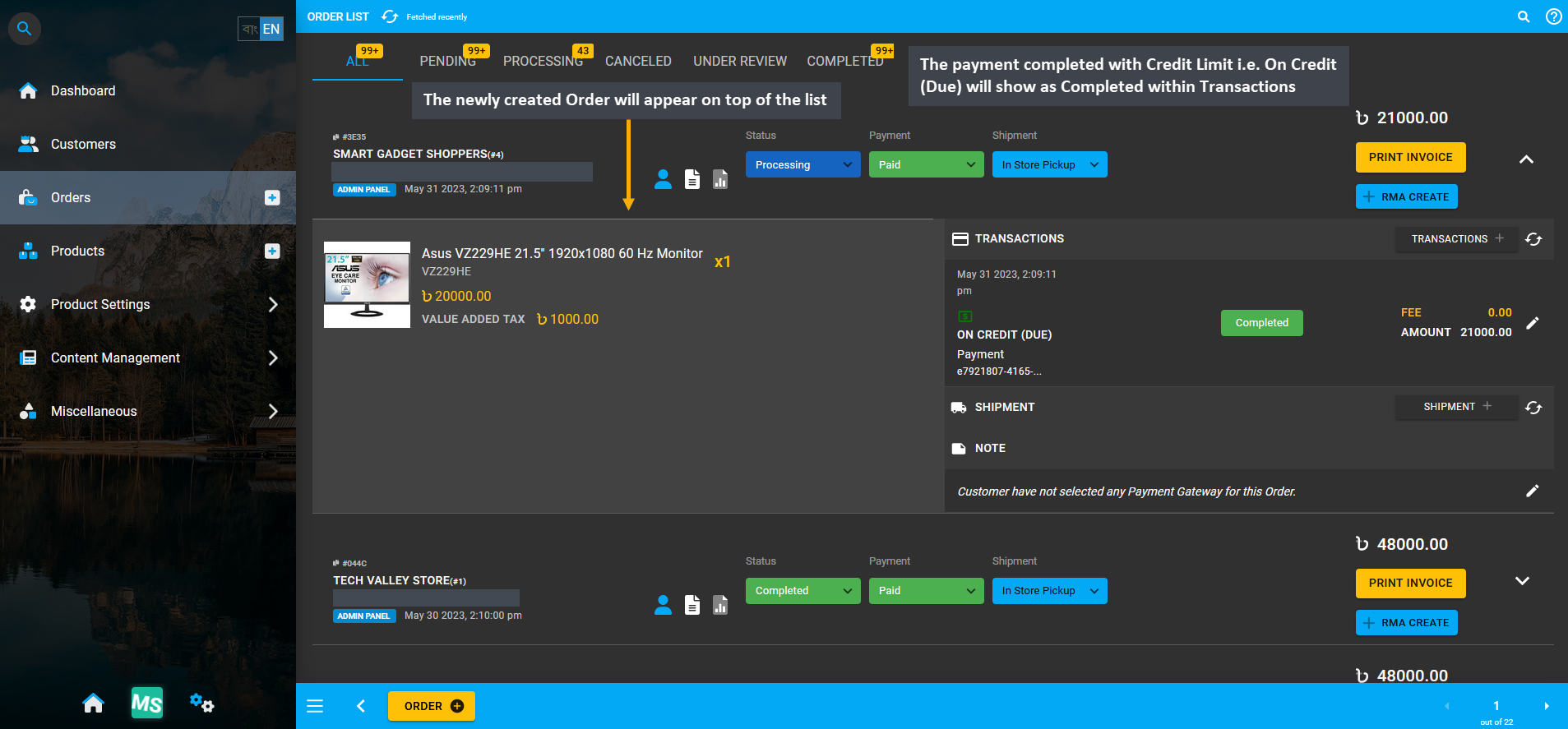

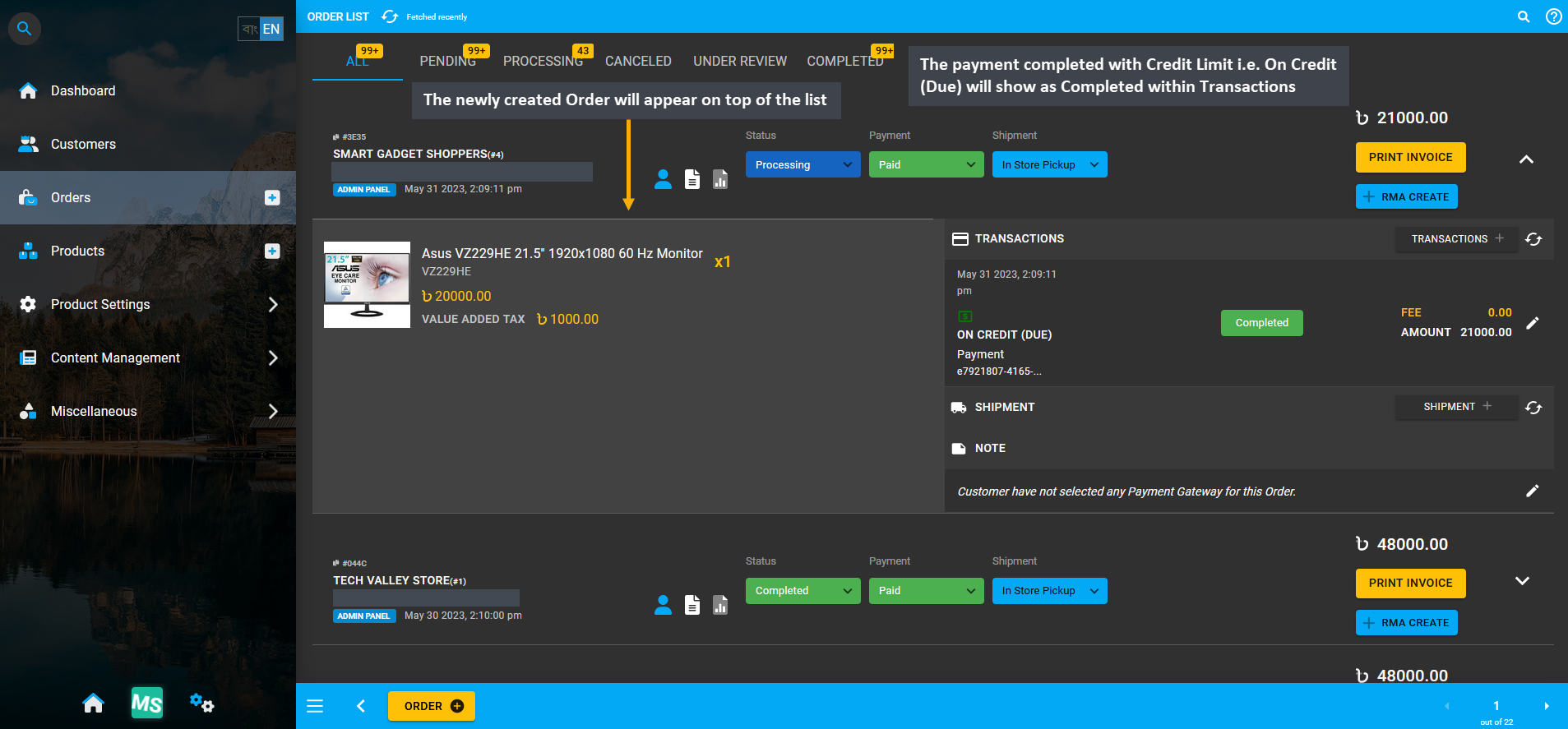

To check the payment details to this Order, go the the Orders Tab. The newly created Order will appear on top of the list. The payment completed with Credit Limit i.e. On Credit (Due) will show as Completed within Transactions.

Image 5: Payment completed with On Credit (Due) will show as Completed within Transactions on Order List.

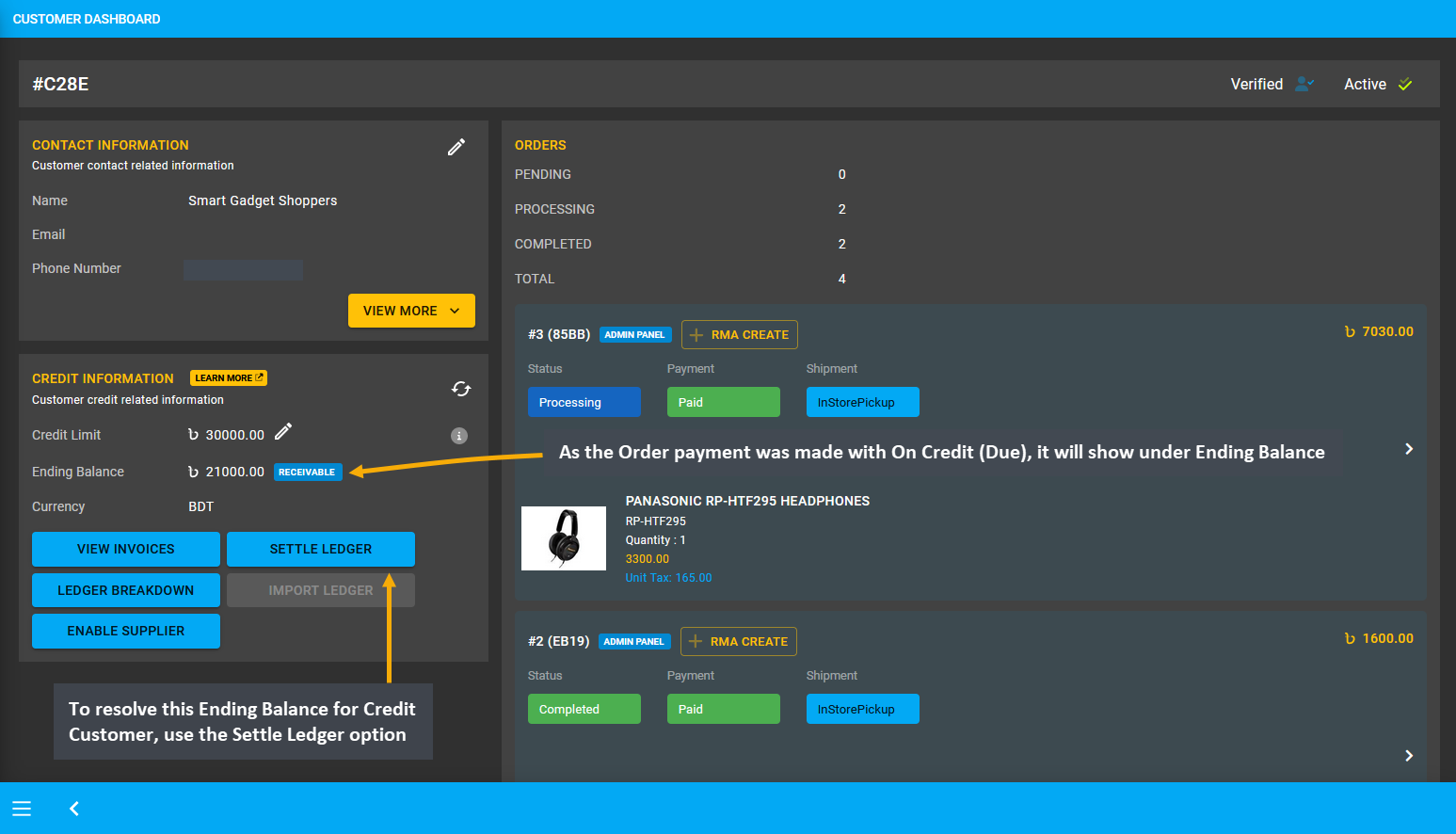

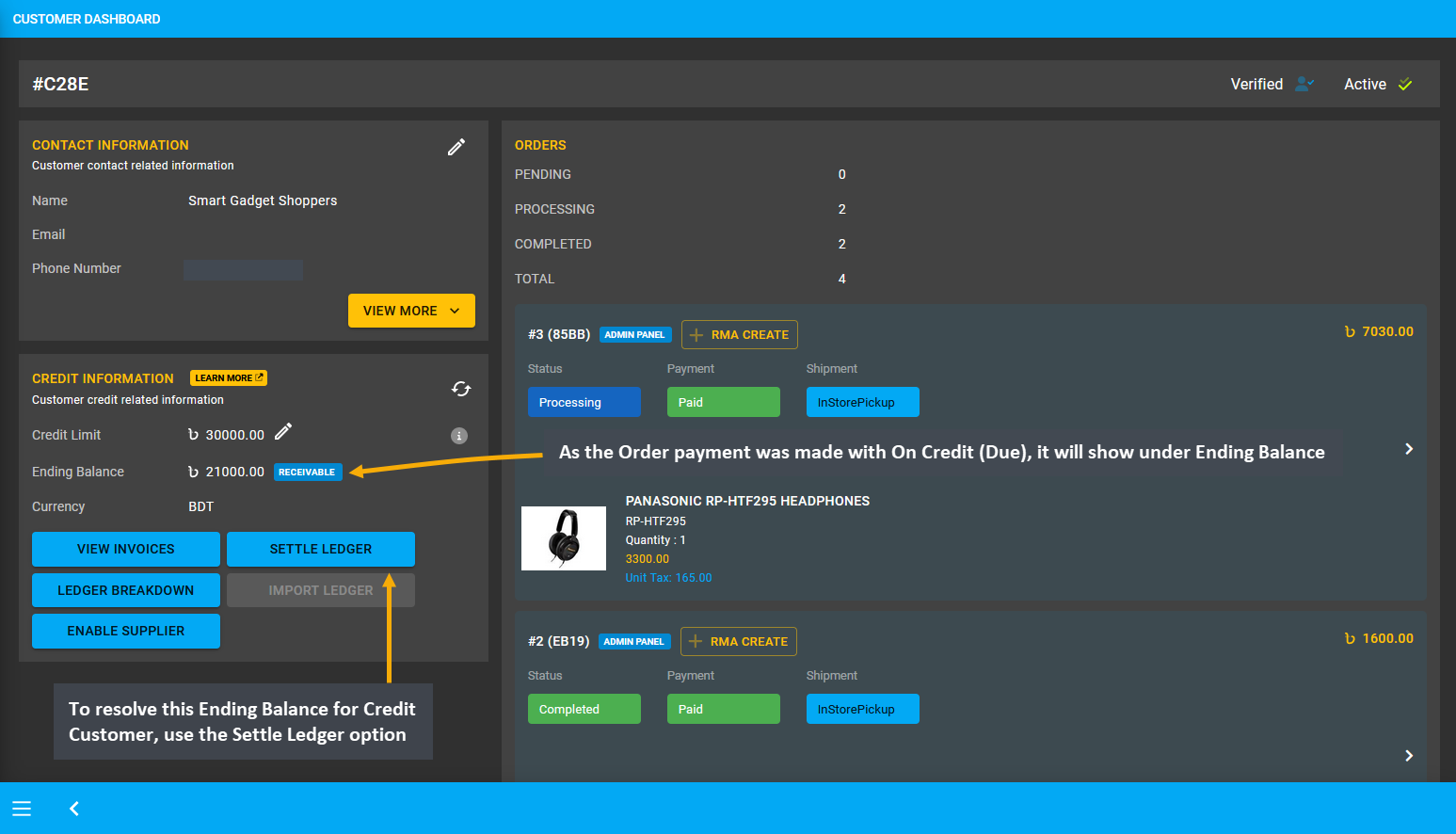

As the Order payment was made with On Credit (Due), it will show under Ending Balance within Credit Information on Customer Dashboard. To resolve this Ending Balance for Credit Customer, use the Settle Ledger option.

Image 6: To resolve Ending Balance for On Credit (Due), use Settle Ledger option from Credit Information.

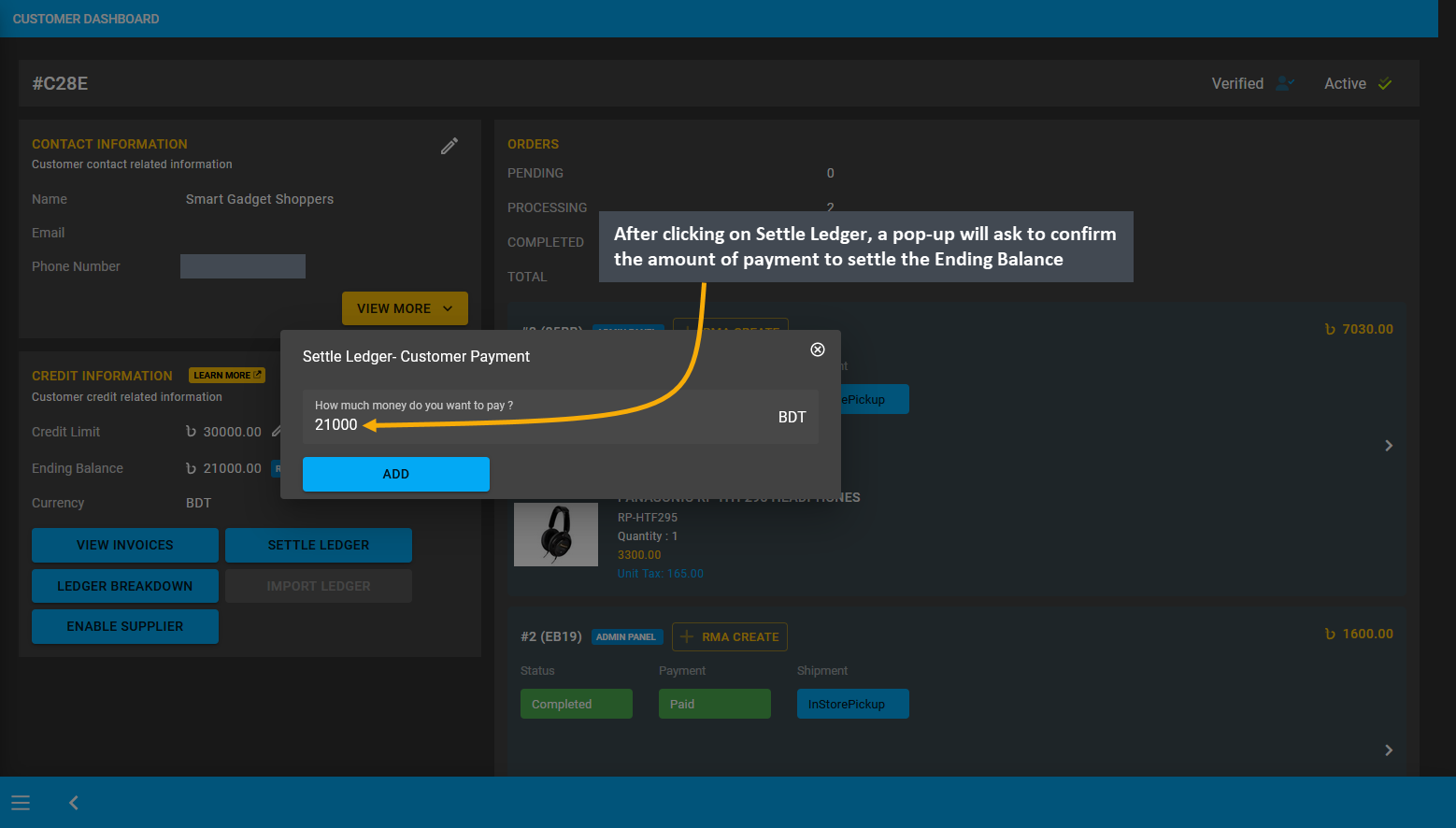

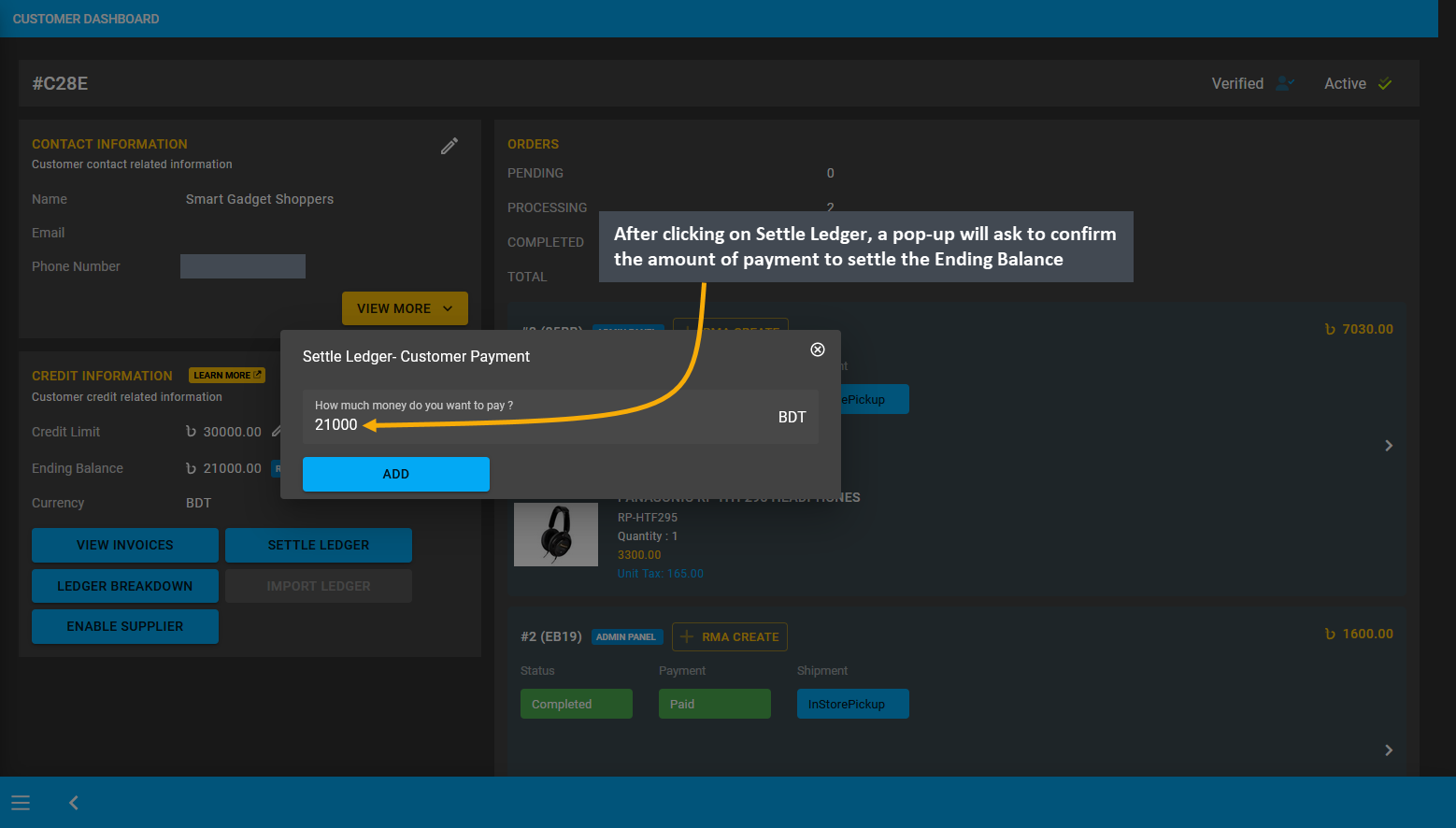

After clicking on Settle Ledger, a pop-up will ask to confirm the amount of payment to settle the Ending Balance.

Image 7: When Settling Ledger, confirm the amount of payment to proceed with to settle the Ending Balance.

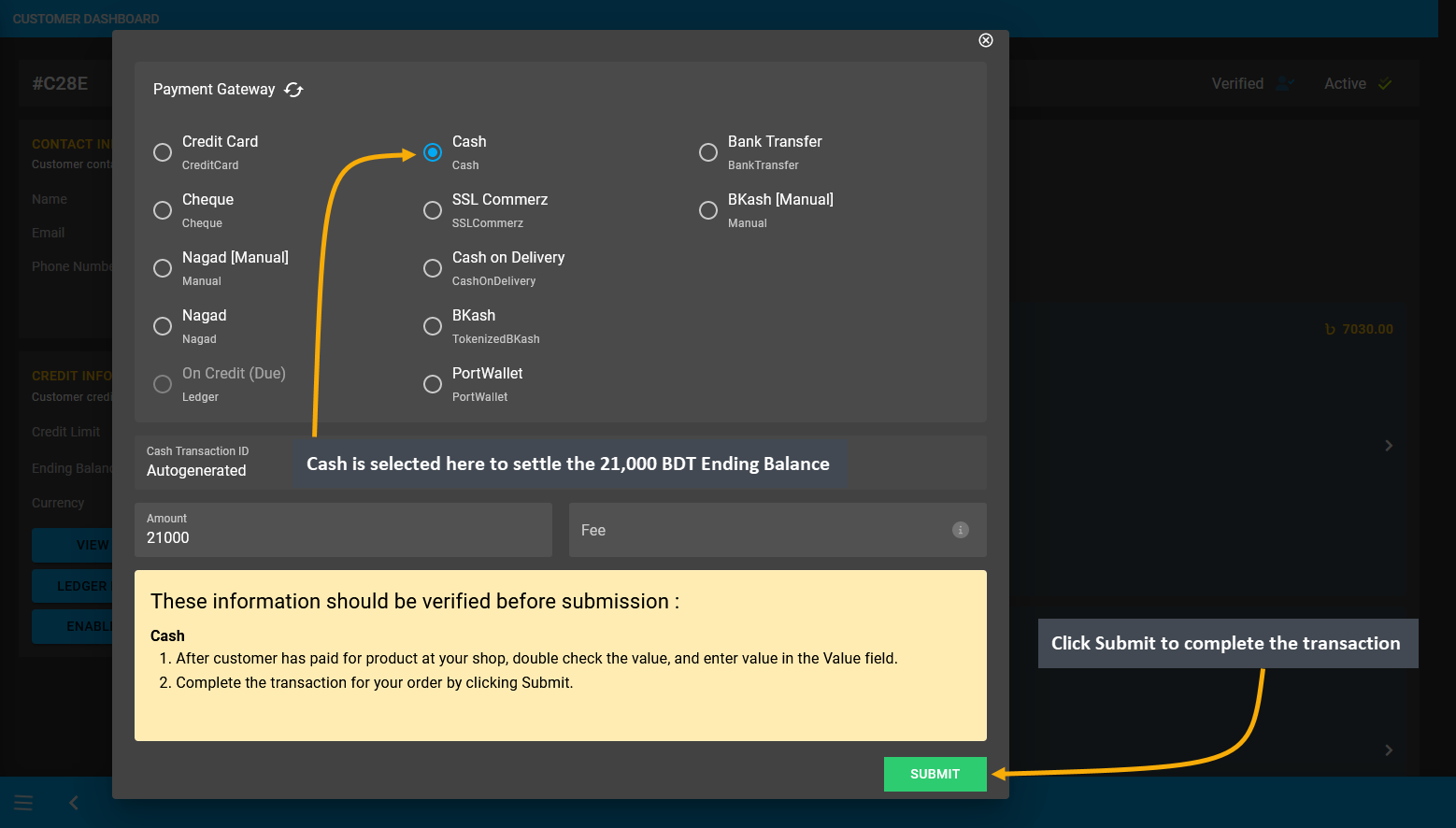

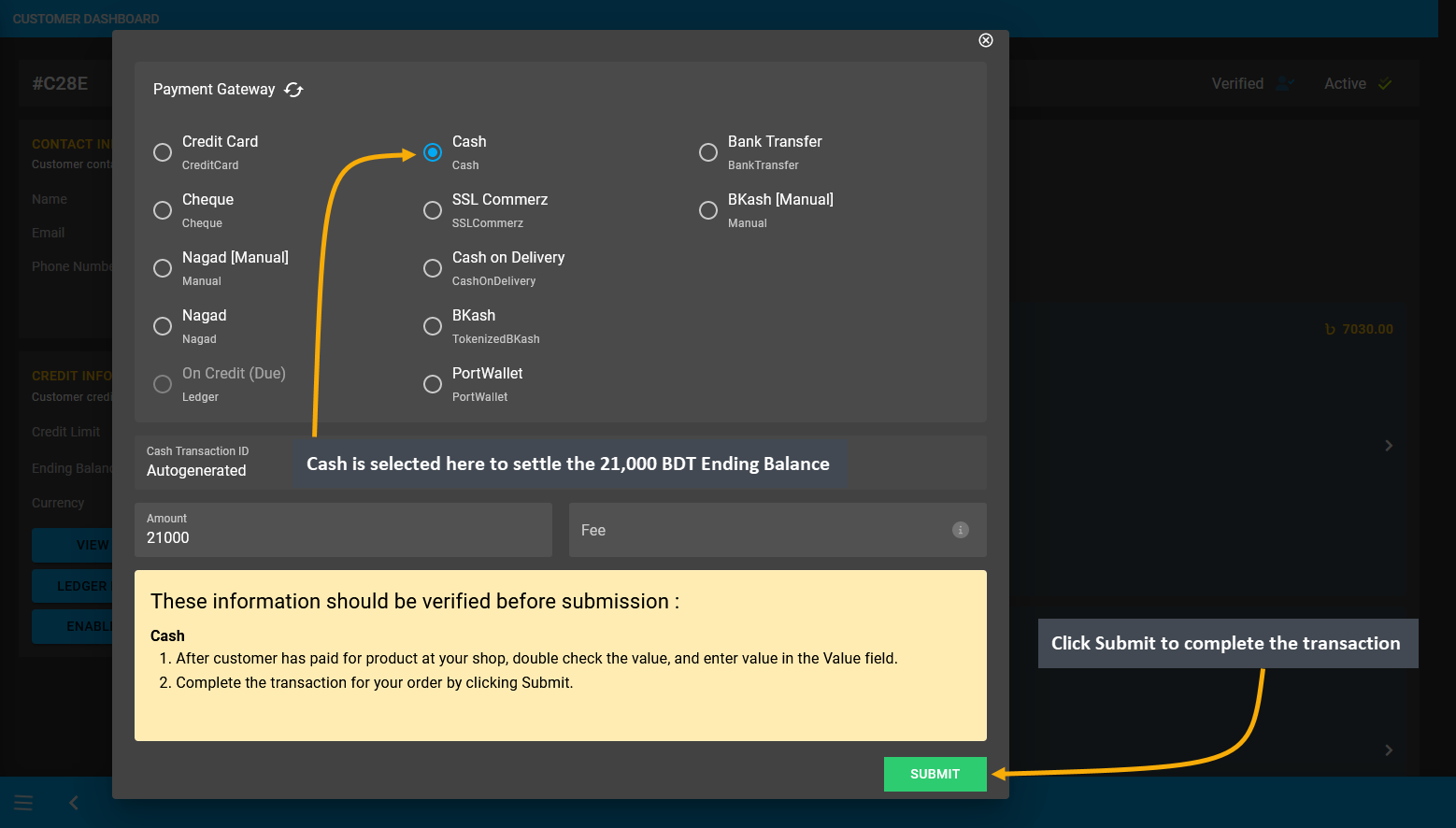

Select a Payment Gateway to settle the Ending Balance for Ledger. For instance, Cash is selected here to settle the 21,000 BDT Ending Balance. Other payment gateways can also be used. Click Submit to complete the transaction.

Image 8: Select a Payment Gateway to settle the Ending Balance and click Submit to complete transaction.

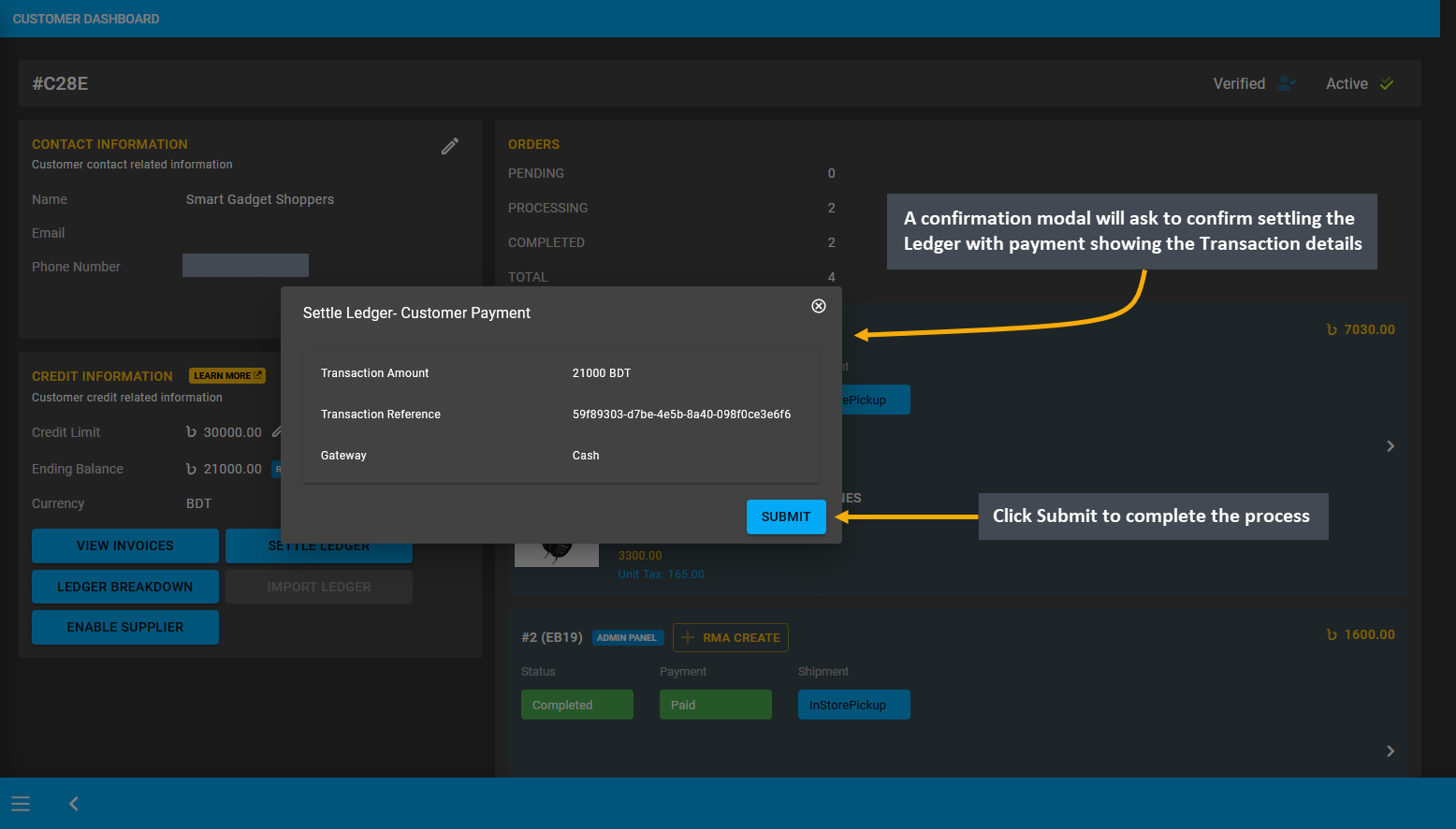

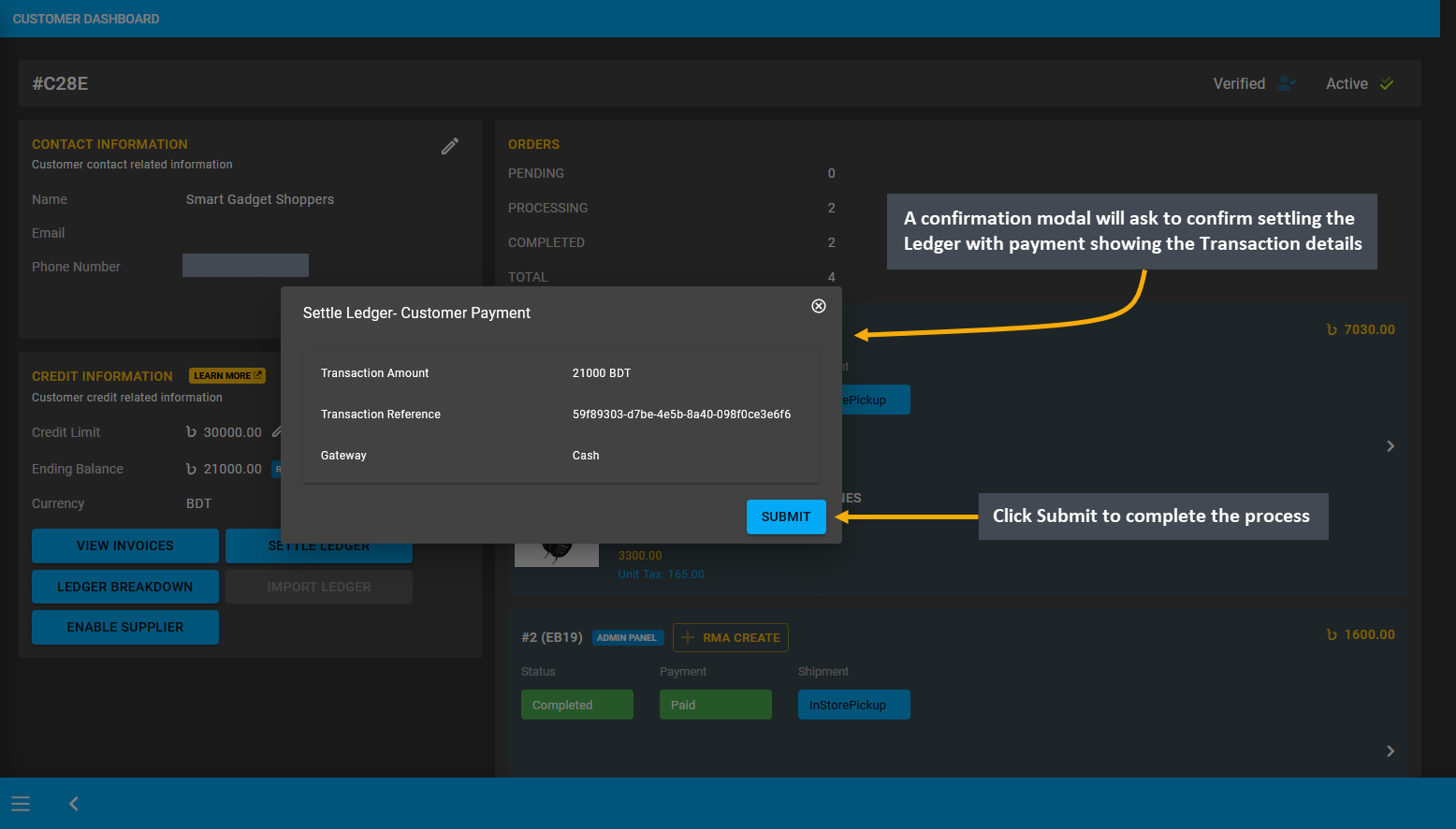

Before completing transaction, a pop-up will ask to confirm settling the Ledger with selected Payment Gateway showing the Transaction Amount and Reference. Click the Submit button to complete the process.

Image 9: Before confirming to Settle Ledger, the Transaction Amount, Reference, and Gateway will be shown.

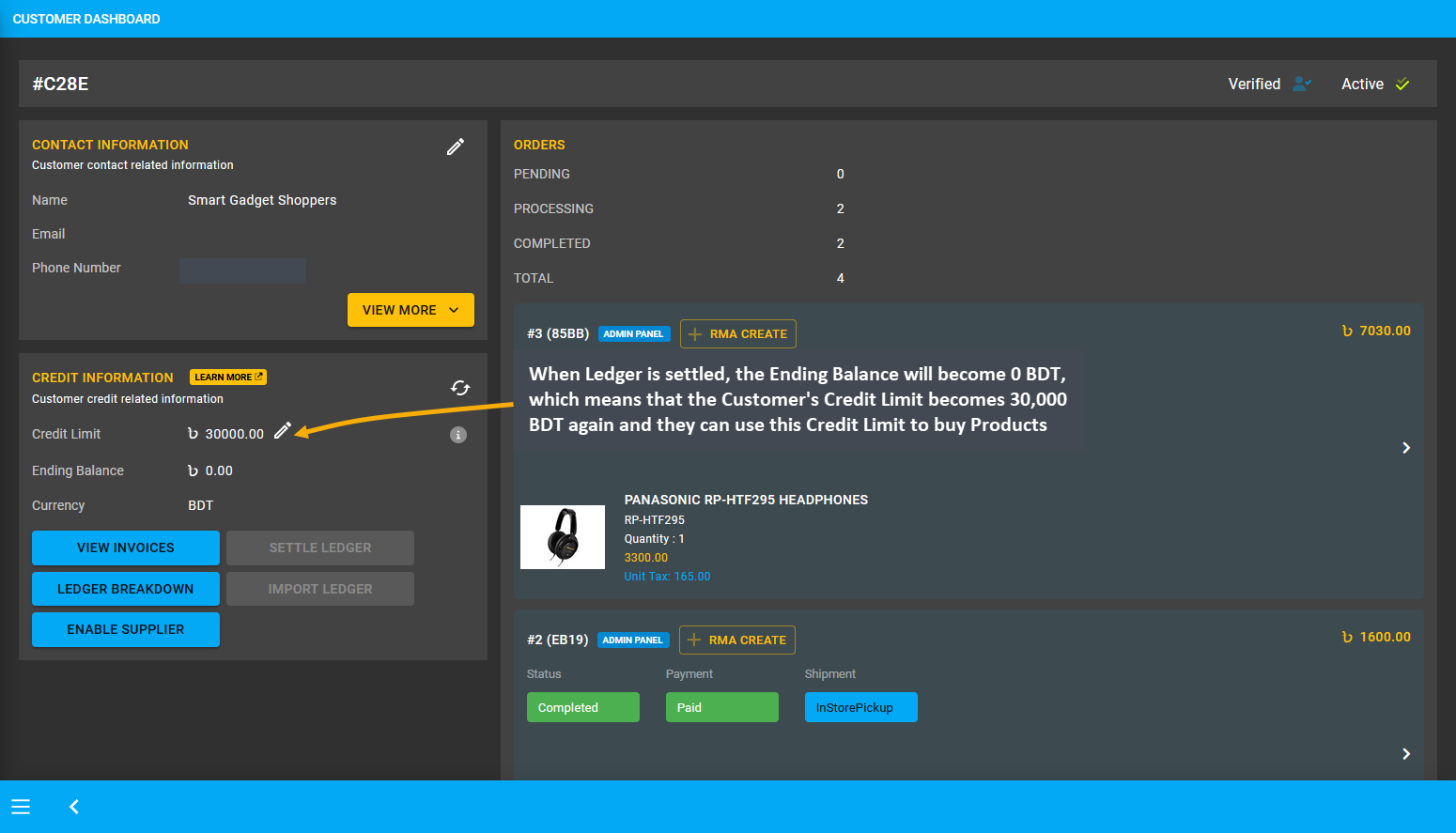

When Ledger is settled with Payment Gateway, the Ending Balance will become 0 BDT, which means Customer’s Credit Limit is restored to 30,000 BDT again. So, they will be able to make purchase with this Credit Limit again.

Image 10: When Ledger is settled, the Ending Balance will become 0 BDT and Credit Limit will be restored.

Credit Limit not available to cover Full Order Payment

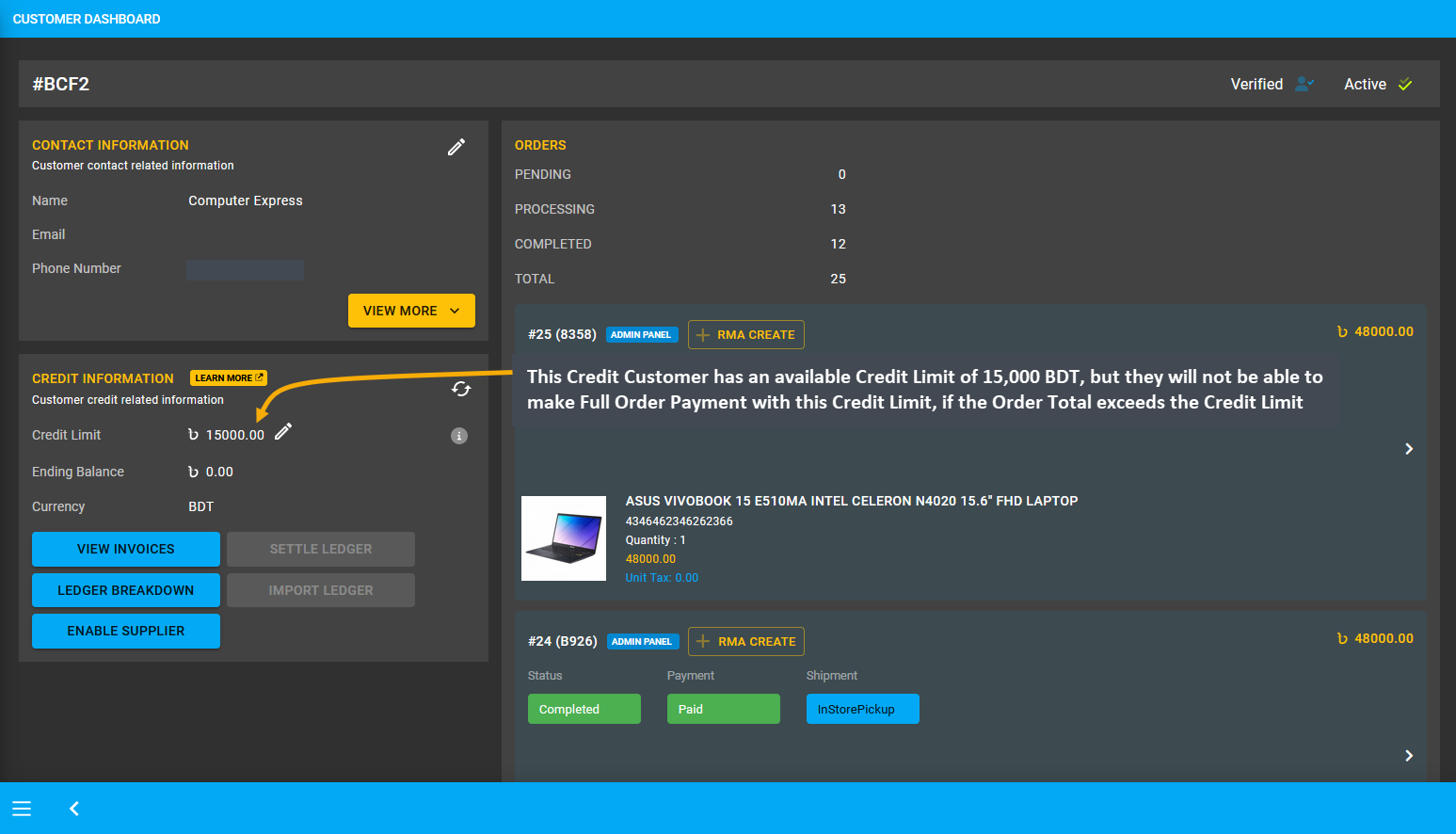

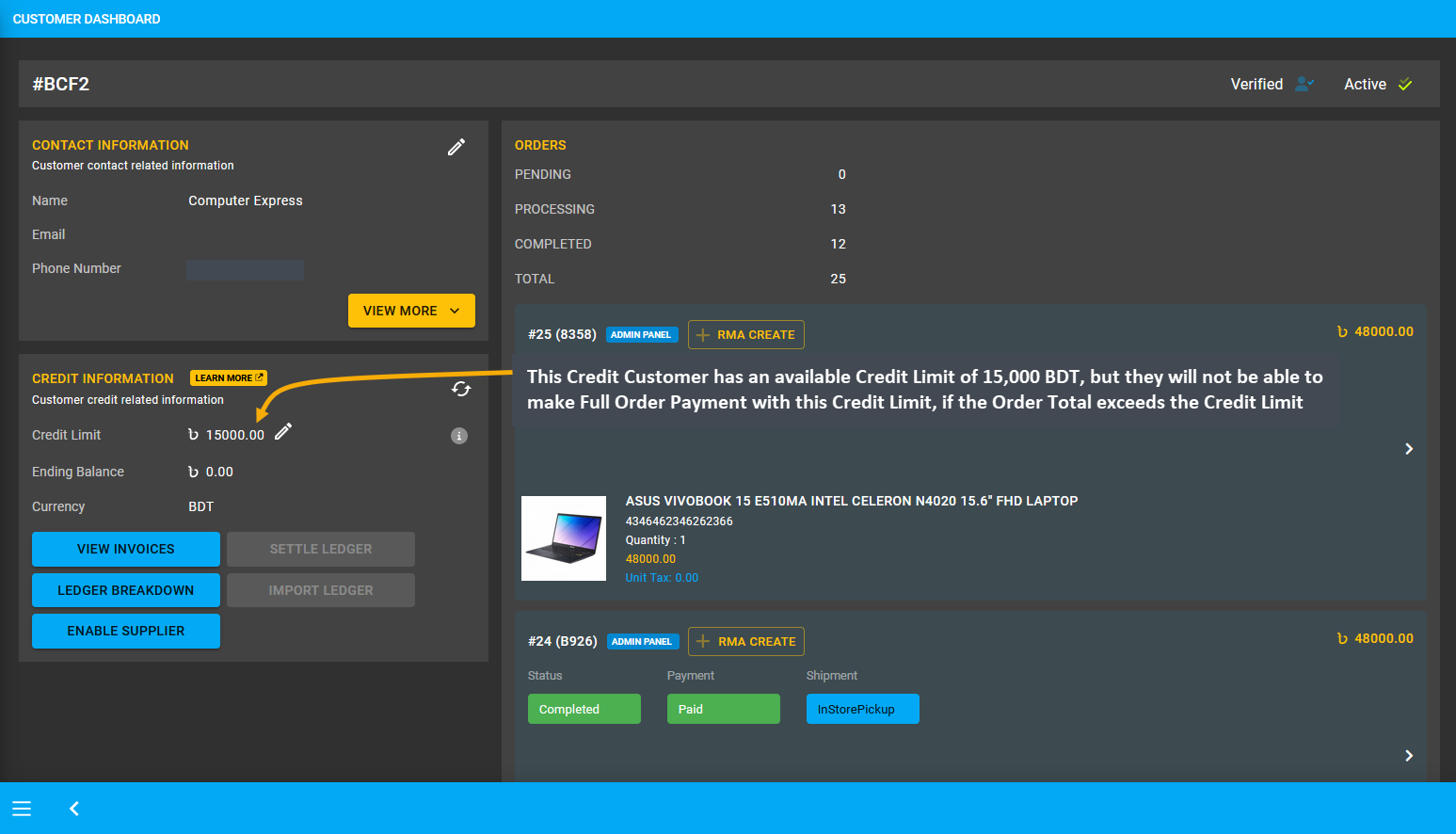

Despite having Credit Limit on their account, a Credit Customer may still not be able to use it for placing Order. So, they will not be able to make Order payment with Credit Limit, if the available Credit Limit is not enough to cover Full Order Payment. For instance, this Credit Customer has an available Credit Limit of 15,000 BDT. However, this Credit Limit may not be enough to cover a Full Order Payment that exceeds 15,000 BDT.

Image 11: Credit Customer cannot pay for Order with Credit Limit, if Order Total exceeds the Credit Limit.

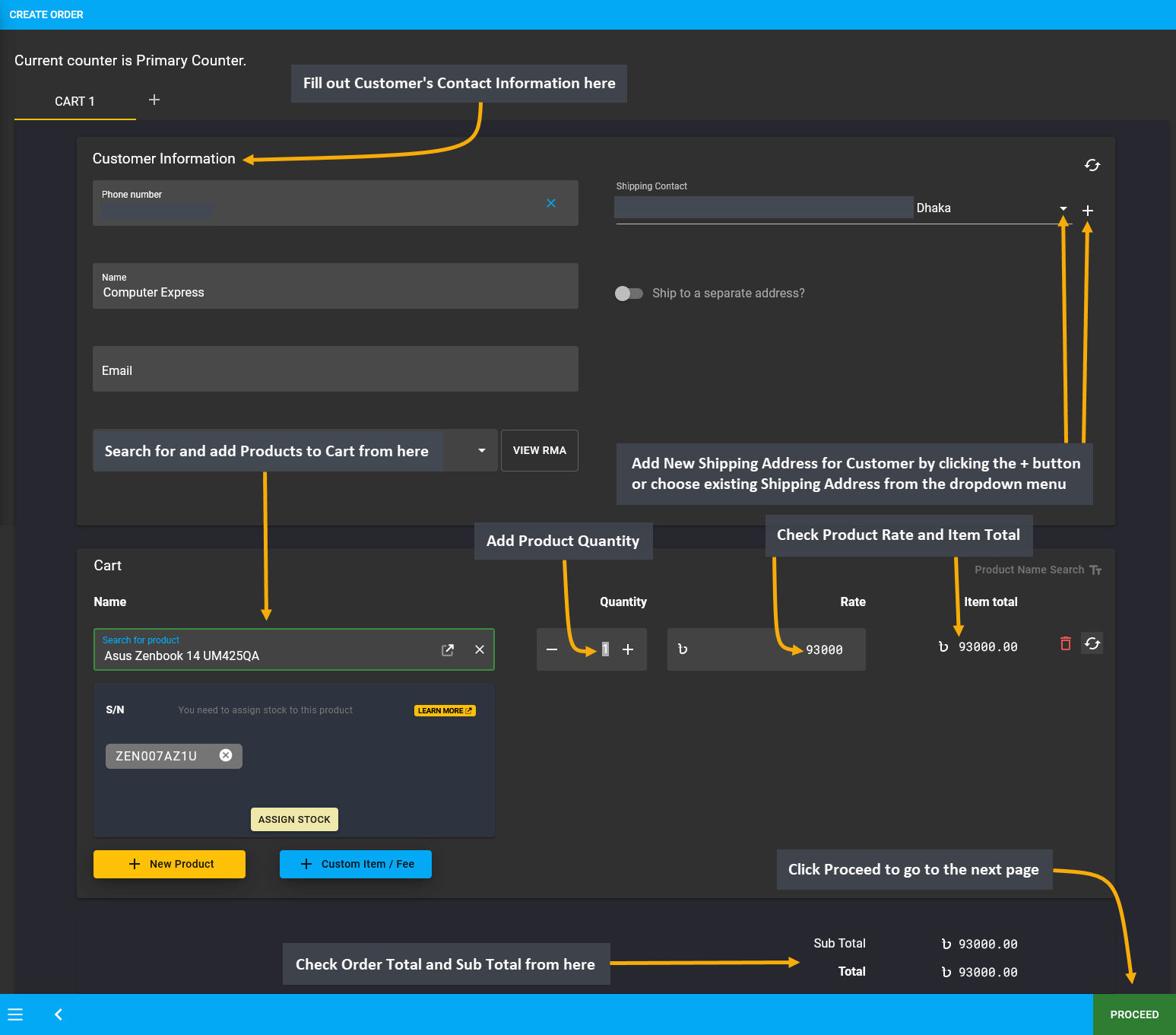

Therefore, an example Order will be placed with Order Total that exceeds the Credit Limit, to complete Full Order Payment with On Credit (Due). Start Order by filling basic Customer Information and Shipping Address. Then, search for and add Products to Cart from dropdown. Check Product quantity, rate, item total, Order total, and subtotal. Click the Proceed button to select payment and shipping options on the next page.

Image 12: Create Order Cart by adding Product and checking Product quantity, Order total, and subtotal.

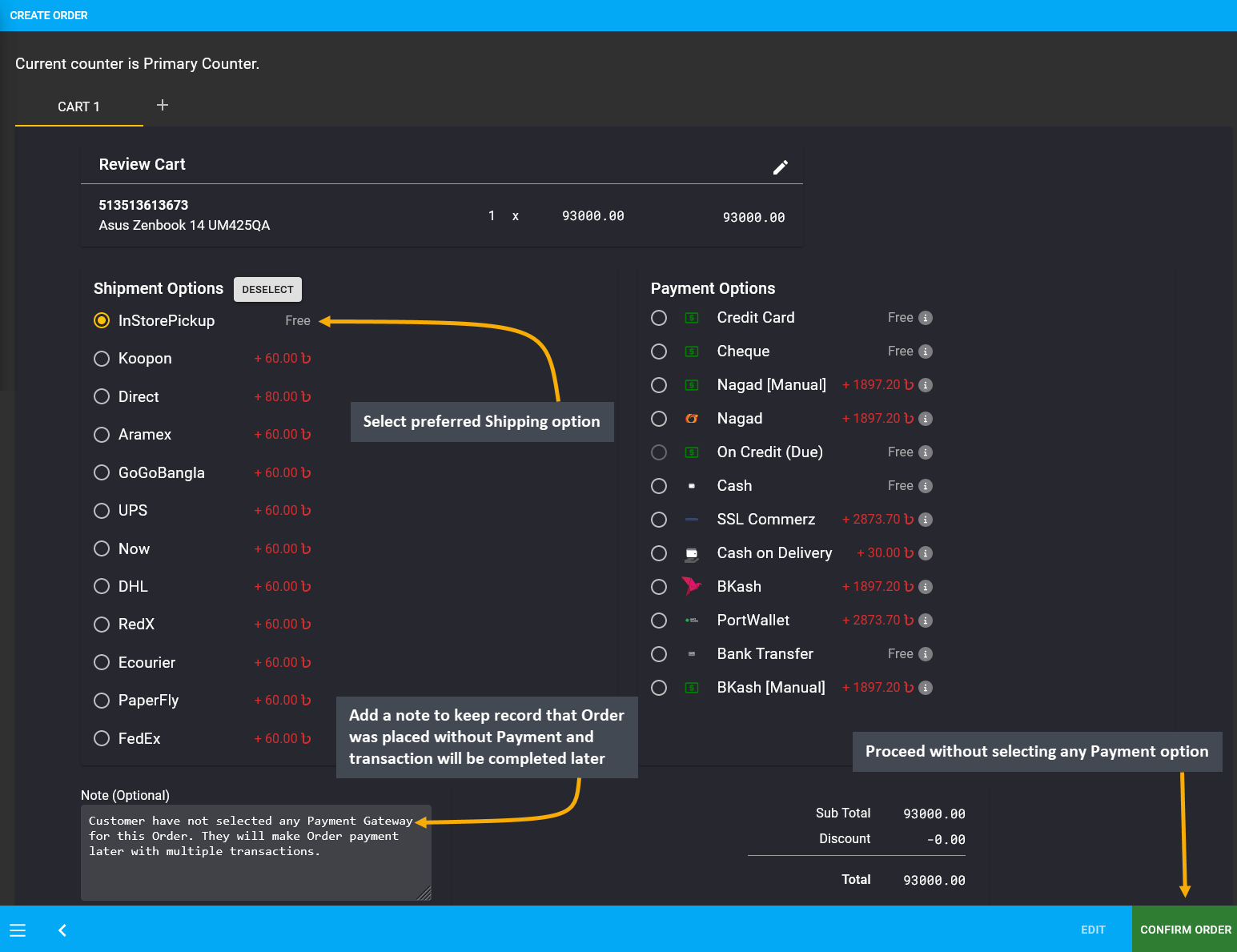

If the Credit Customer wants to place Order without payment, then they have to complete Order without selecting any payment option. Here, In Store Pickup was selected as shipment option without selecting any payment option. Add a Note to keep record that Order was placed without Payment and transaction will be completed later. Thus, proceed without selecting any payment option and click the Confirm Order button to proceed to the next step.

Image 13: Credit Customer can proceed without selecting payment option to complete Order without payment.

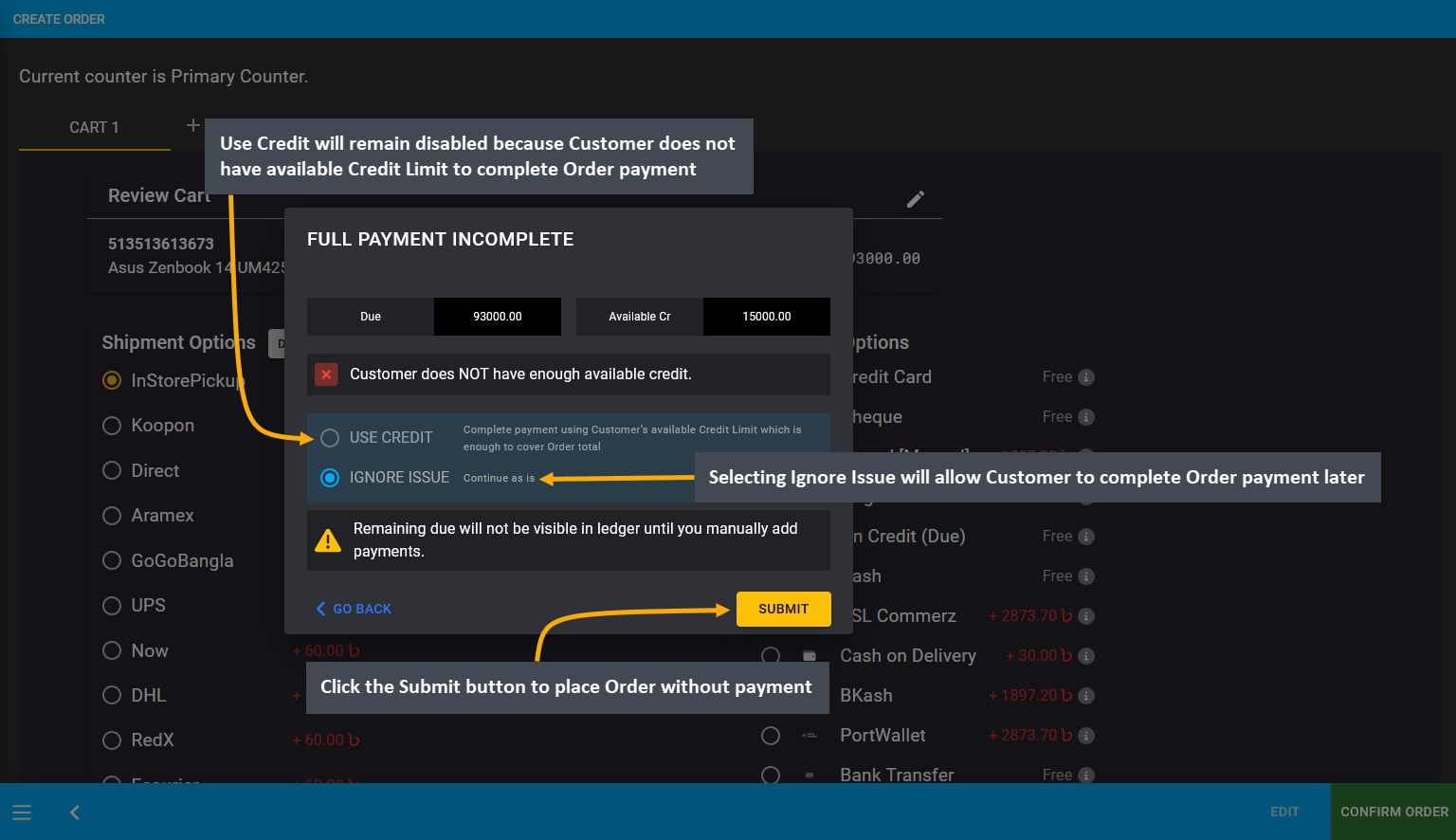

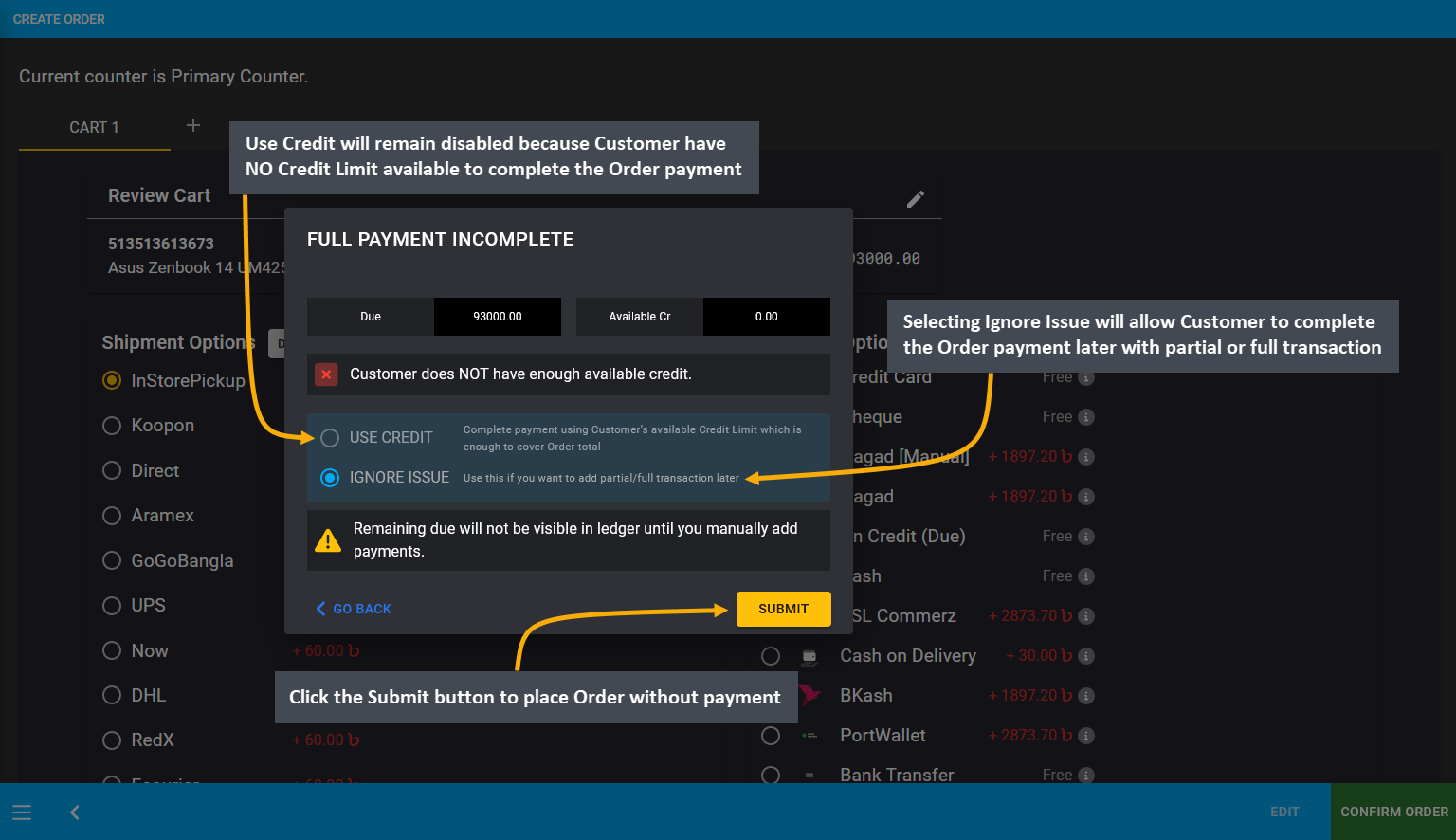

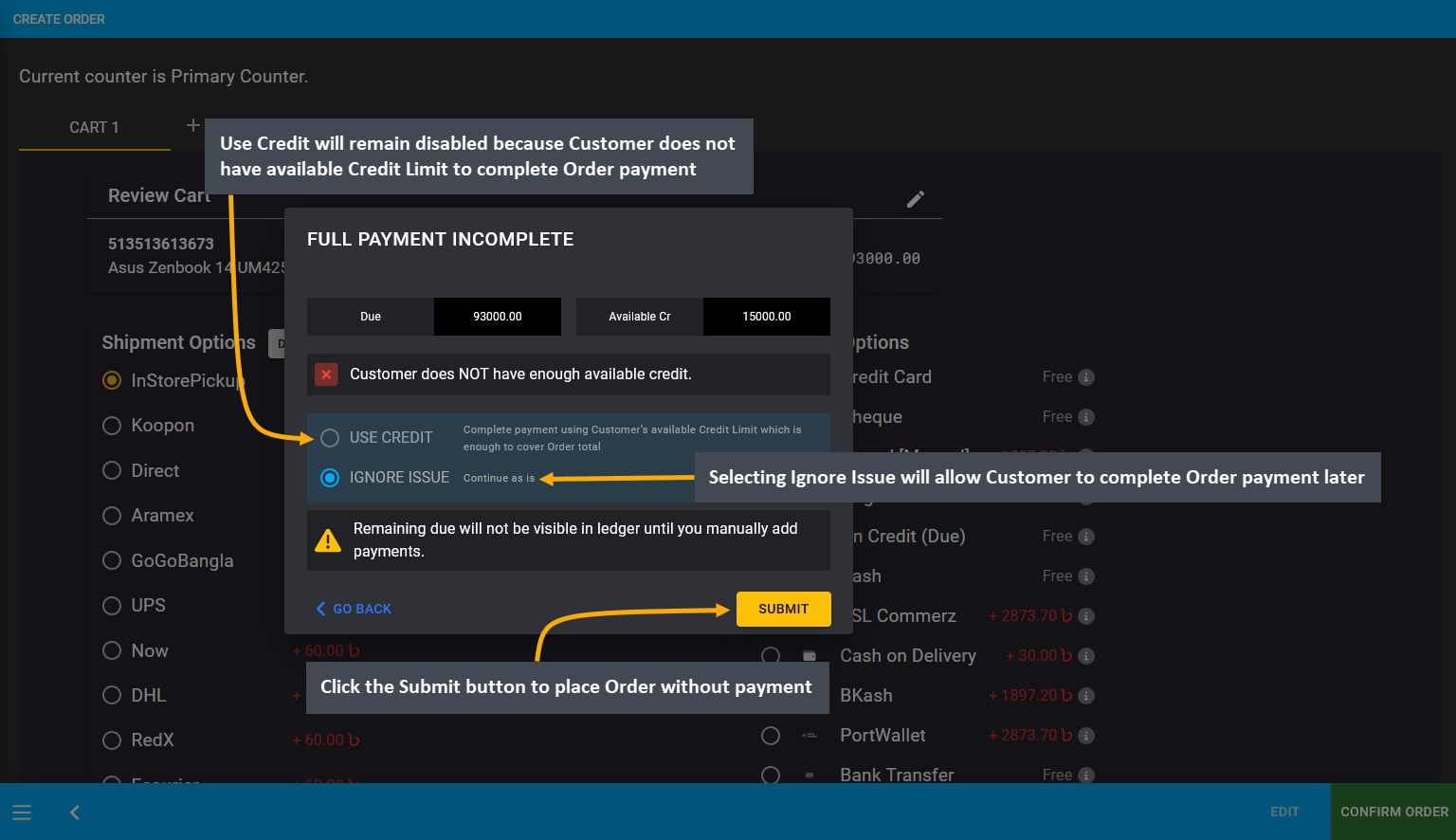

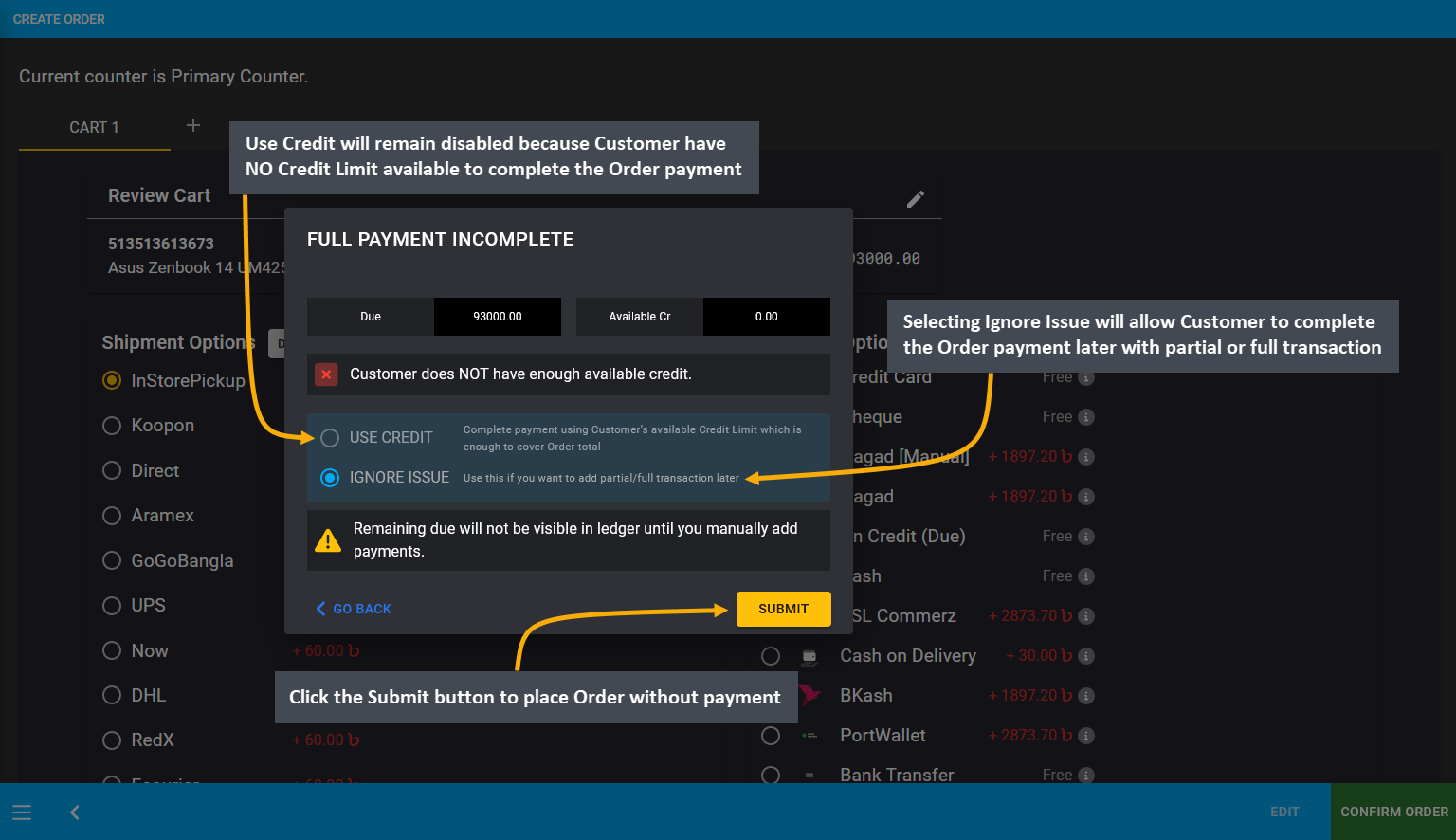

As Credit Customer proceeded to place Order without payment, a pop-up of Full Payment Incomplete will show two options. The first option to Use Credit will remain disabled because Customer does not have available Credit Limit to complete Order payment. The second option which remains enabled is Ignore Issue, selecting which will allow Customer to complete Order payment later. Therefore, click the Submit button to place Order without payment.

Image 14: Customer does not have enough Credit Limit to cover Full Order Payment, so select Ignore Issue.

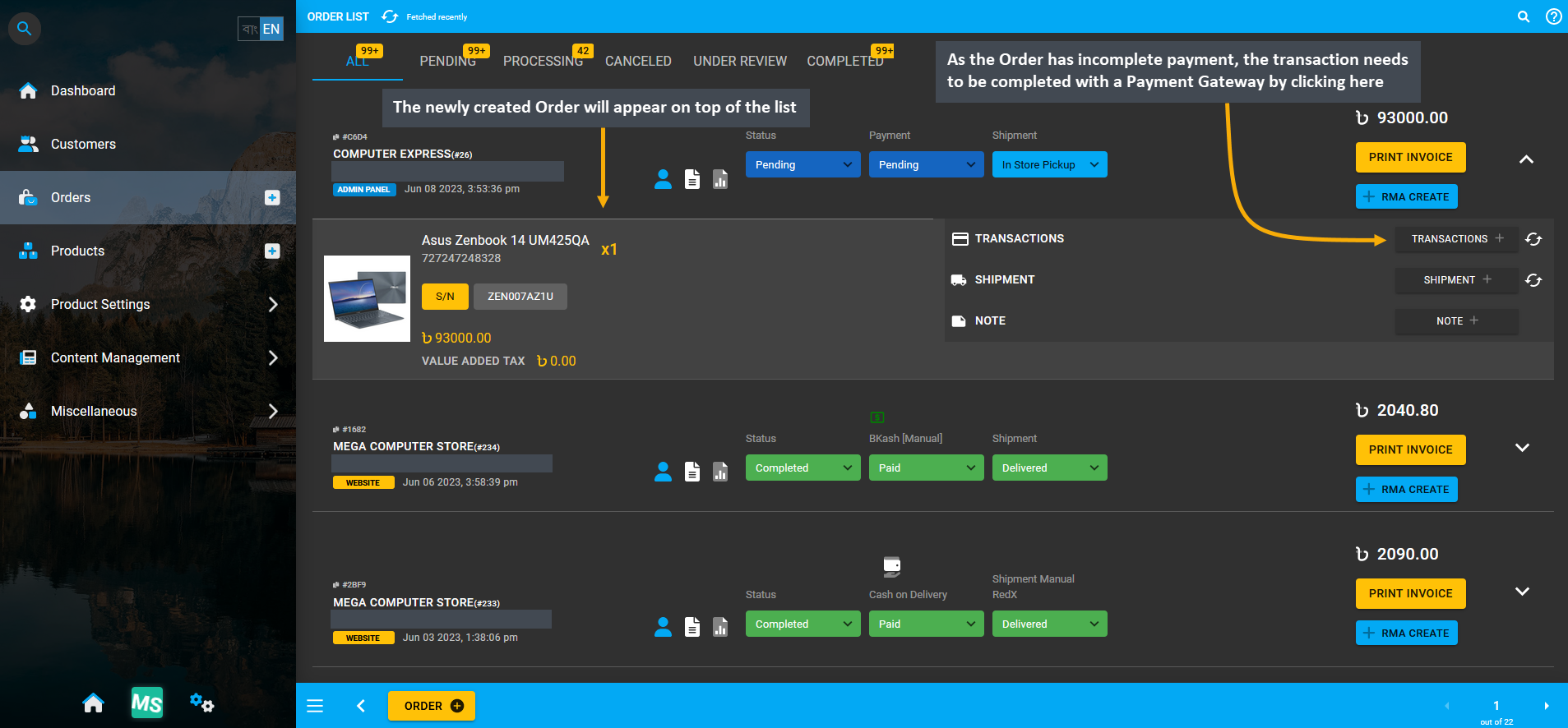

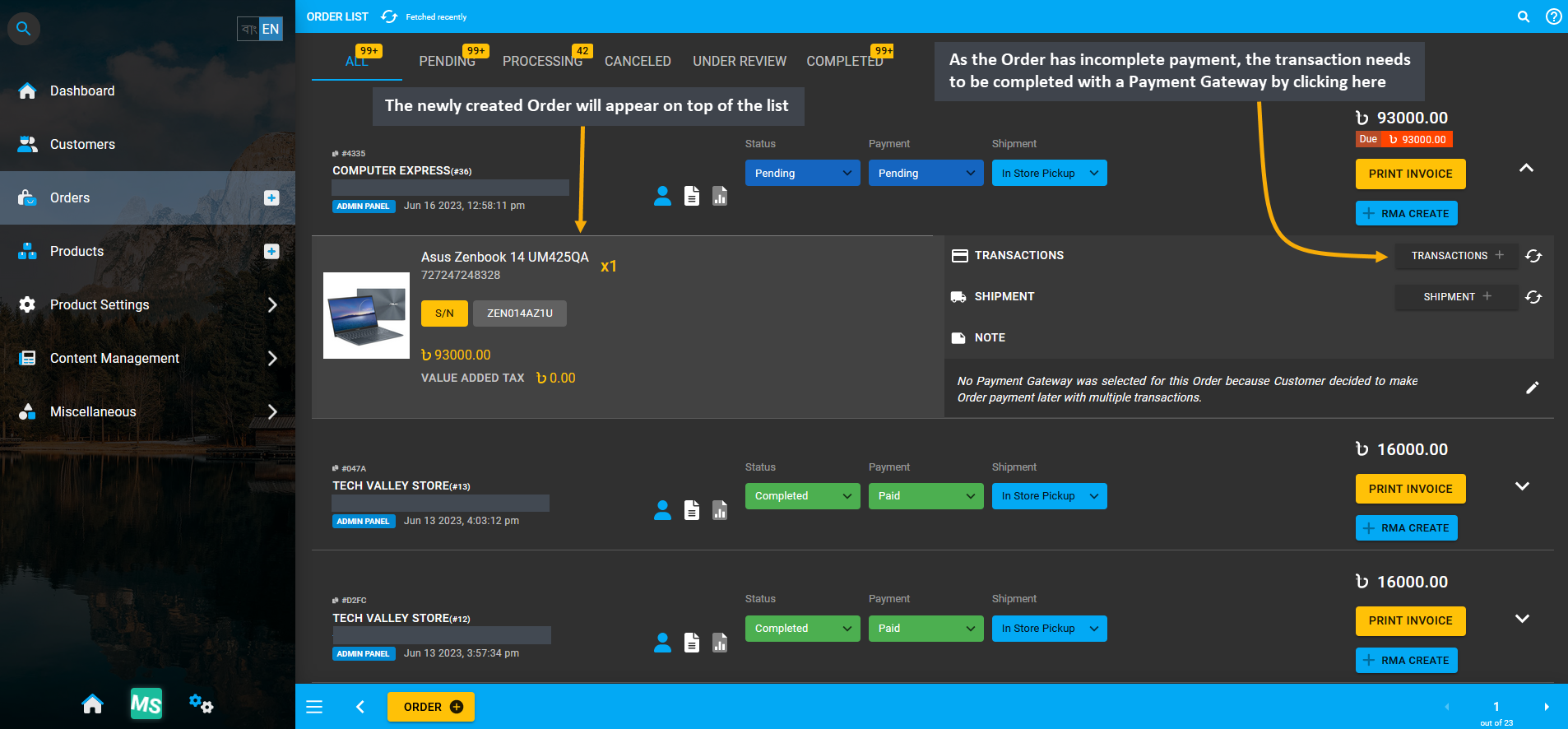

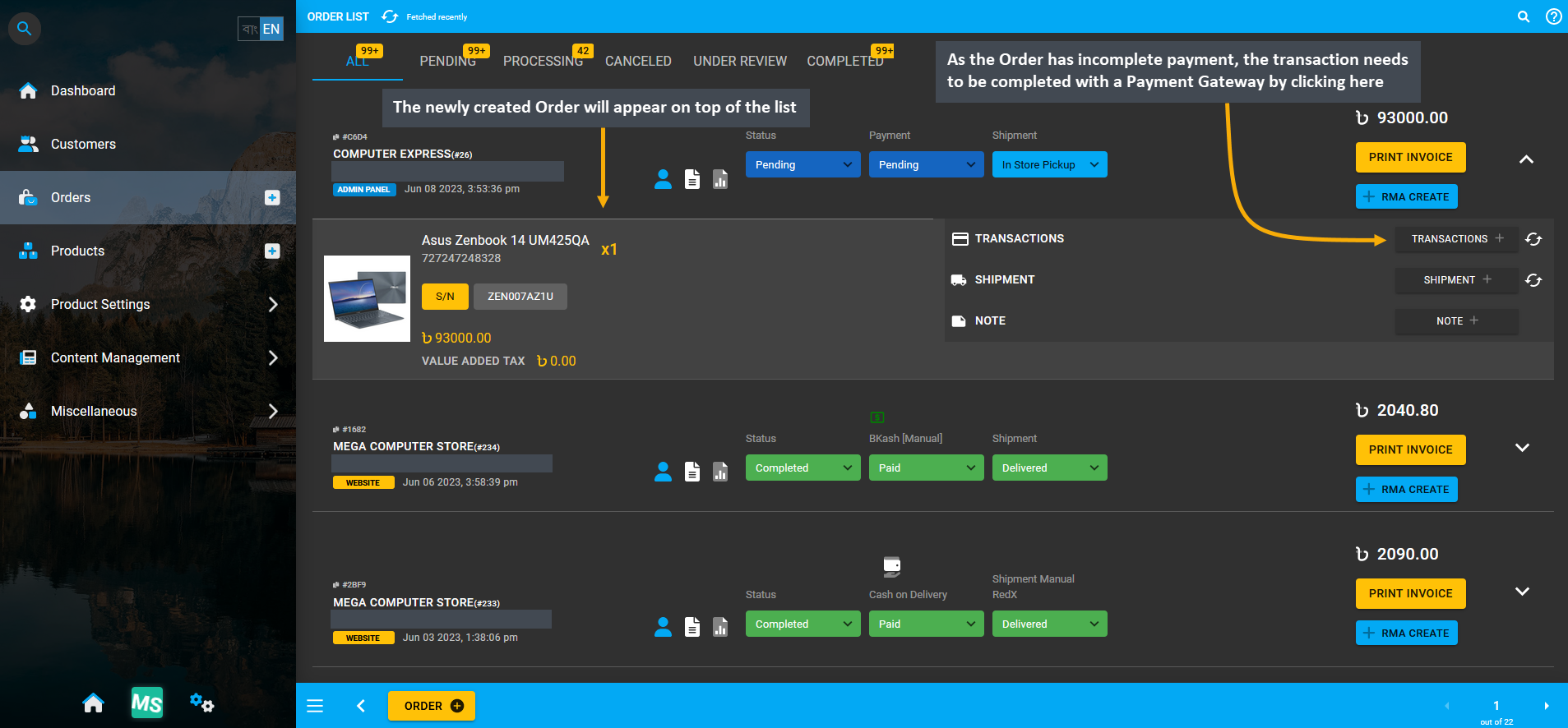

In order to add payment details to this Order, go the the Orders Tab. The newly created Order will appear on top of the list. It has incomplete payment which needs to be completed. For this, click the Transaction + button which will redirect to the Payment Gateway from where transaction can be completed for this Pending Order.

Image 15: Click Transaction + to select Payment Gateway and complete transaction for this Pending Order.

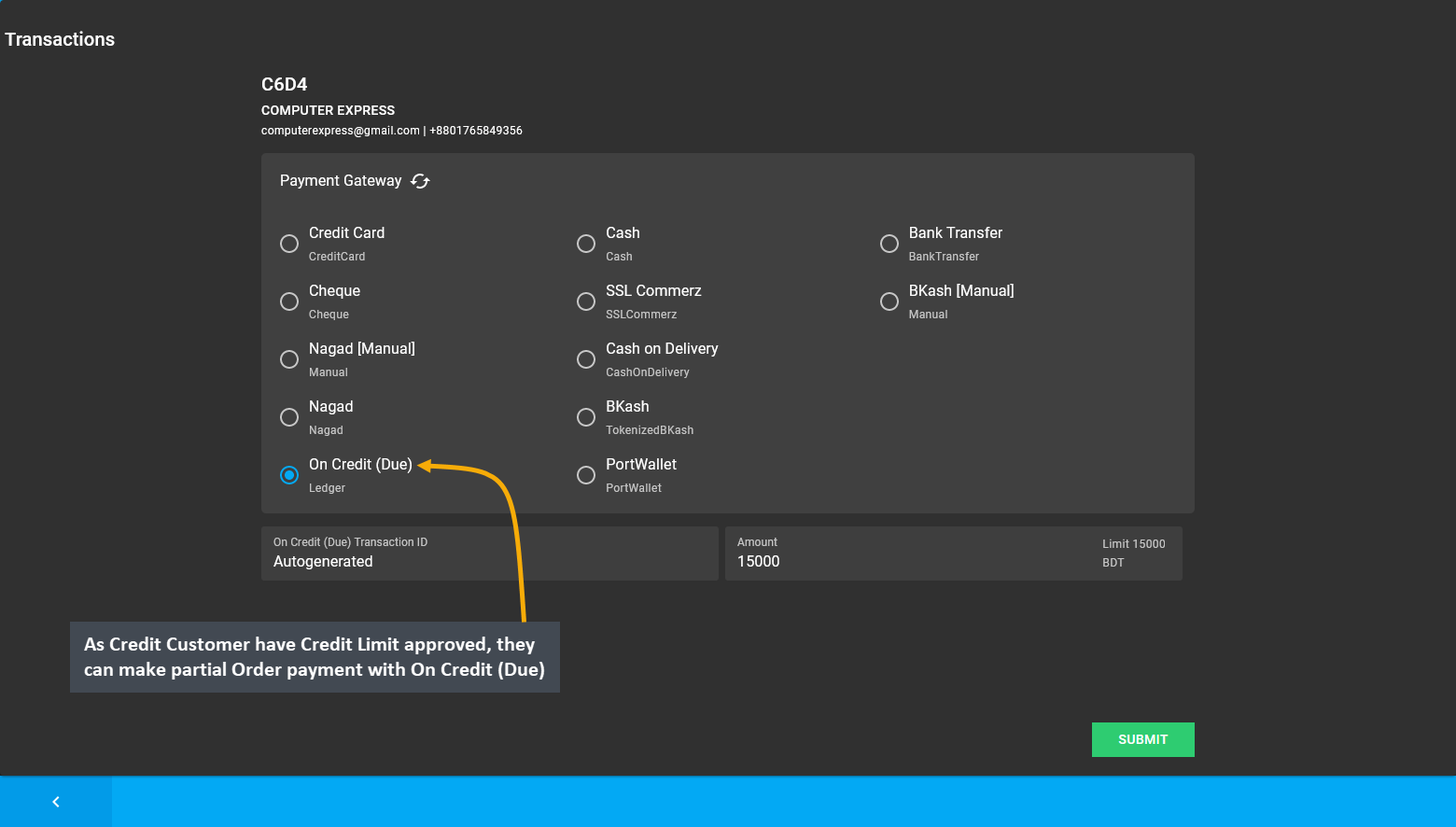

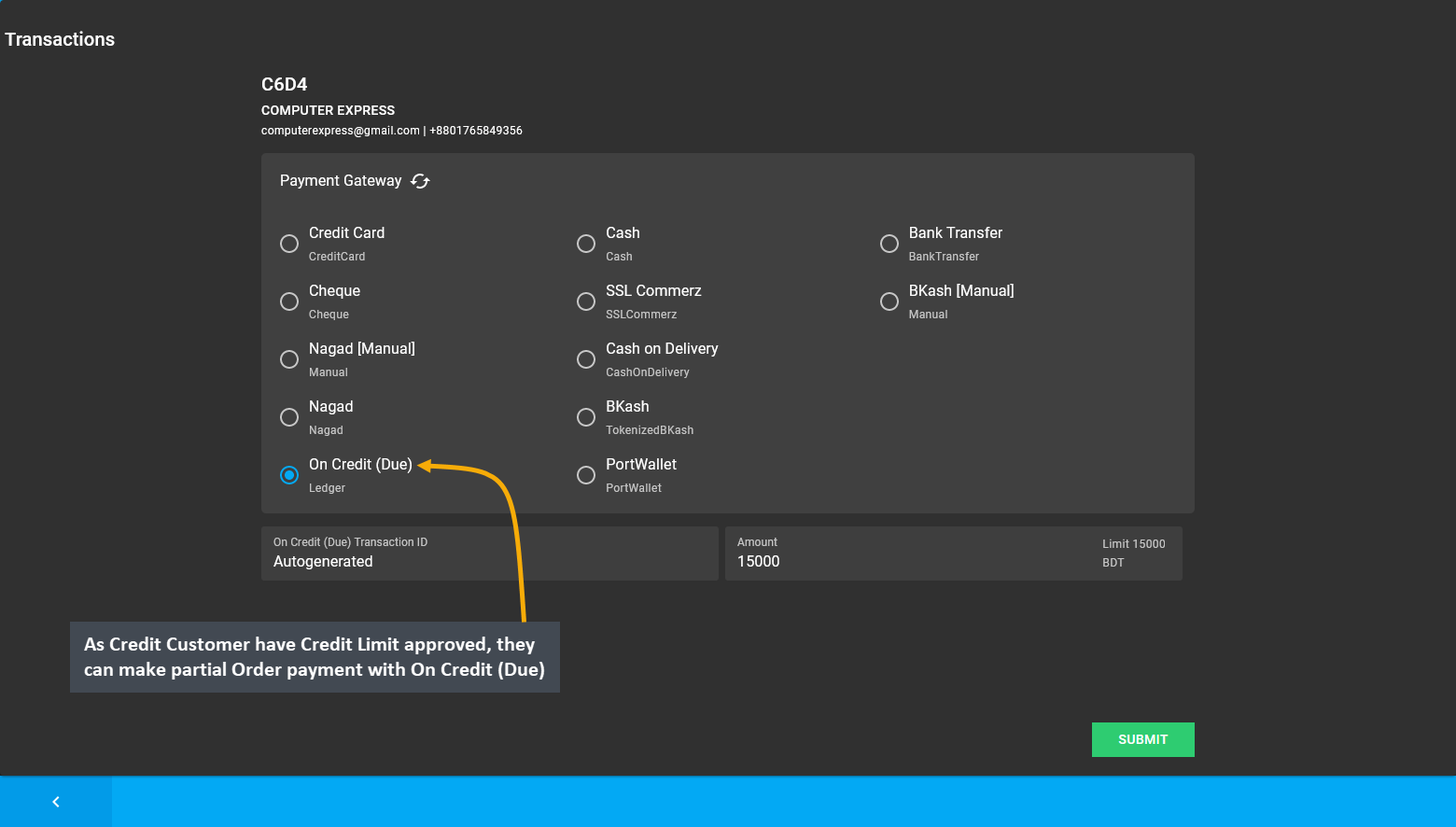

To resolve this Pending Order for Credit Customer, complete Order payment by selecting any Payment Gateway. As the Credit Customer have Credit Limit approved and allowed, they can make partial Order payment with On Credit (Due). Click the Submit button to complete partial payment transaction for this Credit Customer’s Order.

Image 16: Credit Customer can make partial Order payment with On Credit (Due) as they have Credit Limit.

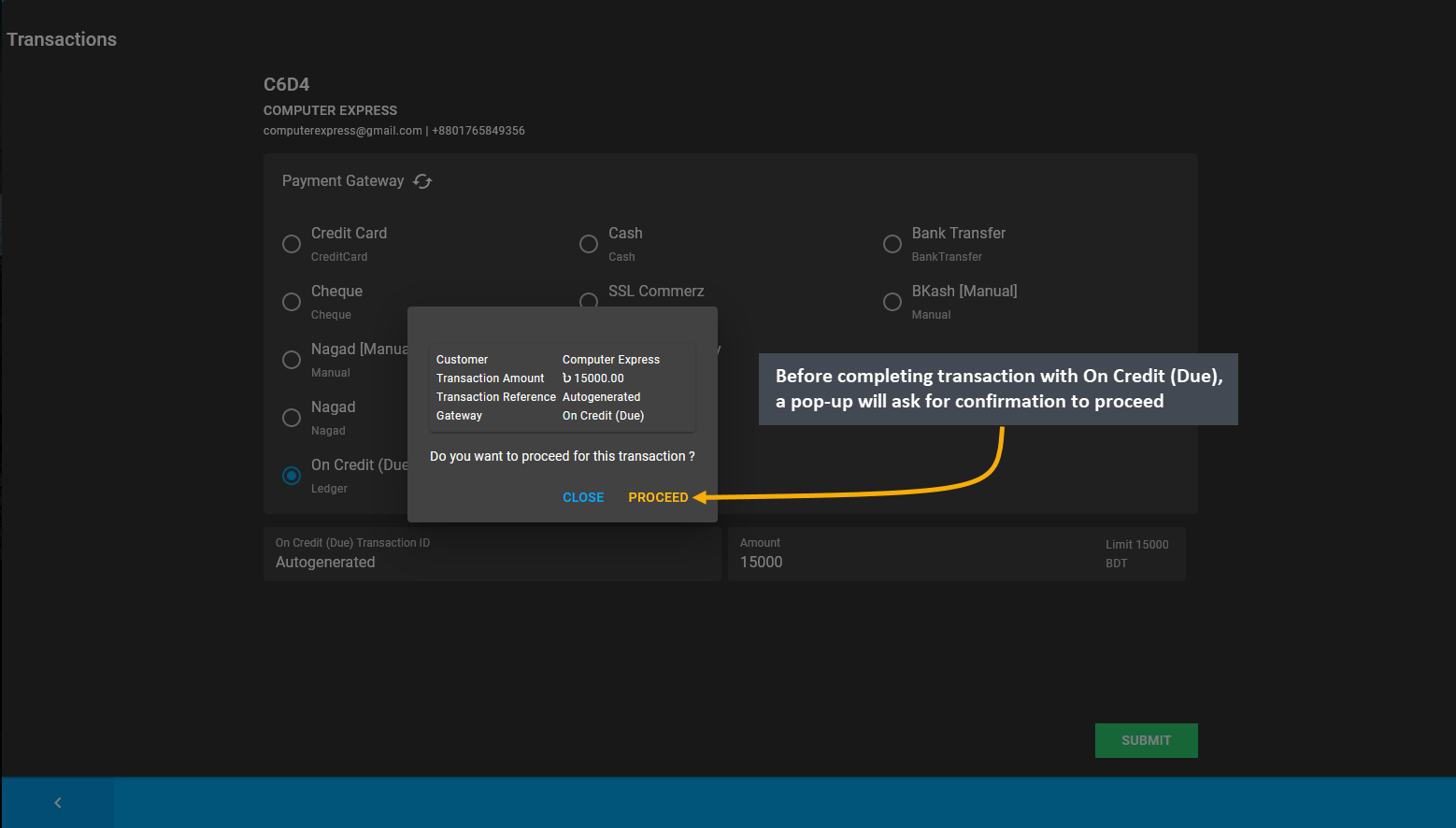

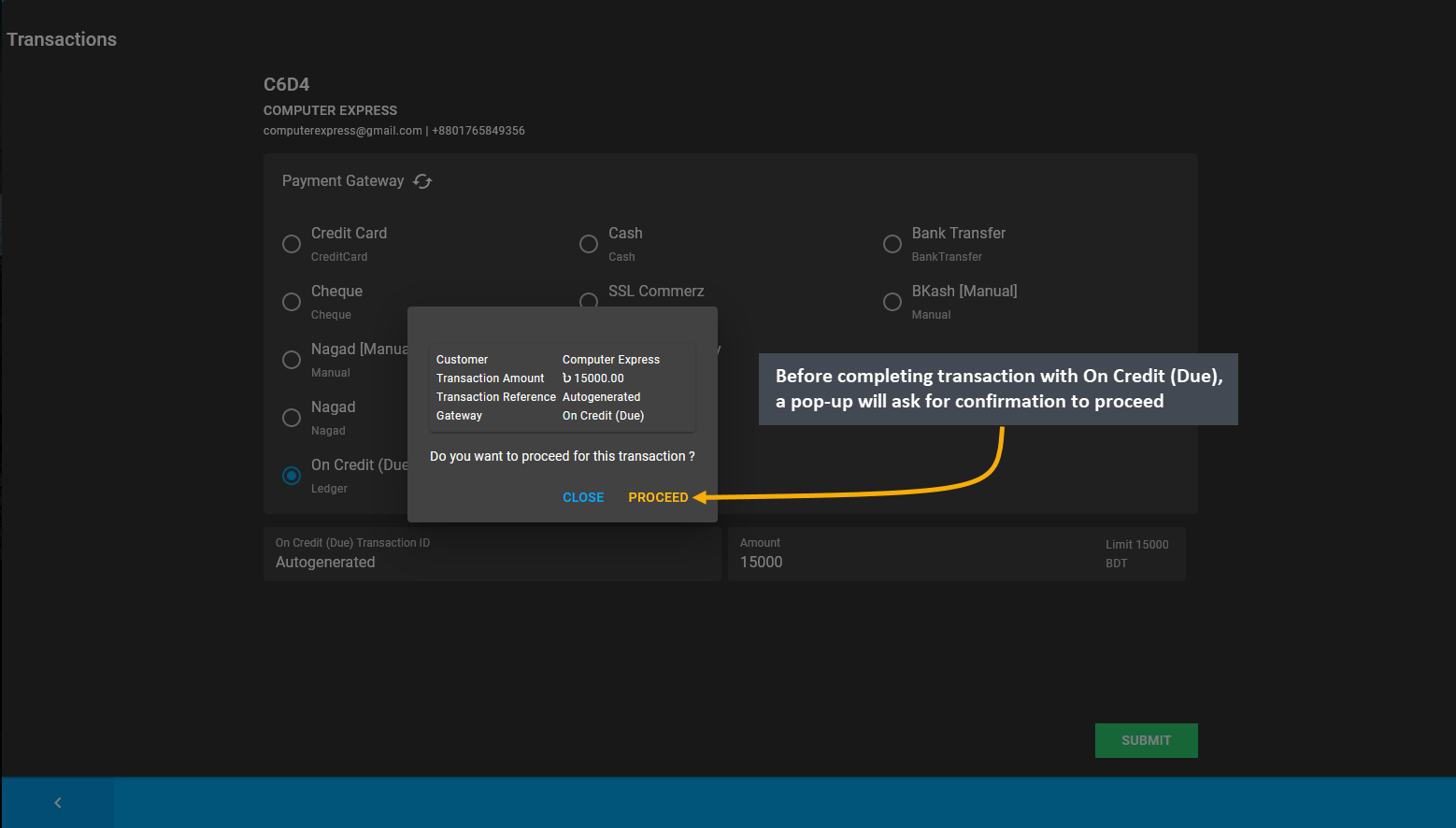

Before completing the partial payment of 15,000 BDT with On Credit (Due), a pop-up will ask for confirmation to proceed with the transaction. Click the Proceed button to confirm payment with On Credit (Due). After confirming to pay the 15,000 BDT with On Credit (Due), the amount will be deducted from total Due, and remaining Due will show as 78,000 BDT that needs to be completed later with other Payment Gateways to complete Order payment.

Image 17: Before completing transaction with On Credit (Due), pop-up will ask for confirmation to proceed.

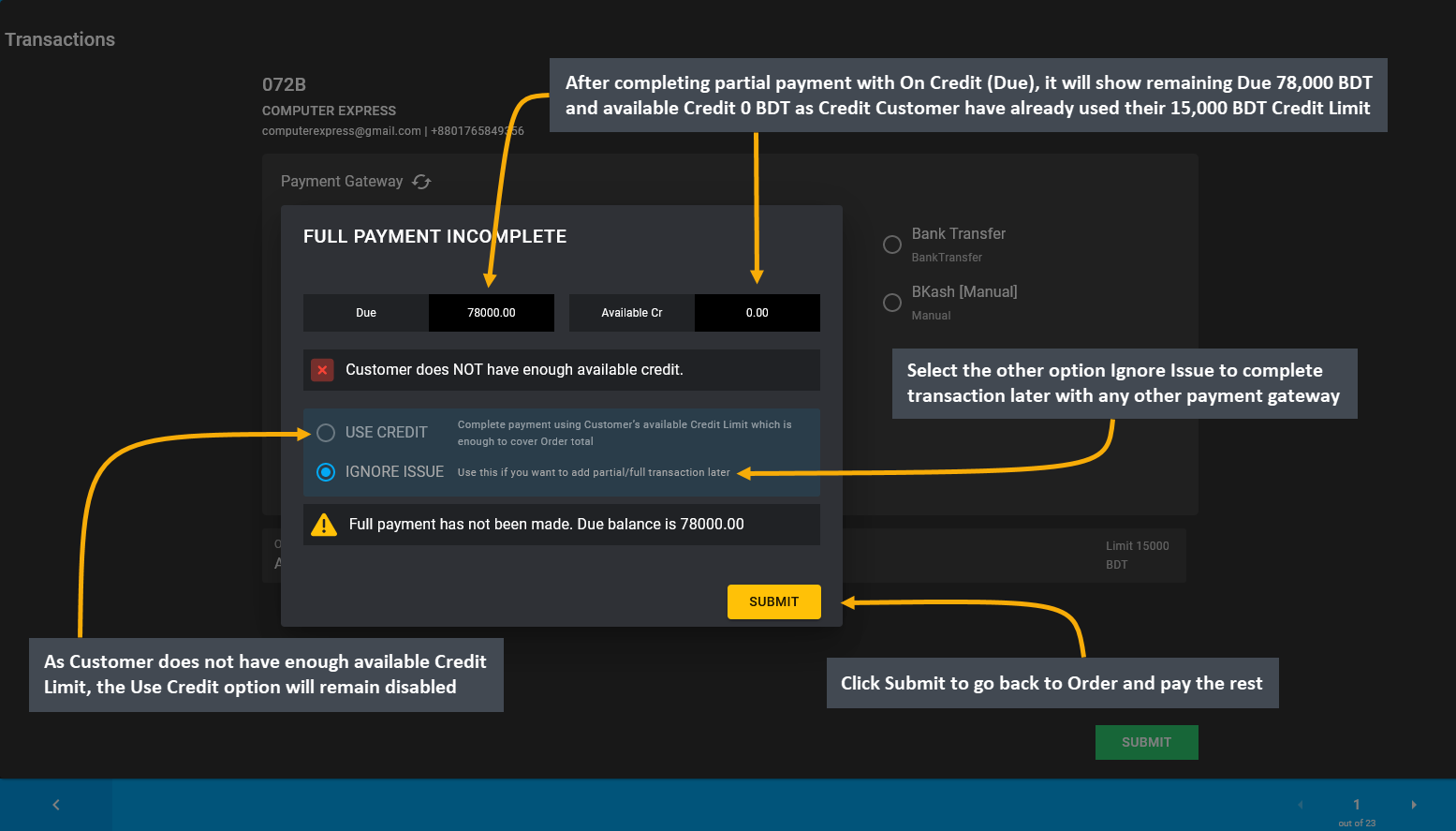

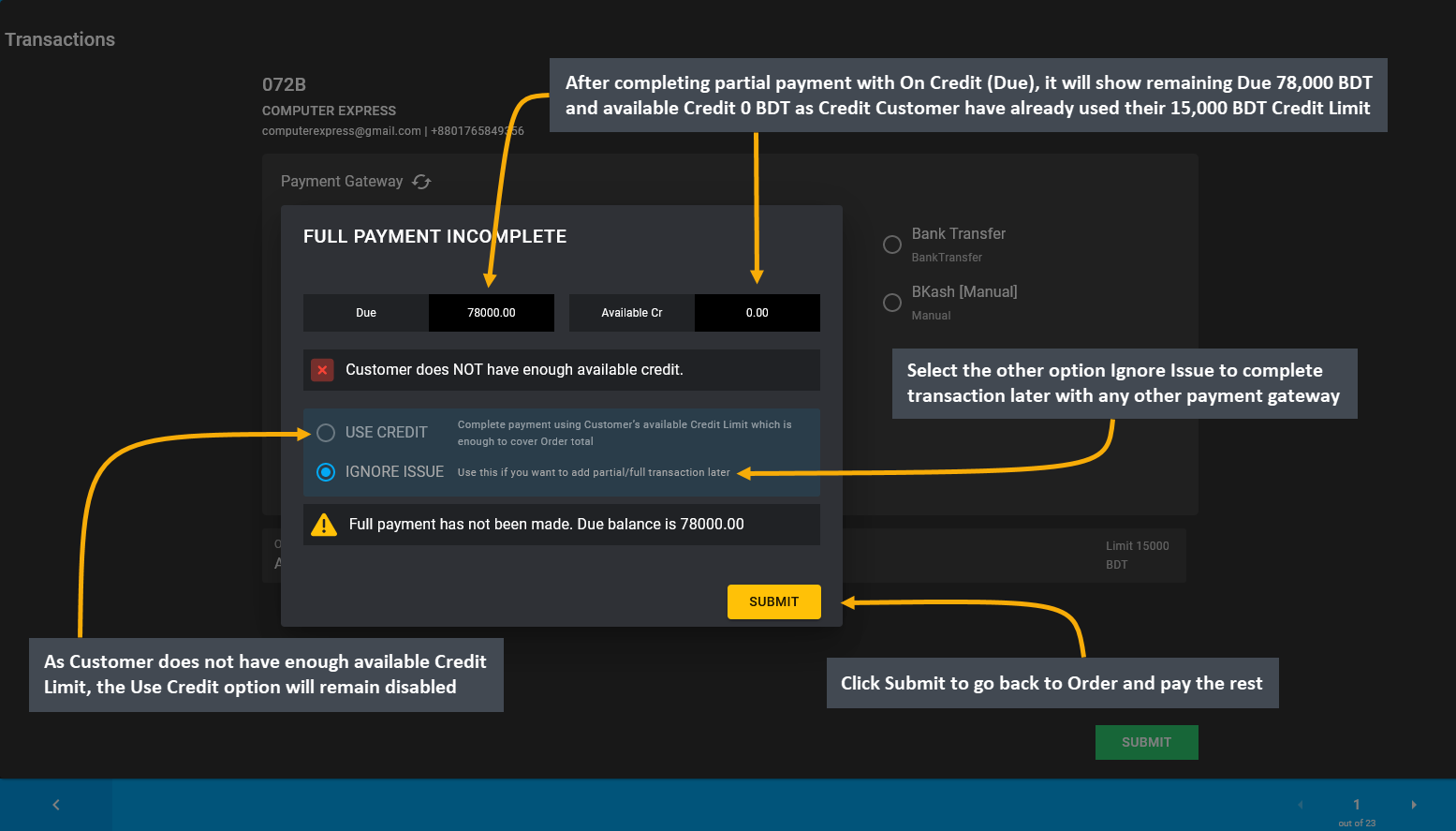

After completing partial payment with On Credit (Due) i.e. Credit Limit, a Full Payment Incomplete pop-up will show the remaining Due 78,000 BDT and available Credit 0 BDT as the Credit Customer have already used their 15,000 BDT Credit Limit. Therefore, as Customer does not have enough available Credit Limit, the Use Credit option will remain disabled. Thus, select the other option Ignore Issue to complete transaction later with any other payment gateway. Notification will show that Due balance is 78,000 BDT. Click Submit to go back to Order and pay the rest.

Image 18: After partial payment with On Credit (Due), remaining Due and available Credit Limit will show.

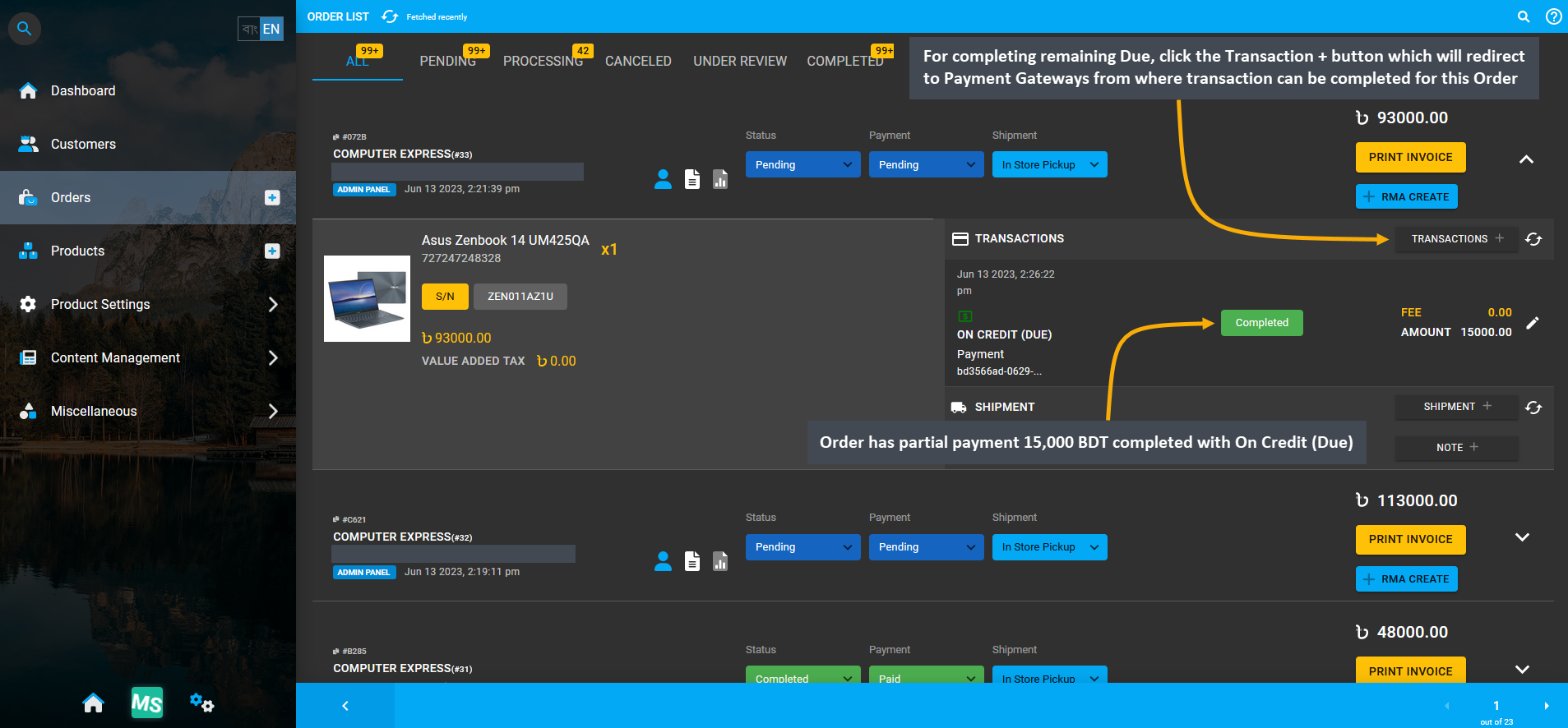

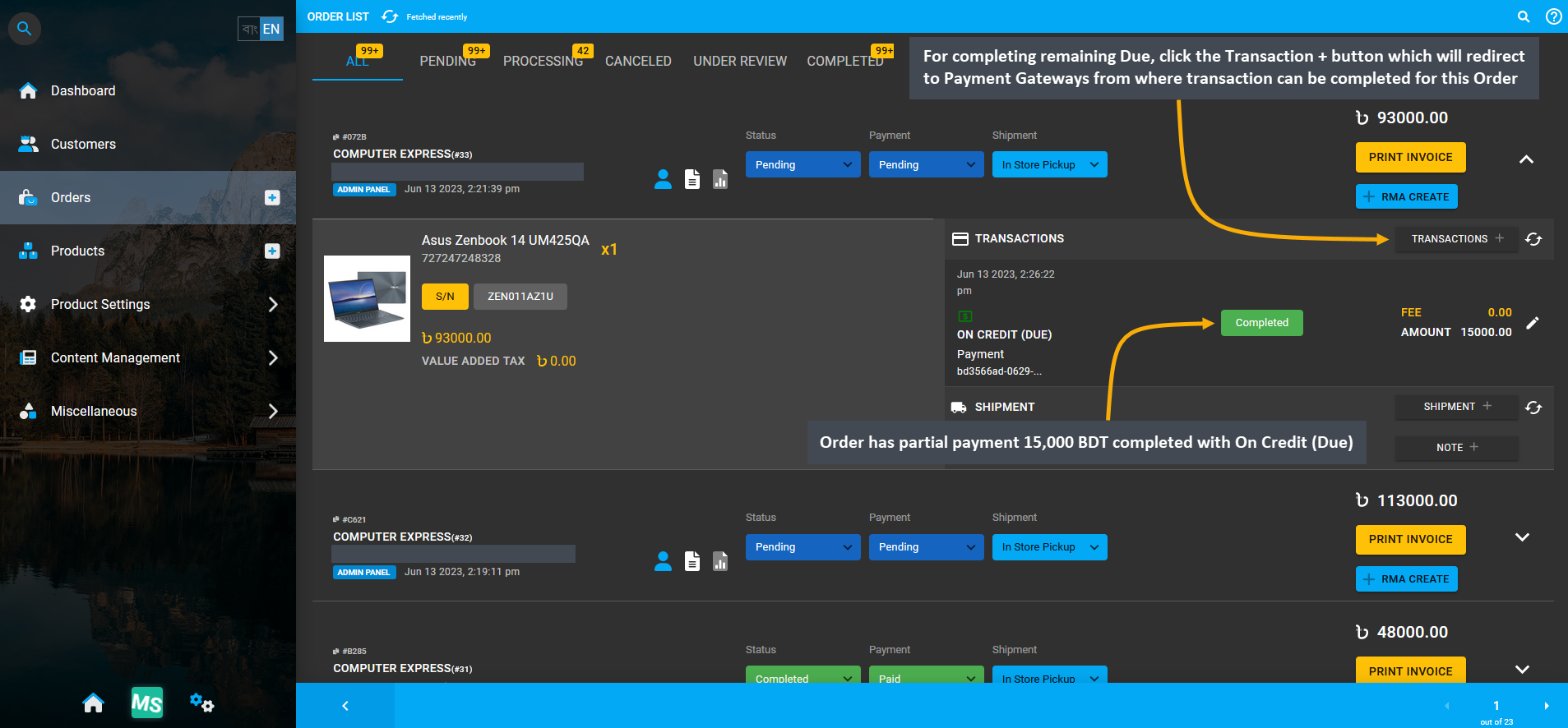

In order to complete remaining Due for this Order, go the the Orders Tab, which has partial payment 15,000 BDT completed with On Credit (Due). For completing remaining Due, click the Transaction + button which will redirect to Payment Gateways from where transaction can be completed for this Order with one or multiple gateways.

Image 19: Click Transaction + to be redirected to Payment Gateways from where Order due can be completed.

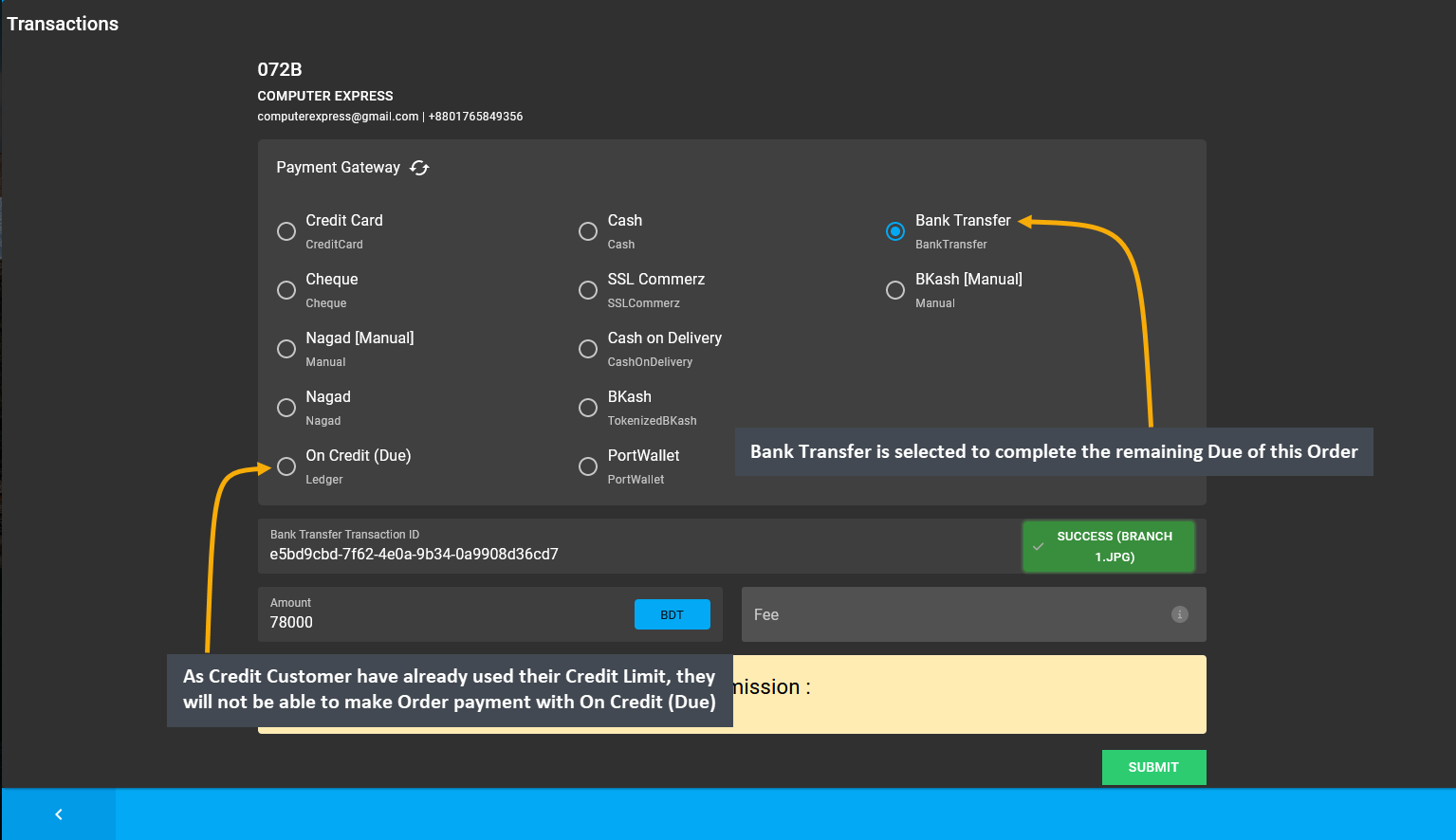

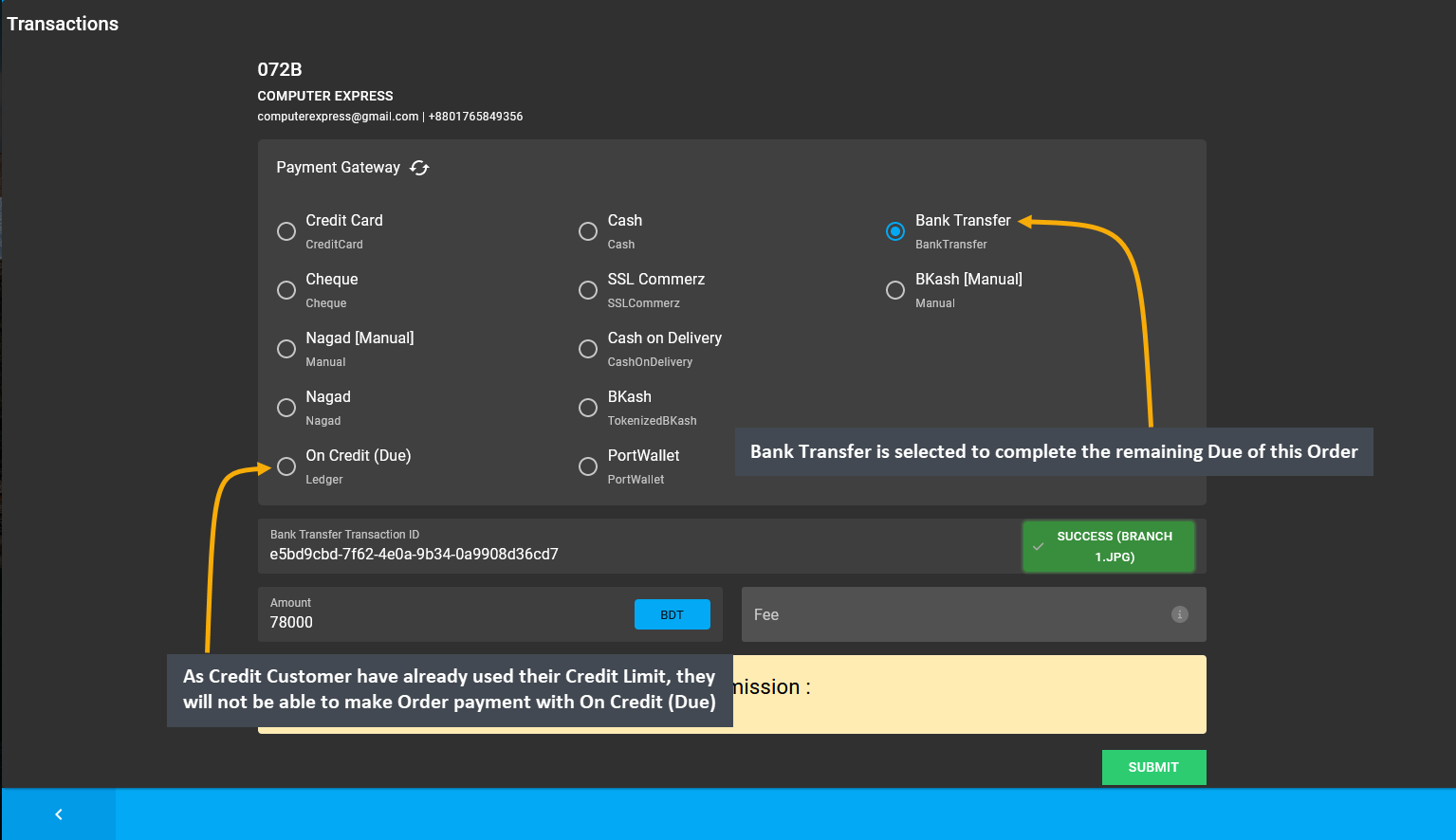

To resolve remaining Due for this Order, complete Order payment by selecting any other Payment Gateway. As Credit Customer have already used their Credit Limit, they will not be able to make Order payment with On Credit (Due). Therefore, another payment gateway Bank Transfer is selected to complete the remaining Due of this Order.

Image 20: To resolve remaining Due for this Order, complete payment by selecting another Payment Gateway.

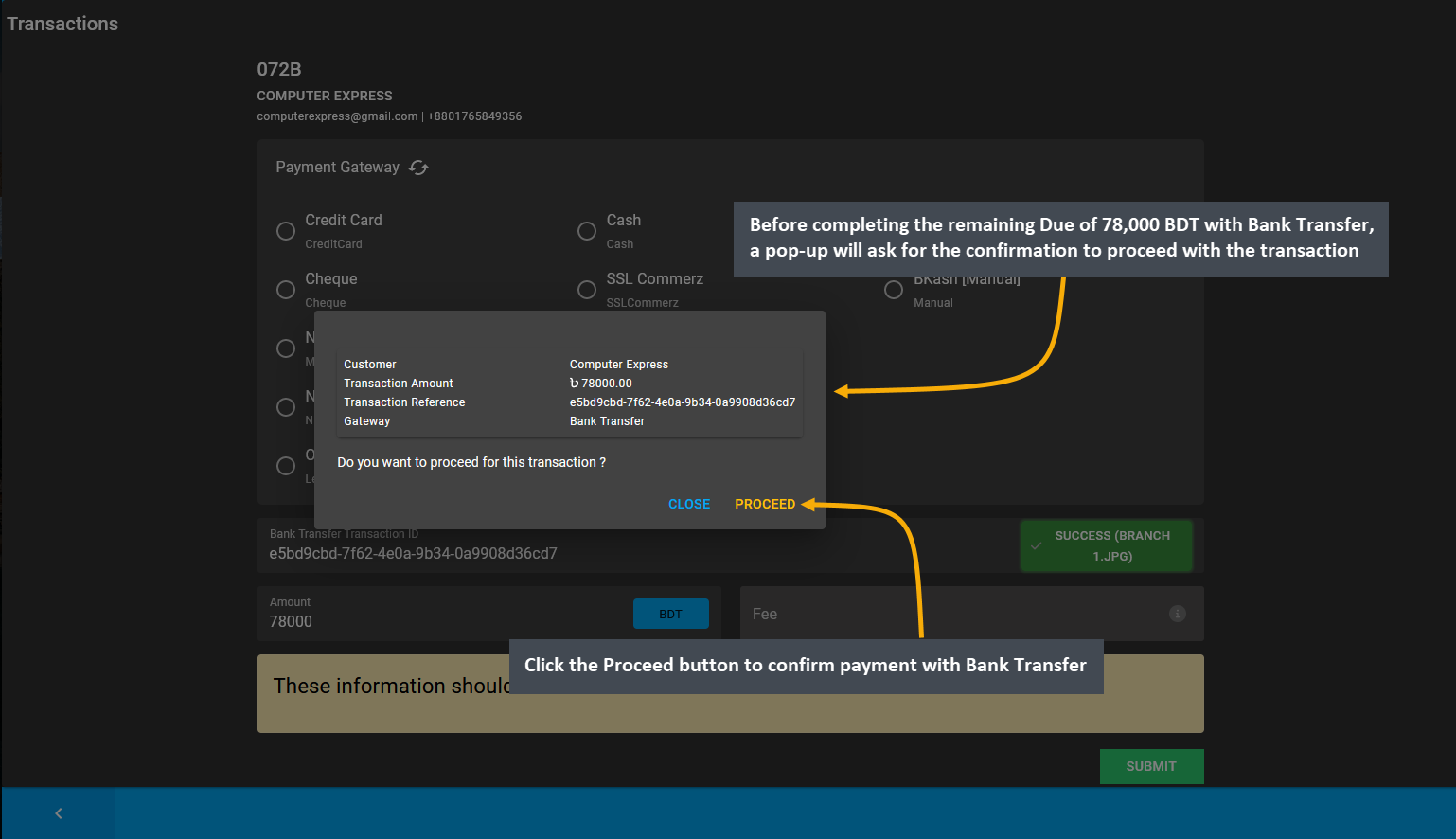

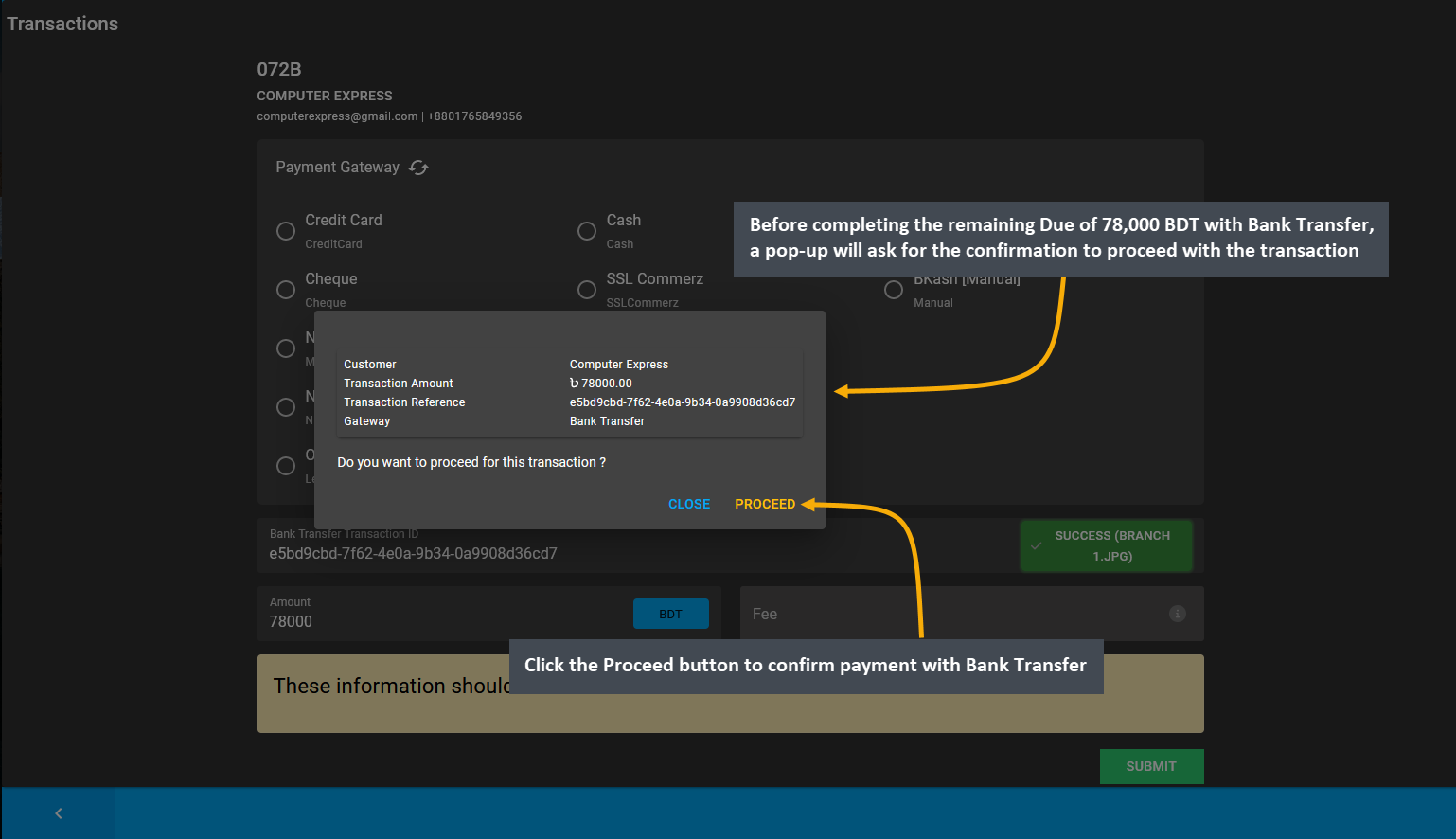

Before completing the remaining Due of 78,000 BDT with Bank Transfer, a pop-up will ask for the confirmation to proceed with the transaction. Click the Proceed button to confirm payment with Bank Transfer. After completing Full Order Payment, it will redirect to the Order List, showing completed transactions for the Order.

Image 21: Before completing transaction with Bank Transfer, pop-up will ask for confirmation to proceed.

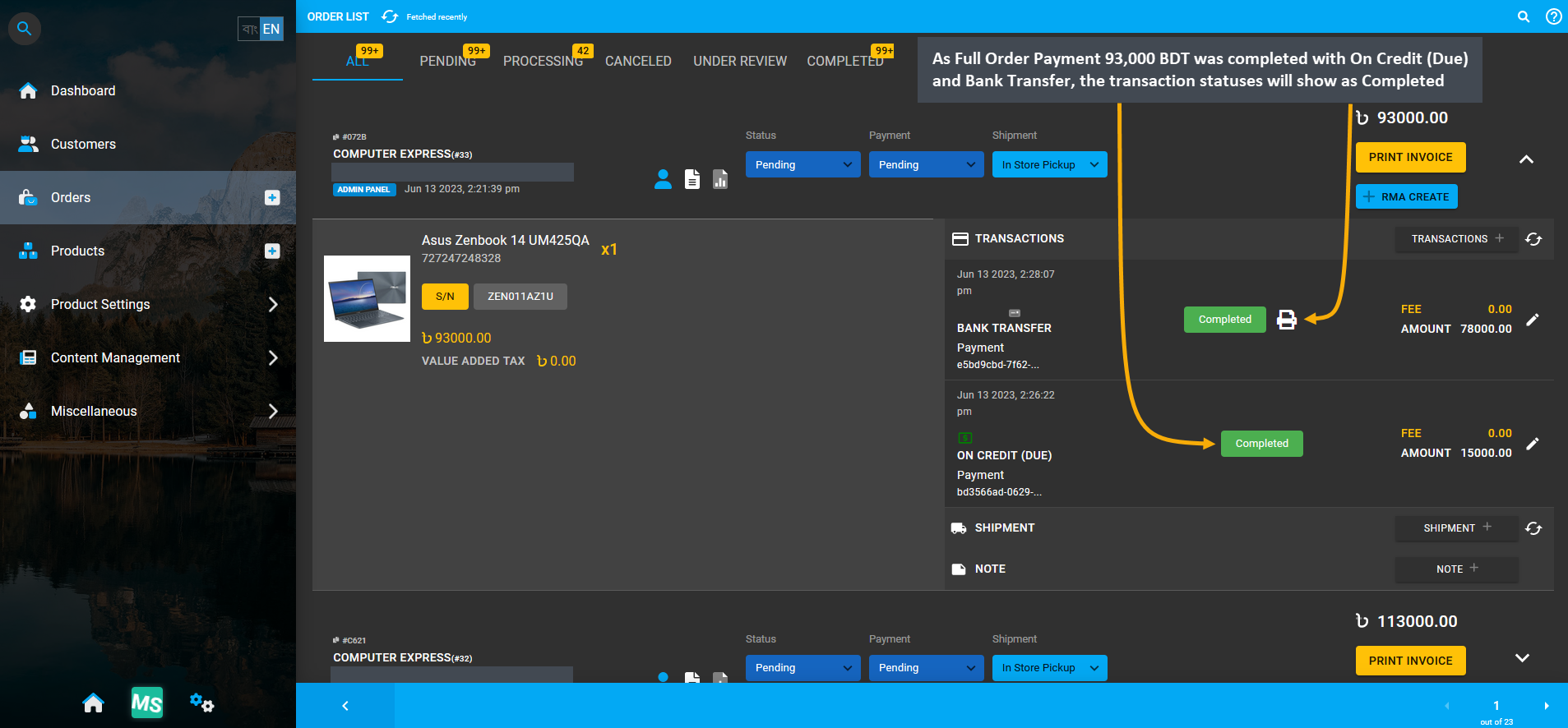

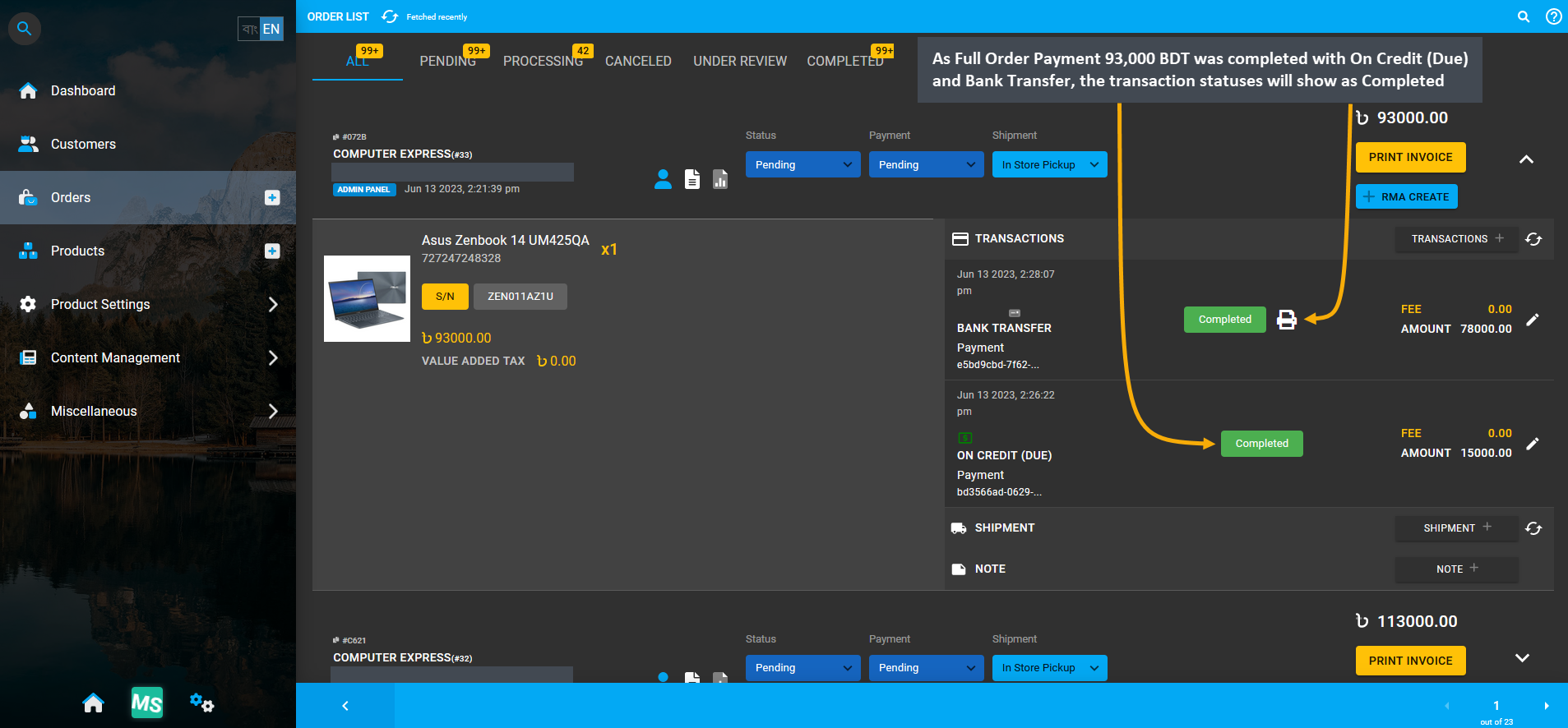

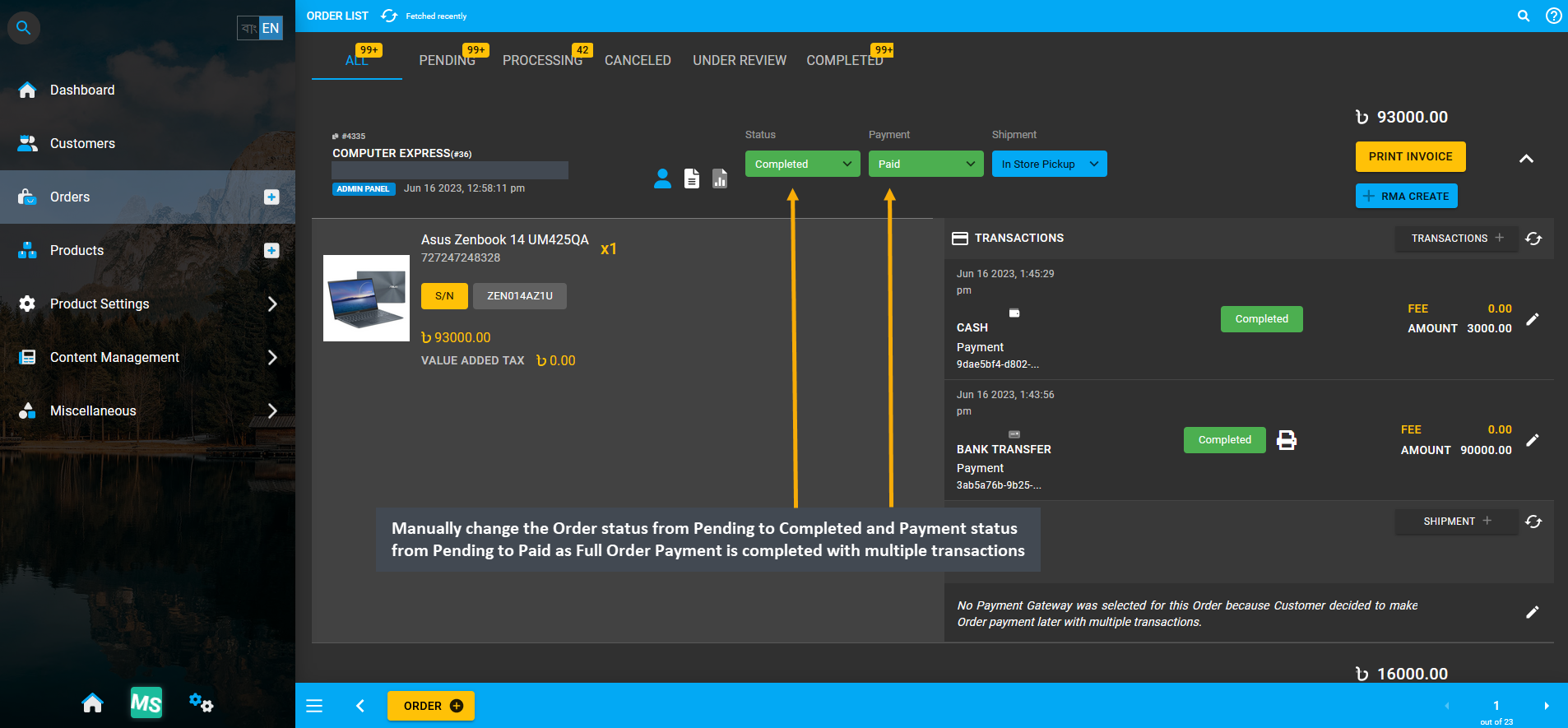

After payment is completed with Bank Transfer for Credit Customer, it will show within the Transactions history. As Full Order Payment 93,000 BDT was paid with On Credit (Due) and Bank Transfer, the transaction statuses will show as Completed. This is how a Credit Customer can make Order payment with Credit Limit and Payment Gateways.

Image 22: As Full Payment was made with On Credit (Due) and Bank Transfer, transaction will show Completed.

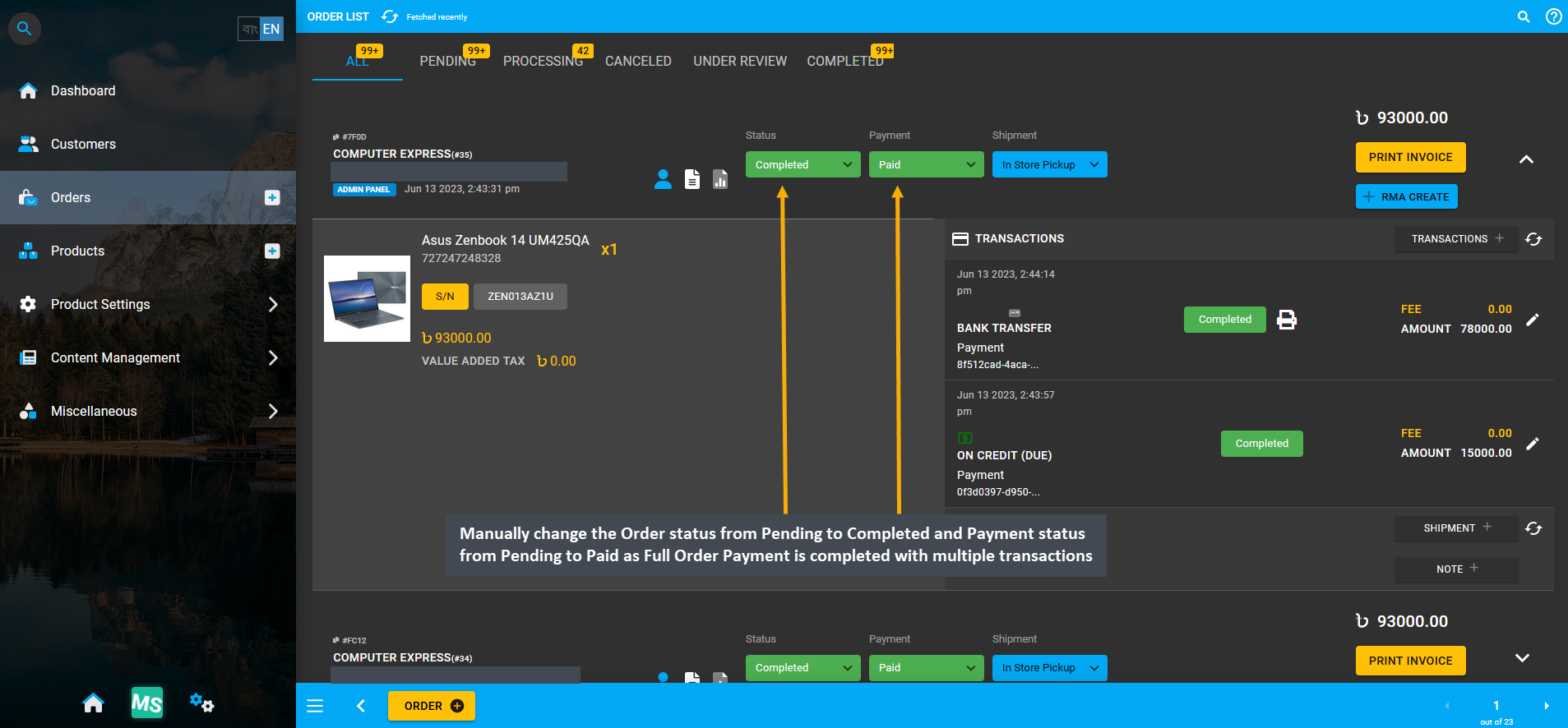

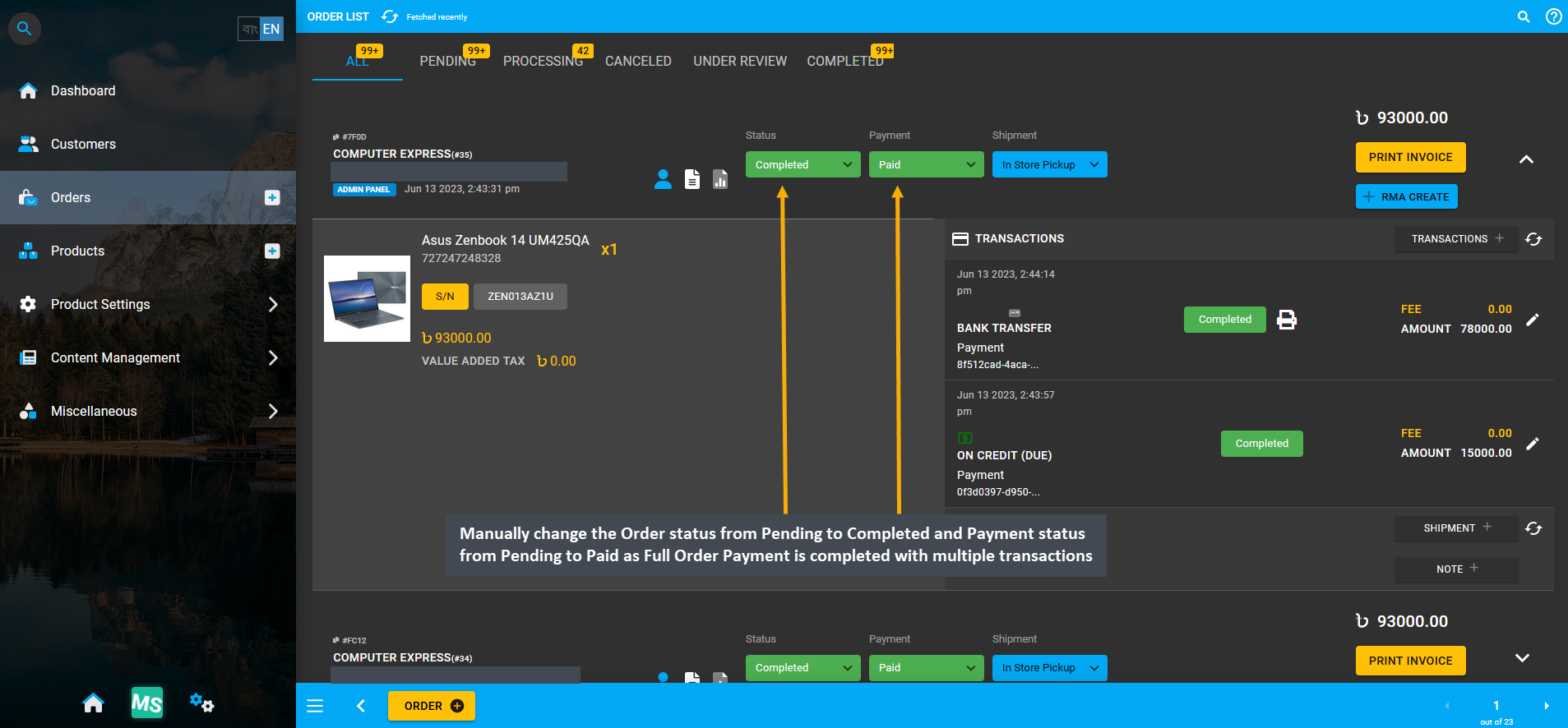

Thus, manually change the Order status from Pending to Completed and Payment status from Pending to Paid as Full Order Payment is completed with multiple transactions. These statuses need to be updated manually.

Image 23: As Full Order Payment was Completed, change Order status to Completed and Payment status to Paid.

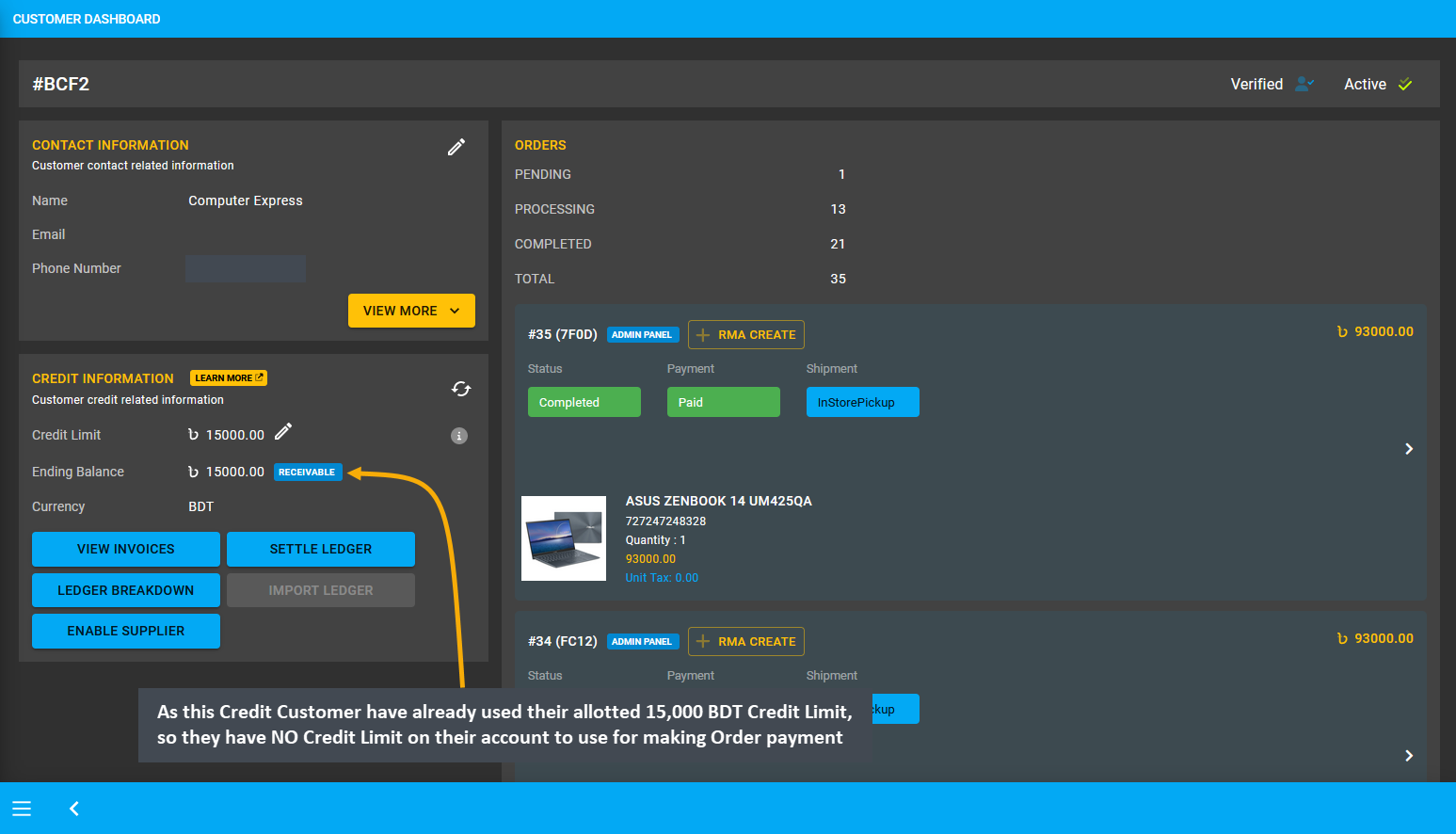

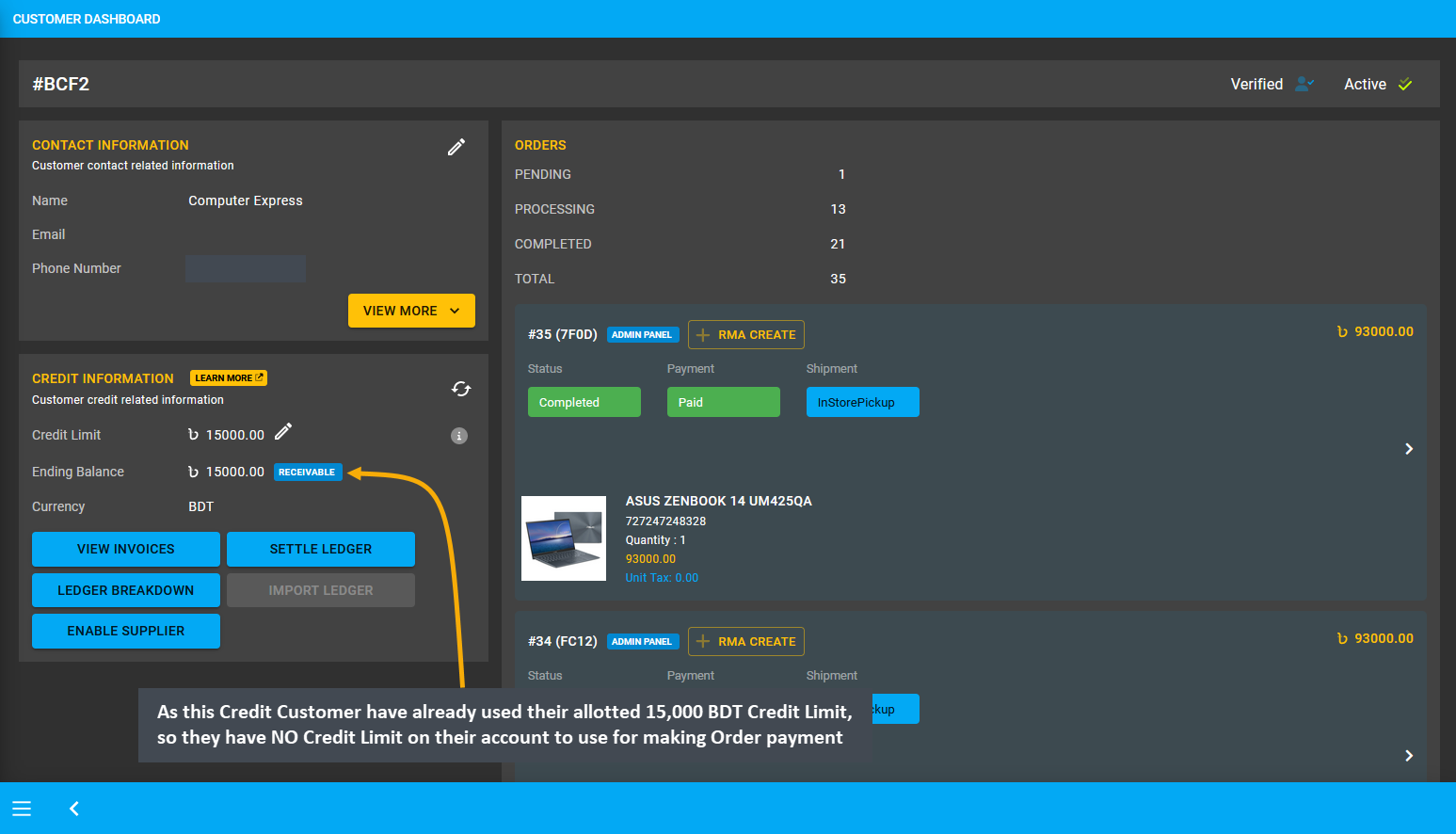

No Credit Limit available to make Order Payment

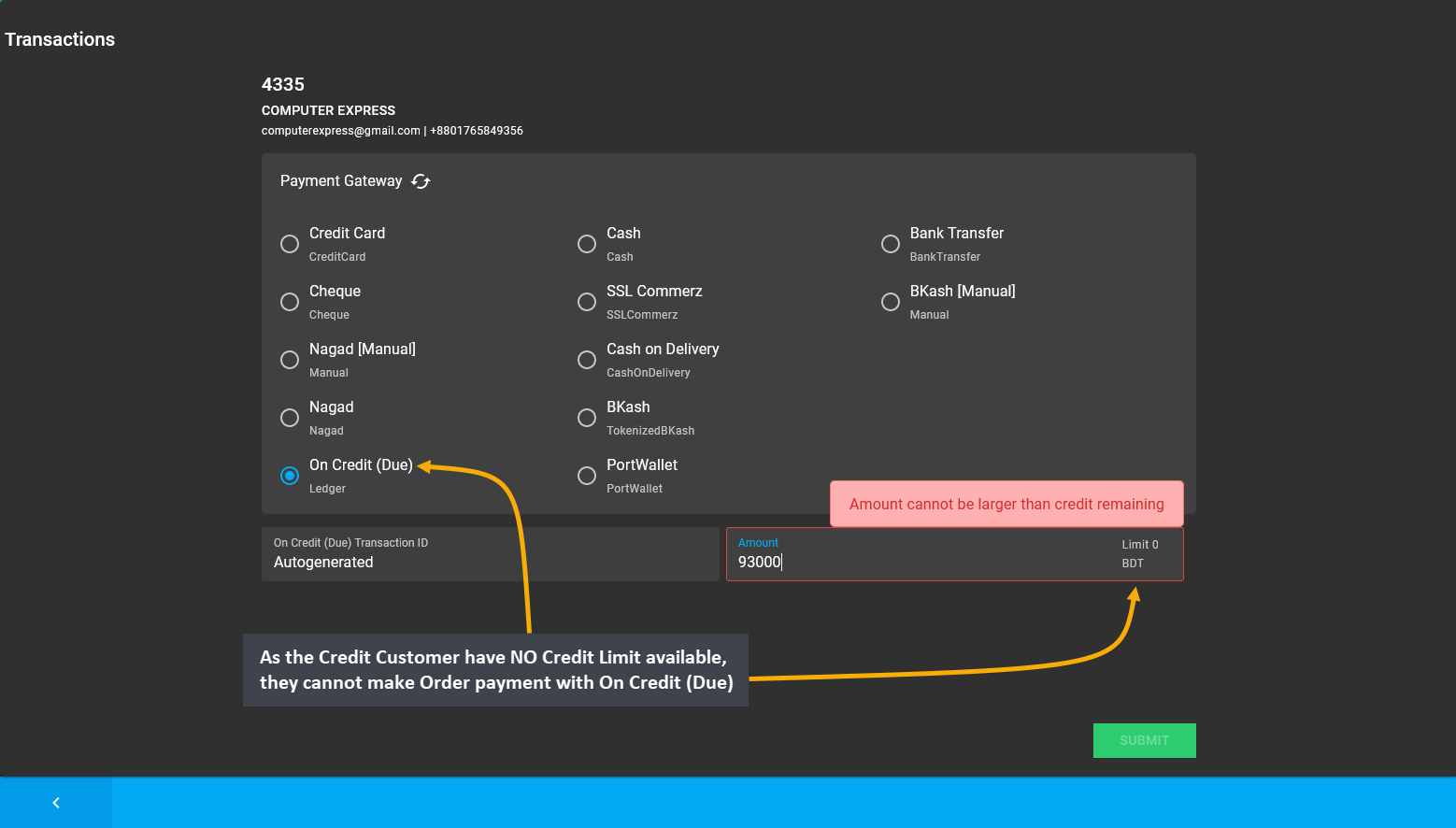

If a Credit Customer has NO Credit Limit on their account, they will not be able to use Credit Limit for making Order payment. For example, this Credit Customer has NO available Credit Limit as they have already used their allotted 15,000 BDT Credit Limit. Thus, if they try to make Order payment later with Credit Limit, they will find the option to pay with On Credit (Due) disabled on Payment Gateways. They will be able to pay with other Payment Gateways.

Image 24: Credit Customer cannot pay for Order with Credit Limit if they have NO Credit Limit available.

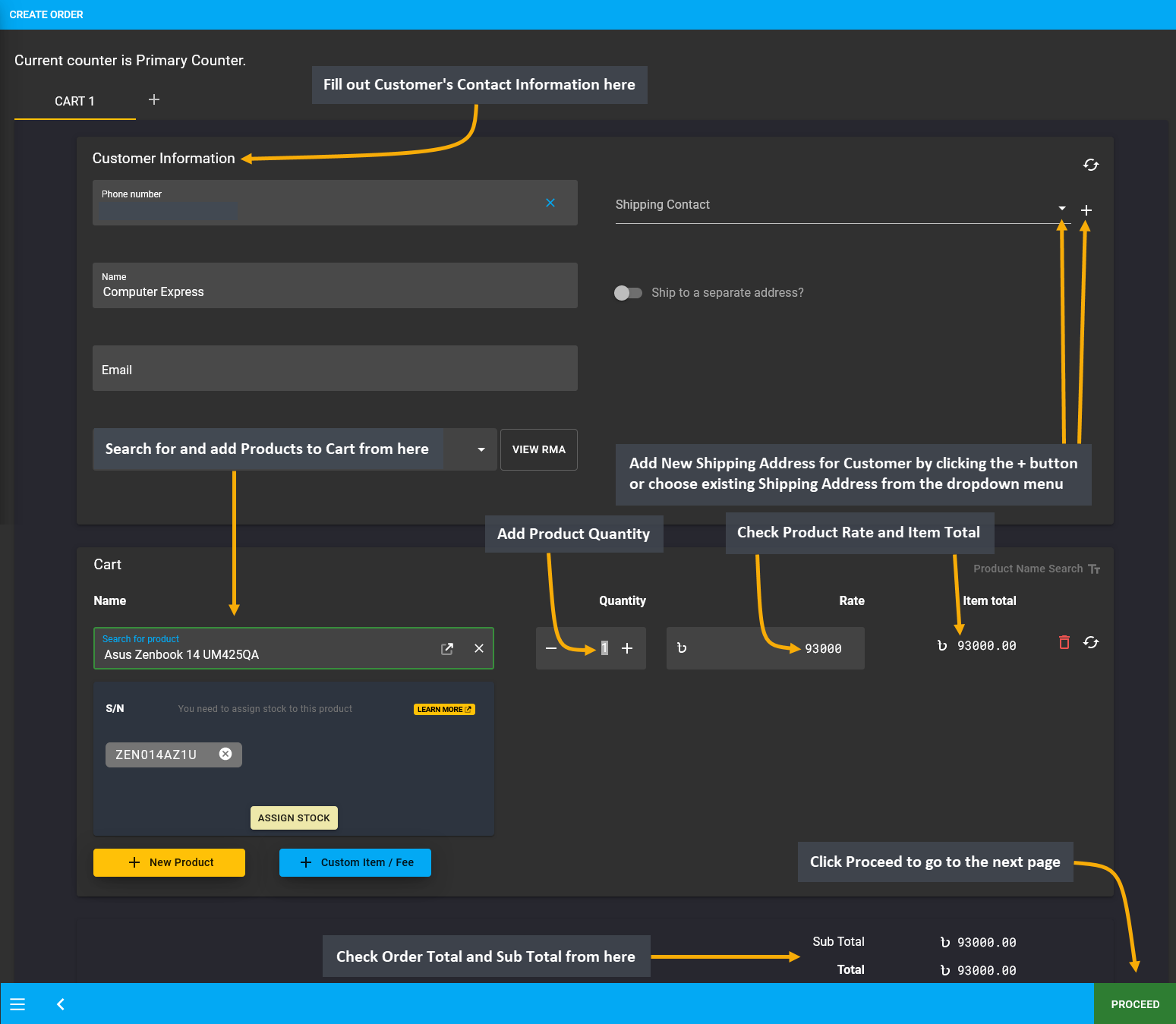

Therefore, an example Order will be placed and to complete Full Order Payment, other Payment Gateways can be used except On Credit (Due). Start Order by filling basic Customer Information and Shipping Address. Then, search for and add Products to Cart from dropdown. Check Product quantity, rate, item total, Order total, and subtotal. Click the Proceed button to select payment and shipping options on the next page and confirm Order.

Image 25: Create Order Cart by adding Product and checking Product quantity, Order total, and subtotal.

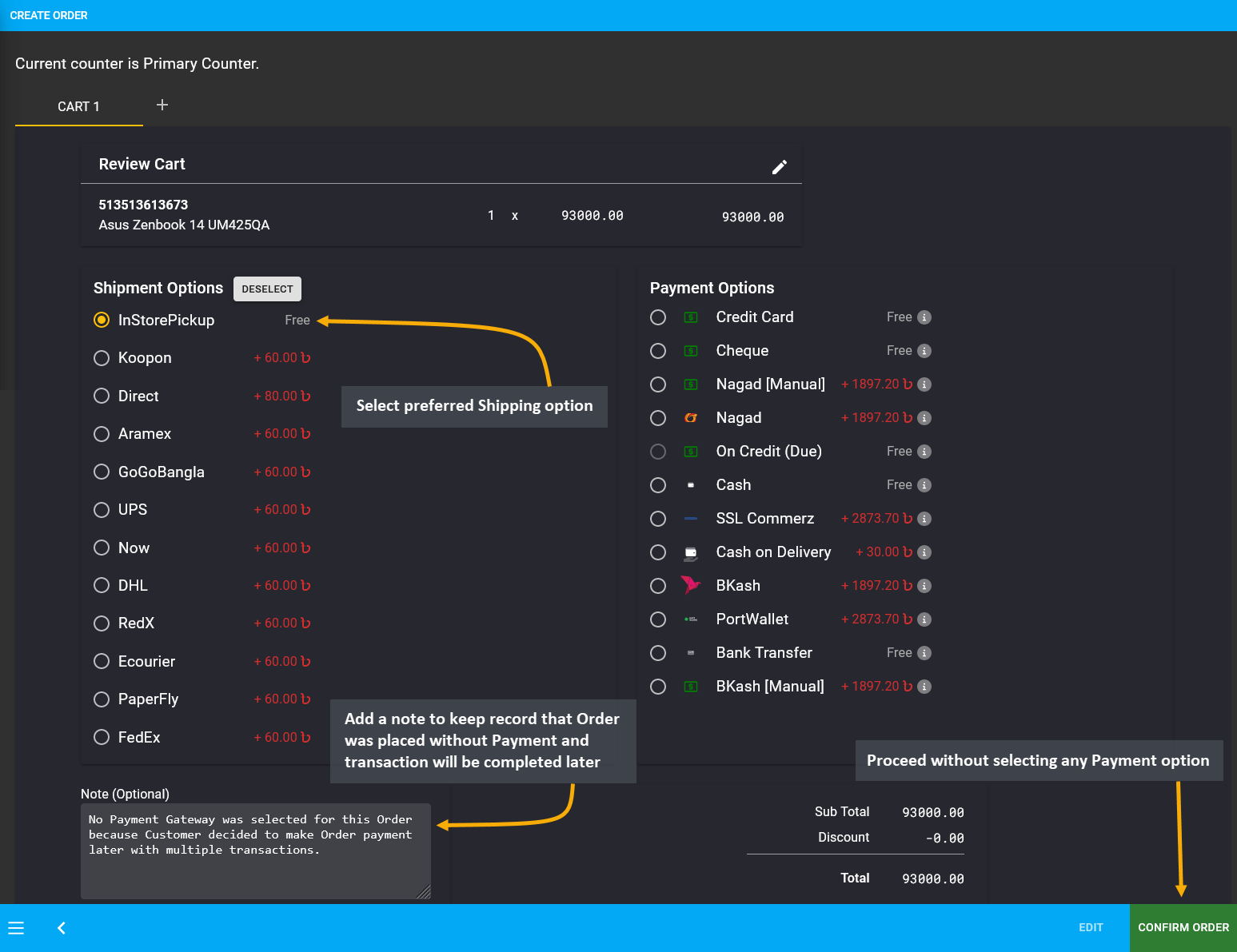

If the Credit Customer wants to place Order without payment, then they have to complete Order without selecting any payment option. Here, In Store Pickup was selected as shipment option without selecting any payment option. Add a Note to keep record that Order was placed without Payment and transaction will be completed later. Thus, proceed without selecting any payment option and click the Confirm Order button to proceed to the next step.

Image 26: Credit Customer can proceed without selecting payment option to complete Order without payment.

As Credit Customer proceeded to place Order without payment, a pop-up of Full Payment Incomplete will show two options. The first option to Use Credit will remain disabled because the Customer have NO Credit Limit available to complete Order payment. The second option which remains enabled is Ignore Issue, selecting which will allow the Customer to complete Order payment later with partial or full transaction. Therefore, click the Submit button to place Order without payment.

Image 27: Credit Customer have NO Credit Limit at all to cover Full Order Payment, so select Ignore Issue.

In order to add payment details to this Order, go the the Orders Tab. The newly created Order will appear on top of the list. It has incomplete payment which needs to be completed. For this, click the Transaction + button which will redirect to the Payment Gateway from where transaction can be completed for this Pending Order.

Image 28: Click Transaction + to select Payment Gateway and complete transaction for this Pending Order.

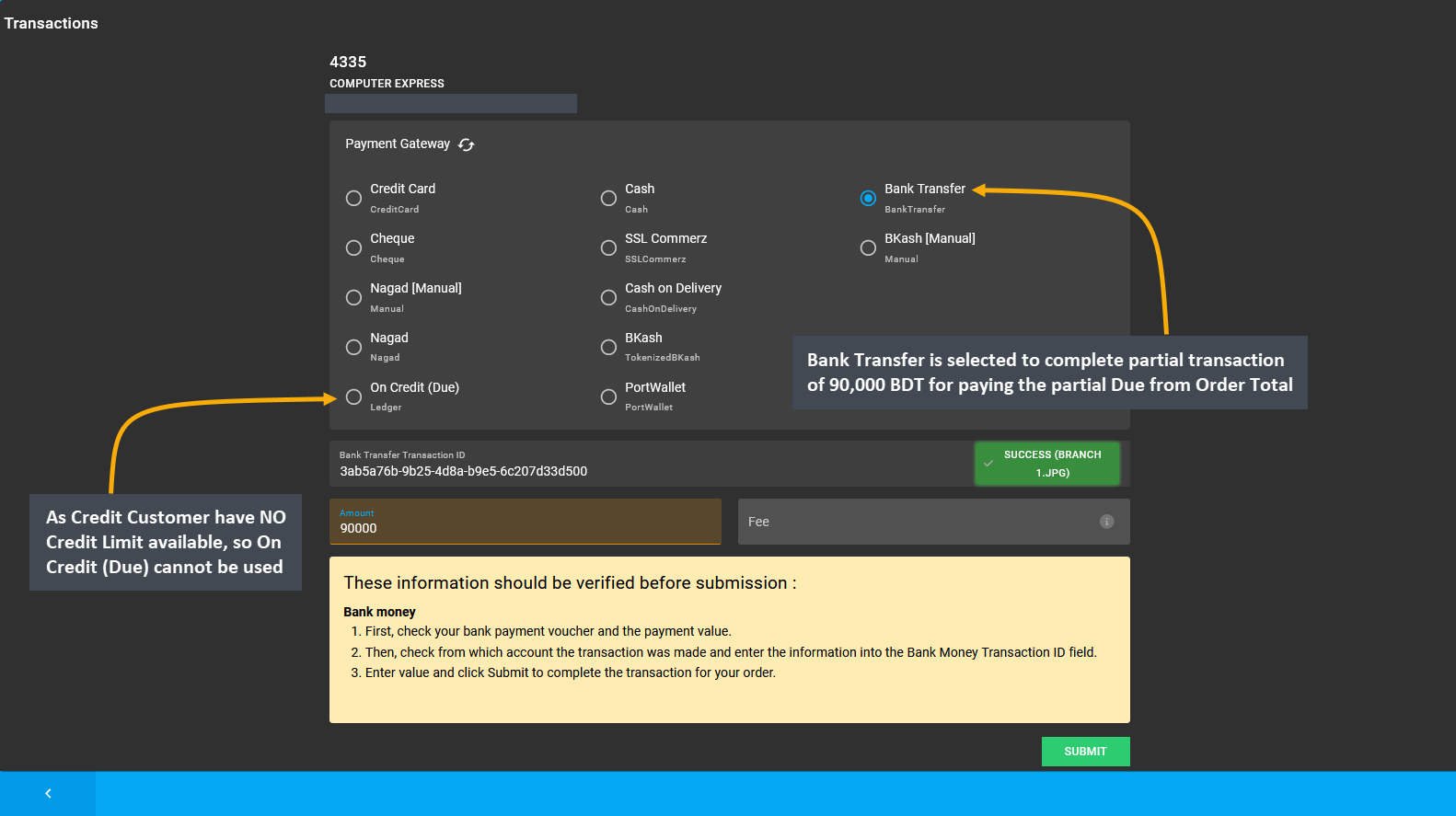

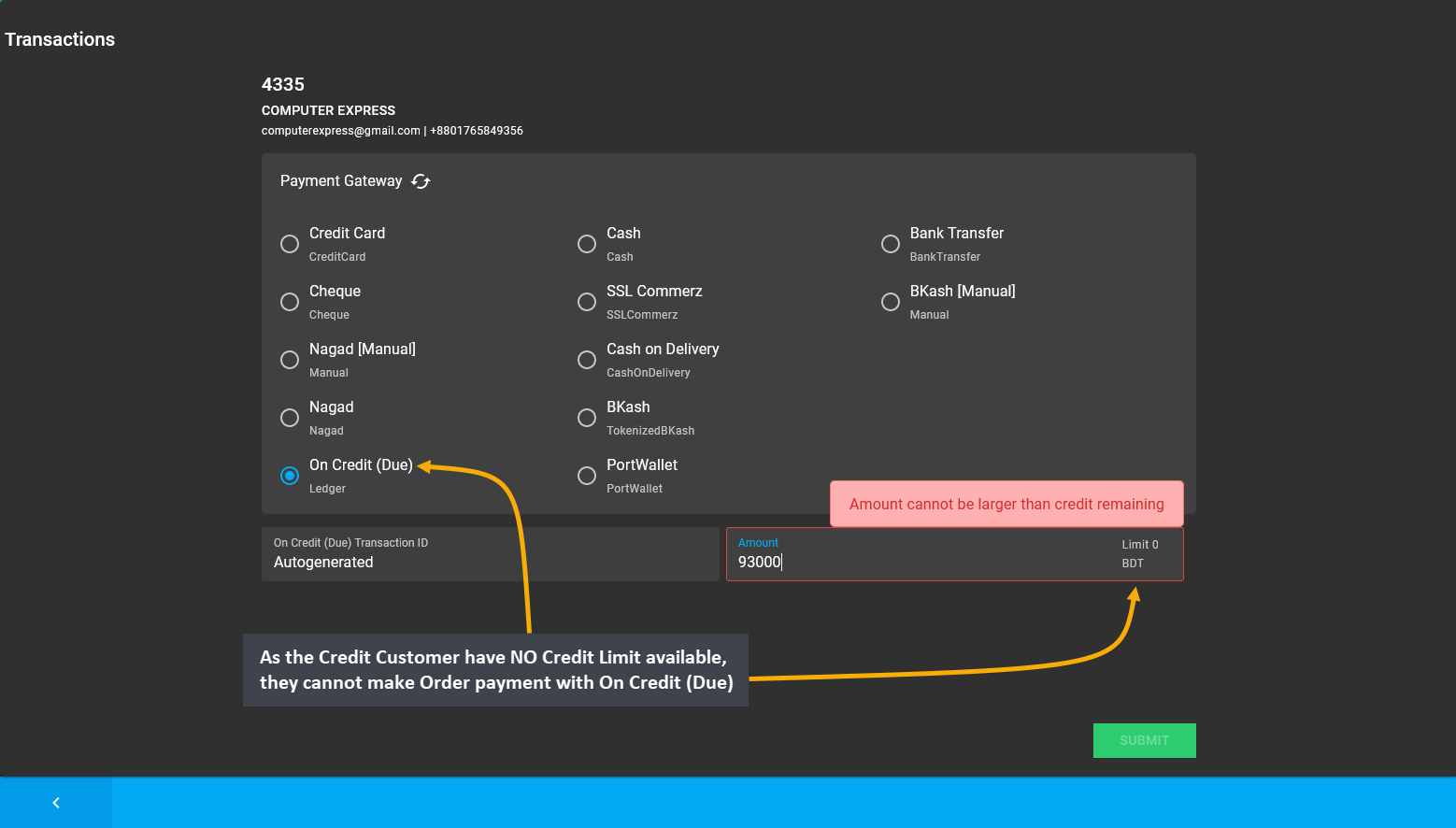

To resolve this Pending Order for Credit Customer, complete Order payment by selecting any Payment Gateway except On Credit (Due). As the Credit Customer have NO Credit Limit available, they cannot make Order payment with On Credit (Due). Click Submit to complete partial payment transaction for this Credit Customer’s Order.

Image 29: As Credit Customer have NO Credit Limit available, they cannot make payment with On Credit (Due).

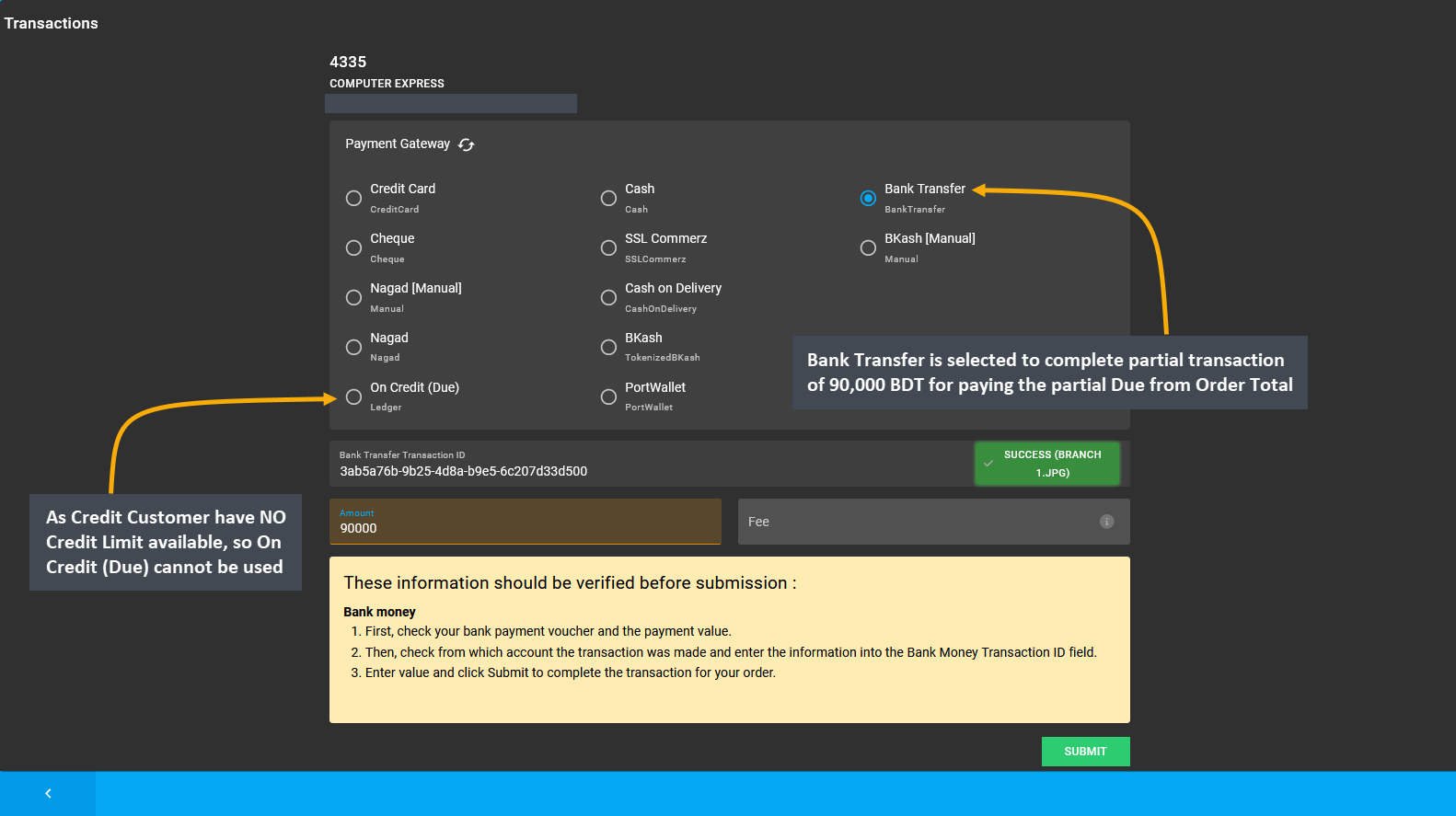

To resolve the remaining Due for this Order, complete Order payment by selecting any other Payment Gateway, as Credit Customer have NO Credit Limit available, so On Credit (Due) cannot be used. Therefore, Bank Transfer is selected to complete partial transaction of 90,000 BDT for paying the partial Due from Order Total.

Image 30: To resolve remaining Due for this Order, complete payment by selecting another Payment Gateway.

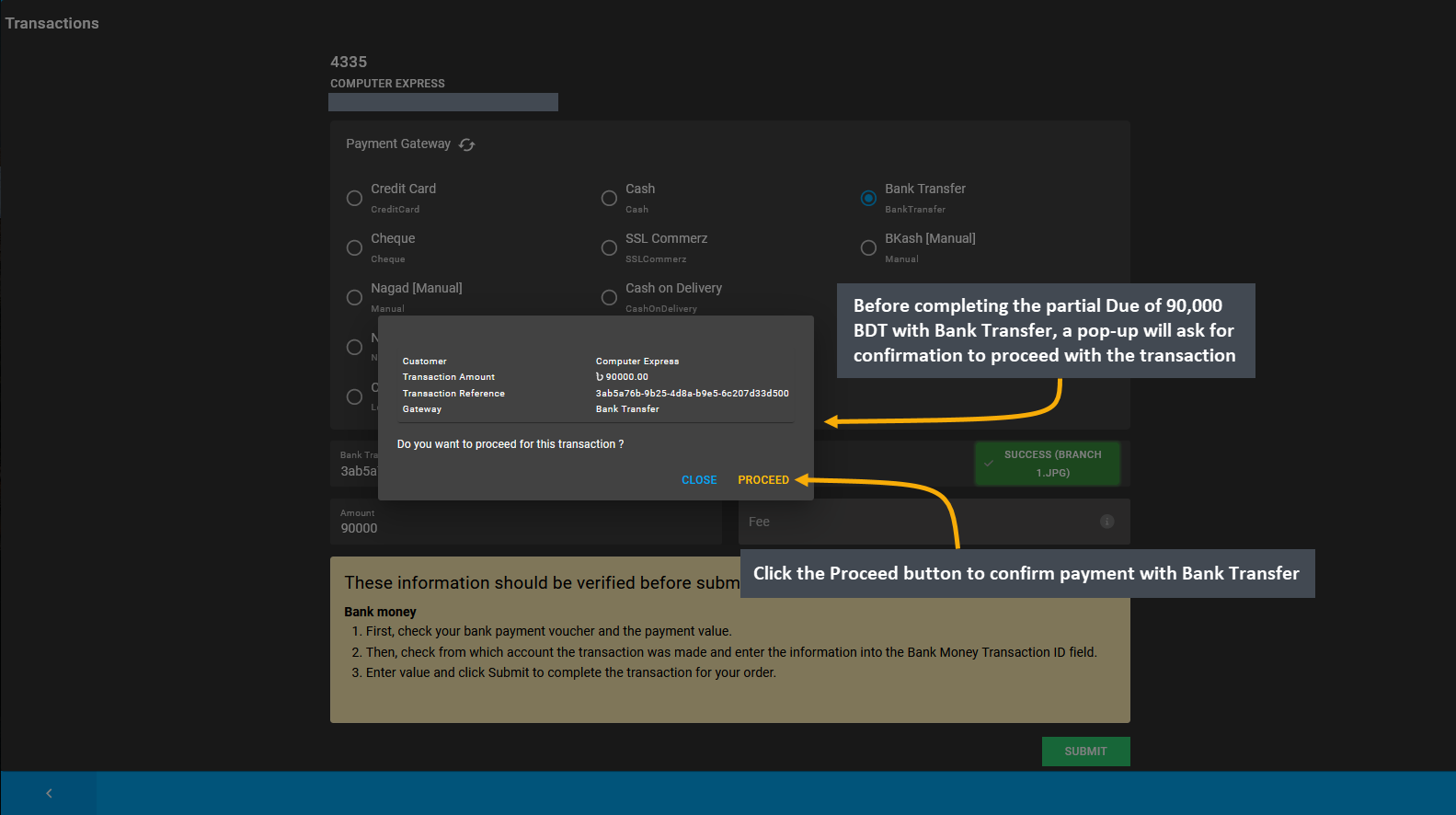

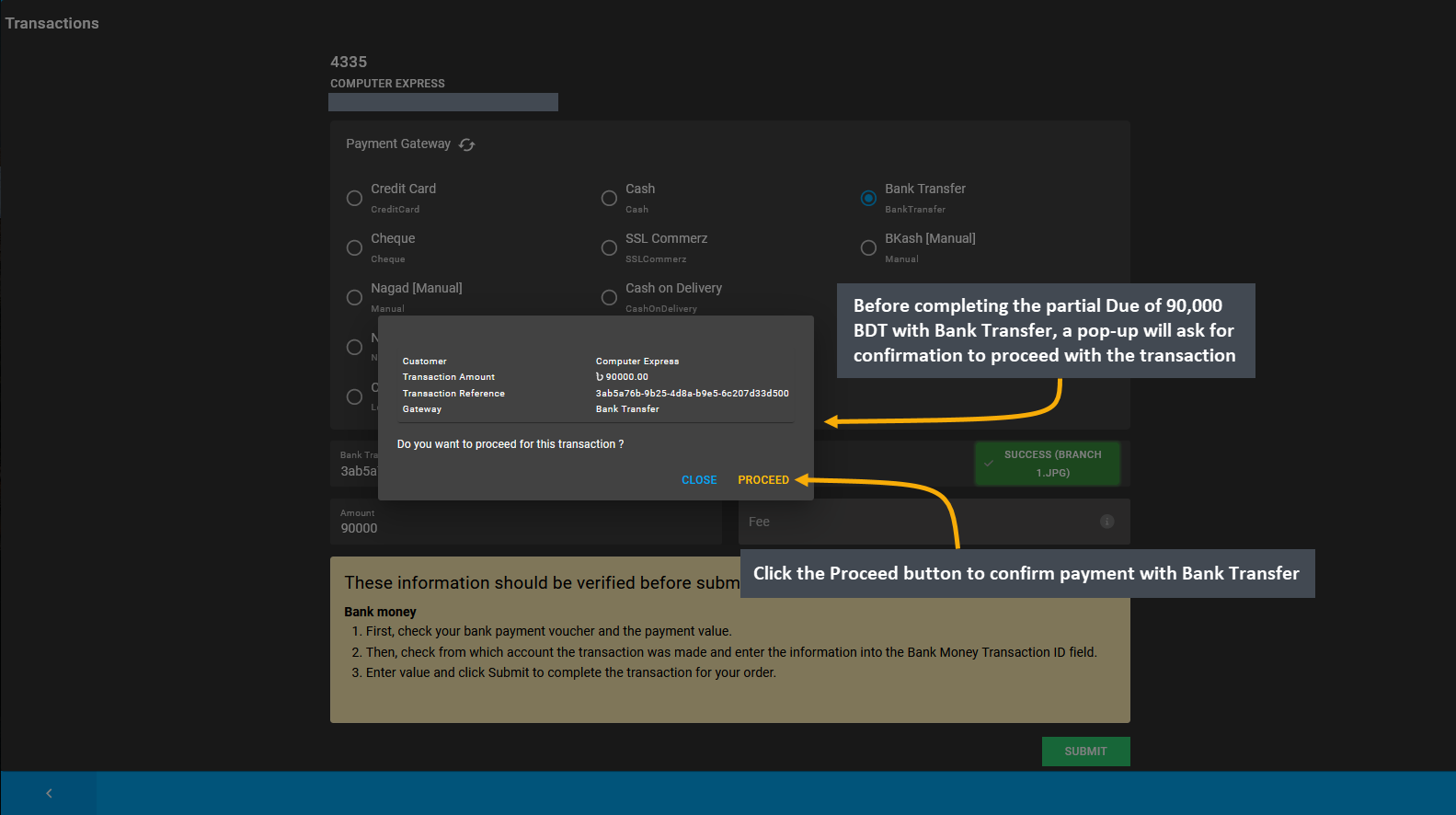

Before completing the partial Due of 90,000 BDT with Bank Transfer, a pop-up will ask for confirmation to proceed with the transaction. Click the Proceed button to confirm payment with Bank Transfer. After completing the partial Order payment, it will redirect to the Order List, showing remaining Due for the Order.

Image 31: Before completing transaction with Bank Transfer, pop-up will ask for confirmation to proceed.

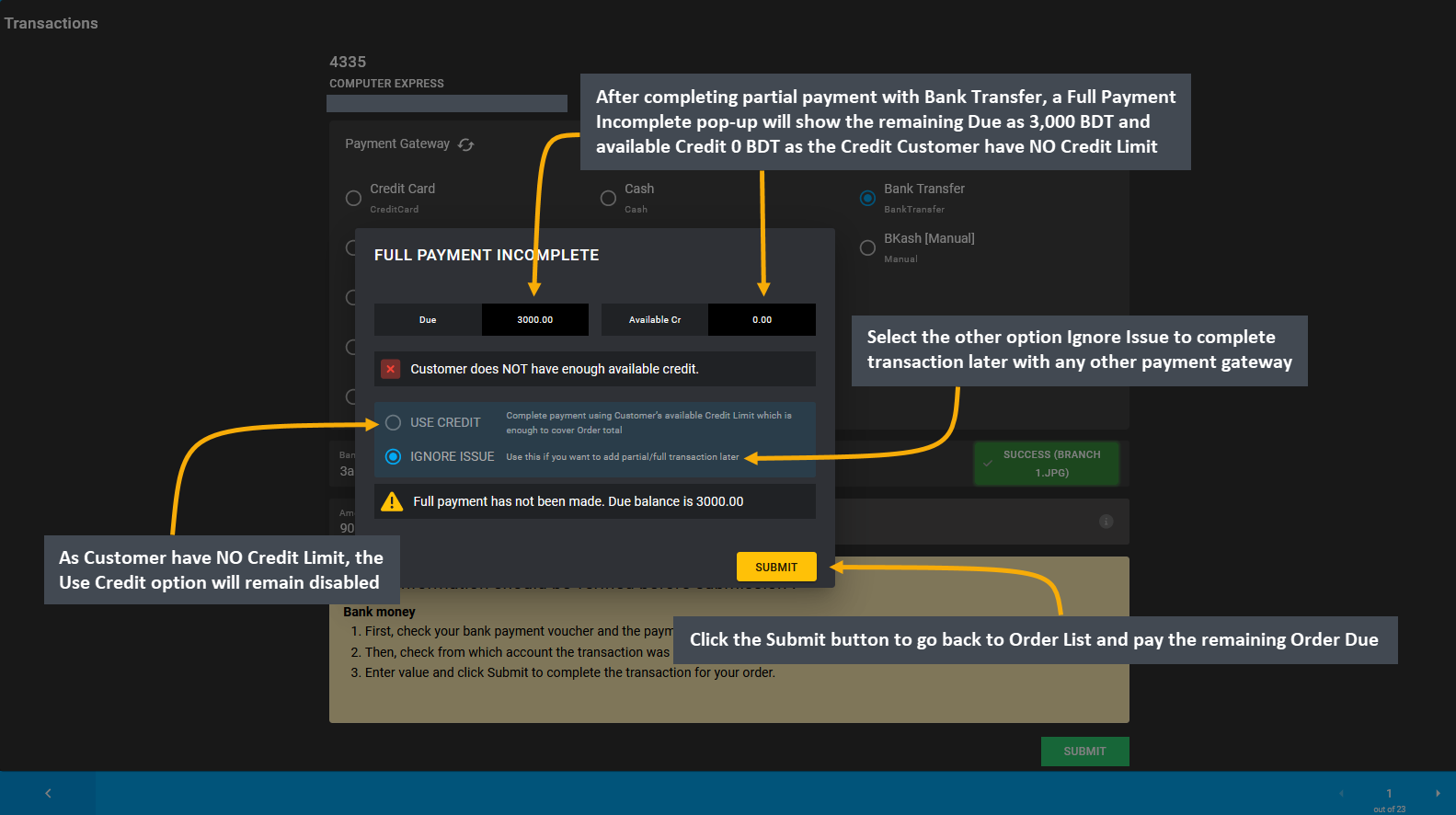

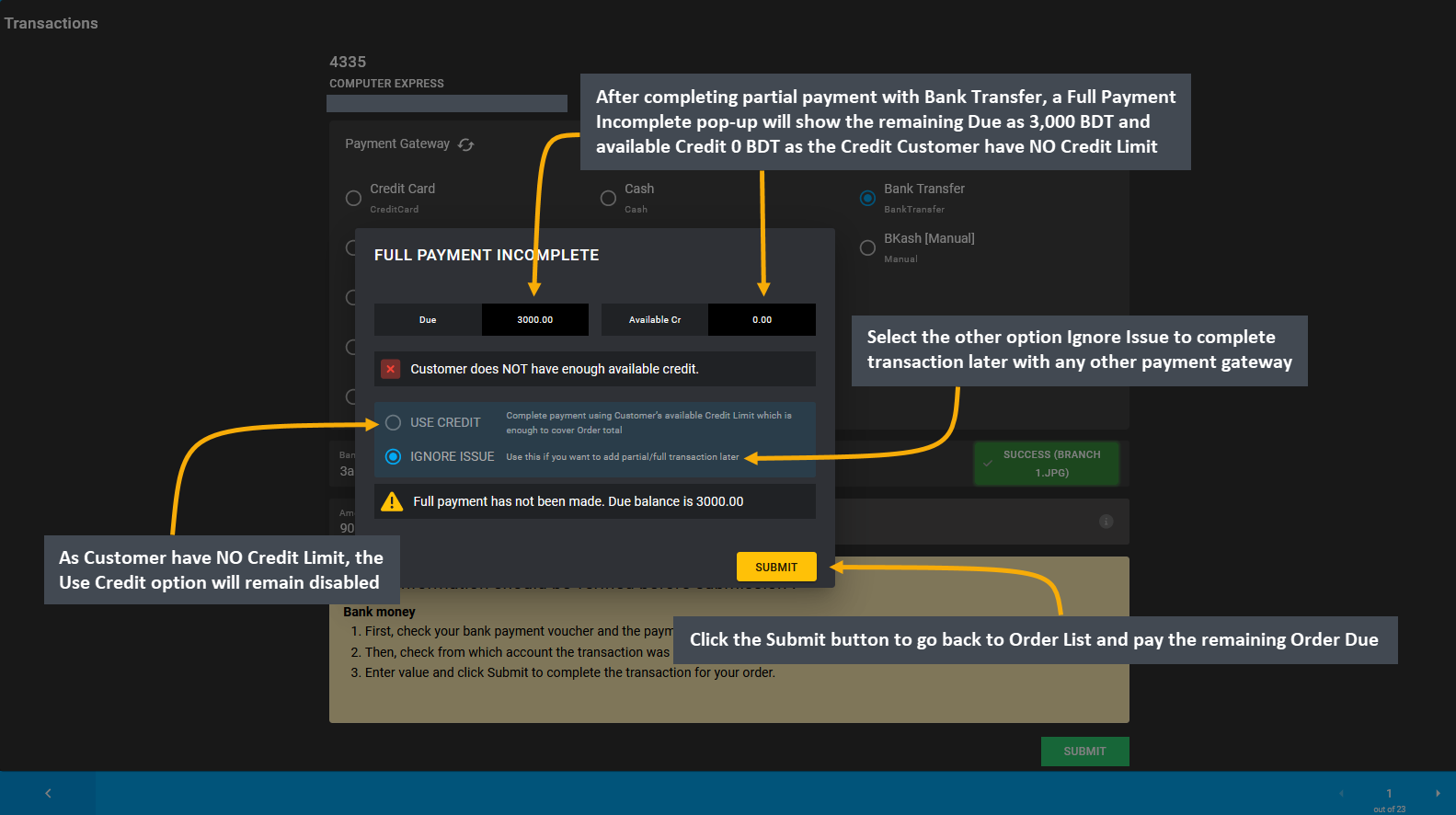

After completing partial payment with Bank Transfer, a Full Payment Incomplete pop-up will show the remaining Due 3,000 BDT and available Credit 0 BDT as the Credit Customer have NO Credit Limit. Therefore, as Customer have NO Credit Limit, the Use Credit option will remain disabled. So, select other option Ignore Issue to complete transaction later with any other payment gateway. Notification will show that Due balance is 3,000 BDT. Hence, click the Submit button to go back to Order List and pay the remaining Order Due.

Image 32: After partial payment with Bank Transfer, remaining Due and available 0 Credit Limit will show.

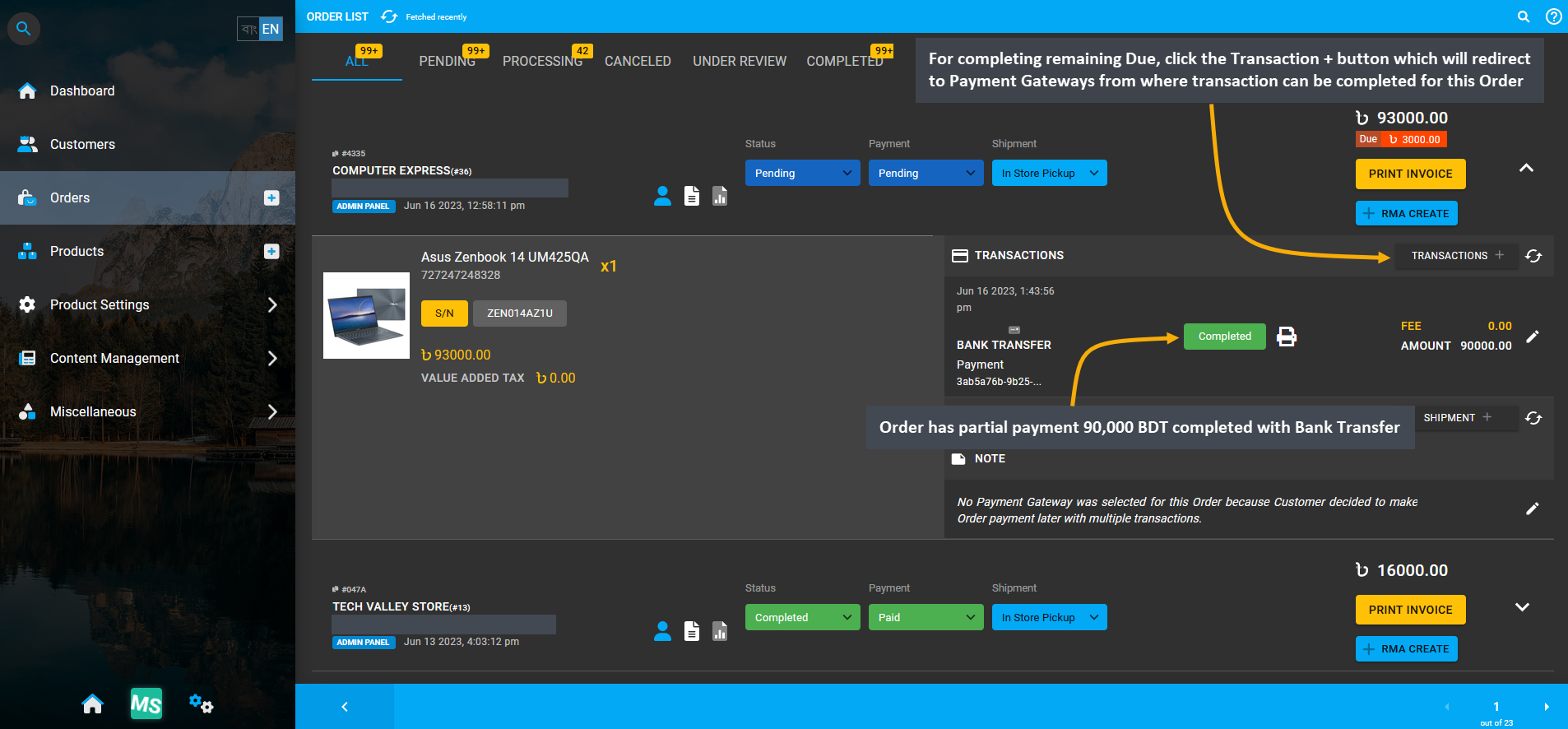

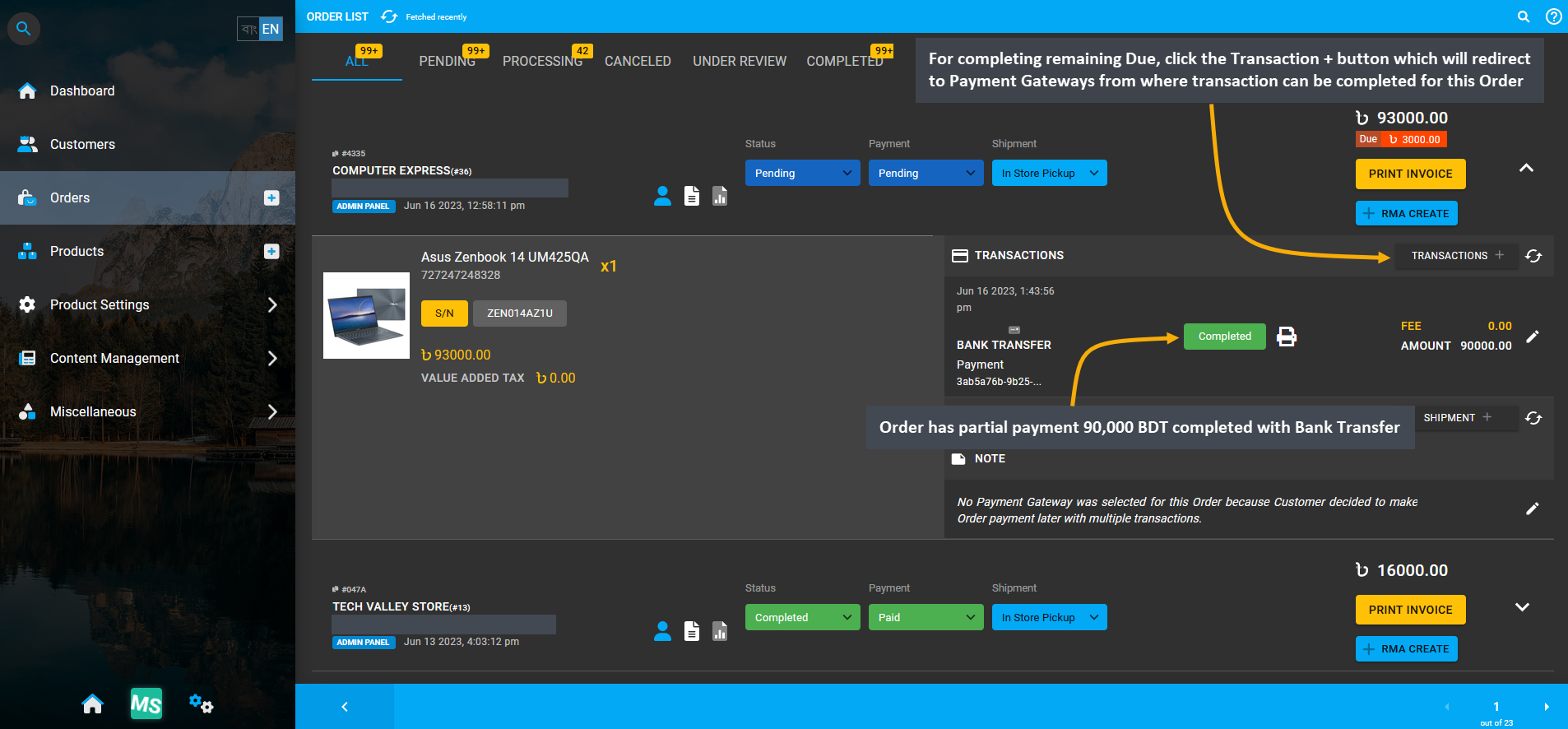

In order to complete remaining Due for this Order, go the the Orders Tab, which has partial payment 90,000 BDT completed with Bank Transfer. For completing remaining Due, click the Transaction + button which will redirect to Payment Gateways from where transaction can be completed for this Order with one or multiple gateways.

Image 33: Click Transaction + to be redirected to Payment Gateways from where Order due can be completed.

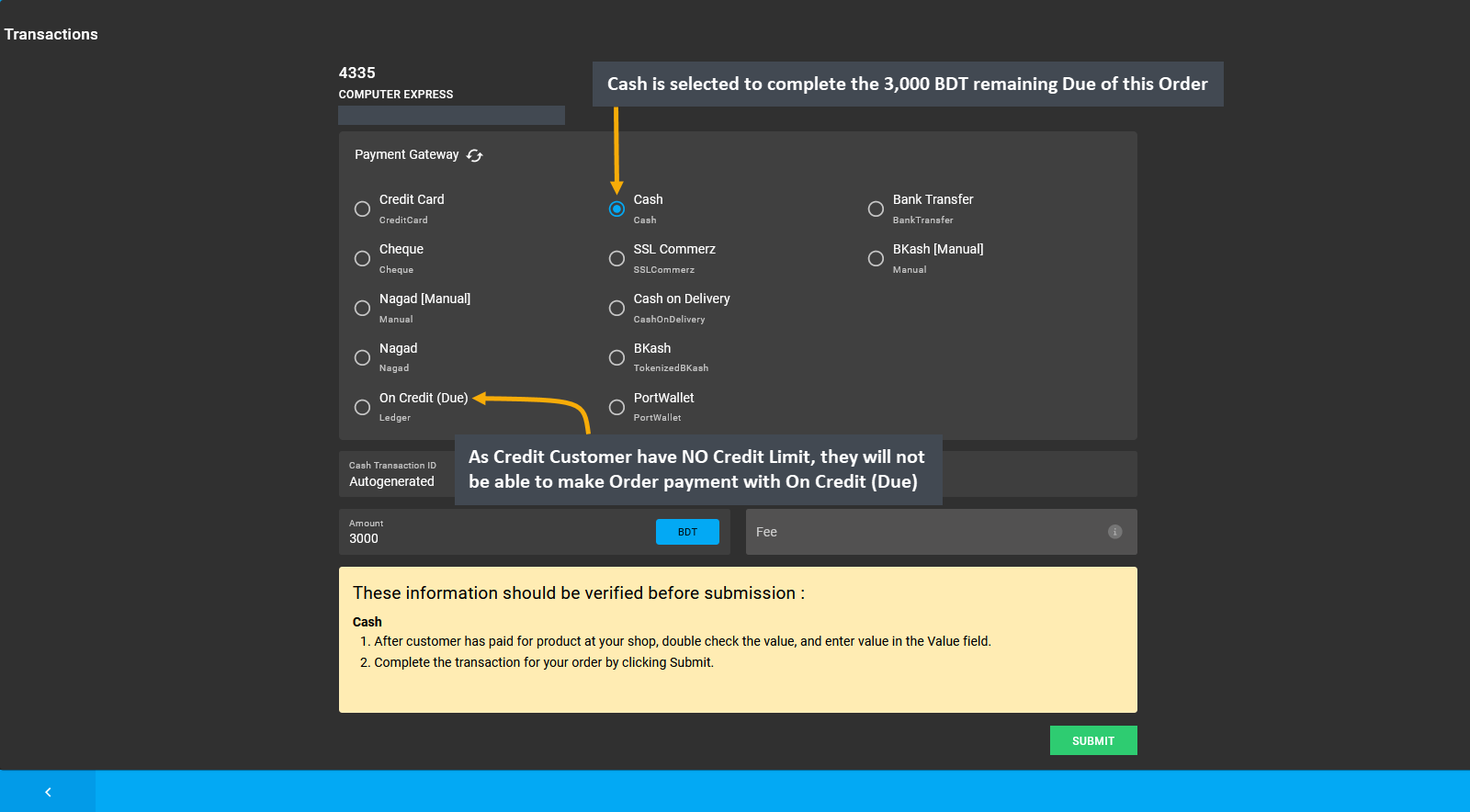

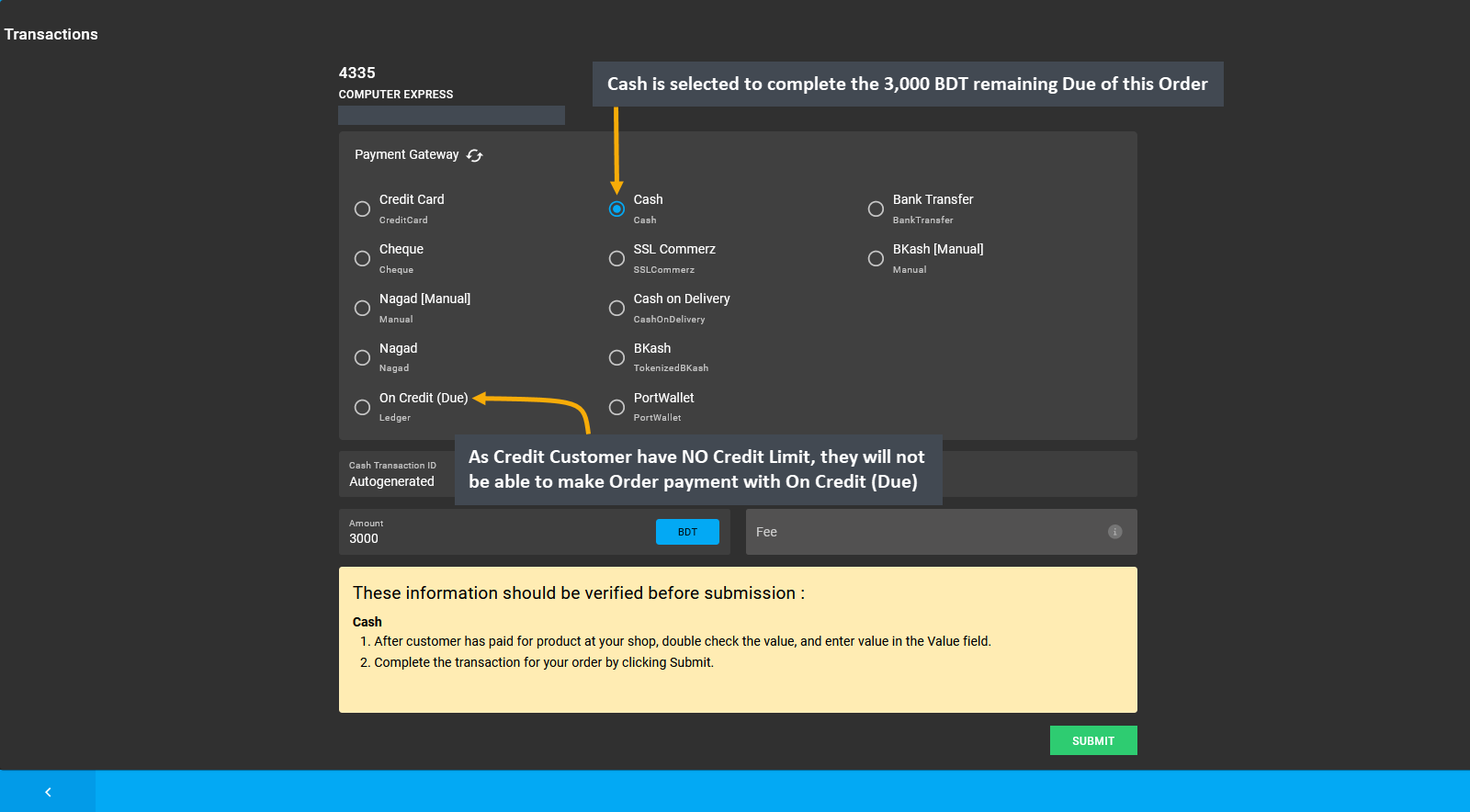

To resolve the remaining Due for this Order, complete Order payment by selecting any other Payment Gateway. As Credit Customer have NO Credit Limit, they will not be able to make Order payment with On Credit (Due). Thus, another payment gateway Cash is selected to complete the 3,000 BDT remaining Due of this Order.

Image 34: To resolve remaining Due for this Order, complete payment by selecting another Payment Gateway.

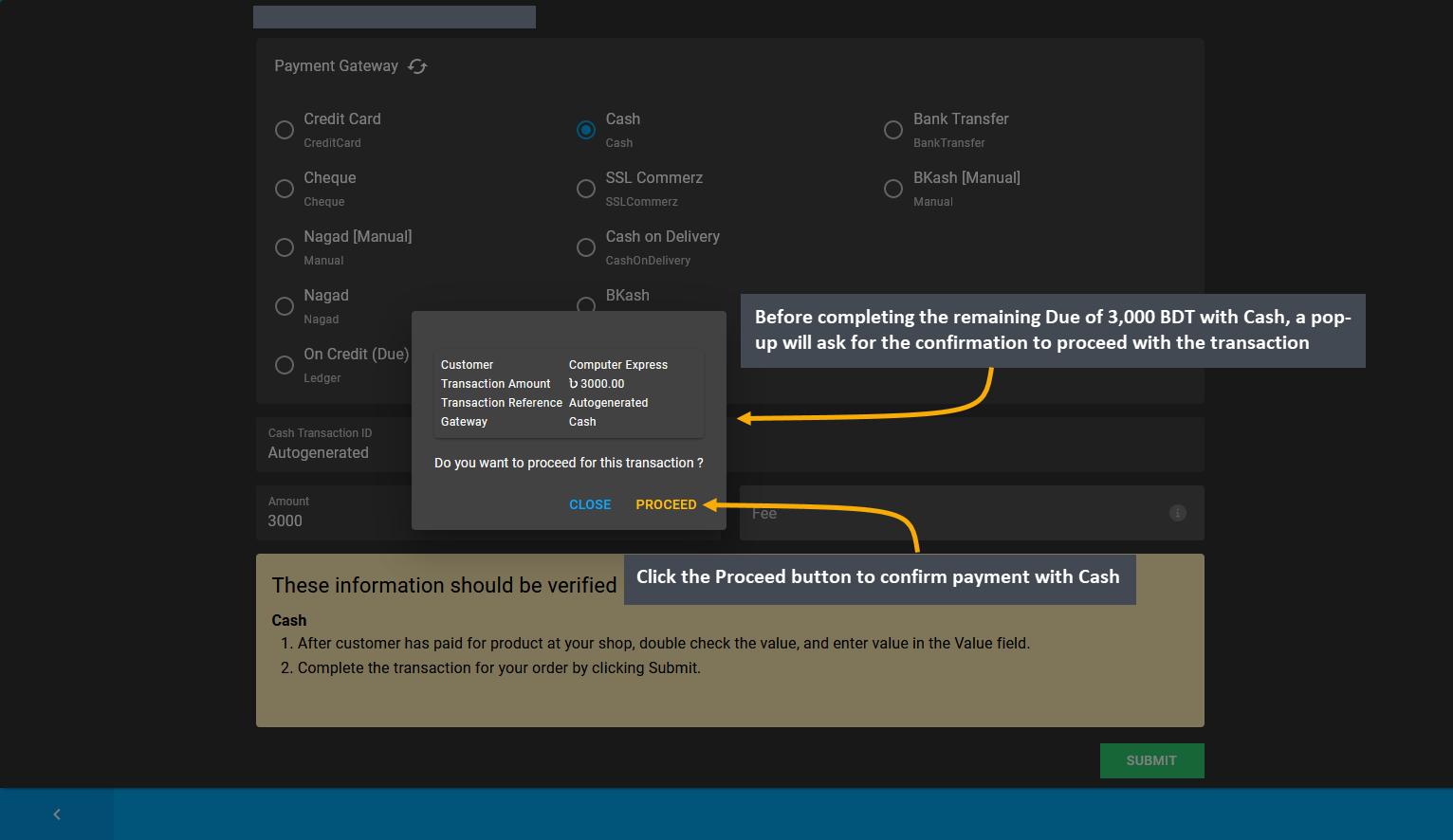

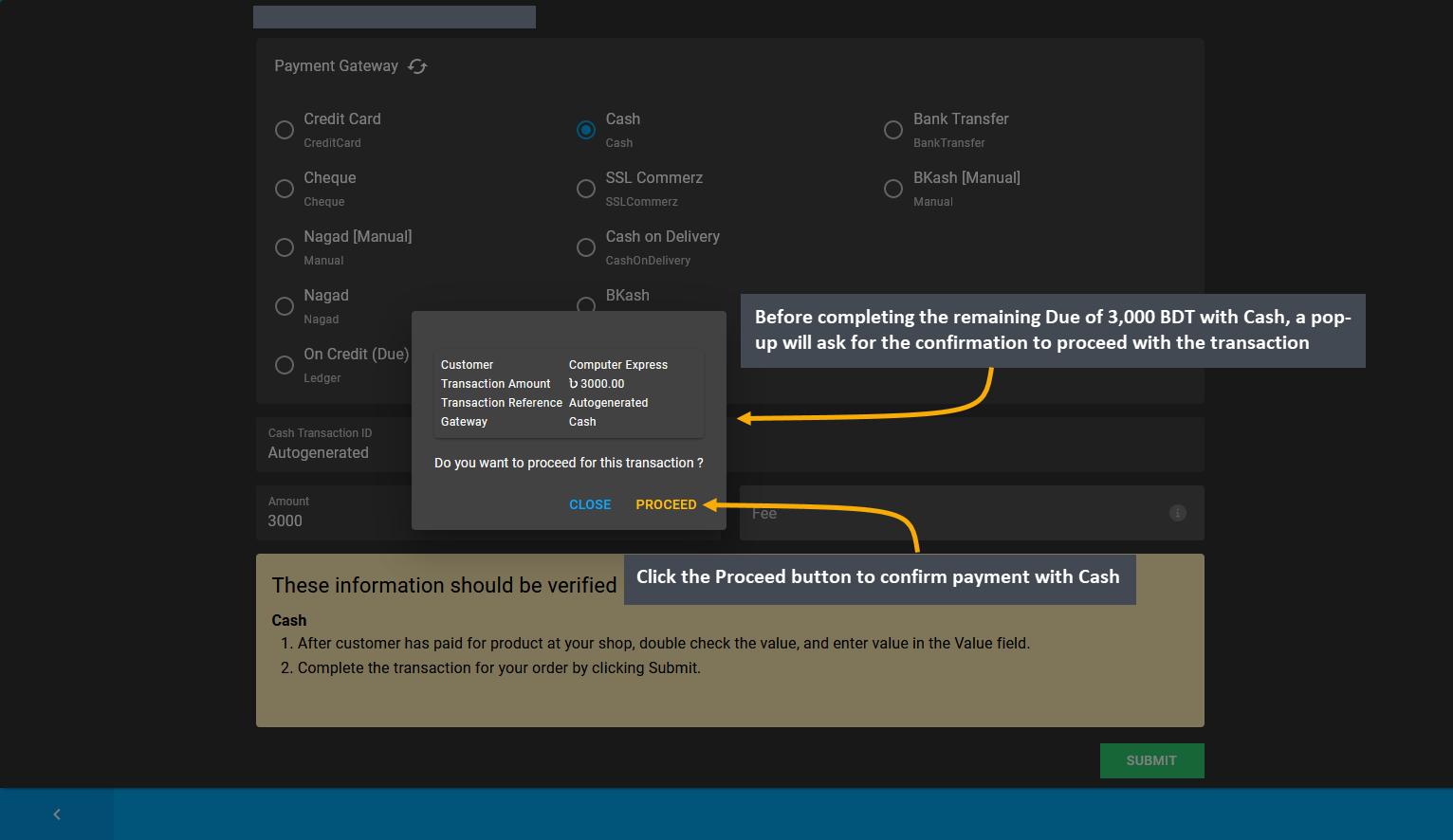

Before completing remaining Due of 3,000 BDT with Cash payment gateway, a pop-up will ask for confirmation to proceed with the transaction. Click the Proceed button to confirm payment with Cash. After completing Full Order Payment, it will redirect to the Order List, showing multiple completed transactions for the Order.

Image 35: Before completing transaction with Cash, a pop-up will ask for confirmation to proceed.

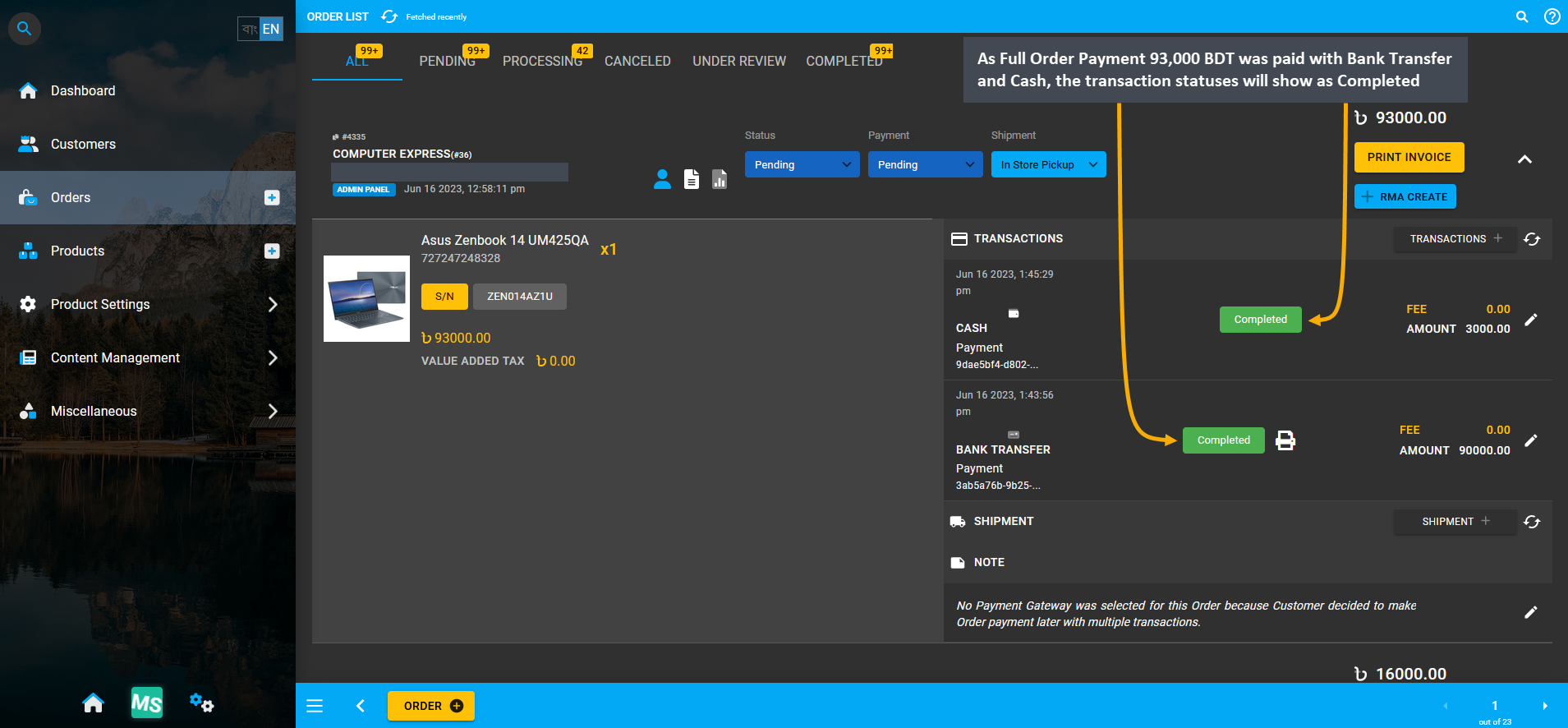

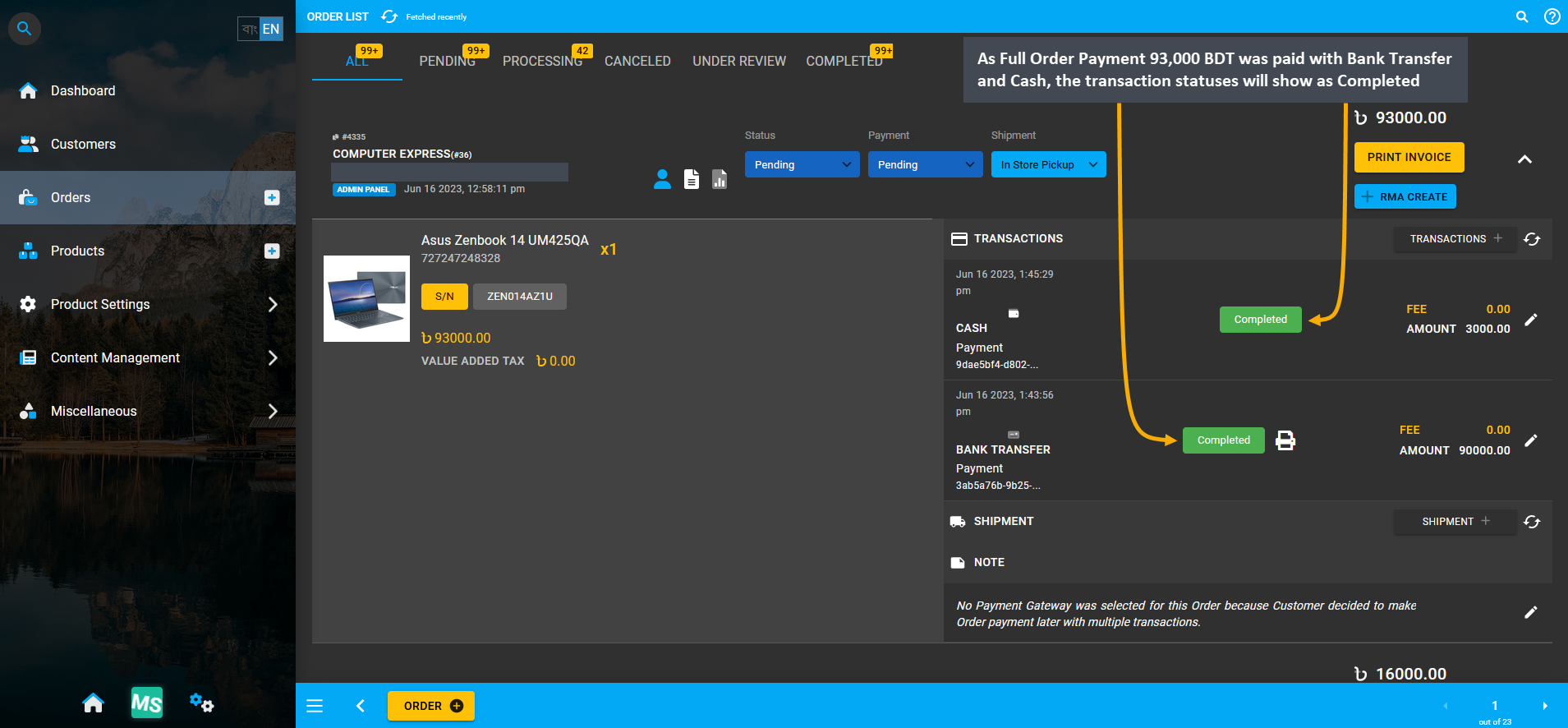

After payment is completed with Cash for Credit Customer, it will show within the Transaction history. As Full Order Payment 93,000 BDT was paid with Bank Transfer and Cash, the transaction statuses will show as Completed. This is how a Credit Customer can make Order payment with other Payment Gateways if they have NO Credit Limit.

Image 36: As Full Payment was made with Bank Transfer and Cash, gateway transactions will show Completed.

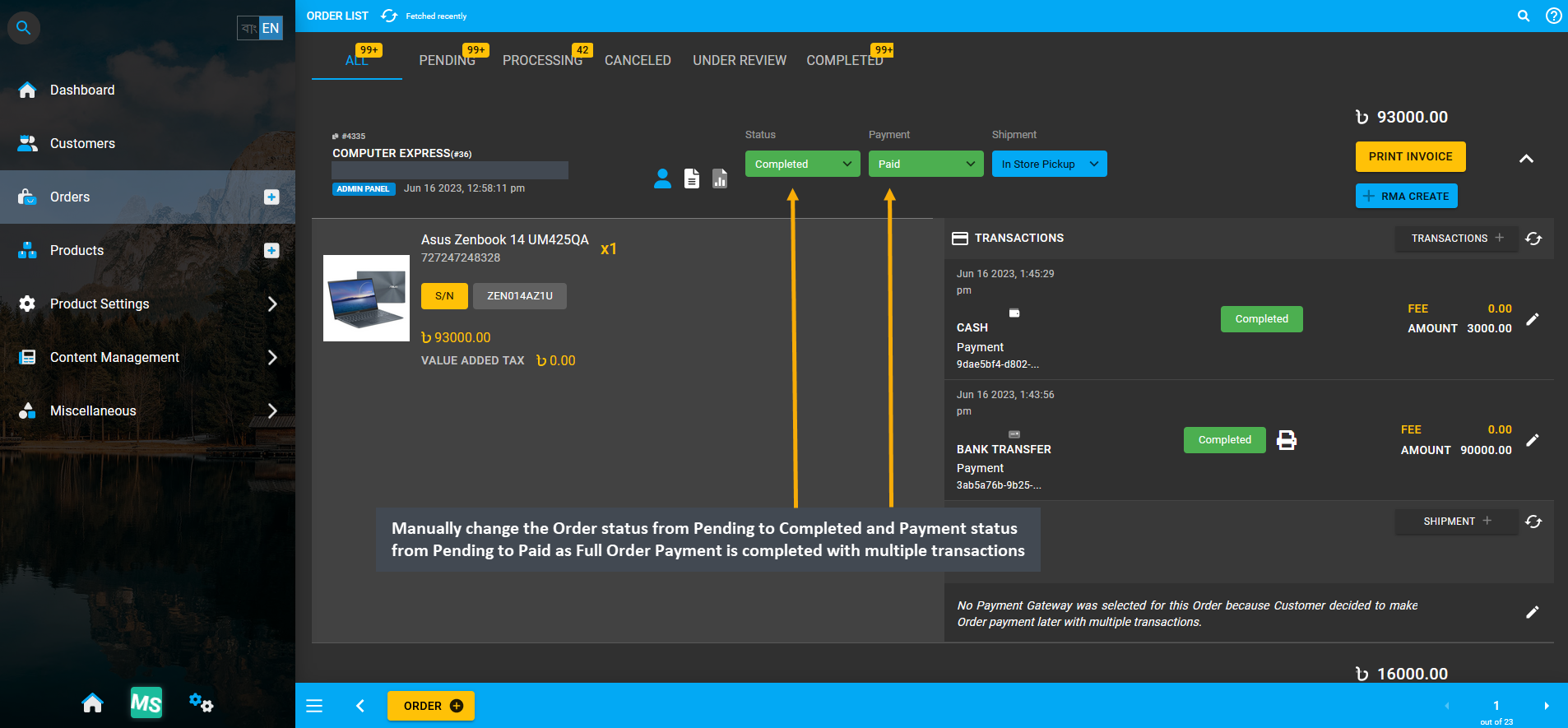

Thus, manually change the Order status from Pending to Completed and Payment status from Pending to Paid as Full Order Payment is completed with multiple transactions. These statuses need to be updated manually.

Image 37: As Full Order Payment was Completed, change Order status to Completed and Payment status to Paid.